Joseph Fuller

Introduction

This is the third episode of a series that I introduced in my article: “Learning From Buffett About Investing In Railroads: The BNSF Case Study”.

I highly recommend reading it because it explains thoroughly what I have found out about the way Warren Buffett thinks about the railroad Berkshire owns. I have outlined the general mind-frame of the Oracle of Omaha and what we can learn from him as we assess the publicly traded railroad companies.

This series is attempting to look at railroads exactly from the perspective of Warren Buffett, which, as we will see, takes into account a certain number of factors that are not always the first ones to think about.

For those interested in reading the previous episodes, here are the links:

- Looking At Railroads Like Buffett: Canadian National Railway

- Looking At Railroads Like Buffett: Canadian Pacific

For this third episode, we will move to the East coast and we will consider Norfolk Southern (NYSE:NSC).

Norfolk Southern

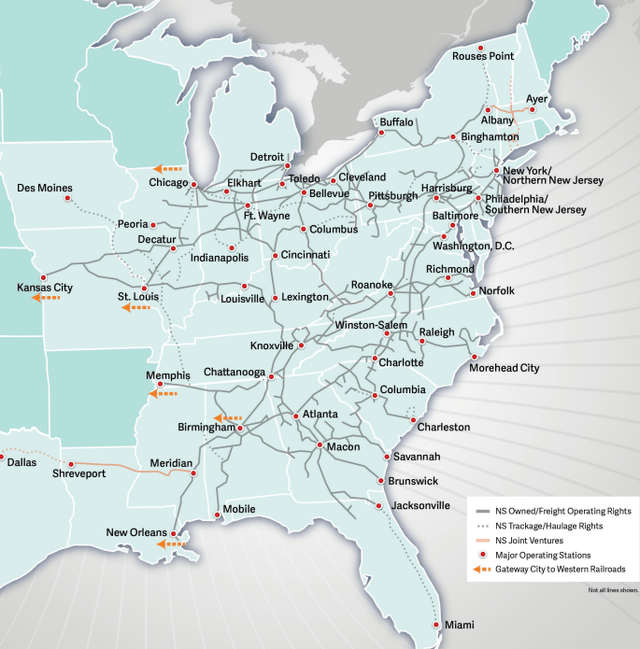

Norfolk Southern Corporation is an Atlanta-based transportation company, whose Norfolk Southern Railway Company subsidiary operates approximately 19,300 route miles in 22 states and the District of Columbia. This makes the company the fifth largest North American railroad. One of the most important advantages that the railway offers is that it serves every major container port in the eastern U.S. and provides efficient connections to other rail carriers. Norfolk Southern transports industrial products, including agriculture, forest and consumer products, chemicals, and metals and construction materials. In addition, the railroad operates the most extensive intermodal network in the East and is a principal carrier of coal, automobiles, and automotive parts. Among the major rail lines, Norfolk is the one most exposed to coal, as we will see in a bit.

Norfolk Southern’s geography shows that it serves a densely populated region, with the only limit being that it doesn’t serve Florida. Furthermore, it owns key infrastructure to serve a part of the growing trend that sees a population shift from the east to the west.

Norfolk Southern Q2 2022 Financial Data Report

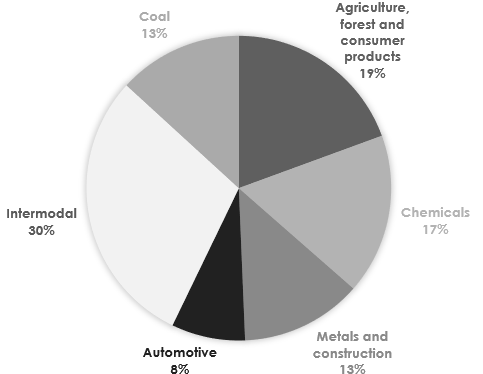

When we consider the different sources of revenues we see that 28% of the 2021 revenue of $11.142 billion came from intermodal. This consists of shipments moving in domestic and international containers and trailers handled on behalf of intermodal marketing companies, international steamship lines, premium customers and asset owning companies. In 2021, Norfolk handled 4.1 million intermodal units. In the first six months of 2022, intermodal grew again and it generated $1.82 billion in revenue, which is equal to 29.6% of total revenues.

