agnormark/iStock via Getty Images

It’s been a much better year thus far for the Gold Juniors Index (GDXJ), with the ETF up 13% year-to-date, massively outperforming the major market averages. This year, one of the best performers has been Wesdome Mines (OTCQX:WDOFF), a mid-tier producer that’s expected to see high double-digit production growth this year, helped by its Kiena Mine in Quebec. However, while Wesdome is an industry leader from a grade and growth standpoint, the stock is a little extended short-term. So, while I see Wesdome as a top-15 producer sector-wide, I would not be chasing the stock here above US$12.65.

Eagle River Mine Operations (Company Presentation)

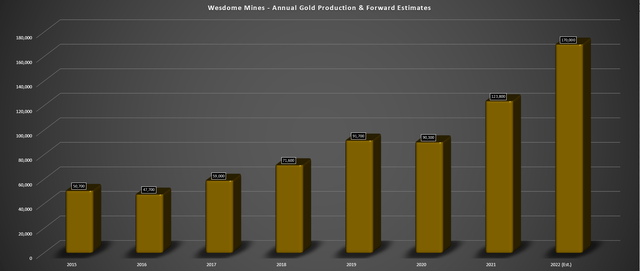

Wesdome Mines has spent the past several years relatively under-the-radar, given that it’s hovered just below the ~100,000-ounce production mark, relying solely on its Eagle River Complex for production. However, after years of hard work adding resources at Kiena, the company has successfully added a second operation that’s expected to catapult its production to 170,000 ounces per annum in 2022. This is a huge deal for Wesdome. The reason is that it allows the company to shed its riskier single-asset producer status, and it will also provide a major boost to free cash flow, helping to support continued aggressive drilling at its Ontario/Quebec operations.

Wesdome – Annual Gold Production (Company Filings, Author’s Chart)

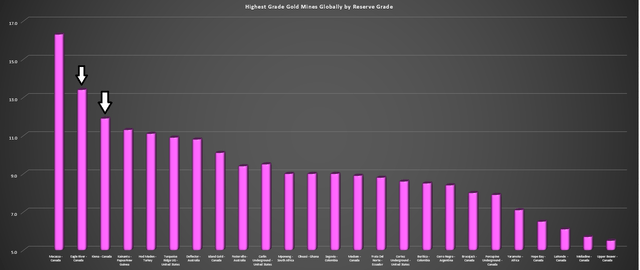

Some investors might be wondering what’s so special about a ~170,000-ounce producer when there are several other 100,000 to 250,000-ounce producers to choose from in the sector. When it comes to Wesdome, the company differentiates itself from most of its peers, benefiting from a few traits that made Kirkland Lake (KL) so desirable. These attributes include operating out of solely Tier-1 jurisdictions (Eagle River: Ontario, Kiena: Quebec), very high-grade underground operations, and ore bodies that appear to have significant upside, with reserves understating the true potential at these two assets.

Highest-Grade Mines by Reserve Grade (Company Filings, Author’s Chart)

In fact, as the chart above shows, Wesdome owns not one but two of the highest-grade mines globally from a reserve grade standpoint, second only to the world-class bonanza grade Macassa Mine in Ontario. Meanwhile, the company also benefits from strong leadership, with Chief Executive Officer Duncan Middlemiss previously being President & CEO of St. Andrew Goldfields before Kirkland Lake Gold acquired the company. This combination of high grades, growth, attractive jurisdictions, a clean balance sheet (~$70 million net cash), and meaningful excess processing capacity makes Wesdome a stand-out among its peer group.

