G0d4ather

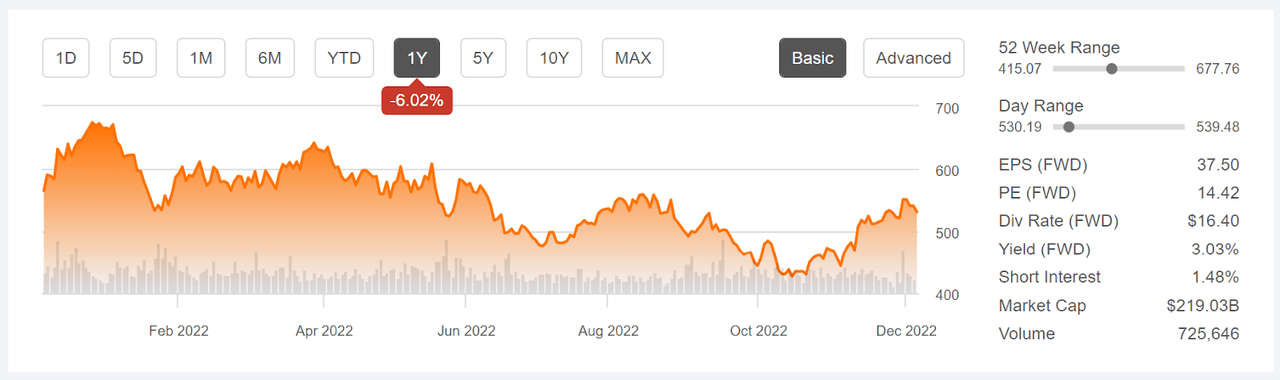

Broadcom (NASDAQ:AVGO), which will report Q4 FY 2022 results after market hours on December 8th, has been one of the few bright spots in the semiconductor industry over the past year. AVGO has returned a total of 0.86% over the past 12 months (including dividends) as compared to -26.8% for the iShares Semiconductor ETF (SOXX) and -9.7% for the S&P 500 (SPY) over the same period. AVGO is the largest holding in SOXX. The 2nd-, 3rd-, and 4th-largest holdings are Texas Instruments (TXN), Nvidia (NVDA), and Qualcomm (QCOM), and these stocks have returned -5.8%, -47.4%, and -27.4% (respectively) over the past year.

Seeking Alpha

12-Month price history and basic statistics for AVGO (Source: Seeking Alpha)

Broadcom is in the midst of acquiring VMware (VMW) for $61 Billion and the deal is expected to close sometime in the next 12 months. The remaining hurdles are mainly regulatory. My own analysis suggests that the deal is likely to be completed.

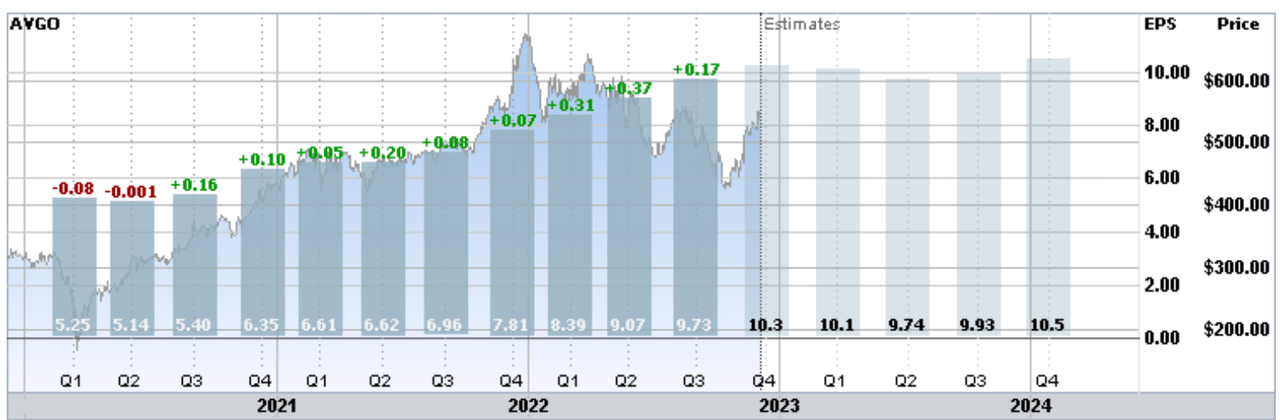

AVGO’s earnings growth over the past several years is impressive, particularly given the economic instability around COVID. The consensus expectation for Q4 EPS is $10.3 per share, as compared to $7.81 for the same quarter of last year. It is worth noting, however, that the outlook is for considerably slower earnings growth in the next year or two (see chart below). The longer-term outlook is favorable, however, with a consensus estimate of 16.9% per year in EPS growth over the next 3 to 5 years.

