Joe Raedle

Procter & Gamble (NYSE:PG) is one of those rather boring (but very profitable …) consumer staple stocks that typically outperform in a weak market – and that has certainly been the case again this year. The company has a very diverse product line across multiple consumer categories and across six different global regions. P&G generates the majority of its revenue (~56%) overseas. While the company is strategically well-positioned for current macro-environment, it still faces some significant challenges going forward. Today, I’ll take a close look at the company’s recent performance to see if it currently offers investors a good entry point.

Investment Thesis

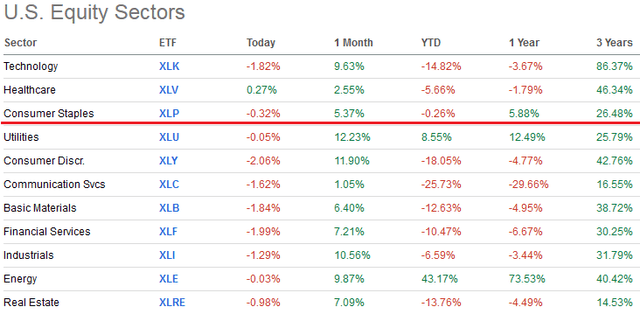

As mentioned in the bullets, the Consumer Staples sector is one of only three sectors in the green over the past year and during the 2022 bear market:

That being the case, many investors like to allocate some capital to the Consumer Staples sector to act as a ballast or “shelter from the storm” in order to smooth out portfolio returns during down markets. Yet, over the longer term (3 years in the graphic above), it is clear that there are better performing sectors, which is – of course – why I continue to advise investors to build and maintain a well-diversified portfolio and to stay in the market through its up-n-down cycles.

Procter & Gamble has a wide assortment of very popular consumer products. These include: Head & Shoulders, Pantene, Olay, Old Spice, Secret, Braun, Gillette, Crest, Oral-B, Downy, Vicks, Cascade, Dawn, Febreze, Pampers, Luvs, Tampax, Bounty, and Charmin – among many others.

P&G is a “dividend aristocrat” and has raised its dividend for 66 consecutive years.

Today, I’ll take a fresh look at Procter & Gamble to see if it may offer investors a good entry point – or if they should consider adding shares to an existing position.

Q4 & FY2022 Earnings

P&G announced its Q4 FY22 EPS report at the end of July and it was generally considered to be a miss on the top (by $0.02/share) and a beat on the bottom line (by $110 million). Q4 revenue was up only 3% yoy as a result of tough year-over-year comparisons and a slowing global economy. Organic sales were up 7% during the quarter.

During Q4, net earnings generated by the Beauty and Grooming Segments were down significantly (-18% and 16%, respectively) as lower volume (heavily impacted by China lockdowns) and commodity prices hit margin. Shaving products were down 30% in China and were negatively impacted by both manufacturing shutdowns and lower consumer demand. On the upside, net earnings for the Fabric & Home Segment were up 9% as P&G continues to gain market share with innovative products – particularly its laundry “unit-dose” and fabric enhancer beads offerings.

Notably, P&G continued to generate strong free cash flow during the quarter: $3.0 billion. For the year, P&G generated $13.8 billion in free cash flow or an estimated $5.48/share based on the 2.52 billion shares outstanding at the end of FY22. That bodes well for shareholders considering the current annual dividend is only $3.65/share.

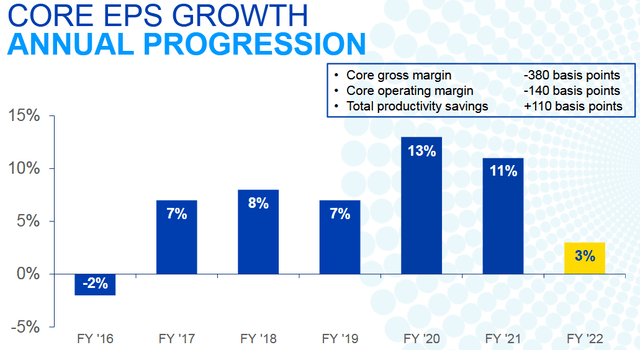

For the year, EPS growth was only 3% and was a significant deceleration as compared to recent – and covid-19 impacted – years as margin contracted:

Source: Q4 & FY22 Presentation

Note that gross margin was down 380 basis points, a big move for a company like P&G.

