eyesfoto/E+ via Getty Images

A Quick Take On TDCX

TDCX (NYSE:TDCX) went public in September 2021, raising approximately $340 million in gross proceeds from an IPO that priced at $18.00 per share.

The firm provides contact center outsourcing and customer experience software to organizations in Asia and internationally.

Value-oriented investors may see a bargain at the current entry point of around $10.40 per share, although I’m cautious given a slowing macro environment and strong US dollar for the foreseeable future.

While I’m on Hold for TDCX in the near term, investors may wish to put the stock on a watch list or nibble at it over time.

TDCX Overview

Singapore-based TDCX was founded to enable organizations to improve and monitor their customer’s information journeys and related online experiences.

Management is headed by founder, Executive Chairman and CEO, Laurent Junique, who was previously a managing director at Phone Communication Pte Ltd.

The company’s primary offerings include:

-

Omnichannel CX (Customer Experience) solutions

-

Sales and digital marketing services

-

Content, trust and safety services

The firm markets its system and services through an in-house business development team, with coverage teams for each major global region of the Asia Pacific, North America and Europe.

The company has clients across numerous industry verticals, with Facebook (META) and Airbnb (ABNB) accounting for 62.3% of the firm’s revenue for the six months ended June 30, 2021, so there is significant revenue concentration risk.

TDCX’s Market & Competition

According to a 2018 market research report by Research and Markets, as a proxy for the firm’s services, the global customer experience management market is projected to grow to $21.3 billion by 2024.

This represents a forecast CAGR of 22% from 2018 to 2024.

The main drivers for this expected growth are the growing needs of customers for a personalized customer experience throughout their purchase journey.

Also, experience management helps enterprises grow their brands, increase customer loyalty, reduce client attrition and improve their operations.