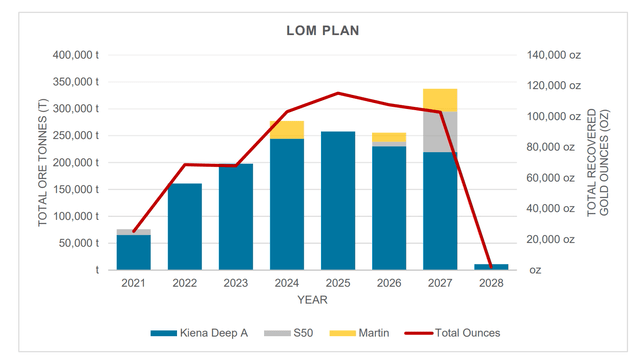

When it comes to Wesdome’s production growth, it’s worth noting that the company’s new Kiena Mine has projected life-of-mine [LOM] all-in sustaining costs [AISC] that are well below its current cost profile ($676/oz.). Even if we assume that these estimates are too ambitious and that all-in sustaining costs come in closer to $750/oz., this would still make Kiena one of the lowest-cost mines globally. This should help Wesdome pull down its consolidated costs, which have previously hovered closer to the $1,050/oz. mark.

Kiena Life of Mine Plan (Company Technical Report)

It’s also important to note that while Kiena already has a respectable production profile according to its recently released Pre-Feasibility Study, the Kiena Mine Complex has significant excess capacity. This is because it was designed to process up to 2,000 tons per day (2,000-ton per day mill, additional hoisting capacity). So, while the current production profile might seem on the low end with ~84,000 ounces per annum and just over ~100,000 ounces in the peak years, there is a meaningful upside to this production profile if the company can increase its processing rates down the road.

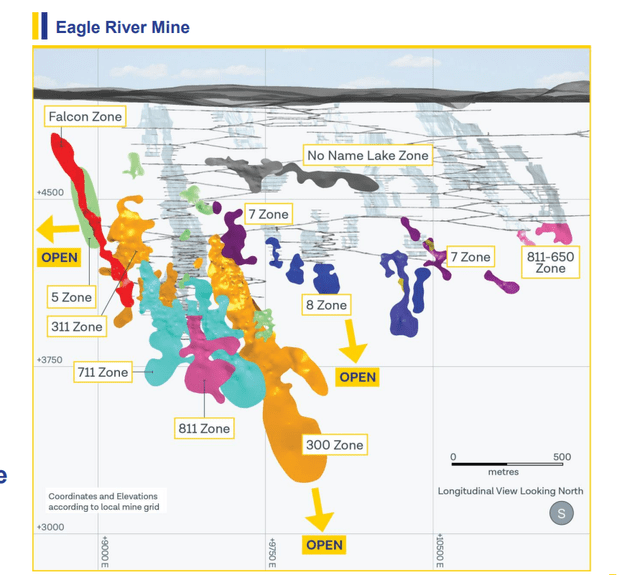

Moving to the company’s Eagle River Mine, another high-grade underground operation, this processing facility also benefits from excess processing capacity, with a total mill capacity of 1,200 tons per day. This means that both of Wesdome’s have expansion potential outside of increased mined grades. Based on this, I would argue that the 2022-2024 production profile of ~180,000 ounces per annum understates the real opportunity here for the company, with the possibility to produce well over 230,000 ounces of gold per annum by utilizing just a portion of the excess mill capacity.

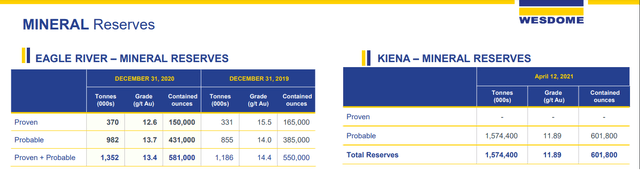

Mineral Reserves & Resources

Moving over to Wesdome’s mineral reserves, we can see that Wesdome is clearly an industry leader from a grade standpoint, with an average reserve grade of ~12.58 grams per ton gold for its two operations. As shown below, Eagle River has the smaller reserve base at 581,000 ounces but a slightly higher grade of 13.4 grams per ton gold, while Kiena’s reserves come in at ~602,000 ounces at a grade of 11.9 grams per ton gold. It’s also important to point out that despite a great year for Eagle River in 2020 (80,000+ ounces produced), the company easily replaced its reserves net of depletion.