Going Forward

P&G faces a number of headwinds going forward:

- Continued tough yoy comparisons as market growth have decelerated.

- Being a global company with a relatively strong U.S. dollar, P&G facing significant foreign exchange headwinds.

- Commodity prices and freight costs will continue to be a drag on margin.

- Covid-19, geopolitical risks, and high inflation and rising interest rates could all negatively affect product costs as well as consumer demand.

Acknowledging all those challenges, it is not surprising that management’s FY23 guidance was tepid at best:

- Revenue growth of 0-3% (that includes a negative 3% FX headwind).

- EPS growth of flat to +4% as the company expects various headwinds to account for a whopping $1.33/share negative impact (~23% as compared to FY22).

- Share repurchases of $6-$8 billion (versus $10 billion in FY2022).

Risks

In addition to the risks and headwinds already discussed, note that P&G hedges interest rate & FX risks, but not commodities. That being the case, there could be considerable upside in FY23 if commodity prices were to come down. I say that because P&G is known to operate one of the top (if not the top) supply-chain management teams in the business. In addition, P&G has the ability to raise prices in order to offset commodity price increases, supply chain, and labor shortages.

In addition, P&G top-tier branding leaves it exposed to financially stressed consumers who would trade down to private label brands in order to save money.

At the end of FY22, P&G had $7.2 billion in cash & cash equivalents and $22.85 billion in long-term debt. My opinion is that P&G should spend a bit less on share repurchases and pay down more of its debt load. That would increase bottom line EPS and, eventually, free up more cash for dividends directly to shareholders.

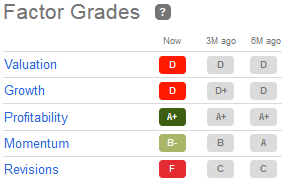

P&G currently trades with a P/E=25.8x, which is a significant premium to the S&P500 (21.4x). That is especially the case given P&G’s own relatively weak guidance for FY23. As a result of all these various dynamics, it is not surprising that the current Seeking Alpha overall “Factor Grade” is full of red, including an “F” grade for downward revisions:

Seeking Alpha

However, one reason that Procter & Gamble is “no gamble” is because of the green: an A+ for profitability.

Summary & Conclusion

Although P&G is down ~10% from its 52-week high, the stock price still does not appear to be overly attractive here given relatively strong headwinds and tepid growth (on both the top- and bottom-lines) expectations for FY23. However, if market volatility were to push the stock down to the $135 price range – which would equate to a TTM P/E=23.2x and a dividend yield of 2.7%, I’d be a buyer. Now, the best I can do is a HOLD recommendation based on the company’s excellent and demonstrated long-term profitability and free cash flow profile.

A significant reduction in commodity prices would greatly benefit P&G and might cause me to raise my rating. Meantime, if investors want to put money into consumer staples right now, the Consumer Staples SPDR ETF (XLP) may offer a superior and diversified alternative (0.10% expense ratio, 2.33% yield).