TDCX’s Recent Financial Performance

-

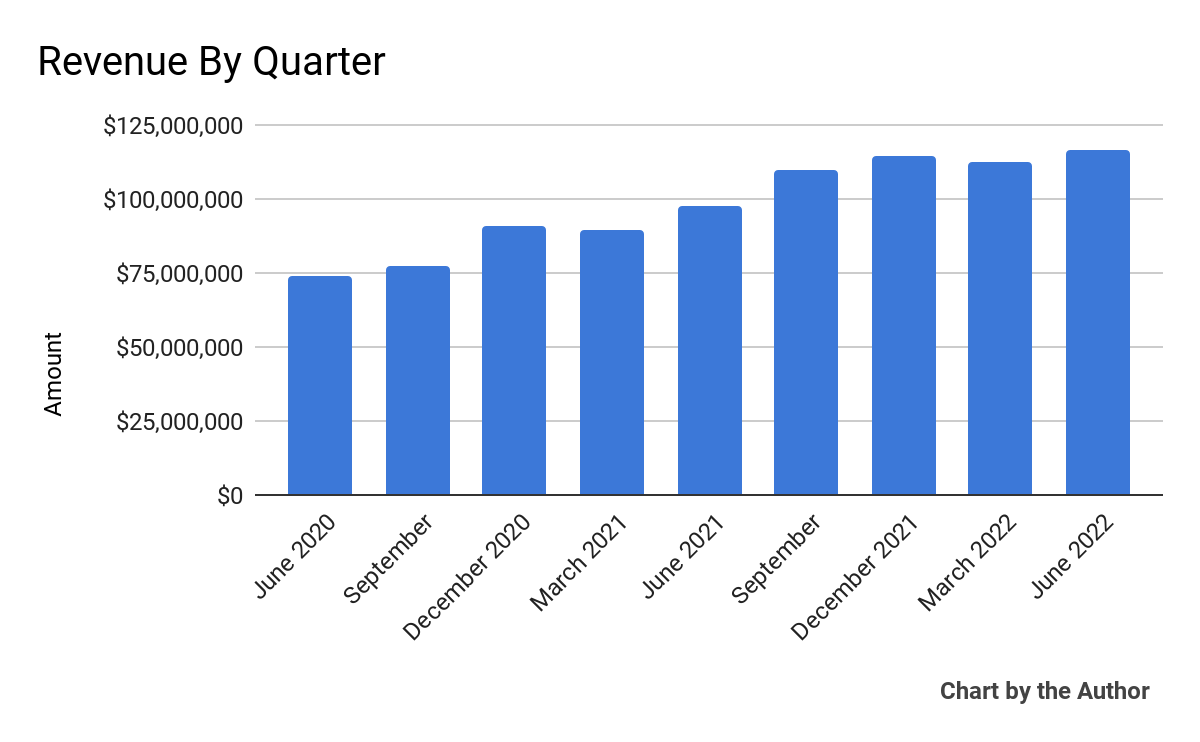

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

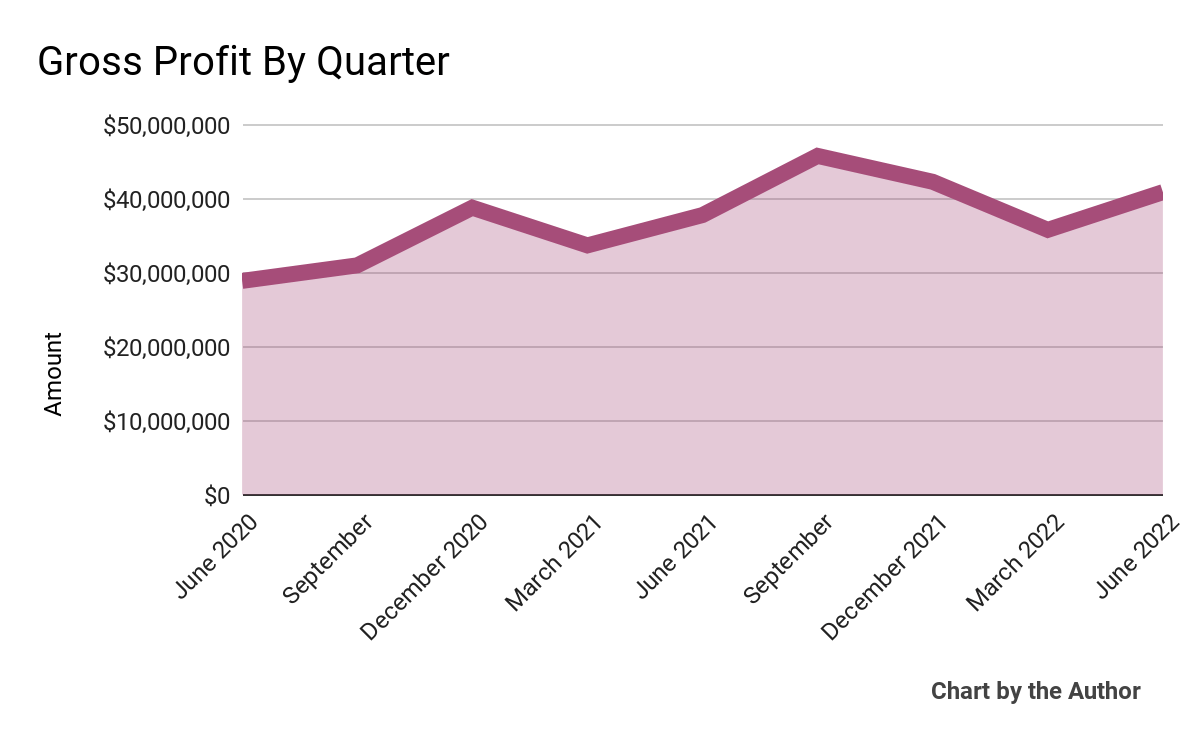

Gross profit by quarter has trended higher, as the chart shows below:

