scyther5/iStock via Getty Images

1 – Introduction

Canada-based New Gold Inc. (NYSE:NGD) released its first quarter of 2021 production results on April 12, 2022. The first reaction was a surprise after looking at the production results. It was a multi-year low and contrasting with the preceding quarter.

CEO, Renaud Adams, said in the press release:

“The first quarter saw both of our operations deliver total gold equivalent production of 87,696 ounces as we begin a year focused on operational excellence and optimization at both assets”

1.1 – Investment Thesis

Despite a bullish gold price, production numbers were insufficient to rank NGD as attractive for the long term. The first quarter production is far from encouraging, and the investment thesis is getting better but still uncertain.

I recommend trading LIFO about 60% of your position and keeping a small core long term.

One crucial element that can help a long-term investment thesis is the cash position of $541 million in 4Q21 and should remain above $520 million despite the lower production in 1Q22. On December 13, 2021, New Gold sold the existing gold stream held on the Blackwater Project to Wheaton Precious Metals (WPM) for $300 million in cash and other considerations.

- New Gold will receive upfront cash consideration of US$300 million from Wheaton upon closing of the transaction;

- The gold stream entitles Wheaton to 8% of the gold produced from Blackwater, reducing to 4% of gold production once approximately 280,000 ounces of gold have been delivered to Wheaton. Gold delivered under the stream is subject to an ongoing cash price equal to 35% of the spot gold price, payable to Artemis.

The company is now net debt-free.

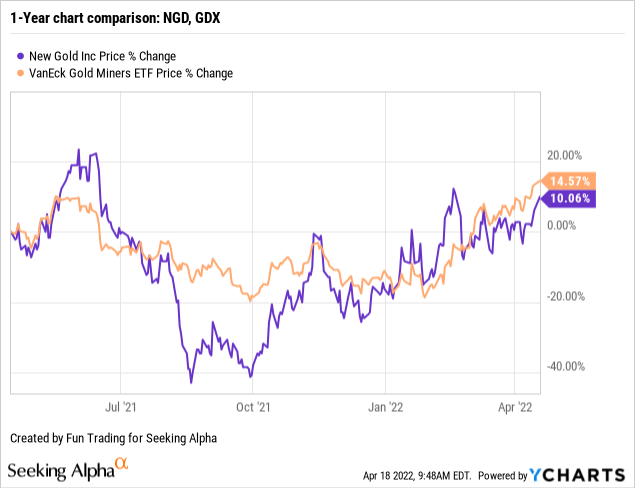

1.2 – Stock Performance

NGD has underperformed the VanEck Vectors Gold Miners ETF (GDX) significantly, especially after the news related to the Rainy River. However, NGD is recovering fast and is now up 15% on a one-year basis.

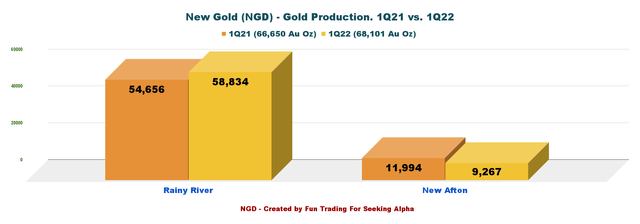

2 – Gold Production Details for the First Quarter of 2022

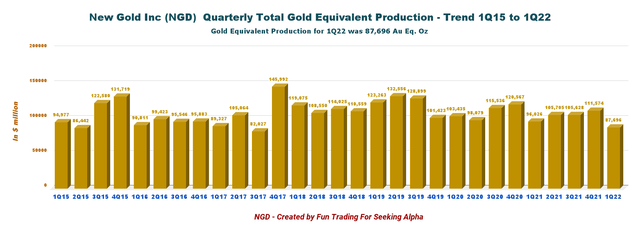

The quarterly gold equivalent production was surprisingly weak this quarter.

- Total gold equivalent production was 87,696 Eq. Oz for 1Q22, down 8.7% compared to the same quarter a year ago and down 21.4% sequentially.

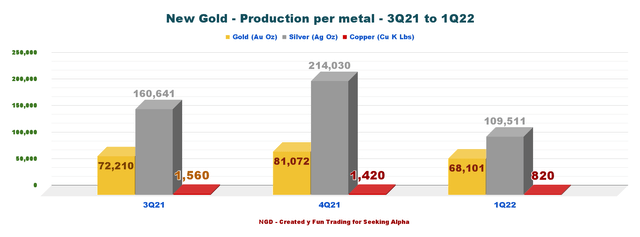

- New Gold produced 68,101 Au Oz, 109,511 Ag Oz, and 8.2 Mlbs of copper.

NGD: Chart quarterly gold equivalent production history (Fun Trading)

Note: New Gold has a gold stream obligation with Royal Gold (RGLD) on Rainy River, reducing the quarterly gold price realized.

