imaginima

Thesis

Leading oil and gas producer Canadian Natural Resources Limited (NYSE:CNQ) has seen its stock recover remarkably from its September lows. Accordingly, CNQ delivered a price gain of more than 30% over the past month, outperforming the SPDR S&P 500 ETF (SPY).

Energy bulls’ sentiment has been lifted by the allure of “OPEC+’s put,” as the cartel announced a dramatic 2M barrels per day cut in production to stem the decline in the oil futures market (CL1:COM) (CO1:COM). However, Bloomberg highlighted in a recent piece that energy investors need to consider the possibility of a cut of just 10% of the announced 2M per day figure, given the current underproduction among its members.

The Biden Administration’s efforts to “manage prices” with the Strategic Petroleum Reserve (SPR) saw it primed to release another 15M barrels in December. Biden has also pledged to do more if necessary, as he highlighted: “It’s motivated to make sure that I continue to push on what I’ve been pushing on.”

Notwithstanding, Energy Aspects highlighted that the Biden Administration’s move could be facing a decisive pause, as Co-Founder and Director Amrita Sen highlighted that Biden has just 60M more barrels in the SPR to “play with.“

We gleaned that buyers in CNQ seem to have reacted more positively to OPEC+’s announced cuts than Biden’s stratagem. However, we urge investors to be highly cautious in assuming the buying momentum will continue surging.

Our analysis highlights that the market remains tentative in lifting CNQ’s buying upside decisively from the current levels, with selling pressure potentially building up as the bears drew in the unsuspecting buyers quickly.

Coupled with the increasing likelihood of a global recession, energy analysts still seem overly optimistic about the supply/demand dynamics moving in favor of the former. However, we gleaned that recent upward moves in CNQ didn’t reflect the uncertainties in the underlying oil and gas markets. Therefore, the bifurcation is a red flag that investors need to consider carefully.

Accordingly, we believe the opportunity to cut exposure has arrived again, given the recent sharp rally.

As such, we rate CNQ as a sell and encourage investors sitting on massive gains to start layering out.

Global Recession Risks Are Brewing

Global recessionary risks have continued to intensify, with the media catching up on a theme we had already highlighted to our members earlier in the year.

However, the critical question investors need to ask is whether oil & gas analysts have factored in the potential for demand destruction in their earnings estimates.

We noted that while the underlying WTI crude and Nymex natural gas prices (NG1:COM) have weakened considerably from their June highs, industry analysts have raised their earnings estimates.

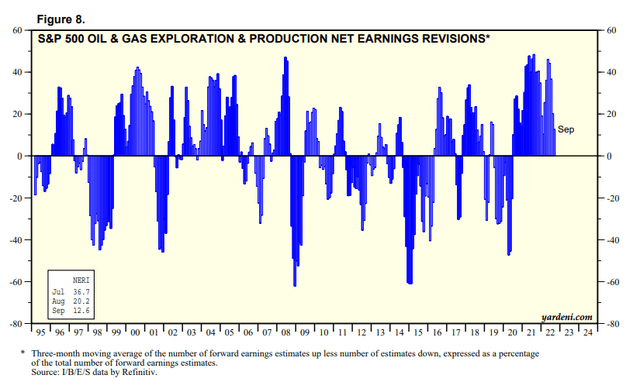

S&P 500 Oil & Gas E&P Industry net earnings revisions % (Yardeni Research, Refinitiv)

As seen above, analysts have continued to raise the industry’s forward earnings prospects through September.

Therefore, the possibility of over-optimism among industry analysts cannot be ruled out, as Wall Street could be too confident about the industry’s cyclicality through the coming global recession.

It’s essential for investors to note that the IEA has already cut its global demand outlook for 2023. Moreover, OPEC+’s move suggests that it saw global demand weakening, given the zero COVID policies in China.

Investors continue to speculate on the possibility of Chinese President Xi Jinping easing its stringent COVID restrictions from 2023. However, we urge investors not to second-guess what the Chinese leader would do. Hence, it’s better for investors to analyze what the markets are thinking about the current battle between the energy bulls and the bears.

