Solskin

Just like how the broader market can be irrational for an extended period of time, individual stocks can behave in a similar fashion. Even though a company might be fairly valued or even somewhat overpriced, that does not mean that shares cannot rise further, even at a time when fundamental performance is worsening. A really good example of this phenomenon in action can be seen by looking at Montrose Environmental Group (NYSE:MEG), an enterprise that focuses on making this planet healthier by providing services centered around environmental activities. Examples include regulatory consulting, emergency response services, testing, leak detection and repair services, and so much more. Although the company operates in an industry where demand is almost certain to grow for the foreseeable future, shares are priced at rather lofty levels and its bottom line results are showing signs of deterioration in the near term. Given the rapid growth the company has achieved in prior years, I still hesitate to rate the business a ‘sell’. So instead, I have decided to retain the ‘hold’ rating I assigned it previously. But in the event that shares rise further, I may very well revise my outlook for the firm.

A hefty price tag for a healthy planet

Near the end of June of this year, I wrote an article discussing whether or not it made sense to consider Montrose Environmental Group as an appealing investment prospect. In that article, I found myself lotting the business for its attractive top line and bottom line growth over the prior few years. But so far in 2022, results were showing signs of being disappointing. Ultimately, I believe that the weakness the company was experiencing then, weakness that has extended into today, is just a bump in the road. But because of that and because of how shares were priced at that moment, I ended up rating the company a ‘hold’ to reflect my view that the stock was probably more or less fairly valued. Since then, the market has wholeheartedly disagreed with my assessment. While the S&P 500 is up 3.9%, shares of Montrose Environmental Group have generated upside of 31.9%.

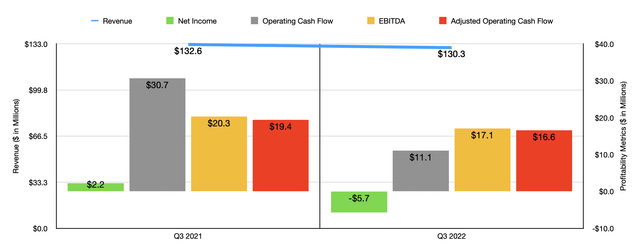

Given this massive return disparity, you would be forgiven for thinking that the company has been knocking it out of the park. But the fact of the matter is that financial performance has been rather disappointing. Consider how the company has performed in the latest quarter, the third quarter of its 2022 fiscal year. During that time, sales came in at $130.3 million. That’s actually 1.7% lower than the $132.6 million reported the same time last year. This increase came even as the company benefited to the tune of $908,000 from new operations that management acquired. The drop in revenue, then, was driven largely by expected and significantly lower revenue from its CTEH operations as a result of lower demand for COVID-19-related services. The company also suffered from certain contracts that were labeled discontinued. Outside of these items, organic growth was otherwise positive year over year.

As revenue dropped, profitability achieved by the company also declined. The business went from generating $2.2 million in profit during the third quarter of 2021 to $5.7 million in loss the same time this year. The decline in revenue certainly didn’t help. But in addition to that, the company suffered from Higher selling, general, and administrative expenses. These numbers jumped by 40.5% year over year, driven largely by $8.5 million related to increased stock-based compensation, $2.1 million from acquisition activities the company engaged in after the third quarter of 2021, and $1.1 million related to higher labor and medical benefit costs, and other related items. Other profitability metrics also worsened. Operating cash flow plunged from $30.7 million to $11.1 million. But if we adjust for changes in working capital, it would have fallen more modestly from $19.4 million to $16.6 million. Meanwhile, EBITDA also declined, dipping from $20.3 million to $17.1 million.

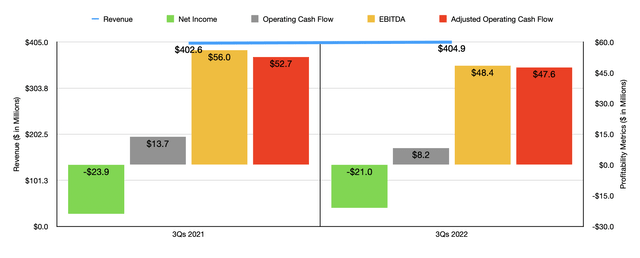

The results achieved in the third quarter were in no way a one-time event. For the first nine months of 2022 as a whole, sales totaled $404.9 million. That was marginally higher than the $402.6 million the company generated one year earlier. To be fair, the company’s net loss also improved, going from $23.9 million to $21 million. But beyond that, all other measures of profitability worsened year over year. For instance, operating cash flow declined from $13.7 million to $8.2 million. On an adjusted basis, it dropped from $52.7 million to $47.6 million. And over that same window of time, we saw EBITDA fall from $56 million to $48.4 million.

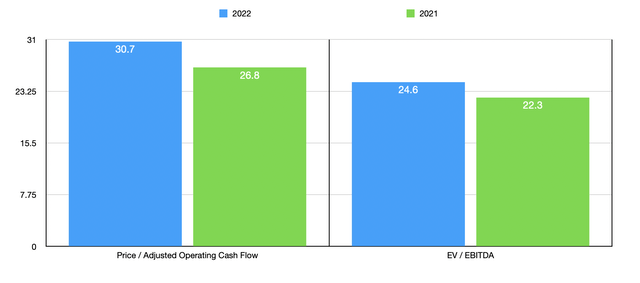

For the 2022 fiscal year in its entirety, management has narrowed guidance for revenue to be between $535 million and $555 million. The only other real guidance they gave involved EBITDA, which they now expect to be between $68 million and $73 million. No guidance was given when it came to adjusted operating cash flow. But if we assume that the final quarter of this year will look a lot like the first three, then we should anticipate a reading there of $47.9 million. Based on these figures, the company would be trading at a forward price to adjusted operating cash flow multiple of 30.7 and at a forward EV to EBITDA multiple of 24.6. By comparison, using the data from 2021, these multiples would be 26.8 and 22.3, respectively. As part of my analysis, I also compared the company to five similar businesses. As you can see in the table below, for the price to operating cash flow approach, the companies ranged from a low of 3.8 to a high of 8.7. And when it came to the EV to EBITDA approach, the range was from 6.3 to 14.1. In both cases, Montrose Environmental Group was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Montrose Environmental Group | 30.7 | 24.6 |

| BrightView Holdings (BV) | 6.1 | 8.7 |

| SP Plus (SP) | 7.7 | 9.7 |

| Heritage-Crystal Clean (HCCI) | 8.7 | 6.3 |

| Harsco (HSC) | 3.8 | 14.1 |

| Aris Water Solutions (ARIS) | 4.7 | 10.2 |

Takeaway

Based on all the data we have in front of us, I do acknowledge that there are certain factors affecting Montrose Environmental Group in the near term that may not impact the company in the long run. Cost increases though have been painful, particularly when it comes to selling, general, and administrative costs. While it is true that these are investments in the company’s future growth, it’s also true that the bottom line results for the enterprise make the stock look expensive, both on an absolute basis and relative to similar firms. I don’t think that the company is so expensive at this point that it warrants a bearish outlook. But if the stock does rise much further from here without some significant improvement fundamentally, I do think that it will warrant such a revision at some point. But until then, I do think it still falls in the range of a ‘hold’ candidate.

Be the first to comment