9 Quarter Gross Profit (Seeking Alpha)

-

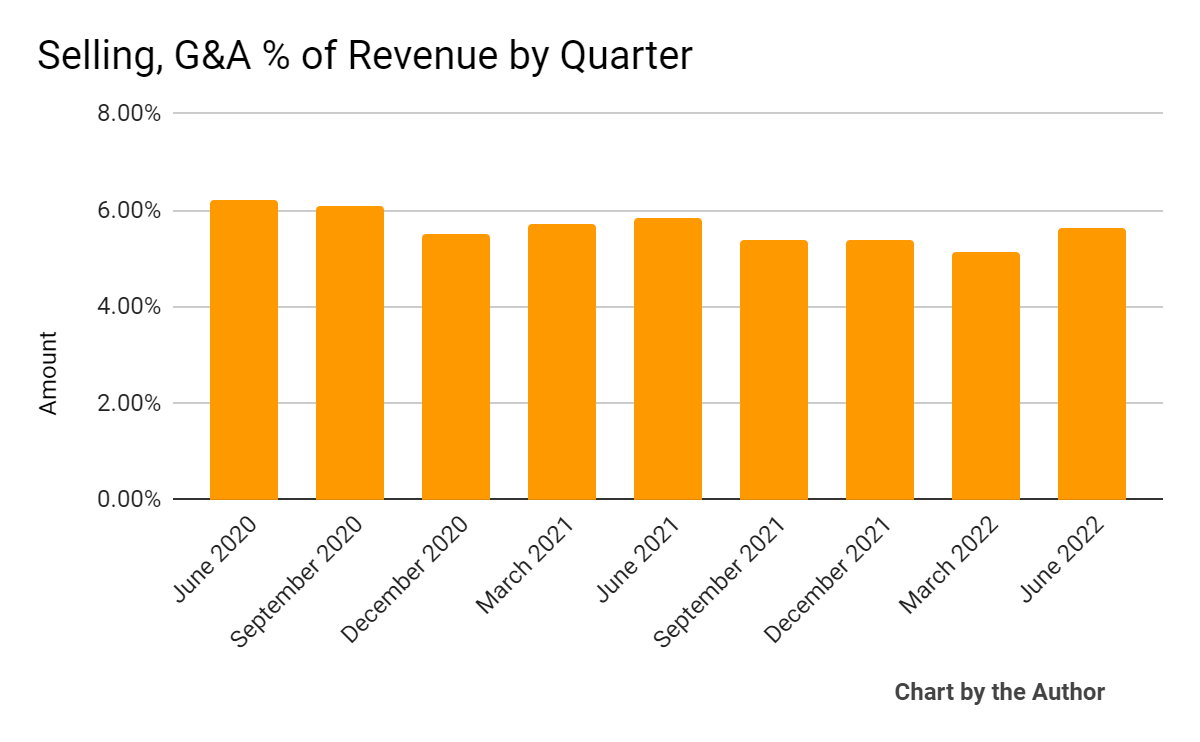

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a fairly tight range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

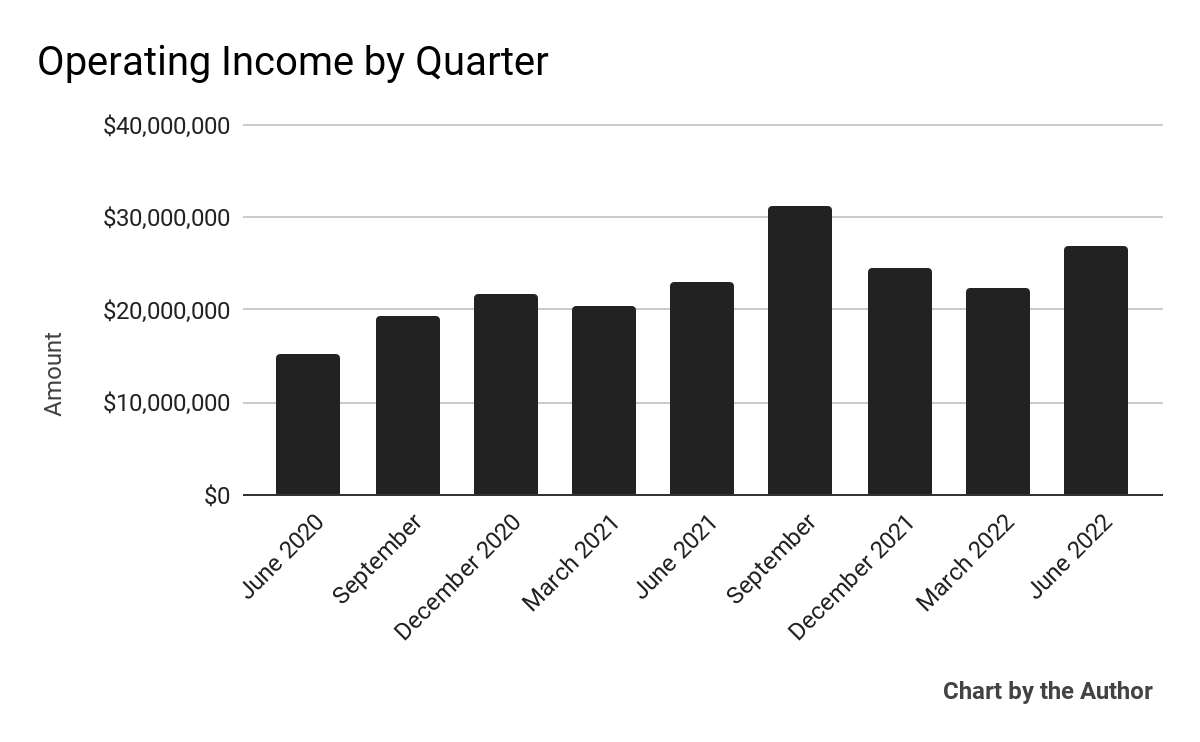

Operating income by quarter has trended higher in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

