JasonDoiy

Intel Corp (NASDAQ:INTC) is a blue-chip technology company that has a long history of paying dividends. Intel now yields over 4% which has not happened too often in the past. In this article, I will analyze Intel’s ability to continue paying its dividend and look at the previous times Intel has yielded over 4%.

Intel has an impressive record of paying dividends. Intel has been paying dividends for 28 straight years and has grown its dividend for seven consecutive years. Now, Intel has a forward yield of 4.08%. Its forward dividend is $1.46, and its current price is $35.38.

Intel’s ability to pay its dividend is not in doubt in my opinion. According to its most recent 10-Q, Intel has a current ratio of 1.86. That is a good ratio. A metric that is not good is Intel’s free cash flow. That is a negative number. Free cash flow is cash flow from operations minus capital investments. Again, from Intel’s most recent 10-Q, Intel had $800M in cash flow from operating activities for the most recent quarter. Intel had a net of $7.2B in capital investments. Therefore, free cash flow is a negative $6.4B. That is not what investors want to see when it comes to free cash flow. However, Intel expects its free cash flow situation to improve by year-end. In the most recent earnings call, Intel’s Chief Financial Officer Dave Zinsner stated that Intel is expecting adjusted free cash flow of a negative $1B to negative $2B in free cash flow for the year. In other words, Intel expects adjusted free cash flow to be positive for the rest of the year. Long term, Intel aims for free cash flow to be 20% of revenues. While I would like to see positive free cash flow now, I am comfortable with Intel’s business strategy that put them in this temporary position of negative free cash flow. Zinsner believes that Q2 and Q3 are the “financial bottom” for the company.

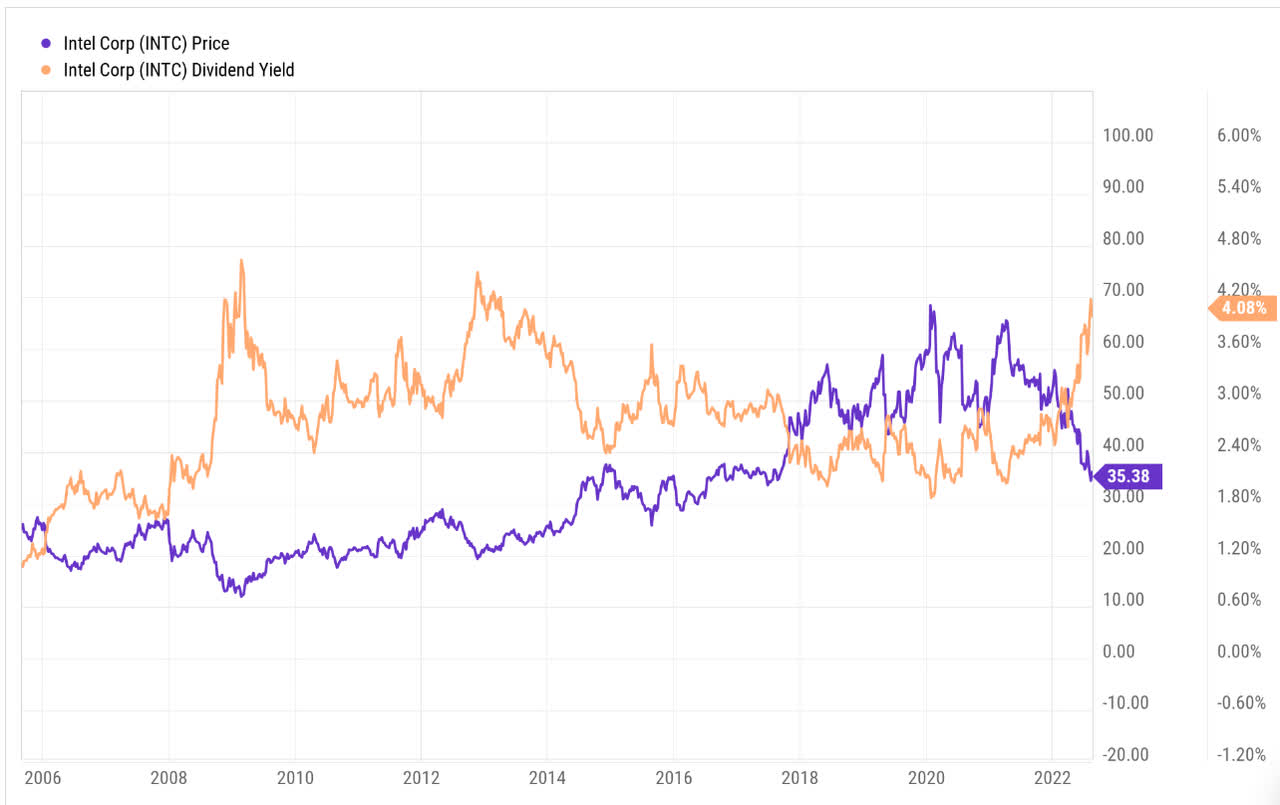

As I mentioned, Intel has a current yield of 4.08%. When I noticed this, I wondered how many times in the past has Intel yielded over 4%. The answer to that is not too often.

Chart 1 – Intel price and dividend yield

website

Source: link

By looking at Chart 1, you can see that there have only been a few other times Intel has yielded more than 4%. In November 2008 and March 2009, Intel yielded over 4%. That proved to be a good time to buy Intel stock.

October 2012, January 2013, August 2013, and October 2013 were also times when Intel yielded over 4%. Again, each of these times proved to be good times to go long Intel stock. See the table below.

Table 1 – Intel Yields 4% & Returns Moving Forward

|

Date |

Stock Price |

One Year Return |

Two Year Return |

Three Year Return |

|

Nov 12, 2008 |

$13.52 |

55% |

65% |

94% |

|

Jan 13, 2009 |

$13.67 |

62% |

66% |

108% |

|

Oct 19, 2012 |

$21.27 |

17% |

64% |

76% |

|

Jan 18, 2013 |

$21.25 |

30% |

84% |

55% |

|

Aug 8, 2013 |

$22.45 |

50% |

40% |

71% |

|

Oct 8, 2013 |

$22.48 |

57% |

53% |

86% |

|

Average Returns |

45% |

62% |

82% |

|

Source: www.stockcharts.com, ycharts.com

Those returns look very good to me. The previous six times Intel yielded over 4%, the future returns one year out, two years out, and three years out were all positive. The worst one-year return was 17%.

While I don’t know for sure, my guess is that each time reflected in the chart above, there were plenty of concerns surrounding Intel’s business strategy, competition, market penetration, chip technology, capital allocation mix, etc. That is what caused the stock price to decline so much that the dividend yield reached 4%. It seems that this time is no different. Concerns about Intel’s lack of penetration into the cell phone market, competition from other chip companies, Intel’s reliance on the Wintel standard, poor balance sheet, etc. It is in times of doubt when share prices are on sale. Now appears to be that time.

In summary, I think that Intel is a good buy at its current price. I am not fearful that Intel will cut its dividend nor be able to continue its dividend moving forward. In fact, I expect Intel to raise their dividend next year as their free cash flow improves. In the past, when Intel has yielded over 4%, it was proven to be a good time to go long Intel. With Intel now yielding 4.08%, I think it is an excellent time for the long-term investor to buy some shares.

Be the first to comment