sankai

Dust on gold doesn’t change the nature of gold. – Jon Gordon

The Aberdeen Physical Gold Shares ETF (NYSEARCA:SGOL) with over $2bn in AUM is one of the more efficient ways (a low expense ratio of only 0.17%) to gain access to physical gold bars which are held in vaults based in Zurich and London. SGOL reflects the prices of gold less the trust’s expenses.

Another notable feature of SGOL is that it is structured as a ‘Grantor Trust,’ which prevents its trustees from monetizing the underlying gold via loans.

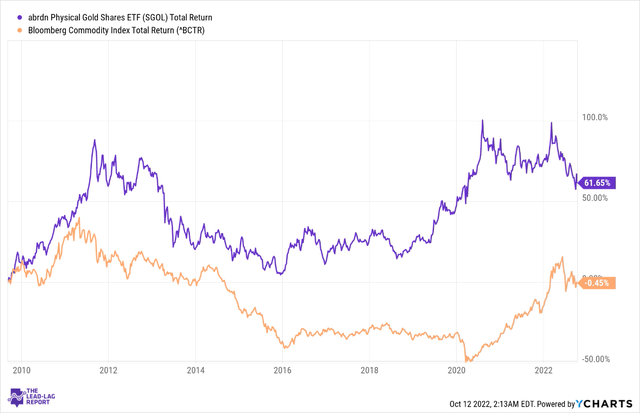

Over the years, SGOL has proven to be a very competent source of returns; since its inception back in Sep 2009, it has comfortably outperformed a basket of diversified commodities as represented by the Bloomberg Commodity Index.

Gold market conditions

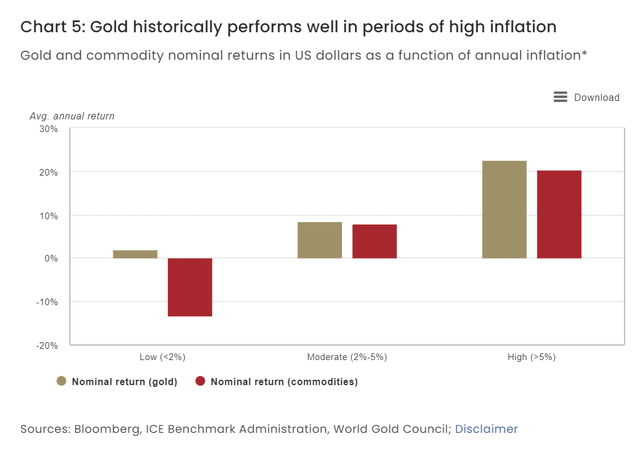

Gold enthusiasts can be forgiven for feeling betrayed by the negative returns delivered by the yellow metal this year, particularly given the perniciously high levels of inflation that we’ve been swamped with. Studies dating back to the 1970s have shown that when inflation has been above 5%, Gold has done very well, typically generating nominal returns of over 20%. This year has been something of an anomaly.

The major stumbling block for gold appreciation this year has been the US Fed’s aggressive monetary tightening endeavors, which in turn have boosted the allure of the dollar, the currency in which gold is priced in.

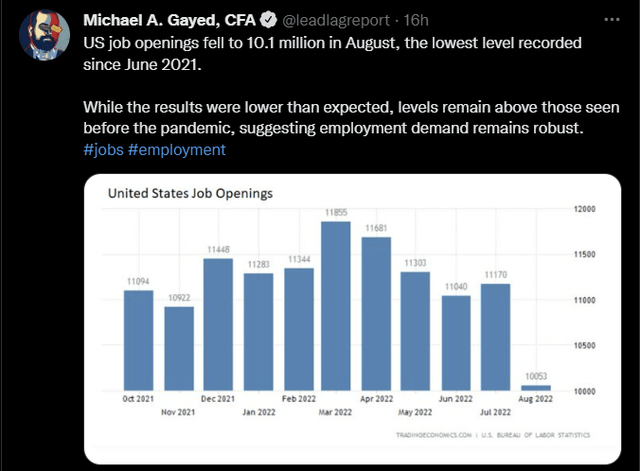

Thursday’s inflation report could be yet another mile marker for ascertaining the ferocity of the US Fed’s future intentions, but I don’t believe investors should brace themselves for a major pivot any time soon, particularly when you consider the way the employment market has been faring.

As noted in The Lead-Lag Report, whilst the run-rate of job openings may have slowed sequentially, this is still well above the levels seen during the pandemic. Until we see a major breakdown in the employment market, I suspect the Fed won’t be too perturbed with carrying on their rate hiking spree.