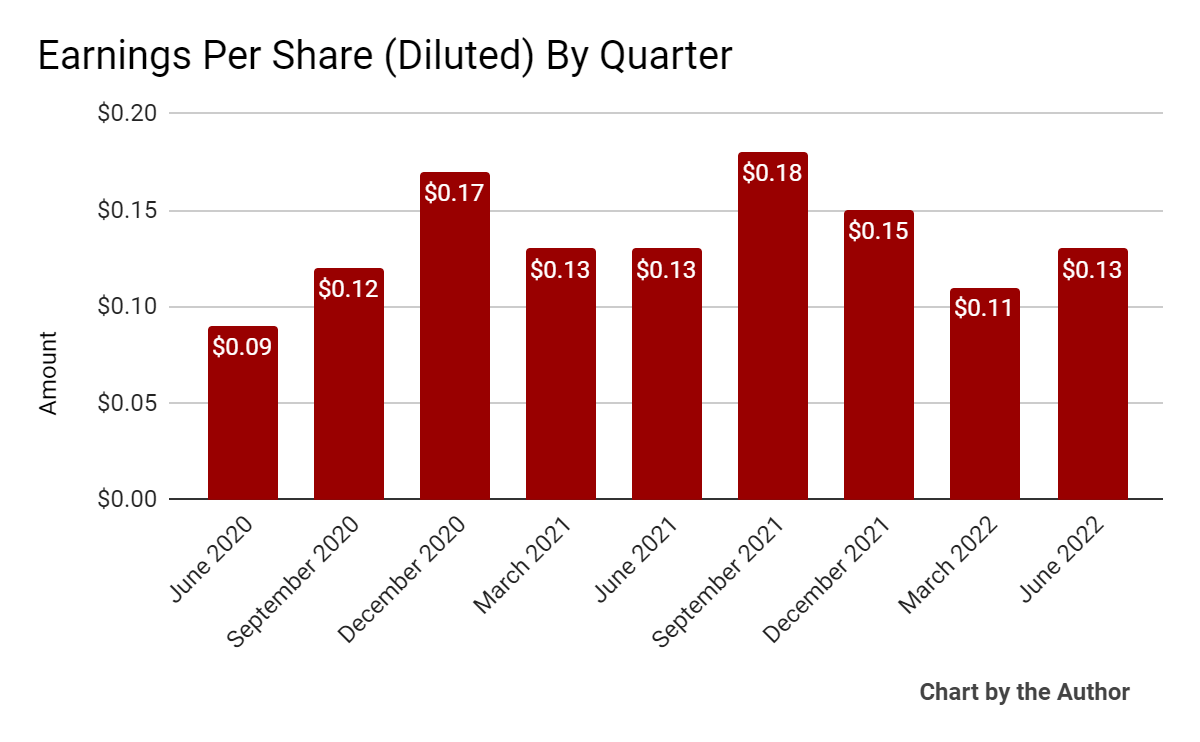

Earnings per share (Diluted) have fluctuated as follows:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