Increased COVID-19 cases impacted the Rainy River production at the site, which created technical issues. Also, the cold weather affected drilling productivity. At the New Afton mine, the lower production was due to a transitioning to the B3 ramp-up and C-zone.

CEO, Renaud Adams, said in the press release:

At Rainy River, we achieved quarter over quarter production growth despite lower tonnes mined as a result of an increase in COVID-19 cases at site in the first part of the quarter, which impacted equipment utilization, and the cold weather affecting drilling productivity. The milling rate was also impacted during the quarter due to mechanical maintenance on the SAG mill and crusher, and weather conditions impacting stockpile movement.

At New Afton, the planned closure of the Lift 1 cave was completed with the exception of the recovery level, commissioning of the thickened and amended tailings facility was completed, and we continued to advance the B3 ramp-up and C-Zone development.

- Details per metal comparing 3Q21, 4Q21, and 1Q22: Production was weak for gold, silver, and copper.

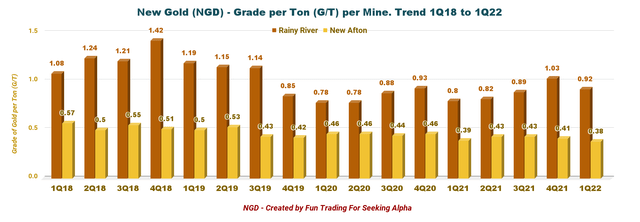

NGD: Chart gold production comparison 3Q21 to 1Q22 (Fun Trading) NGD: Quarterly grade per tonne per mine history (Fun Trading) NGD: Chart gold production comparison 1Q21 1Q22 (Fun Trading)

- The Company indicated that the Rainy River mine produced 59,895 GEOs (58,834 ounces of gold and 79,621 ounces of silver) in 1Q22.

- The New Afton mine produced 27,800 GEOs (9,267 ounces of gold and 8.2 million pounds of copper, and 29,890 Ag Oz) in 1Q22.

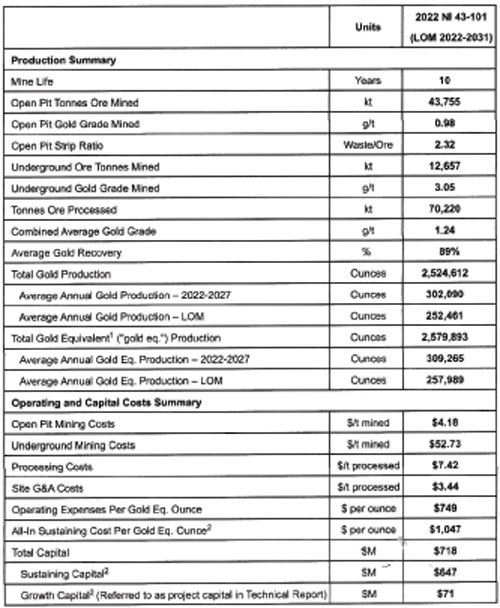

3 – One Positive: The Recent Rainy River Technical Report

On March 31, 2022, New Gold published new mineral reserves for the Rainy River mine. LOM is ten years, and the average annual gold production from 2022 to 2027 is expected to be 302K Au Oz (309K Au Eq. Oz). AISC per GEO is estimated at $1,047.

NGD: Table from the company press release (New Gold)

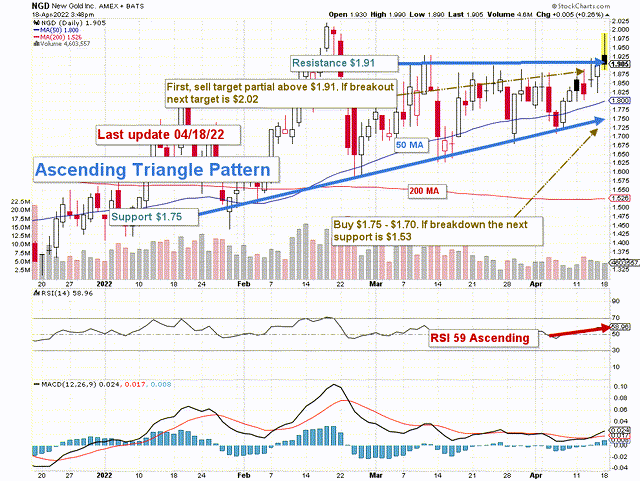

Technical Analysis (Short-Term)

NGD forms an ascending triangle pattern with resistance at $1.91 and support at $1.75. The trading strategy is to trade LIFO about 60% of your total position and keep a core long-term position for a higher return.

I suggest selling at or above $1.91-$1.95, 30% of your position, and waiting for an eventual breakout to sell 30% from $2 to $2.10.

However, if gold turns bearish again due to the Fed’s hawkish action, NGD will likely drop below $1.80 (50MA)-$1.75 and retest $1.55-$1.50 again in the worst-case scenario, assuming no catastrophic news. I suggest accumulating below $1.75 with a bottom potential set at $1.50.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

Be the first to comment