ETrade

Trailing (3 years) and estimated future quarterly EPS for AVGO. Green (red) values are amounts by which EPS beat (missed) the consensus expected value (Source: ETrade)

AVGO has a forward dividend yield of 3.03% and trailing 3-, 5-, and 10-year dividend growth rates of 15.7%, 32.1%, and 40.2% per year, respectively. The dividend is well-supported by earnings, with a payout ratio of 46.9%, and Seeking Alpha’s Dividend Scorecard gives AVGO a grade of A+ for both dividend growth and dividend safety.

I raised my rating on AVGO from a neutral / hold to a bullish / buy on August 15, 2022 and reiterated the buy rating on September 13th, following the Q3 earnings report. AVGO’s earnings growth has been impressive, both in consistency and magnitude. The valuation looked reasonable, with a forward P/E of 15.1, well below the average P/E for the stock since mid-2019. The Wall Street consensus rating was a buy and the consensus 12-month price target corresponded to an expected total return of about 25% for the next year. The market-implied outlook, a probabilistic price forecast calculated from options prices, was neutral with a bullish tilt to the start of 2023. As a rule of thumb for a buy rating, I want to see an expected 12-month return that is at least ½ the expected annualized volatility, which I calculated to be 32%, using the market-implied outlook. Taking the Wall Street consensus price target at face value, AVGO considerably exceeded this threshold.

Seeking Alpha

August analysis of AVGO and subsequent performance vs. the S&P 500 (Source: Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With the upcoming Q4 results, I have calculated updated market-implied outlooks for AVGO and I have compared these with the current Wall Street consensus outlook in revisiting my rating.

Wall Street Consensus Outlook for AVGO

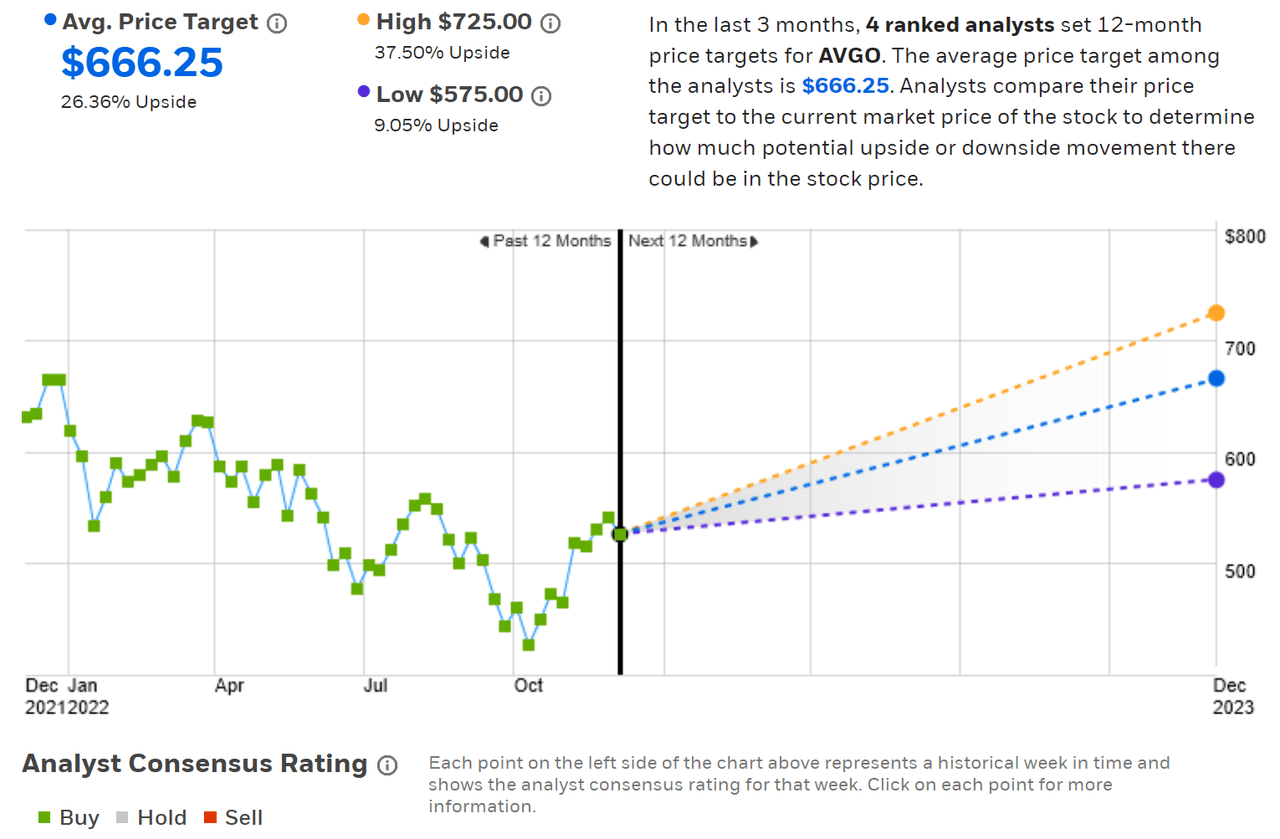

ETrade calculates the Wall Street consensus outlook for AVGO using the views of 4 ranked analysts who have published price targets and ratings in the past 3 months. The consensus rating is a buy and the consensus 12-month price target is 26.4% above the current share price. The very small number of analysts included in this consensus is a concern.

ETrade

Wall Street analyst consensus rating and 12-month price target for AVGO (Source: ETrade)

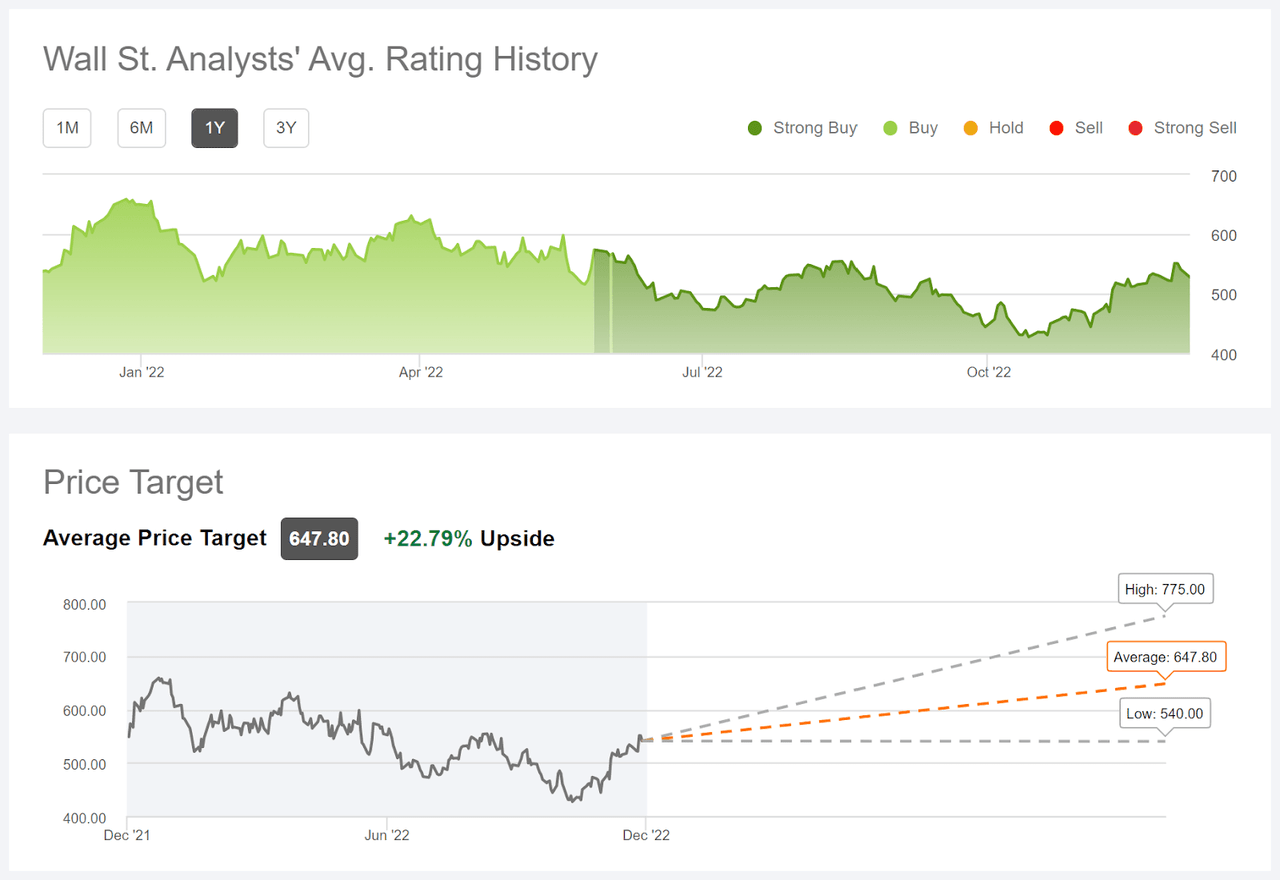

Seeking Alpha’s version of the Wall Street consensus outlook is calculated using price targets and ratings from 26 analysts who have published their views within the past 90 days. The consensus rating is a strong buy and the consensus 12-month price target is 22.8% above the current share price, for an expected total return of 25.8% over the next year.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for AVGO (Source: Seeking Alpha)

The small number of ranked analysts in ETrade’s cohort is one of the reasons why I look at two sources for the consensus outlook. In this case, the results are very consistent, however. The Wall Street consensus outlook has changed very little since August.

Market-Implied Outlook for AVGO

I have calculated the market-implied outlook for AVGO for the 6.4-month period from now until June 16, 2023 and for the 13.5-month period from now until January 19, 2024, using the prices of call and put options that expire on these dates. I selected these specific options to provide a view to the middle and through the end of 2023.

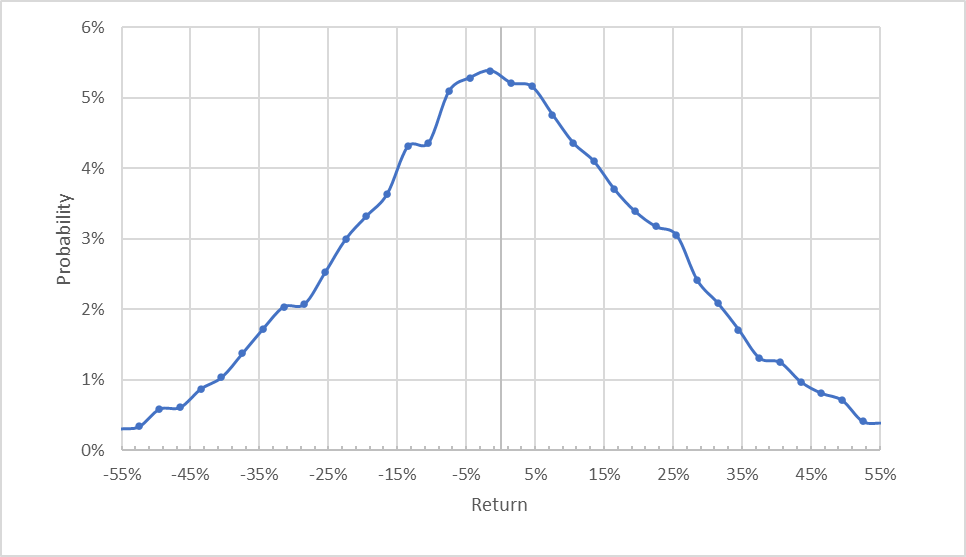

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for AVGO for the 6.4-month period from now until June 16, 2023 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook to the middle of 2023 is centered at -1.5% return, so the distribution is almost symmetric about zero (the maximum probability corresponds to a return of -1.5% on the chart above). The expected volatility calculated from this distribution is 35% (annualized), very close to the 33% implied volatility that ETrade calculates for the options expiring on June 16, 2023.

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

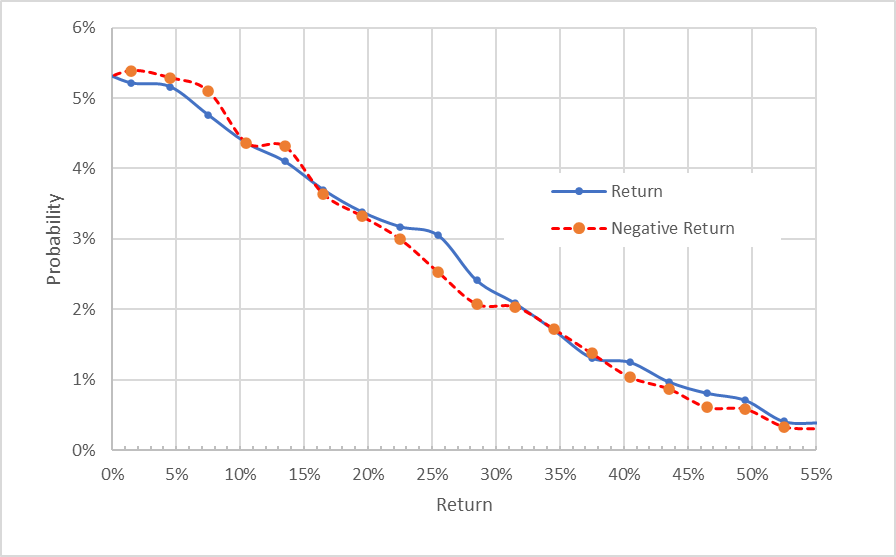

Geoff Considine

Market-implied price return probabilities for AVGO for the 6.4-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view shows just how closely the probabilities of positive and negative returns of the same magnitudes match (the solid blue line and the dashed red line are almost on top of one another).

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias suggests that this outlook is best interpreted as slightly bullish.

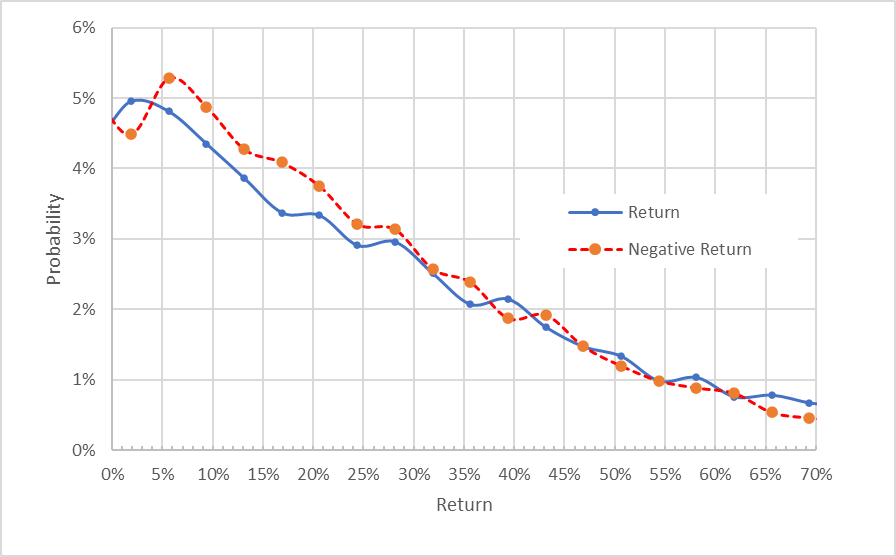

The market-implied outlook for the 13.5 month period from now until January 19, 2024 has slightly elevated probabilities of negative returns for a range of the most-probable outcomes (the dashed red line is above the solid blue line over most of the left side of the chart below). The maximum probability corresponds to a price return of -5.6%. Given the theoretical expectation that the market-implied outlook will be negatively biased, I interpret this outlook as neutral. The expected volatility calculated from this distribution is 34%.

Geoff Considine

Market-implied price return probabilities for AVGO for the 13.5-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook to the middle of 2023 is slightly bullish, but the outlook through 2023, to mid January of 2024, is neutral. The expected volatility is consistent across these 2 periods at 34% to 35%. This is a moderate level of volatility for a large-cap tech stock.

Summary

Broadcom has performed admirably so far in 2022 and the consensus expectation is that the company will be able to maintain its quarterly earnings at the high level achieved in Q3. While there is uncertainty associated with the acquisition of VMWare, the market is viewing this purchase favorably. The Wall Street consensus rating for AVGO is a buy using ETrade’s calculation and a strong buy according to Seeking Alpha. The consensus price target corresponds to an expected total return of about 26% over the next year. This expected return is well above ½ the expected volatility (34% to 35%), meeting one of my criteria for a buy rating. The market-implied outlook is slightly bullish to the middle of 2023 and neutral for the full year. AVGO’s valuation is very reasonable. Overall, things look good approaching the Q4 earnings report. I am maintaining my buy rating on AVGO.

Be the first to comment