Bryan Bedder

Pershing Square Tontine Holdings, Ltd. (PSTH) is winding up. The Bill Ackman-led SPAC just announced it will redeem all of its outstanding shares of Class A common stock effective as of July 26, 2022.

The press release says:

Net of taxes, the Company currently expects the per-share redemption price for the public shares will be approximately $20.05 (as finally determined, the “Redemption Amount”). The Company anticipates that the public shares will cease trading as of the close of business on July 25, 2022. As of July 26, 2022 the public shares will be deemed cancelled and will represent only the right to receive the Redemption Amount. After July 26, 2022, the Company shall cease all operations except for those required to wind up the Company’s business.

The Redemption Amount will be paid on July 26, 2022 to the beneficial owners of public shares held in street name without any required action on their part. The Redemption Amount will be paid to record holders of public shares held in certificated form after presentation of their respective stock certificates or other delivery of their shares to the Company’s transfer agent, Continental Stock Transfer & Trust Company, on or after July 26, 2022.

There will be no redemption rights or liquidating distributions with respect to the Company’s warrants, which will expire worthless.

This means shareholders are to receive $20.05 at the end of July and warrants should expire worthless.

Ackman followed up the press release (the basic wind-up is not complicated by any SPARC or SPAR which Ackman is inventing; special purpose acquisition right) with a letter to shareholders. One of the primary reasons I’m still involved with PSTH to date is because of the optionality of a SPARC/SPAR (more color on this mechanic in my previous note) (emphasis mine):

With the SPAC and IPO market effectively shut today, now is a highly opportunistic investment environment for a public acquisition vehicle which does not suffer from the negative reputation of SPACs. With this in mind, as we have previously explained, we are working diligently to launch Pershing Square SPARC Holdings, Ltd., a privately funded acquisition vehicle which intends to issue publicly traded, long-term warrants called SPARs, which will offer SPAR owners the opportunity to acquire common stock in the newly merged company, the outcome of a business combination between SPARC and a private company. The SPARC structure has many favorable attributes compared with conventional SPACs that should increase the probability a transaction can be executed on favorable terms. We intend to distribute SPARs to PSTH security holders who own either Class A Common Stock (ticker: PSTH) or warrants (ticker: PSTH.WS) as of the close of business on July 25, 2022 (the last date such instruments are redeemed or cancelled): ½ of a SPAR for each share of common stock and one SPAR for each warrant. The timing of the SPAR distribution will be determined by reference to the date SPARC’s registration statement becomes effective, which we would not expect to occur until Fall 2022.

Common stockholders are to receive 1/2 SPAR (if this SPAR abstract is ultimately realized) and warrant holders will receive 1 full SPAR for each warrant. In the current SPAC environment, I don’t expect these SPARs or SPARCs will trade well at first. But perhaps these will be valued at $0.20 – $0.50.

Pre-market, Pershing Square Tontine Holdings is trading up to $20.07, which makes it very attractive in my opinion. The only reason I’m not sure if I’ll add to my position is that it is by far my biggest position already.

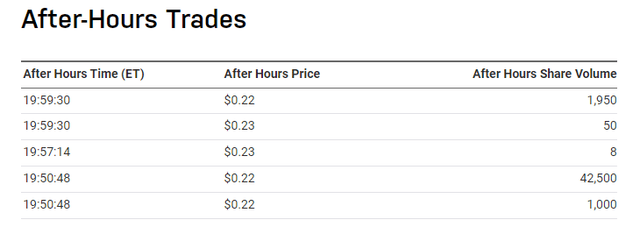

The warrants could get really attractive, as these officially zero out, but they do receive 1 SPAR each if that idea ultimately comes to fruition. After hours, the warrants traded small volumes around $0.22-$023.

After hours trades in PSTH warrants (NASDAQ.com)

With PSTH around $20.07, the warrants have to become extremely cheap to become more attractive. PSTH is worth $20.05 in liquidation value + value of 1/2 a SPAR. PSTH warrants are worth the value of 1 SPAR. The one redeeming quality of the warrants is they allow cheap levered exposure to the SPAR. Through PSTH, you can only get exposure to 1 SPAR by investing $40 in PSTH with no upside over the next month.

If possible, it could be attractive to go long PSTH at ~$20.07 and short 1/2 the number of warrants around $0.23. That should theoretically lock in a $0.21 return over the next month while locking up $19.95 in capital. The bottom line is that I favor PSTH at this time, but the warrants could become attractive if they depreciate enough.

Be the first to comment