Wesdome – Mineral Reserves (Company Presentation)

Some investors might be a little turned off by the relatively small reserve base here, with the current reserves of ~1.18 million ounces barely supporting six years of total mine life at a ~185,000-ounce production rate (both operations combined). However, this is not that unusual for underground operations to have sub-10-year mine lives, and in addition to the reserve base, Wesdome does have a decent resource base as well. This includes over 800,000 ounces of indicated and inferred ounces at Kiena at an average grade of more than 6.0 grams per ton of gold.

While below the reserve grade, these ounces are well above the cut-off grade of 2.8 to 3.6 grams per ton gold, calculated using a more conservative gold price of $1,450/oz. If we assume a 55% conversion rate, this would amount to another ~2.2 million tons of material added to the mine plan, supporting a 10+ year mine life on top of the current 7-year mine life outlined in the PFS. However, the real opportunity looks to be in the Footwall Zone at Kiena.

Exploration Upside

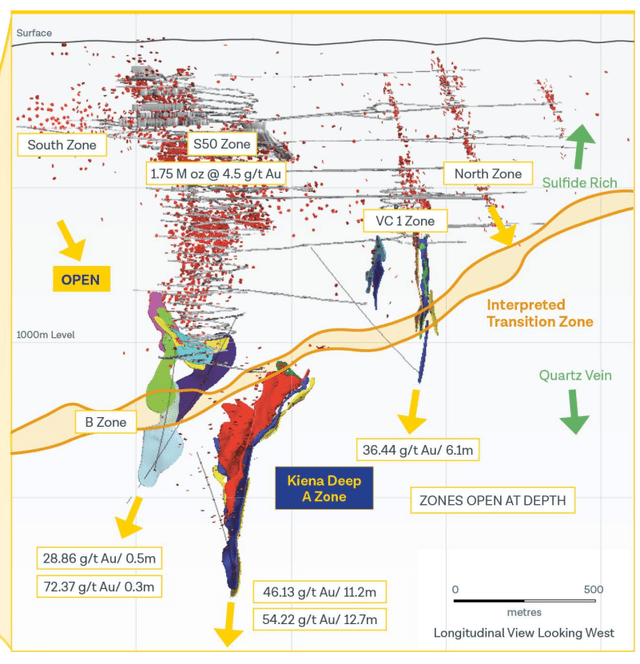

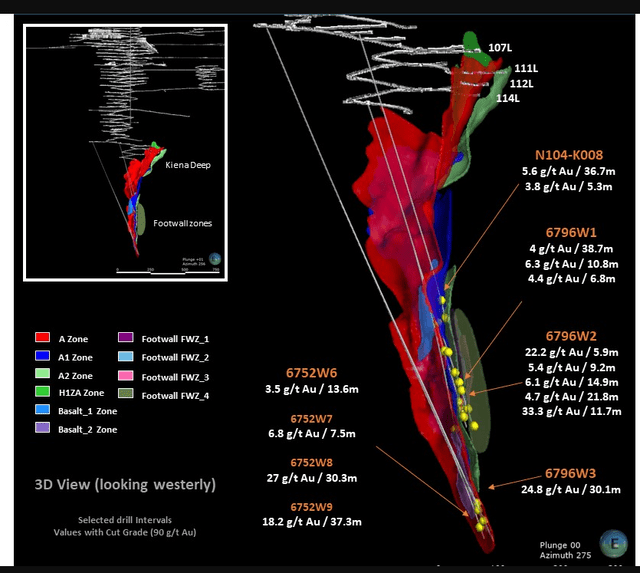

Looking at the company’s Kiena Mine, the VC 1 Zone, Kiena Deep A Zone, and B Zone remain open at depth, and recent intercepts in the footwall of the Kiena Deep A Zone have been spectacular. For those unfamiliar, the discovery of the Footwall Zone was made in March of last year, with down-plunge follow-up drilling in May 2021, intercepting a record intercept of 51.2 meters of 41.19 grams per ton gold, one of the top-20 intercepts drilled in the sector last year. Wesdome has since followed this up with intercepts of 16 meters of 13.4 grams per ton gold and 9.1 meters of 20.1 grams per ton gold.

