Khanchit Khirisutchalual

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on August 6th, 2022.

Dividend growth stocks aren’t always the most exciting investments out there. They often times aren’t grabbing the headlines; they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. There are definitely yield-traps out there, trust me – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all return back into your pocket from that point forward.

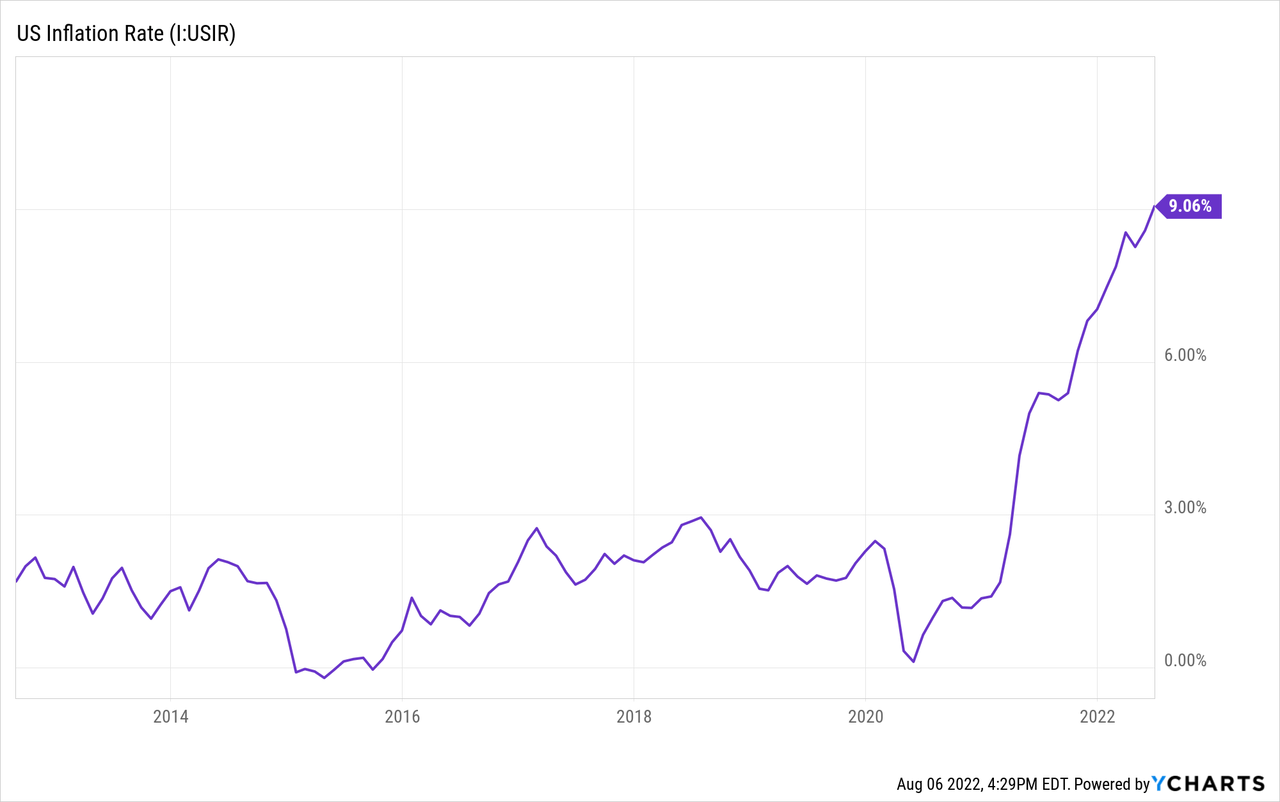

These dividend growth stocks can be even more critical in the current environment as it combats inflation. With the rising prices, an income investor needs a growing income to compensate for the price erosion. Inflation has been a key theme of 2022.

In the last month, inflation continues to tick higher after having a small decline a couple of months before. This prompted the Fed to boost rates by another 75 basis points.

Ycharts

Inflation and interest rates continue to be the main focus, but the Fed has a bit of time before deciding their next move. With the month of August off, they will get a bit more data to see how things are shaking out after implementing the rate hikes so far. That being said, the latest payrolls figure came in much hotter than expected. That could suggest that the Fed can continue to be aggressive here.

The market continues to be volatile but has gained a lot of ground from the lows reached in June. July ended up being quite a strong month across the board.

With July’s latest inflation reading, we saw that it was cooling a bit. That is good news for the fight against inflation.