Canadian Natural Resources’ Valuations Seem Cheap, But Don’t Be Deceived

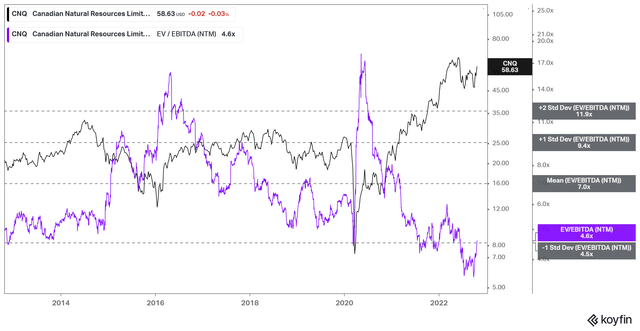

CNQ NTM EBITDA multiples valuation trend (koyfin)

As seen above, CNQ last traded at an NTM EBITDA multiple of 4.6x after falling to a 10Y low in September.

Hence, the market has clearly de-rated CNQ, despite its robust performance in 2022. Moreover, CNQ’s valuation is also in line with its peers’ average NTM EBITDA multiple of 4.5x (according to S&P Cap IQ data). Hence, it seems the market has not re-rated the whole industry.

Could the market know something that we don’t? Could industry analysts still be too optimistic with their forecasts on CNQ and its peers?

Let’s try to find out.

Is CNQ Stock A Buy, Sell, Or Hold?

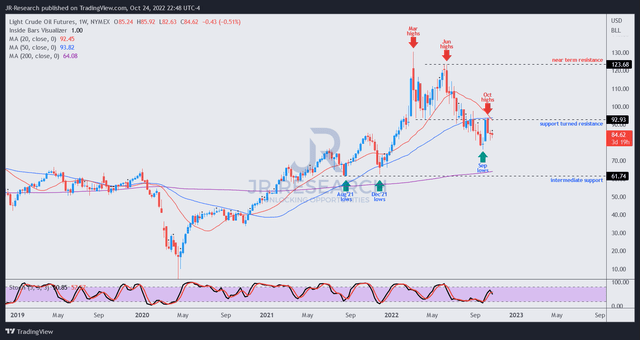

WTI crude oil price chart (weekly) (TradingView)

As seen above, CL1 has been sent spiraling below its critical 50-week moving average (blue line). Its “support-turned-resistance” also acts as a level for sellers to deny further buying upside from its recent recovery.

Therefore, it’s pretty clear that CL1 buyers have been unable to muster enough momentum to retake its 50-week moving average, which could lead to a decisive loss in its medium-term bullish bias.

For now, CL1’s September lows ($76) are helping it consolidate at the current levels. However, the longer it stays under its “support-turned-resistance,” the longer the initiative remains with the sellers looking to force a steeper selloff moving ahead.

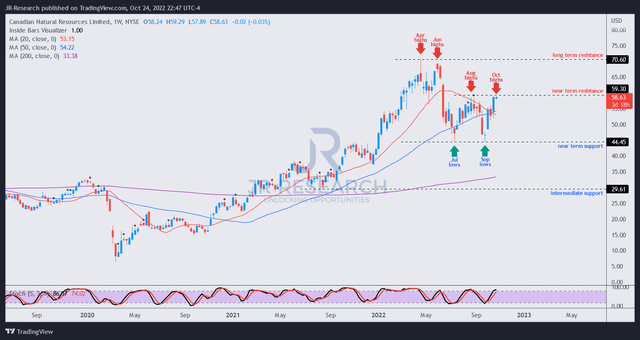

CNQ price chart (weekly) (TradingView)

Also, the bifurcation was apparent in CNQ’s medium-term price action. As seen above, CNQ has recovered remarkably from its September lows (a critical support level). However, it has met stiff resistance again at its near-term resistance. That level also led to a distribution zone in August before sending buyers fleeing through its September lows.

Furthermore, the rapid surge over the past month is not constructive, as we prefer a more gradual accumulation phase to indicate sustained buying momentum. Hence, we postulate that CNQ’s price action is not in sync with the underlying uncertainties seen in CL1, suggesting extreme caution should be heeded at the current levels.

Therefore, we believe it’s appropriate for investors to leverage the recent sharp recovery to cut exposure in CNQ and layer out.

We rate CNQ as a Sell.

Be the first to comment