Kiena Mine – Targets (Company Presentation) Kiena Deep (Company Presentation)

In addition to the Footwall Zone, the company has also discovered the Hanging Wall Basalt zones, which are not included in the current mine plan. These new high-grade discoveries could boost the resource and reserve base at Kiena, boosting the mine life further without pulling from the lower-grade resources in the current resource base at Kiena. This would allow the company to maintain a 100,000-ounce plus production profile for much longer than the envisioned 7-year mine life.

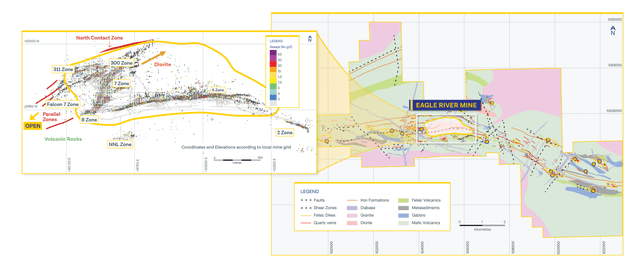

Meanwhile, the company has also had exploration success at its Eagle River Mine and has recently begun mining at its Falcon 7 Zone (discovered in 2019). This zone has much higher grades than the global reserve grade at Eagle River, with an average grade of 19.7 grams per ton gold. The discovery of the Falcon 7 Zone is significant from a production growth standpoint and from a geological standpoint, with mineralization at Eagle River historically being hosted in the mine diorite. This is because the Falcon 7 Zone is hosted in volcanic rocks west of the intrusion, which increases the prospectivity of volcanic rocks east and west of the current mine footprint.

Eagle River Mine (Company Presentation)

Just recently, Wesdome Mines made a new discovery called the North Contact Zone. The North Contact Zone (shown above) is located along the northern contact of the mine diorite, with highlight intercepts that included 1.5 meters of 9.26 grams per ton gold and 3.7 meters of 12.19 grams per ton gold. In addition, Wesdome’s recent drilling intersected parallel zones to the bonanza-grade Falcon 7 Zone, with highlight intercepts that include 1.5 meters of 13.72 grams per ton gold, 2.5 meters of 11.19 grams per ton gold, and 1.5 meters of 13.42 grams per ton gold. The company stated the following:

“This discovery shows the potential of the mine diorite and surrounding volcanics to host more zones of mineralization, especially where host structures continue across the diorite-volcanic contact, such as 311 West, 8, and 5 Zones”.

– Company News Release, December 15th, 2021

Eagle River Mine (Company Presentation)

In summary, I would not get hung up on Wesdome’s relatively small reserve base compared to peers, given that I see the potential for reserves to increase to more than 1.65 million ounces by Q1 2025, a more than 40% increase from current levels. This estimate is net of more than 400,000 ounces of mine depletion in the period. Given the increase in gold prices we’re seeing, I would not be surprised to see Wesdome ramp up its drilling efforts at its two operations, up from an already respectable ~$18 million in drilling at Kiena alone this year. Let’s take a look at Wesdome’s valuation below to see if the stock is a Buy.

Valuation

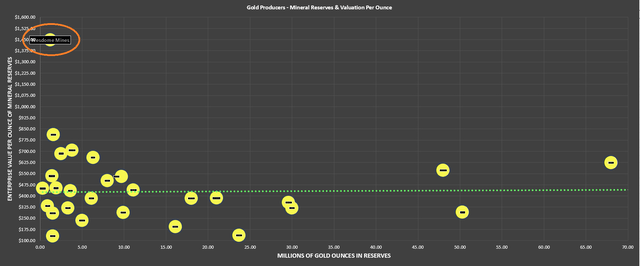

Wesdome has a relatively tight share structure with ~145 million shares on a fully diluted basis, translating to a market cap of $1.83 billion and an enterprise value of ~$1.76 billion at a share price of US$12.65. This is certainly a lofty valuation for a sub-200,000-ounce producer, even if Wesdome owns two of the highest-grade gold mines globally. In fact, based on its enterprise value of ~$1.76 billion, Wesdome’s ~1.2 million ounces of reserves are valued at more than $1,400/oz., more than triple the industry average (~$450/oz.).