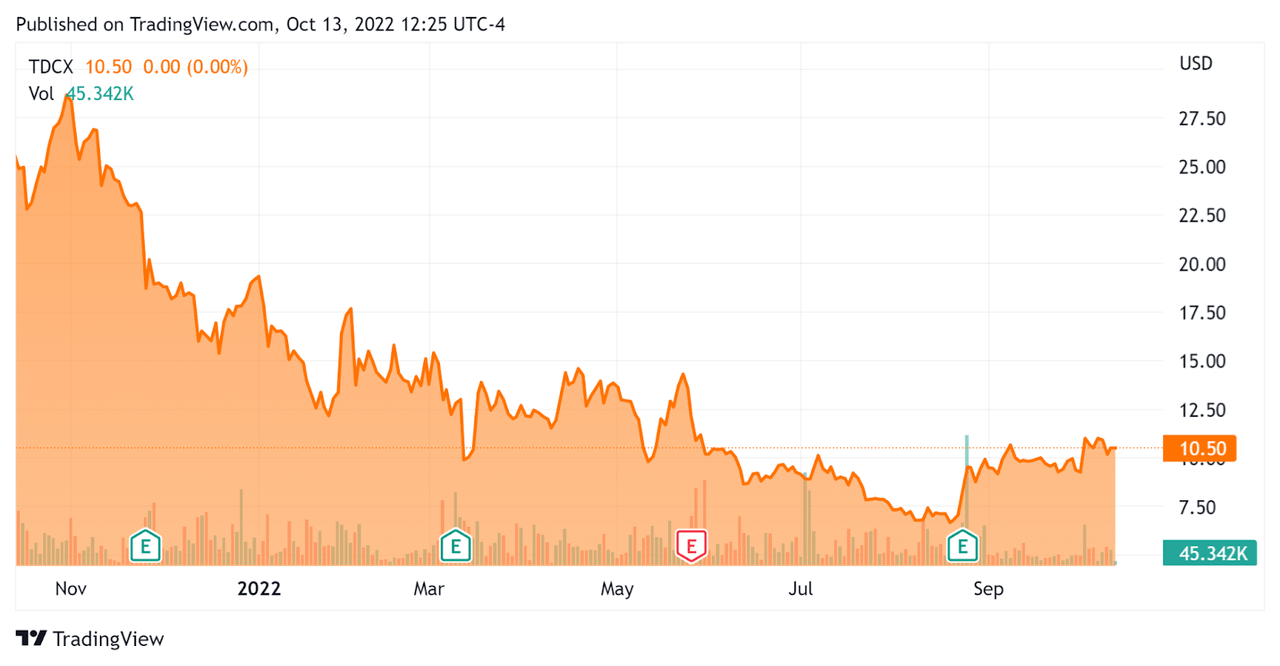

Since its IPO, TDCX’s stock price has dropped 59.1% vs. the U.S. S&P 500 index’ drop of around 17%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For TDCX

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.72 |

|

Revenue Growth Rate |

29.6% |

|

Net Income Margin |

17.5% |

|

GAAP EBITDA % |

26.5% |

|

Market Capitalization |

$1,480,000,000 |

|

Enterprise Value |

$1,210,000,000 |

|

Operating Cash Flow |

$112,460,000 |

|

Earnings Per Share (Fully Diluted) |

$0.57 |

(Source – Seeking Alpha)