One of the larger sources of revenues is coal, which accounted for 12% of Norfolk’s total railway operating revenues in 2021. The company handled 73 million tons, or 0.7 million carloads, most of which originated on its lines from major eastern coal basins, with the balance from major western coal basins received via the Memphis and Chicago gateways. Norfolk’s coal franchise supports the electric generation market, serving approximately 50 coal-fired power plants, as well as the export, domestic metallurgical and industrial markets, primarily through direct rail and river, lake, and coastal facilities, including various terminals on the Ohio River, Lamberts Point in Norfolk, Virginia, the Port of Baltimore, and Lake Erie. Clearly, in the midst of the energy crisis we are going through, Norfolk plays a strategic role in supplying this commodity that is witnessing a renewed demand surge. While over the long-term coal may see a decline, it must be recognized that it is a near-term opportunity that could benefit Norfolk more than its peers.

In fact, as the company reported in July, during the first six months of 2022 we can see a further increase in coal revenue that spiked up 29% from $630 million in 2021 to $814 million in the first six months of this year. This brought coal to make up 13.2% of total revenues.

Here is the full breakdown of the other major sources of revenues. Norfolk is accustomed to gathering up together agriculture, chemicals, metals and automotive under the label “merchandise”.

Author, with data from NSC Q2 Earnings Report

Earning power

Readers of this series may be getting used to this metric. Warren Buffett has stressed it quite a bit, as we have seen in the introductory article. In fact, it is this point that made him understand that it is possible to invest in capital intensive businesses with decent returns. The point that Buffett has clarified is that these companies need to be able to earn enough money to cover their interest requirements in any economic conditions. Interest coverage is calculated as pre-tax earnings/interest. In 2021, Norfolk Southern reported pre-tax earnings of $3.9 billion and an interest expense of $646 million. The ratio is 6.04.

Just to recap what we have seen so far. BNSF’s interest coverage was 9.5x. Canadian National reached a 10.4x, while Canadian Pacific reached a 6.2x.

Norfolk Southern achieves, so far, the lowest ratio among the companies we have considered. A 6 is still quite a good ratio because it means that pre-tax earnings should diminish by 83% before being less than the interest expense.

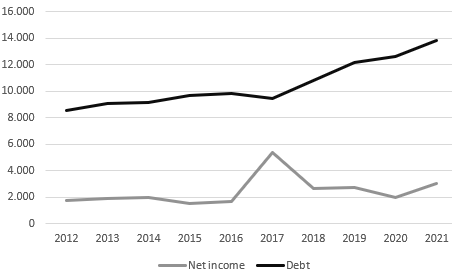

We have also learned from Buffett that when considering the interest coverage we have to look at what the management intends to do with the money it borrows. Here, I have spotted something that I don’t really like.

As we can see from the graph below that in recent years the net income has not grown at the same pace as debt, which is increasing rapidly.

Author with data from Seeking Alpha

In the past six months, while the net income is just $30 million more versus last year, we have a total debt that has increased by $1.34 billion bringing the total debt at $15.05 billion. What has this money been used for? If we look at the cash flow statement, we see that the company spent $1.45 billion for share repurchases over the first six months. There is no sign of the borrowed money under the investing activities, apart from a $210 million increase in property additions spending. This makes me think that most of this debt was used for share repurchases. In fact, the weighted average of outstanding shares decreased by 12.4% YoY. As far as I like buybacks, I stick with Warren Buffett in believing that they are good only when they return excess cash to the shareholders. In this case, I see borrowed cash returned to shareholders who, on the other hand, own more debt and will have to make the company pay an interest on this cash that was returned to them. I must say that I don’t like this operation, especially when interest rates are rising. Furthermore, it is to be considered whether the current share price is attractive for such a big repurchase. At today’s valuation, with a price to sales of 4.3, a price to book of 3.9 and p/e of 16.8 the shares are not exactly cheap. True, in this way the company will have to pay less dividends being thus able to increase it for the remaining shares. But, as I think it is becoming clear, it is not exactly an operation that is creating real value for the shareholders. I would be interested in knowing in the comments what other readers think about this situation.