Gold Producers – Mineral Reserves & Valuation Per Ounce (Company Filings, Author’s Chart)

Based on the above chart alone, one could conclude that Wesdome is insanely overvalued, but I think this is an incorrect assessment. This is because high-grade producers typically receive a premium valuation, and high-grade underground producers moving a relatively small amount of material are the most insulated from cost increases in the inflationary environment we’ve found ourselves in currently. This explains why Yamana Gold (AUY) has been able to control costs so well relative to its peers, with the company operating multiple high-grade underground operations (Cerro Moro, Jacobina, El Penon).

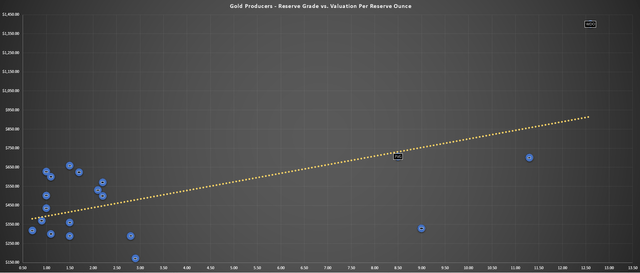

To illustrate my point related to the premium valuation for ounces, we can look at the below chart, which shows the enterprise value per ounce for gold producers adjusted for their reserve grade. As is quite clear from this chart, outside of multi-million-ounce producers that receive premium valuations due to their diversification and size, the high-grade producers are typically valued much higher on a per-ounce basis. One example is Pretium Resources (PVG), acquired for ~$700/oz. by Newcrest Mining (OTCPK:NCMGF) last year.

Gold Producers – Reserve Grade vs. Valuation per Reserve Ounce (Company Filings, Author’s Chart)

Having said that, while Pretium was acquired right near where the trend line matches up for valuation per ounce and reserve grade, Wesdome is a massive outlier, trading well above the trendline in the top right of the chart. Obviously, if the company could grow its reserve base to ~1.7 million ounces, the stock would look much less overvalued on a per ounce basis, and I would argue that this is certainly a possibility. However, with no certainty that this occurs, and other companies also having reserve growth potential (albeit maybe not as significant), Wesdome looks to be close to fully valued here short-term.

This view that Wesdome is near fully valued at US$12.65 is corroborated by the fact that the stock trades at ~1.3x consensus P/NAV. This is a multiple typically reserved for multi-million-ounce producers or companies like Kirkland Lake Gold (pre-Detour Lake acquisition), with all-in sustaining costs below $700/oz. While I would argue that Wesdome has a path to sub $900/oz. costs post-2024, it’s difficult to justify a 1.30x P/NAV for a small-scale producer, even if the company does have meaningful organic growth potential due to its recent discoveries and excess processing capacity.

So, what’s the best course of action?

In a sector with a dearth of Tier-1 jurisdiction producers with organic growth and the possibility for 50% plus AISC margins with a strong leadership team, I do not believe that selling a core position in Wesdome is a good idea. This is because it’s typically the best companies that are the hardest to buy in bull markets, and one often gets locked out of the best names and then is forced to buy an inferior name with that excess capital if they want to maintain exposure to the sector.

Having said that, while Wesdome is an outstanding story, I don’t see any way to justify chasing the stock here either. So, I believe the best course of action is to consider trimming 1/3 of one’s position into strength above US$12.60, or if not in the stock, keeping a close eye on the stock during sector-wide pullbacks to buy the dip. Currently, I have no position in Wesdome, but I am hard-pressed to find a better and safer organic growth story in safe jurisdictions other than Karora Resources (OTCQX:KRRGF) and Alamos Gold (AGI). So, if we were to see a share pullback in Wesdome, I would consider starting a new position in the stock.

Be the first to comment