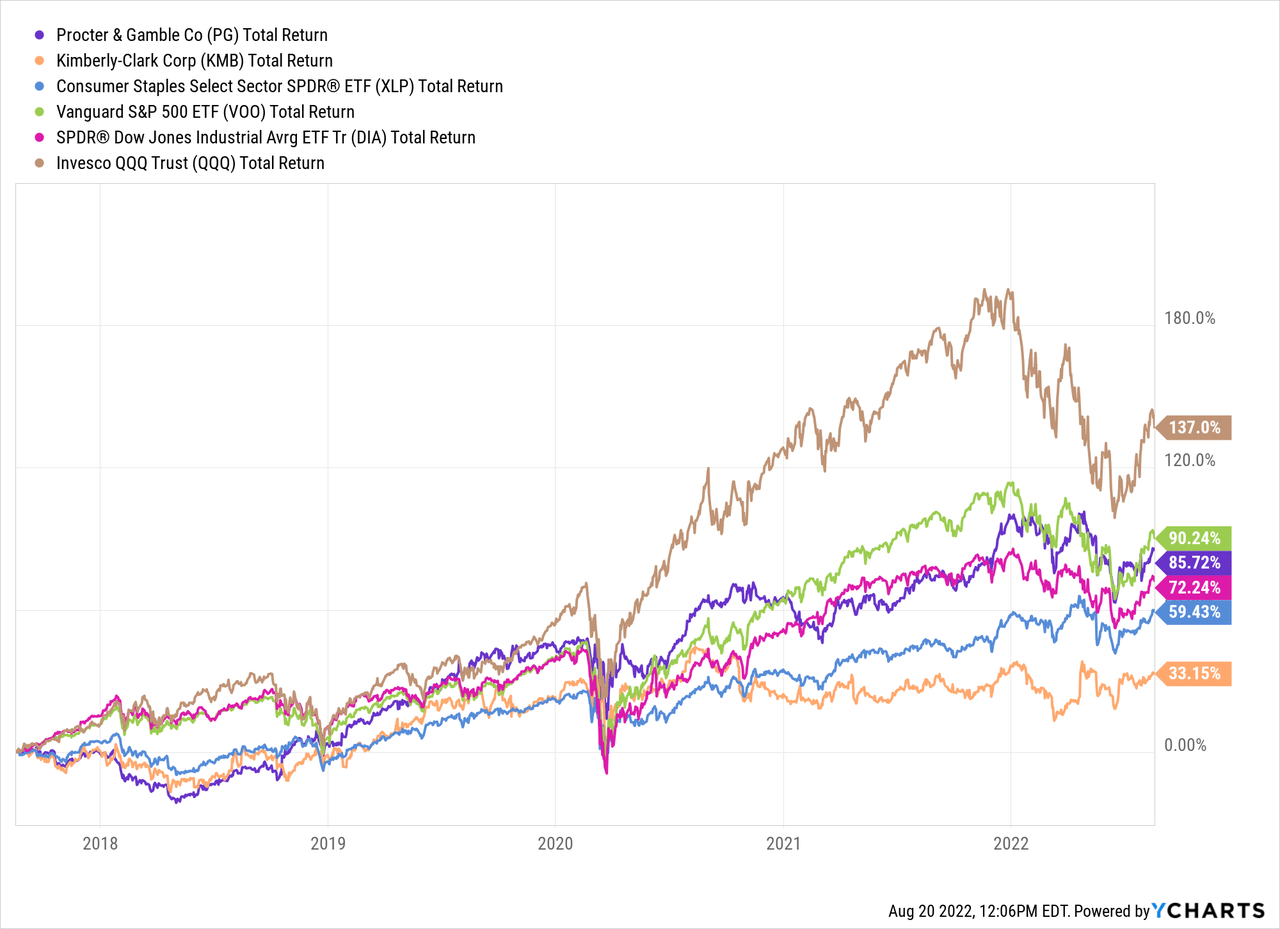

I’ll end with a five-year total returns chart of P&G versus the major market averages as represented by the Vanguard S&P 500 ETF (VOO), the DJIA SPDR ETF (DIA), and the Nasdaq-100 ETF (QQQ), as well as peer Kimberly-Clark (KMB) and the XLP Consumer Staples ETF.

The chart is meant to show the relative value of consumer stocks as compared to the broad market averages and also to note the significant outperformance of P&G versus peer Kimberly-Clark and the XLP Consumer Staples ETF.

Be the first to comment