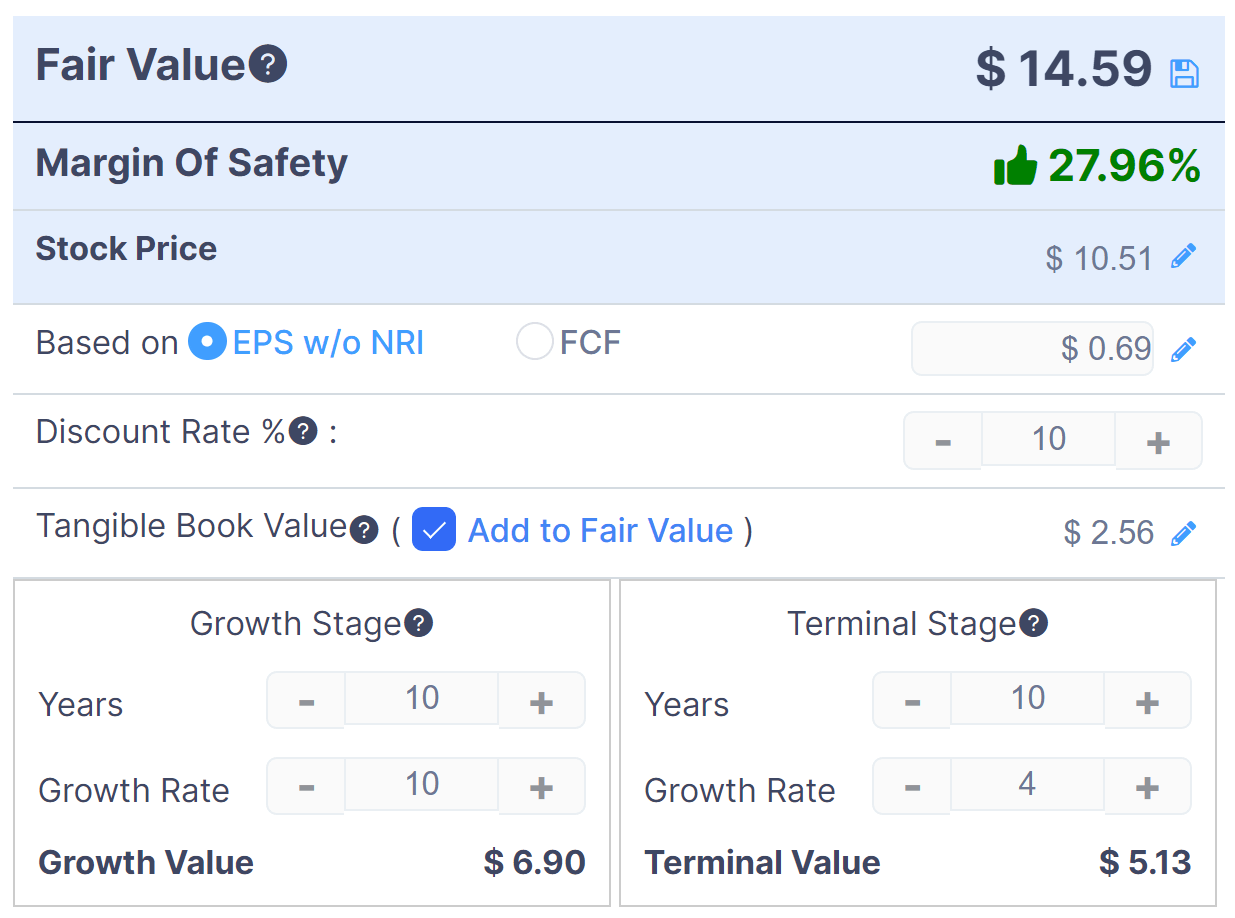

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow – TDCX (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $14.59 versus the current price of $10.51, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

As a reference, a relevant partial public comparable would be Atento S.A. (ATTO); shown below is a comparison of their primary valuation metrics:

|

Metric |

Atento S.A. |

TDCX |

Variance |

|

Enterprise Value / Sales |

0.49 |

2.72 |

455.1% |

|

Revenue Growth Rate |

-4.0% |

29.6% |

–% |

|

Net Income Margin |

-9.9% |

17.5% |

–% |

|

Operating Cash Flow |

$12,370,000 |

$112,460,000 |

809.1% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On TDCX

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted growth in its Fintech vertical and related ecommerce clients.

Southeast Asian clients accounted for 91% of its revenue in the first half of 2022 and the firm expects the verticals of ecommerce, food delivery and digital financial services to be leading sources of growth in the coming years.

The company seeks to expand its contribution in Europe and Latin America but provided little detail in that regard.

As to its financial results, revenue rose 23.3% year-over-year, with travel and hospitality continuing to recover but remaining 16% below its previous peak quarter in Q2 2019.

Management did not disclose its retention metrics other than to say, ‘we have got a very high revenue retention and client retention as usual.’

Notably, employee benefit expenses rose 21% year-over-year, due in part to ‘increased competition for talent in the respective markets that we operate in.’

Other costs rose less quickly than revenue, a positive sign.

Operating income rose year-over-year while diluted earnings per share remained flat versus Q2 2021.

For the balance sheet, the firm finished the quarter with $301.2 million in cash, equivalents, short term investment and trading asset securities and no long-term debt.

Over the trailing twelve months, free cash flow was $103.9 million, out of which the firm spent $8.6 million in capital expenditures.

Looking ahead, for the full year 2022, management reiterated its previous guidance with expected revenue growth of 20.8% at the midpoint of the range and adjusted EBITDA margin of 31% at the midpoint.

Regarding valuation, a conservative discounted cash flow analysis indicates the company’s stock may be undervalued at its current price level.

The primary risks to the company’s outlook are slowing macroeconomic conditions and a strong US dollar. The Singapore dollar has fallen 5.4% against the US dollar in the past year, providing foreign exchange headwinds for the company.

A potential upside catalyst to the stock could include a ‘short and shallow’ economic slowdown leading to reduced foreign exchange pressures and a higher valuation multiple by the market.

Value-oriented investors may see a bargain at the current entry point of around $10.40 per share, although I’m cautious given a slowing macro environment and strong US dollar for the foreseeable future.

Otherwise, I like TDCX, and it appears the firm is well positioned to capitalize on Asia-centric growth.

While I’m on Hold for TDCX in the near term, investors may wish to put the stock on a watch list or nibble at it over time.

Be the first to comment