Deagreez

Late last month, I published an article on iREIT on Alpha titled “When Essex Is Cheap, You Pay Attention.”

It was a fairly catchy title, if I do say so myself. But, more importantly, it was a smart one. A wise one, even. And for two different reasons.

As I wrote that day:

“I haven’t often covered Essex Property Trust – because, frankly, it’s been overvalued for a long time. However, that’s over. The company recently crossed an important line.”

Now, with the way the markets are behaving this year, don’t go rushing out to buy it on that word alone. Really, in any market, make sure to do your due diligence. But that rule applies especially to today, where a week’s worth of market action can make an intense difference in a stock’s price point.

And a stock’s price point can easily determine whether you’re ultimately going to be a happy investor… or one that has to deal with buyer’s remorse.

That’s my first point about the “Essex” title up above. At the time of publication – again, something that needs to be stressed – I noted how the real estate investment trust (“REIT”) was trading at a 15x price to funds from operations (“FFO”).

That’s “something we” hadn’t seen “since the depths of the Covid-19 crash.” In short, it was (and maybe still is) trading on the cheap.

At first glance, you could even say it was trading ridiculously cheap.

A Killer Combination

I think the key word in that last sentence is “ridiculously.” Because anything can be “cheap” depending on one’s perspective.

If you got right down to it, people who bought into Tesla (TSLA) at its peak last November thought they were buying on the “cheap” compared to where everyone else would be getting in later on.

Who knows. They might be proven right someday. But as it stands now, that “someday,” if it happens at all, might be a ways off. The stock is trading at around $180… far, far off from its record of over $400.

Which means they’re not only working with a major paper loss at the moment… they also could have bought in at a much more cost-effective point to better capitalize on any future gains Tesla might make.

I’m not trying to promote market timing here, for the record. My regular readers know I consider that to be a fool’s errand – as does every serious, successful investor I know of.

What I’m trying to say is that a company’s stock price should be in proper proportion to its actual value. Sure, take into account its potential, but you’d better base even that off of reality, not hopes and dreams.

When reality doesn’t match where shares are trading on the overvalued side, you’re better off passing on the “opportunity.” Tell FOMO (the fear of missing out) where it can go. And put the company on your wish list instead, determining to wait for a better price.

But if it’s unrealistic the other way around… if it’s trading below its actual value? Then you have a bargain on your hands!

That’s the second point I want to highlight in “When Essex Is Cheap, You Pay Attention.” It isn’t just about the price.

It’s about the company, too.

Bring on the Market Melodrama!

Quality and value: They need to go hand in hand when investing.

I could easily argue that’s true of most things in life. Maybe even everything in life. But this article isn’t about most things. It’s about investing.

So investing, we will go…

This brings me back to Essex Property Trust, Inc. (ESS) before we move on to today’s “3 Ridiculously Cheap REITs.” Picking back up with that 15x p/FFO evaluation:

“It’s an extreme sort of trough that I don’t view as being justified even in a negative potential future scenario for this company.”

Even if Essex “goes absolutely nowhere” revenue-wise for the next two years – “which I view as highly unlikely” – investors who bought in on my publication date could still expect “double-digit [returns on revenue] of 10% annually” until 2024.

That’s because of its “very sound capital structure.” We’re talking about 94% unencumbered net operating income (“NOI”)… $1.2 billion in total liquidity… and net debt to adjusted earnings before interest, taxes, depreciation, and amortization for real estate (EBITDAre) of just 5.8x.

That’s only worth so much, mind you. It’s not worth overpaying for.

But the market grossly discounted Essex and its long list of strengths because so many businesses have exited and are exiting the West Coast, where it exclusively operates. That exodus is an important factor to note, of course.

However, as I also wrote:

“The market always overreacts – this seems to be a cardinal rule, both in the positive and negative directions.”

Which can work in our favor. When the collective investment community gets melodramatic about quality companies, we get ridiculously cheap stocks.

We just have to recognize the opportunities as they come.

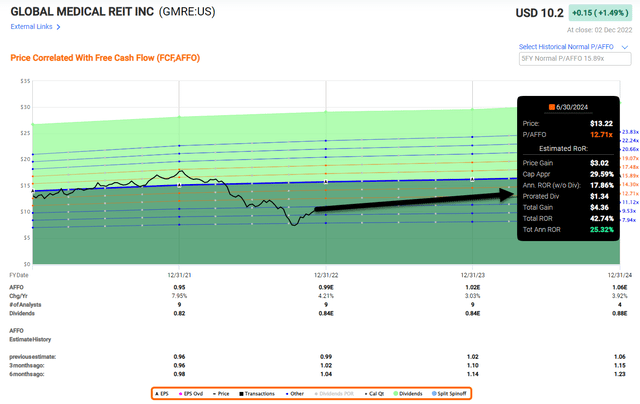

Global Medical REIT Inc. (GMRE)

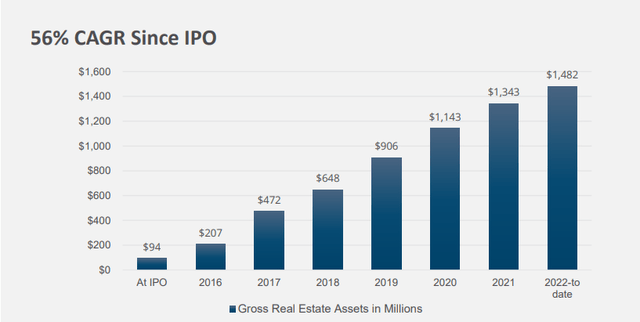

GMRE is a healthcare REIT that owns a portfolio of 189 properties (4.9 mm square feet) with a primary emphasis on medical office buildings (68%), IRF (17%), surgical hospital (6%) and other (9%).

As of Q3-22 the portfolio was 97% occupied with a weighted average lease term of 6.4 years.

GMRE is differentiated from peers by its focus on “bedroom communities” or essentially secondary markets with favorable demand drivers. Since listing in 2015 GRE has acquired over $1.5 billion in properties that has resulted in 56% CAGR (as seen below).

In Q3-22 GMRE missed FFO expectations (FAD in line), and as expected, acquisition activity moderated ($50.8 at 7.1%; $149M YTD). The REIT reported FFO/sh of $0.23 (flat y/y), below the Street at $0.24. Adjusted AFFO/FAD came in at $0.25, in line with Street and Total revenues grew +18.1% y/y to $35.3M driven by acquisitions.

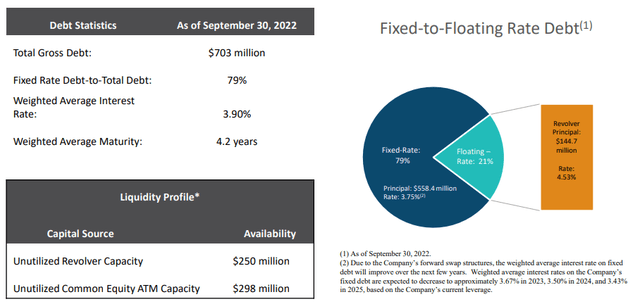

Several risks include leverage, elevated at 7.3x net debt+prefs/EBITDA with 20% floating debt exposure. Net debt + preferred/adjusted EBITDA was flat sequentially at 7.4x with leverage (excluding preferred) up to 47.6% (46.2% at Q2-22) – above management’s long-term target (45%).

Another risk worth noting, Pipeline Health (10th largest tenant) recently filed for bankruptcy and GMRE management expects Pipeline to continue to pay rents on its Dallas, TX hospital, which is covering rents.

Notably, GMRE is building out asset management capabilities to proactively lease-up acquired vacancy and more effectively manage multi-tenant assets.

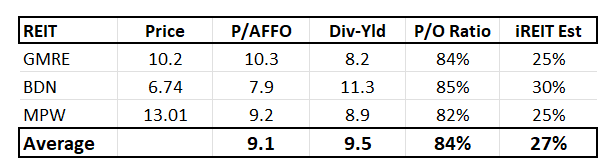

In terms of valuation, GMRE has returned negative 40% year-to-date and shares are now trading at $10.20 with a P/AFFO multiple of 10.4x. Historically shares have traded at 14x to 15x, which means GMRE is extraordinarily cheap.

The dividend yield is 8.2% and the payout ratio (based on AFFO) is 85%. As mentioned, FAD came in at $.25 in Q3-22, which translates into a Q3 payout ratio of 84%.

I’ll admit, I have not always been a fan of GMRE because of the unsafe dividend – payout ratio was 107% in 2018 and 2019, however in 2020 the company began to boost its dividend as earnings grew,

Given the elevated WACC (equity multiple is 9.7%), GMRE will likely not see the historical growth of 2020 (+17%) and 2021 (+8%), as analysts are forecasting modest growth of 4% in 2022 and 3% in 2023.

Nonetheless, our conservative model (show below) illustrates that GMRE could return 25% over 12 months, which translates to 8.2% in dividends and 17% in growth and multiple expansion. The model reflects a P/AFFO multiple of 12.7x, still below historical norms.

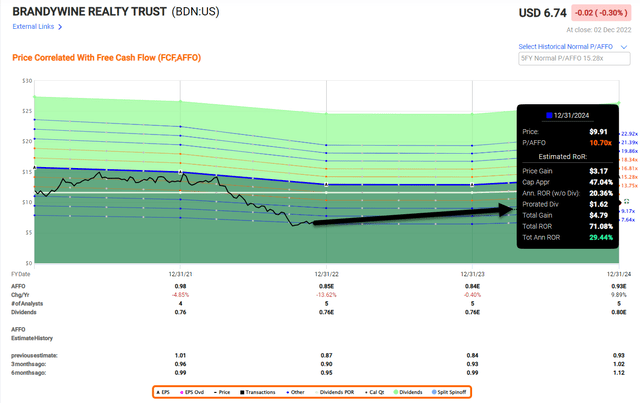

Brandywine Realty Trust (BDN)

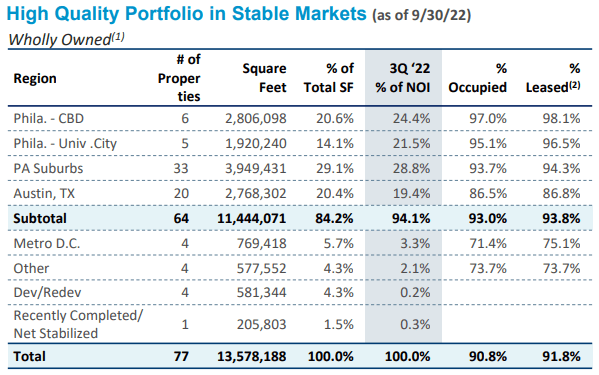

BDN is an office REIT that was founded in Philadelphia in 1986 and is focused on class-A commercial office space in Philadelphia and Austin. It’s been diversifying into mixed-use properties due to the uncertainty surrounding long-term office space demand.

21% of its portfolio is lab space it’s building or expanding in Philadelphia, where the NIH has approved a $5.5 billion five-year grant for the local university to invest in medical R&D. Today, BDN’s property base includes office (43%), residential (28%), life science (15%), and other (14%).

BDN Investor Presentation

While BDN has been busily diversifying into Texas and Austin specifically, 75% of NOI still comes from Philly, so how the greater Philadelphia area develops is core to the company’s results and overall thesis.

Some fundamental attractions are very clear though, even when considering the relatively one-sided Philly focus. The company has a relatively attractive lease expiration schedule for an office REIT.

Around 50% of the company’s leases do not expire until 2029 or thereafter – with the closest double-digit ABR expiration in 2027. There are a few percent until then – around 30-40% but spread out fairly well.

Despite the company’s relatively limited size with a current market cap of just above $1.5B, the business carries an investment-grade credit rating.

I really want to emphasize this, because even if it’s BBB-, the company has a market cap (current) of just about $1.1B. That’s not a typical size where we see this sort of characteristic, and it speaks to the journey this REIT has made.

It also carries one of the highest yields currently available in the sector with an investment-grade credit rating – of around 11.7%. Technically, such a yield begs the question of “when comes the dividend cut?”

I’m not so sure it does.

BDN’s FFO as well as AFFO cover the dividend with a very comfortable margin. For FFO, the P/O is less than 61%, and that’s assuming the 2023E impacted 8% FFO drop.

Based on NOI, it’s higher and doesn’t have the same positive sound, with an 84-95% payout ratio, which is starting to edge towards the higher end.

However, at these valuations, the company could easily lower its dividend by 20% and still be attractive, even if such a decision would likely send the stock down a bit further.

Since early 2022, BDN has dropped from a P/FFO of around 11x, where the company usually trades, to no more than 4.7x P/FFO. Obviously, such a drop in valuation should be accompanied by a massive drop in earnings, a substantially worsened outlook, or the company being in some sort of real fundamental trouble.

Shares are now trading at $6.74 with a P/AFFO multiple of 7.9x. As noted, the dividend yield is a whopping 11.3%. Analysts are forecasting no growth in 2024 and 10% in 2024.

We estimate BDN could return 30% “conservatively” over the next 12 months – breaking it down 11% dividend yield + 19% in price appreciation.

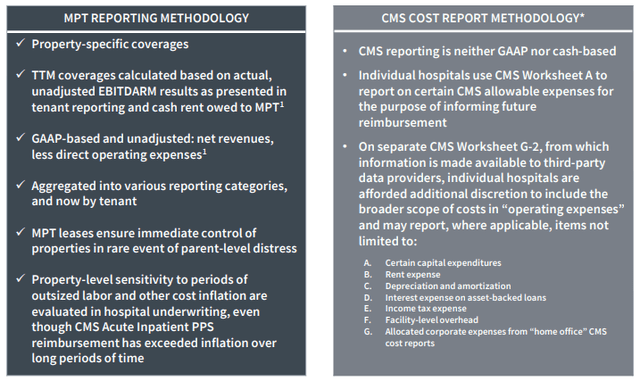

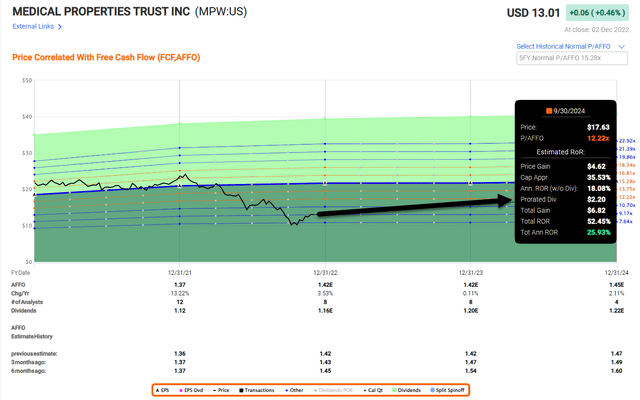

Medical Properties Trust, Inc. (MPW)

MPW is a healthcare REIT that is one of the largest owners of healthcare real estate assets. They own more than 400 hospitals and 46,000 licensed beds. The well-diversified portfolio spans across 32 different states in the U.S., as well as countries across Europe, Australia, and South America.

Hospitals account for a majority of operator income, and MPW’s target is to focus on things like Rehab Centers, Imaging Centers, FSEDs, ASCs, Labs, Managed care networks, MD offices and outpatient clinics, all strategically placed to hospital real estate.

Underwriting is core to MPW. The company needs to be able to identify and purchase attractive assets at good prices in a way that means they can lease it to operators at a good profit. They do this in a variety of ways and by measurements.

MPW’s fundamentals aren’t in question.

Hospital real estate usually stays leased for extensive periods of time, and they’re considered inflation-protected cash flows. This is due to permanently increased cash lease rates in any year when the inflation escalation exceeds the minimum contractual increase.

