Jack Taylor

Company Overview

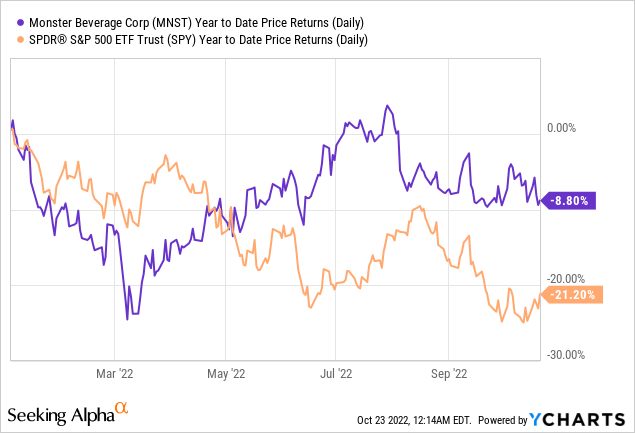

Monster Beverage Corporation (NASDAQ:MNST) is an American beverage company that manufactures energy drinks including Monster Energy, Relentless, NOS, Reign, Burn, Predator Energy and more. As of 2021, Monster has had 23.2% market share, falling right behind market share leader Red Bull. The company has a global presence, as the Monster brand operates in 138 countries. Year-to-date, Monster Beverage’s stock price has seen a decline of -8.80% and has significantly outperformed the S&P 500 index which has seen a decline of -21.20% in the same time period. Monster Beverage has a market capitalization of $46.2 billion.

Q2 Earnings

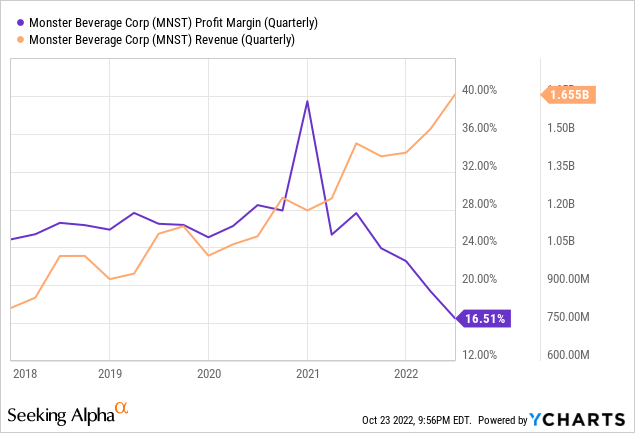

Monster Beverage posted another strong quarter of earnings and growth. Monster reported a 13.2% YoY revenue growth in Q2, marking 30+ consecutive quarters of revenue growth. When adjusting for foreign currency, the revenue growth was even stronger, with a 16.9% YoY growth in net revenue. Though the top line growth was strong, bottom line performance was disappointing, as the company reported a 32.3% decrease in net profits on a YoY basis. Management cited higher costs as one of the main reasons for the deteriorating bottom line, as the company saw operating expenses rise by a third, from $310.9 million to $406.9 million. Supply chain disruptions have been critical to the company’s bottom line as the company saw rising costs in freight and fuel costs, increased input costs such as raw materials and aluminum, and warehousing costs. As seen below, though revenue on a per quarter basis has risen substantially, profit margins have declined, which demonstrates the company’s current woes.

Road To Recovery

Monster Beverage in the past few quarters have continued to blame COVID-19 supply chain disruptions to explain the higher operating expenses and inability for management to financially take advantage from the increased demand of its products. These disruptions have impacted other businesses across the world, and we don’t believe that the company’s business model has anything to do with the subpar margins. We believe that time will eventually solve these disruptions, and the company should be able to improve margins and benefit from the tailwinds that have boosted demand for its products. The demand for energy drinks have been stellar, with the company reporting that net sales for Monster Energy Drinks segment increased 16.1% YoY when adjusting foreign currency. As long as their bread and butter segment continue to grow, we believe the expanding margins will eventually reaccelerate profit growth and boost the company’s multiples.

Valuation

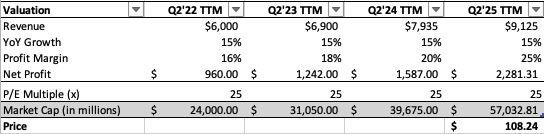

We value Monster Beverage using the company’s TTM revenue and valuing the company based on its historical revenue growth along with its historical profit margin. In the next three years, we forecast the company will grow its revenue at a 15% CAGR, as the company continues to make strides in expanding its market share in the energy drink market. Furthermore, as seen in the chart above, the company has had a net profit margin between 24% and 28% in the years leading up to the supply chain disruptions in 2021 and now. We believe that these disruptions will normalize and conditions will stabilize in the next few years. By 2025, we project the profit margin to hover back at around 25%. Given that the U.S. beverage industry has an average P/E ratio of 25.0x, we conservatively estimate the stock will be worth $108.24 as the base case scenario, which represents a ~24% upside from current levels.

SWMC Valuation Model

Risks

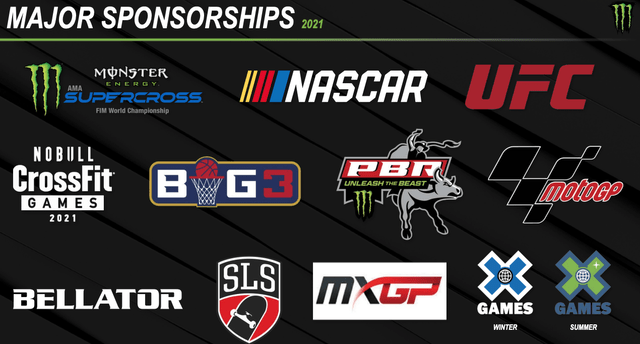

As a consumer discretionary company, Monster Beverage has significant exposure to decline in U.S. consumer sentiment and consumption. If the Federal Reserve over-tightens liquidity conditions and causes a steep recession, Monster Beverage could see its sales impacted. However, with great product diversification and price variations (the company also has brands under the “Affordable Energy” segment), we believe Monster Beverage is capable of navigating through global economic downturns and make the most of the economic environment. Furthermore, Monster Beverage has strong brand partnerships and is well known across the world. The brand and popularity will serve as important moats for the company to continue to drive sales forward even when marketing budget declines. Lastly, the company has $1.13 billion in cash and $1.34 billion in short-term investments. We believe the balance sheet is strong enough to fend off major cyclical downturn.

Conclusion

Overall, we believe that current dislocation in Monster Beverage’s financial results provides an opportunity for investors. The company has strong product pipeline with popular brands that serve customers globally. The Monster Energy brands continue to grow substantially, and we believe that net profit margin will normalize back to its pre-pandemic levels once supply chain disruptions are figured out and the company passes off higher input costs to higher prices in the medium term. We see a solid ~24% upside from current levels, and therefore we initiate coverage of Monster Beverage with a ‘Buy’ rating.

Be the first to comment