Efficiency

The earning power is not only a matter of a ratio. In fact, the numerator (pre-tax earnings) is the result of many factors. On one side, we need revenues, possibly growing. But even in case of flat revenues, pre-tax earnings can increase if the company improves its efficiency. Over the last three years, Norfolk Southern has been able to reduce its operating ratio by 530 basis points and achieved a company record of 60.1%. This was also thanks to an improving average train weight and length of 21% and 20%, respectively.

These outstanding results are possible thanks to PSR (Precision Scheduled Railroading) that is able to manage more efficiently routes and freight car movements. It also makes freight trains depart on scheduled time rather than on waiting for the cars to be fully loaded. This has enabled the company to cut costs, reducing the number of employees 30,943 in 2021 to 18,100 at the end of 2021 with the benefit of lowering compensation expenses.

However, PSR has also produced some negative results, especially regarding employee treatment that has become one of the recent battlegrounds between railroads and unions. Employee burnout has become a problem and employee retention is low. Norfolk acknowledged this in its annual report:

while our focus on productivity and revenue growth produced record financial results, our service – impacted by labor shortages across key areas of our network – was not where it needed to be. Accordingly, we have increased our hiring and retention efforts, and begun development of a new operating plan that is fully aligned around a return to the service levels our customers expect.

So, if on one side we have a big improvement in efficiency, we still have to see how much it will cost the company to not be at odds anymore with its employees. We should expect wage raises and a new shift policy that could have an impact on the company’s future results.

In any case, the company, as most railroads, has already been hit by increasing fuel costs in the first six months of the year, that led operating expenses to a 21% increase. This has made Norfolk Southern, like its peers, work on fuel surcharges that are expected to have a positive impact on Q3 results. I think it is reasonable to expect from this additional source of revenue some tailwinds as fuel has come down in price, but the surcharges lag these price changes by a few months.

Let’s now look at the most important efficiency metric that we have learned from Buffett. The operating ratio is one and in the first half of the year it was up once again at 60.9%, up 260 bps YoY and 80 bps from the 2021 full year results. However, we know that this is due to fuel costs and, as we said in the paragraph above, we can expect this problem to be dealt with in the upcoming quarters. In any case, Norfolk didn’t perform as well as Canadian National (CNI) that is at 59.3% and was actually able to lower this metric in the first half of the year. Canadian Pacific (CP) reported a 59.5%, and, as we have seen, it is the company that has improved its ratio the most in the past decade.

We have to consider fuel efficiency. Here Canadian Pacific reported a fuel efficiency of US gallons of locomotive fuel consumed per 1,000 GTMs (gross ton-miles) of 0.96. Canadian National, on the other hand, reported a 0.838 and actually improved its results in the past six months. Norfolk Southern is less efficient than these two peers as it reports year-to-date 1.11 gallons per 1,000 GTMS, or a 3% decrease YoY, but still 15% more than Canadian Pacific and 32% more than Canadian Pacific. It is clear that Norfolk has to improve from this point of view, perhaps investing in new locomotives, since 2,570 of its 3,210 ones (80%!) are from 2006 or before. Also, the average age of in service locomotives is 26.7 years and the average age to retire them is 31.5 years. I think these numbers hint towards the need of big investments to renew the locomotive fleet.