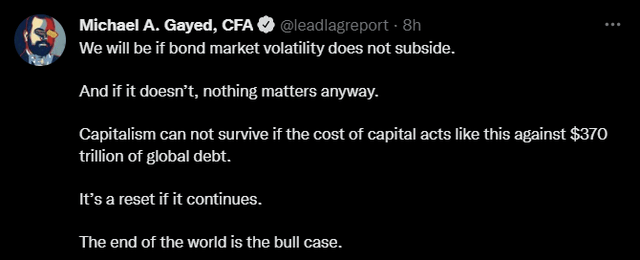

This is all very well, but don’t dismiss the prospect of a potential systemic breakdown; as I’ve posited on Twitter, if the system keeps leveraging higher with even higher interest expenses, you’re talking about annihilation of capitalism.

Last week, subscribers of The Lead-Lag Report were privy to my weekly macro piece in which I highlighted the ever-growing trend of weighted average interest rates through the year which have ended up adding $140bn of annual interest expenses to the government’s books. Prima facie that is not an entirely troublesome number, but if the Fed decides to keep interest rates elevated for an extended period, the mountain of debt will get unserviceable for the US government where a large chunk of its tax revenue would be diverted towards servicing its debt burden.

The issue isn’t limited to the US alone; with $370 trillion of global debt and overly aggressive global central banks all over the entire global system runs the risk of collapsing. When there are question marks over a system that produced fiat money, I suspect something like Gold could hold its own.

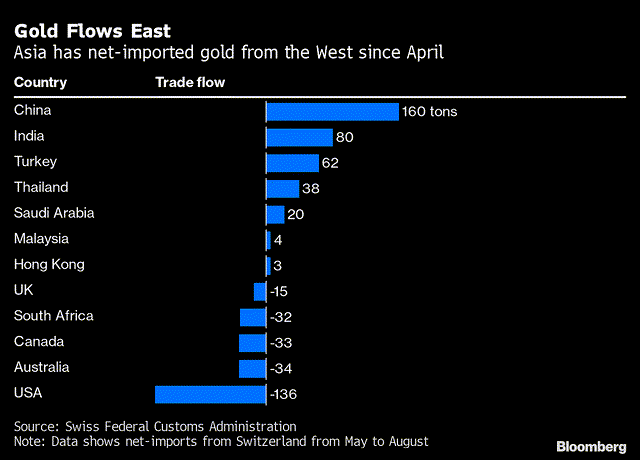

Another underappreciated aspect of the gold story is also what’s happening in some of the eastern markets of the globe, particularly in China which could help put a floor to the gold price slump this year; Gold shipments in China recently hit a 4 year high and despite the ferocity of imports it still isn’t enough to meet demand, raising the premiums charged there. Recent reports have shown that Gold premiums (premiums over the international markets) in markets such as China and Turkey are currently trading in a range of $20-80 an ounce.

These attractive premiums charged in China and Turkey could also have a cascading impact on India where premiums are not as high ($1-$2 an ounce) and which is noted to be a major buyer of the yellow metal ahead of the festivals of Dussehra, Diwali, and Danteras. Reports show that currently, low stock in the Indian market could prompt further demand for the yellow metal in the coming months.

Conclusion

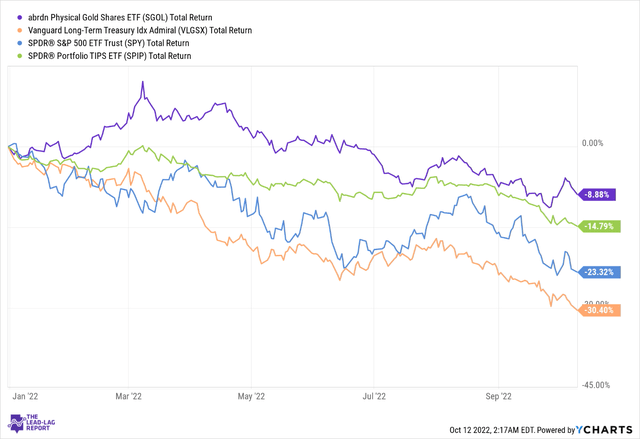

Even though Gold may have chipped away at your wealth this year, it is still worth bearing in mind that this is an asset that has managed to offer some relative defensiveness, even as some of the other alternatives have been annihilated. As the chart below shows, on a YTD basis, SGOL has outperformed not just stocks, but even long-term treasuries, and TIPS by around 1.5-3.5x. To conclude, one shouldn’t underestimate the merit of owning the yellow metal, particularly during times like these.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment