Denis_Vermenko

Investing in growth companies can be fun and exciting, but it’s real cash flows to a company’s bottom line and its shareholders that pays the bills. Such I find the case to be with mature companies like Altria (MO) and British American Tobacco (BTI), which continue to execute on their share buybacks plans at attractive valuations. With a reduced share float, more of their future cash flows can be retained for raising the dividend.

This brings me to Magellan Midstream Partners (NYSE:MMP), which draws parallels to the above two companies given its moat-worthy asset base, mature industry with dependable cash flows, and its low valuation combined with a high dividend yield. This article highlights why the recent downturn in MMP’s share price gives dividend investors a nice opportunity to layer into this durable name.

Why MMP?

Magellan Midstream Partners is an MLP (issues schedule K-1) that operates pipelines and storage terminals across the Central and Eastern regions of the U.S. Its asset base includes America’s longest petroleum products pipeline system, covering nearly 10,000 miles. Its moat-worthy characteristics include its tapping into 50% of the nation’s refining capacity and ability to store more than 100 million barrels of petroleum products.

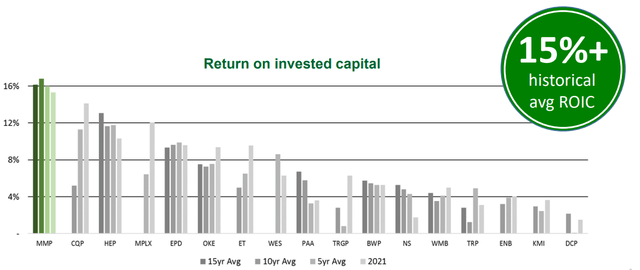

What makes MMP resilient is that 85% of its operating margin is fee based, resulting in less volatility due to commodity prices. Management has also built up an impressive collection of assets with the highest return on invested capital in the midstream space. As shown below, MMP generates the highest ROIC amongst its peer group on a 5, 10, and 15 year basis.

MMP ROIC (Investor Presentation)

MMP is performing well, as it grew its distributable cash flow in its recent quarter by $13 million YoY to $290 million, and is guiding for $1.1 billion in total distributable cash flow this year. This was driven by increases in refined products operating margin and higher transportation and terminals revenue. Moreover, MMP’s asset base is largely built out, thereby requiring relatively little capital spend compared to other MLP peers. This is reflected by just $100 million in planned capital spend next year, and $40 million in 2024.

MMP’s mature asset base is a plus for investors, as its established locations mean little to no incentive for competitors to build redundant assets. This puts MMP in a sweet spot, in that it can return more capital to shareholders rather than focus on continued buildout. This is reflected by the $375 million of unit buybacks executed so far this year. This amounts to $1.18 billion in total equity repurchases through the third quarter, resulting in 12% fewer units outstanding. Looking ahead, management expects to return over $1.2 billion to investors in the current calendar year through buybacks and distributions.

While electric vehicles present a long-term headline risk, the fact remains that MMP’s asset base is located in the mid-Continent of the U.S., where EV adoption has been and is expected to be slower than the rest of the country. Moreover, battery production is difficult to ramp up without more sources for lithium, and the EV tax credit has its limits too. Management highlighted this, along with opportunities for sustainable aviation fuels during the Q&A session of the recent conference call:

One thing I will say about the EVs is, the manufacturing requirement and the input requirements in terms of being domestic or not coming from foreign sources is one that makes getting the full benefit of that incentive more difficult. The additional incentives for things like sustainable aviation fuel. I think those could be interesting. It’s certainly making it more economic for the producers of renewable diesel to consider taking some of that capacity or adding capacity to produce more sustainable aviation fuels. That’s a net positive.

Meanwhile, MMP maintains a strong balance sheet with a debt to EBITDA ratio of just 3.3x, one of the lowest in the MLP sector. It also pays a healthy 8% distribution yield that’s well covered by a DCF coverage ratio of 1.25x. I continue to see value in the stock at the current price of $51.65 with a price to cash flow of 9.6x, which trades towards the low end of its 5-year range.

As shown below MMP has yet to recover to its pre-pandemic valuation range, despite oil prices having largely recovered. While most of MMP’s cash flows are not directly tied to commodity prices, the recovery in oil prices speaks to the overall financial health of the oil industry and MMP’s customer base. As such, I believe MMP deserves to trade at a price to cash flow of at least 11x, representing about a 15% upside from the current price.

MMP Price to Cash Flow (Seeking Alpha)

Investor Takeaway

MMP is in a sweet spot, given its mature asset base that requires low capital spend going forward. Moreover, the company is returning capital to shareholders through both distributions and buybacks, and has maintained a strong balance sheet. The stock looks undervalued at current levels while sporting a yield above 8%. As such, I find MMP to be a sound buy at present high income and potentially strong returns.

Be the first to comment