EtiAmmos

Not even the affirmation of a third term for President Xi over the weekend could keep the stock market down yesterday, given his tyrannical grip over the Chinese economy and stifling Zero-Covid policies that have prolonged the adverse impact on global supply chains. Instead, investors are focusing on earnings with the five largest market caps in the S&P 500, which account for 25% of the index, reporting over the next three days. In total, 165 constituents accounting for 45% of the index will report this week. A combination of lower valuations and minimal expectations sets the bar low for upside surprises this quarter.

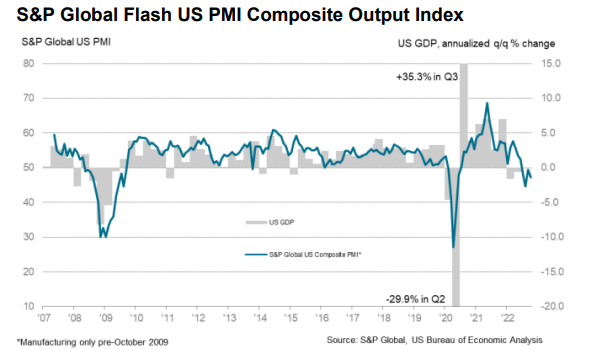

Investors are also welcoming weaker economic data, which is helping to build consensus around the view that the Fed will ease its foot off the brakes on the economy by year end. Yesterday, S&P Global released its mid-month results from its survey of purchasing managers in both the manufacturing and service sectors. The composite index fell for a fourth month in a row to its lowest level since September 2020, reflecting a contraction in business activity. While survey results show an increased risk of recession in the fourth quarter, they also show weakening demand is helping to moderate price increases, as the rate of output charge inflation fell to its lowest level since December 2020.

S&P Global

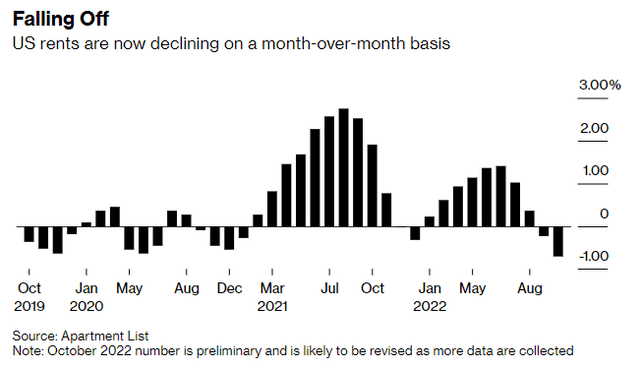

The most important moderation to date in the Feds fight to return inflation to its 2% target can be seen in rents, which have finally hit a breaking point in terms of affordability. Demand is waning across the country, due to price increases, with rents falling month-over-month in 69 of the top 100 cities in the country. At the same time, there is close to a record number of new apartments being built, which will boost supply in the spring. This tells me that we are bound to see a deflationary impact from the cost of shelter next year, which accounts for more than one third of the inflation index tracked by the Fed.

This would be showing up in the index today, but the method of calculating shelter costs results in a 6-9 month lag for current conditions. With respect to what renters are actually paying, the data is updated every six months, so it takes time for new leases at lower rates to be incorporated into the calculation. As for owners’ equivalent rent (OER), it will also take time for homeowners to acknowledge that home price stagnation in combination with the shift in supply and demand for rentals means they would not pay more to rent their own homes each year. This should be glaringly evident by the spring.

Fed officials are aware of this, and they should be able to anticipate the sharp slowdown in the core rate of inflation that will result next year. This development in concert with the broadening macroeconomic slowdown should lead to the pivot in policy the bulls are looking for before year end. Of course, the stock and bond markets should anticipate this in advance if they aren’t already doing so now.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment