Gerasimov174

Introduction

Shell (NYSE:SHEL) disappointed shareholders with a meager 4% dividend increase early in 2022 but as my previous article highlighted, the best is still coming with $22b of hidden value laying within their working capital builds. Now that 2022 is coming to a close, we finally have proof their plan is benefiting shareholders with management already pre-announcing a sizeable 15% dividend increase for early 2023, as discussed within this follow-up analysis.

Coverage Summary & Ratings

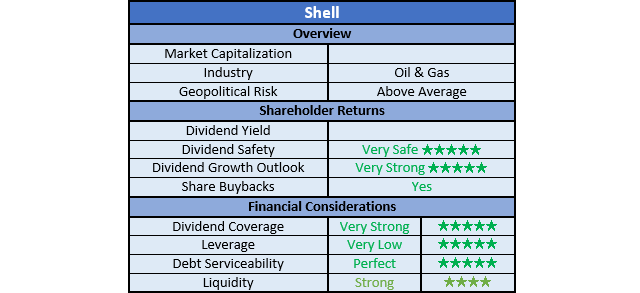

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

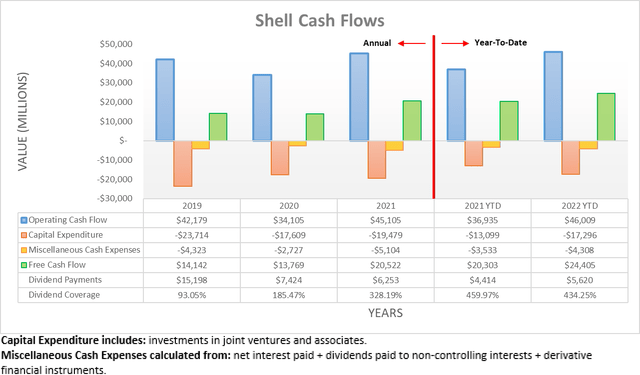

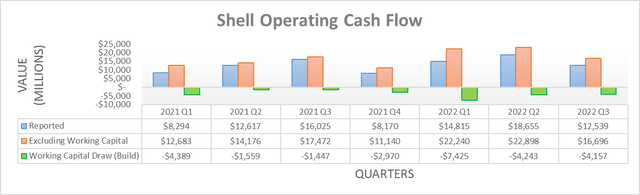

Following their massive operating cash flow during the first half of 2022, it was not surprising to see it slow throughout the third quarter as oil and refined product prices softened. As a result, this now sees their operating cash flow at $46.009b during the first nine months, of which $12.539b is attributable to the third quarter. Once subtracting their associated capital expenditure and miscellaneous cash expenses as listed beneath the above graph, their free cash flow was $24.405b and $5.94b across these same two periods of time, respectively. Even though both are massive results, they were actually still weighed down significantly by their working capital movements once again as the string of builds discussed within the previous analysis continues unabated.

It is very odd to see what is now seven consecutive quarters of working capital builds, which means their reported operating cash flow was hindered every quarter since the beginning of 2021. When viewing their operating cash flow on a quarterly basis, this is easily visible with the third quarter of 2022 in particular seeing another $4.157b. This piles even more hidden value upon the working capital builds seen earlier that as my previous analysis highlighted, already amounted to $22b following the second quarter and thus as a result, now amounts to $26.19b since the beginning of 2021. To put this into perspective, given their current market capitalization of approximately $204b, this represents almost 13% of their valuation, which creates immense potential for shareholder returns. Whilst it was somewhat disappointing to once again see it untapped thus far, the biggest news at the moment is their upcoming dividend increase in early 2023, as per the commentary from management included below.

“Through our share buybacks announced in 2022, we expect to repurchase some 10% of our share capital. And as indicated before, the reduction in share count allows us to increase our dividend in the future. So today, reflecting our progressive dividend policy, we have also announced our plan to increase our dividend per share by an expected 15% at Q4 results, subject to Board approval.”

-Shell Q3 2022 Conference Call.

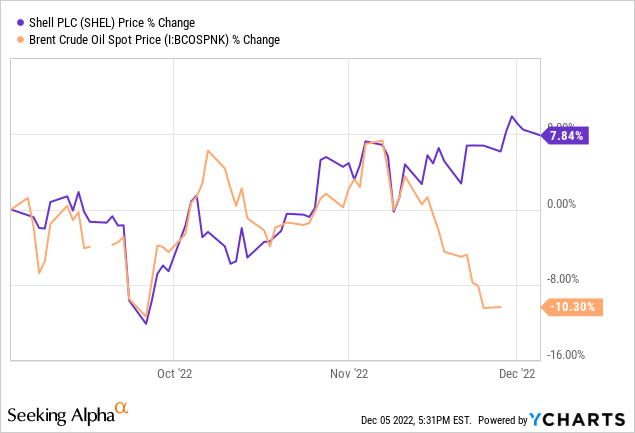

Normally management does not pre-announce their dividend increases, although this time around they let shareholders know they will be getting a 15% increase in early 2023 when they release their results for the fourth quarter of 2022. Interestingly, my previous article expected they would increase their dividends in 2023 between 10% to 20% with their announcement landing right in the middle of this range. Even more interestingly, the subsequent weeks have seen their share price continue climbing higher despite oil prices softening.

Y-Charts

Even though there are many moving parts affecting share prices, I strongly suspect this double-digit gap is heavily influenced by their dividend announcement, especially as natural gas prices have also softened thus far into the fourth quarter of 2022 versus the third quarter. This creates a very desirable base heading into 2023 that in theory, should help lower downside risk because as every investor likely knows, the economic risks on the horizon could see a bumpy ride as central banks continue tightening monetary policy to fight inflation. Nevertheless, thanks slowly oil production growth out of the United States and European sanctions on Russian exports, a full-blown crash does not seem probable.

It may sound odd but in my eyes, the biggest implication and positivity of this upcoming dividend increase is not necessarily its 15% boost in the short-term. Rather, it is the medium to long-term implications whereby investors now have proof their plan is benefiting shareholders whereby their massive share buybacks are finally translating into tangible benefits for shareholders via higher dividends. Whilst such an outcome was previously promised, until now their disappointingly small dividend increase of only 4% early in 2022 left their plan unproven, at least in my eyes.

Since their industry is inherently cyclical and more importantly, naturally depletes itself via running down their oil and gas reserves, the tangible benefits of share buybacks are less certain in the long-term than for companies in other industries. As a result, it remains my accompanying view the primary tangible benefit stems from enhancing their dividend growth prospects as fewer outstanding shares means more cash for each share. Accordingly, if an oil and gas company fails to follow through with suitably large dividend increases to mirror their lower outstanding share count, in my eyes, it raises questions of whether their capital allocation strategy is generating value. Thankfully, they are now clearly translating their lower outstanding share count into dividend increases, which enhances the appeal of their shares heading into 2023. Before moving onwards it is also important to mention their capital allocation strategy is unchanged compared to 2022, as per the commentary from management included below.

“Our capital allocation priorities are unchanged. We will remain disciplined and invest in opportunities that align with our returns framework.“

-Shell Q3 2022 Conference Call (previously linked).

This means they should continue generating massive amounts of free cash flow, notwithstanding the inherent volatility of oil and gas prices. By extension, it also means they should allocate it the same way too, which in turn means, further large share buybacks and finally, a lower outstanding share count. Together, this means their shareholders should see more large dividend increases in future years, especially if their massive circa $26b working capital build finally provides a never-before-seen cash infusion on top of their future free cash flow.

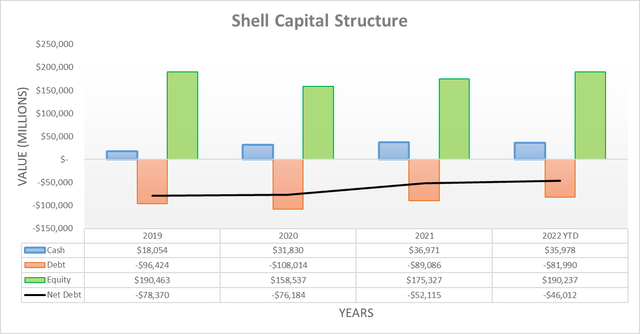

Unlike most of their previous quarters during the past two years, their net debt actually increased during the third quarter of 2022, now sitting at $46.012b and thus $1.241b above its previous level of $44.771b after the second quarter. This slight and likely temporary change of course largely stems from their $4.95b of share buybacks, which combined with their accompanying dividend payments of $1.818b saw total shareholder returns of $6.768b. As a result, they chewed up more than the entirety of the free cash flow of $5.94b with the remaining very small difference stemming from various immaterial acquisitions and divestitures. If adding their leases and debt-related derivatives into the mix with their net debt as practiced by management, the third quarter still saw a similar increase to $48.343b versus $46.357b following the second quarter.

Going forwards into 2023, the first quarter is likely to see modestly higher net debt given their $2b acquisition of Nature Energy. Beyond this point, their net debt should either remain broadly flat as their share buybacks consume most of their excess free cash flow, give or take a little depending upon oil and gas prices. Although similar to the previous analysis, the wild card is their working capital movements because if their nearly two years of builds totaling $26.19b reverse into draws, the cash infusion could potentially eliminate more than half of their net debt, if not directed towards additional shareholder returns.

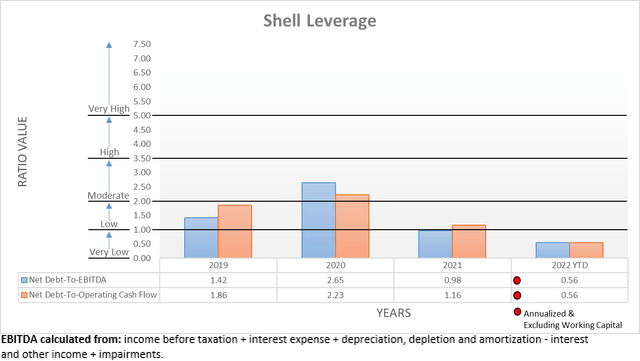

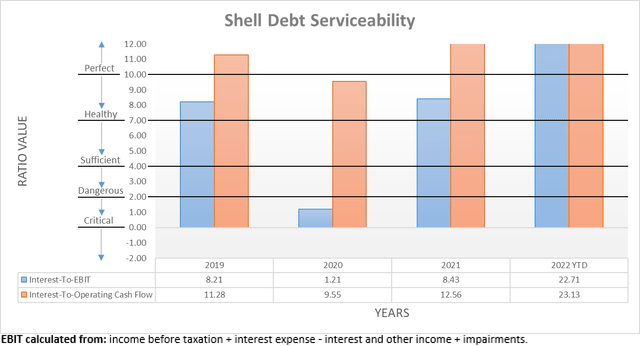

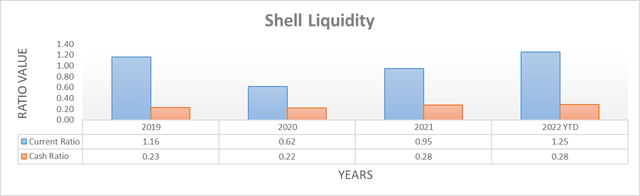

Only time will ultimately tell regarding their working capital movements and in the meantime, as their net debt only increased to a small extent relatively speaking, it would be redundant to reassess their leverage or debt serviceability in detail after only one quarter. Plus, as their cash balance remains a massive $35.978b, it also obviously makes any changes to their liquidity immaterial.

The three relevant graphs are still included below to provide context for any new readers, which to no surprise shows their leverage is once again very low with their net debt-to-EBITDA and net debt-to-operating cash flow both at 0.56 and thus beneath the threshold of 1.00 for the very low territory. It is also evident their debt serviceability is perfect with interest coverage above 20.00 regardless of whether compared against their EBIT or operating cash flow. Finally, their massive cash balance once again sees strong liquidity with respective current and cash ratios of 1.25 and 0.28. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

Finally, after a disappointing start to 2022 in regards to their dividends, we now have proof their plan is benefiting shareholders as management pre-announced a sizeable 15% dividend increase heading to our pockets in early 2023. Seeing as their capital allocation strategy is unchanged going forwards and thus should continue generating massive amounts of free cash flow, notwithstanding the inherent volatility of oil and gas prices, there should be more large dividend increases in future years. Once wrapped together, it should not be surprising that I still believe my strong buy rating is appropriate heading into 2023, despite the potential for a bumpy ride, depending upon economic conditions.

Notes: Unless specified otherwise, all figures in this article were taken from Shell’s Quarterly Reports, all calculated figures were performed by the author.

Be the first to comment