Use of capital: return on investments and shareholder return

Warren Buffett has stressed it many times that a company needs to be able to earn a decent return on the capital employed. It does however say in its annual report that it is assuming a long-term investment rate of return of 8%. This is why ROIC is such an important metric, especially for capital intensive businesses like railroads. Unlike its Canadian peers, Norfolk Southern doesn’t disclose its ROIC. However, if I calculate it using the formula (NOPAT/invested capital) I get a 14%, which is just slightly below Canadian National’s 14.1% and Canadian Pacific’s 16.7% (prior to the Kansas City Southern acquisition, which brought the ROIC down to 8.2%). A 14% ROIC is pretty decent and this is positive for this company and its investors.

Currently, the company is investing a lot to stabilize service levels, expanding its pipeline of conductor trainees and hiring them (right now there are about 900 trainees that are being trained). In 2021 the company spent about $1.8 billion in track and equipment and another $1.2 billion in investing activities. The company now is really focused on labor issues and even during the last earnings call there were no real news that shed more light on other infrastructure investments. Capital expenditures have also been decreasing in the past ten years from $2.24 billion in 2012 to $1.68 billion last year (from 20% of total revenues to 15%, versus Canadian National that targets to spend 17% of revenues on capex). This makes me question if the company is actually managing its network maintenance and development well.

For me, this is a situation not clear enough to give a good assessment of where the money is deployed.

Present and future cash flows

With revenues increasing and capex decreasing, we see that the free cash flow has been growing quite rapidly from $835 million in 2012 to $2.88 billion last year. This is a 13.2% CAGR. Thanks to the big buybacks, the fcf per share has grown even more impressively from $2.57 to $11.28 at a CAGR of 16%.

This has given the company a lot of cash for distribution with an interesting free cash flow yield of 5.78% which supports a dividend yield of 2.35% (the payout ratio is below 40%). Very alluring and tempting, when considered aside from some of the issues I currently see with the company.

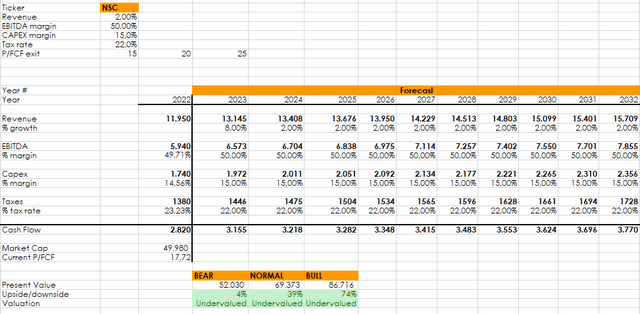

As we learned from Buffett, we have to give a valuation of the company based on its future cash flows. Here below is a simple discounted cash flow model that projects the future cash flows of Norfolk Southern and sets three possible scenarios based on price/free cash flow multiple exits.

I plugged in the numbers I am expecting for this year based on the 1H results and the management’s guidance. I have also assumed that next year’s revenues will grow more thanks to the new 1,000 employees and the surge in intermodal and coal. Afterwards, I assume a constant revenue growth of 2% which may actually seem a bit generous given the past decade.

The EBITDA margin is assumed to be at 50%, in line with the industry average, while I chose a 15% capex on revenue according to the current data available from the company.

Author, with data from Seeking Alpha

The result is that based on the three possible exit multiple the company is undervalued. However, this model stretches into the future the metrics the company has gotten us used to in the past decade where it has been focused on free cash flow while reducing other expenditures. It is to be seen if this choice will make the company more profitable over the long term, since we have seen that a major shift towards productivity has now caused some pains regarding good employee relationships. Furthermore, the lack of information about future investments makes me a bit suspicious about entering into the stock. Therefore, I rate the stock as a hold. It doesn’t fit with all the metrics Buffett likely looks at and there are some uncertainties which make prefer to wait before jumping aboard Norfolk Southern.

Be the first to comment