Bill Ackman 2016 DealBook Conference / One of the funds largest positions is with Pershing Square Holdings Bryan Bedder

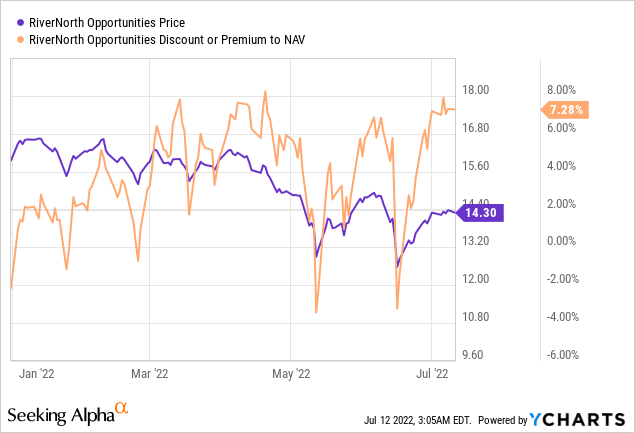

RiverNorth Opportunities Fund, Inc. (NYSE:RIV) is a closed-end fund that invests in closed-end funds (“CEFs”), fund debt, SPACs, and business development companies (“BDCs”). I love these categories and think they are currently quite attractive. The fund is very popular (judging by its premium to NAV of 7%).

The fund generated something like ~9% per year since inception. I’d argue this has been achieved with an attractive risk profile given the assets it invests in. SPACs have limited downside until de-SPAC-ing, and fund debt tends to hold up fairly well, too. Closed-end funds can be volatile, but if you buy opportunistically they are often attractive and, depending on their leverage profile, less risky than equities in general.

This is a $260 million fund which is an excellent size to invest in. A fund of this size is nimble enough to make the most of even less liquid opportunities and opportunistically trade CEFs or SPACs. It is large enough to get pre-IPO allocations with SPACs which are currently quite attractive again. Unfortunately, it is trading at a whopping ~7% premium to the net asset value. I actually prefer these funds when trading at a 10%+ discount to the net asset value. It is fairly common for CEFs to trade at a sizeable discounts.

When I buy these, I tend to hold until the discount decreases to around 5% or goes away, or I find something that I like more. In many cases, there are sizeable distributions (this fund has a distribution rate of 14.27%). These distributions are quite sweet while biding my time for the discount to NAV to revert to the mean. The year-to-date chart below shows how the discount has increased as the price has been declining:

I reviewed the recent management commentary and they report having had to take up CEF exposure, as these have gotten hammered. The average discount of the CEF’s the fund holds widened about 200 basis points, to 11.7% at quarter-end. While you can buy this one at a 7% premium, they are buying at an average discount of 11%…

They also commented on the SPAC market, which has been quite weak recently:

We continue to like the attractive risk/reward profile of SPACs. They provide an opportunity to generate capital gains on top of a short-term government yield. Although the market has soured on new IPOs, including de-SPAC names, this negative sentiment has caused SPAC sponsors to improve the terms on new deals. It’s also provided an opportunity to buy common shares at a discount to the cash value in the trust.

This is an assessment I generally agree with, and I think it’s great to hold a fund (or do it yourself) that allocates to pre-deal SPACs in this current environment.

The fund took up its leverage to 12.2% to opportunistically buy more closed-end funds. This likely means they’re seeing the best opportunities in that universe.

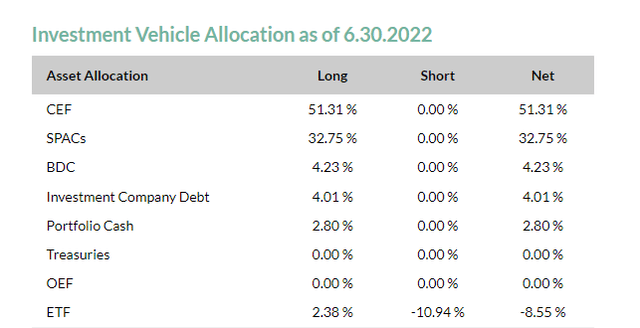

Investment allocations look like this currently:

CEF investment vehicle allocation (RiverNorth)

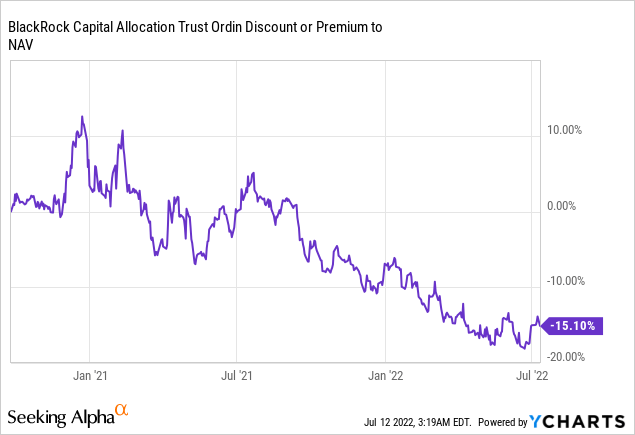

Looking at the portfolio, it holds funds like the BlackRock Capital Allocation Trust (BCAT), which is invested in U.S. mega-caps and historically traded at a much more favorable discount to net asset value:

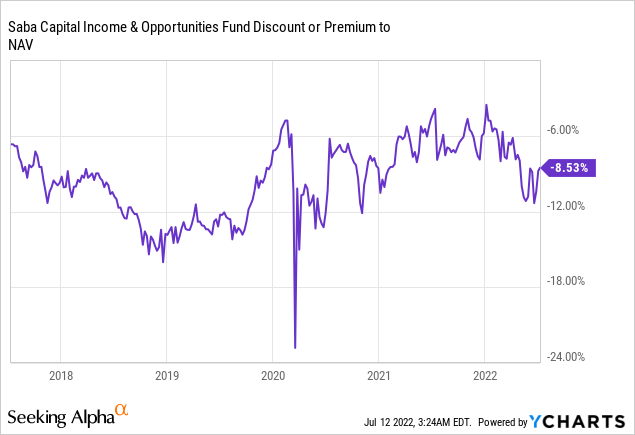

Another is the Saba Capital Income & Opportunities Fund (BRW), which is trading at an 8.5% discount to NAV. It currently allocates 80% towards SPACs, and its manager Saba Capital Management was named Hedge Fund of the Year in 2021 by risk.net.

It also holds a large allocation to Pershing Square Holdings (OTCPK:PSHZF). This is an important position for me as well. The fund holds only a small allocation to Pershing Square Tontine Holdings (PSTH), which is actually my biggest position. I expect that SPAC to wind up but there are some interesting kinks to that process.

Overall, I really like the portfolio. There is no benchmark-hugging going on here. Lots of high-quality SPAC’s available under $10. Large allocations to riskier but highly attractive funds like the BlackRock fund mentioned above and Pershing Square Holdings (which is a leveraged fund itself). Both holdings like Pershing Square and Saba have really terrific managers that I’d expect to do well over long periods of time.

Personally, I’m still not buying into RiverNorth Opportunities here. I like the strategy, I like the portfolio, and I’m impressed with the returns since inception, but I can’t get over the current premium to the net asset value. I’m simply looking CEFs at deeper discounts. If I were already involved here I’d consider selling and replacing it with a quality fund at a larger discount. The distribution is sweet enough but will likely be counteracted to an extent by the premium to net asset value receding and/or net asset value falling.

Be the first to comment