At the end of Q3 2022, MPW had cash and revolver capacity of around $1.5 billion. Recently, the company restated and amended its $2 billion revolving credit facility and extended its term to mature with extension options to June of 2026.

In addition to the $1.5 billion, MPW previously announced it expected proceeds in 2023’s first half from pending transactions that is Springstone and Yale, of up to another $650 million.

MPW generated normalized FFO of $0.45 per diluted share in Q3-22 and refined its 2022 calendar year estimate to a range of $1.80 to $1.82 per share (narrowing the previous range to the higher end). While MPW has obviously slowed its recent years acquisition pace, the company should still maintain solid organic growth.

As seen below, analysts are forecasting no growth in 2023 and 2% (growth) in 2024. Shares are now trading at $13.01 with a P/AFFO multiple of 9.2x. Prior to Covid-19 shares were trading at around 12x to 13x. The dividend yield is 8.9% and the payout ratio is 82%. iREIT forecasts MPW could return “conservatively” 25% over the next 12 months.

In Closing

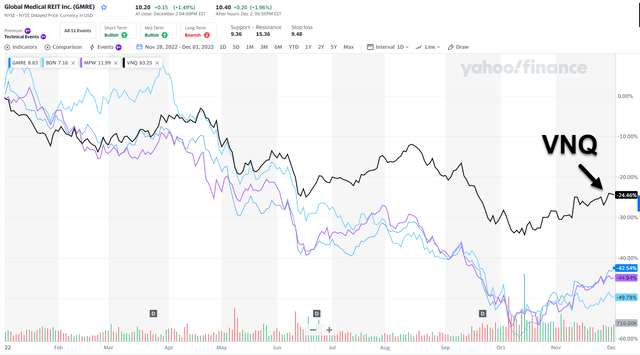

As viewed below, all three above-referenced REITs have been slammed in 2022:

Are we seeing the bottom?

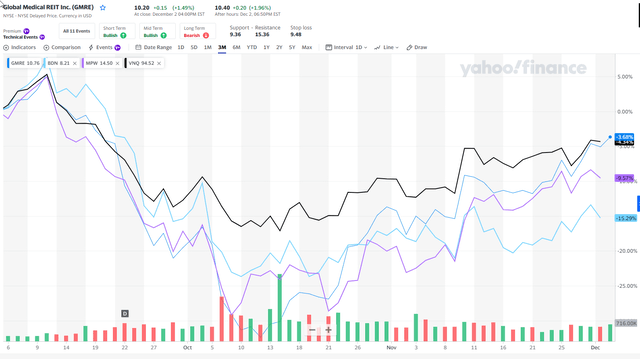

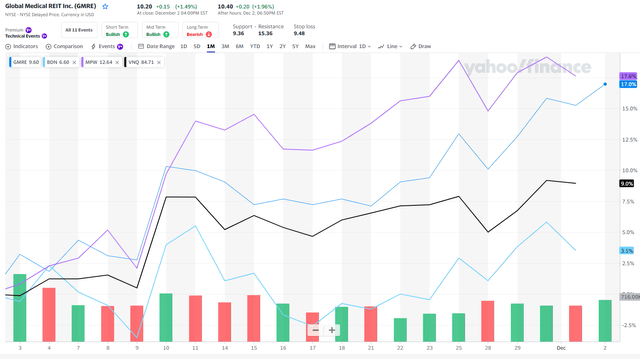

As viewed below, MPW and GMRE have outperformed Vanguard Real Estate ETF (VNQ) during the last 30 days:

Although these three REITs aren’t SWAN (“sleep well at night”) stocks, their dividends are relatively stable, and of course the yield (averaging 9.5% for all 3) is very appealing. Their total return prospects are also alluring, which, of course, is the reason I titled this article,

3 Ridiculously Cheap REITs That Scream Buy, Buy Buy.

Perhaps I’ll include these in my upcoming stocking stuffer article…

iREIT

Happy Holidays!

Be the first to comment