All of this being said is important to understand my approach to dividend stocks and why screening of dividend stocks can be important for income investors. These are August’s 5 dividend growth stocks that might be worthwhile for a deeper exploration. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors but earnings payout ratios, debt and free cash flow are amongst these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising year after year, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means that there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 480 stocks at this time-quite a drop from July’s 551 listings. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more obviously. I then sorted the list by forward dividend yield, highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

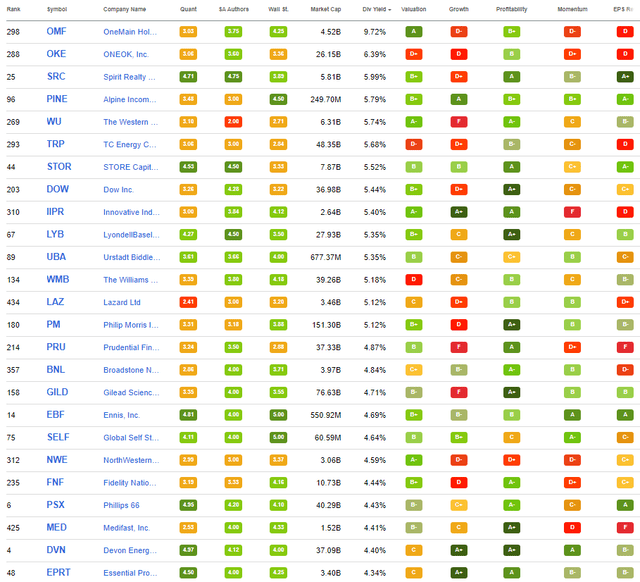

From there, I will share the top 25 that showed up as of 08/06/2022.

Top 25 From Screening (Seeking Alpha)

ONEOK (OKE) and The Western Union (WU) were discussed rather recently in June. STORE Capital (STOR) was discussed in last month’s article.

Spirit Realty Capital (SRC) could be a worthwhile investment. However, a slashed dividend combined with a reverse split in 2019 and with tepid dividend growth since that period will keep it off of today’s discussion.

Dow (DOW) will also be kept off this list. They’ve maintained their dividend, but it hasn’t grown at all since that company was broken up.

With that, we are left with OneMain Holdings (OMF), Innovative Industrial Properties (IIPR), Alpine Income Property Trust (PINE), TC Energy (TRP) and LyondellBasell Industries (LYB). All but LYB are new names to this month’s list, which is great to see what comes in as new potential opportunities.

OneMain Holdings (OMF) 10.41% Yield

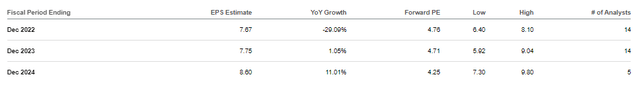

OMF certainly caught my attention as this name sports an over 10% yield. That is quite rare on this screening piece, as a higher yield often means something is wrong. However, given the forward EPS estimate of $7.67, the current payout ratio seems more than sustainable at around a 50% payout ratio.

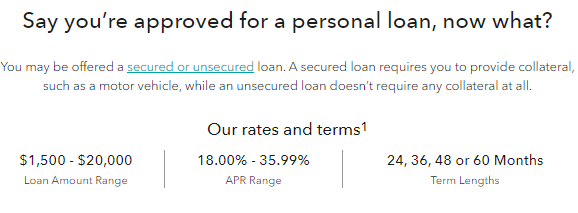

This is a financial services company that provides consumer finance and insurance business. They provide personal loans and other financings to individuals with insanely high interest rates, 18 to 35.99%.

OneMain Financial (OneMain Financial Website)

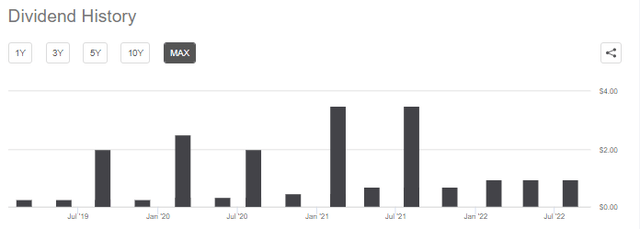

The latest regular quarterly dividend has been $0.95. They have been raising this rapidly but also paying out significant special dividends over the last couple of years now.

OMF Dividend History (Seeking Alpha)

That forward EPS estimate is even based on the stock’s earnings dropping quite materially in this fiscal year.

OMF Earnings Expectations (Seeking Alpha)

Even though the earnings are dropping, given the nature of their business as being quite cyclical, the regular dividend appears safe. The specials probably aren’t going to be continuing through this period but could be something to look forward to again in the future. At least, it would seem wise to strengthen the balance sheet in a period of uncertainty.

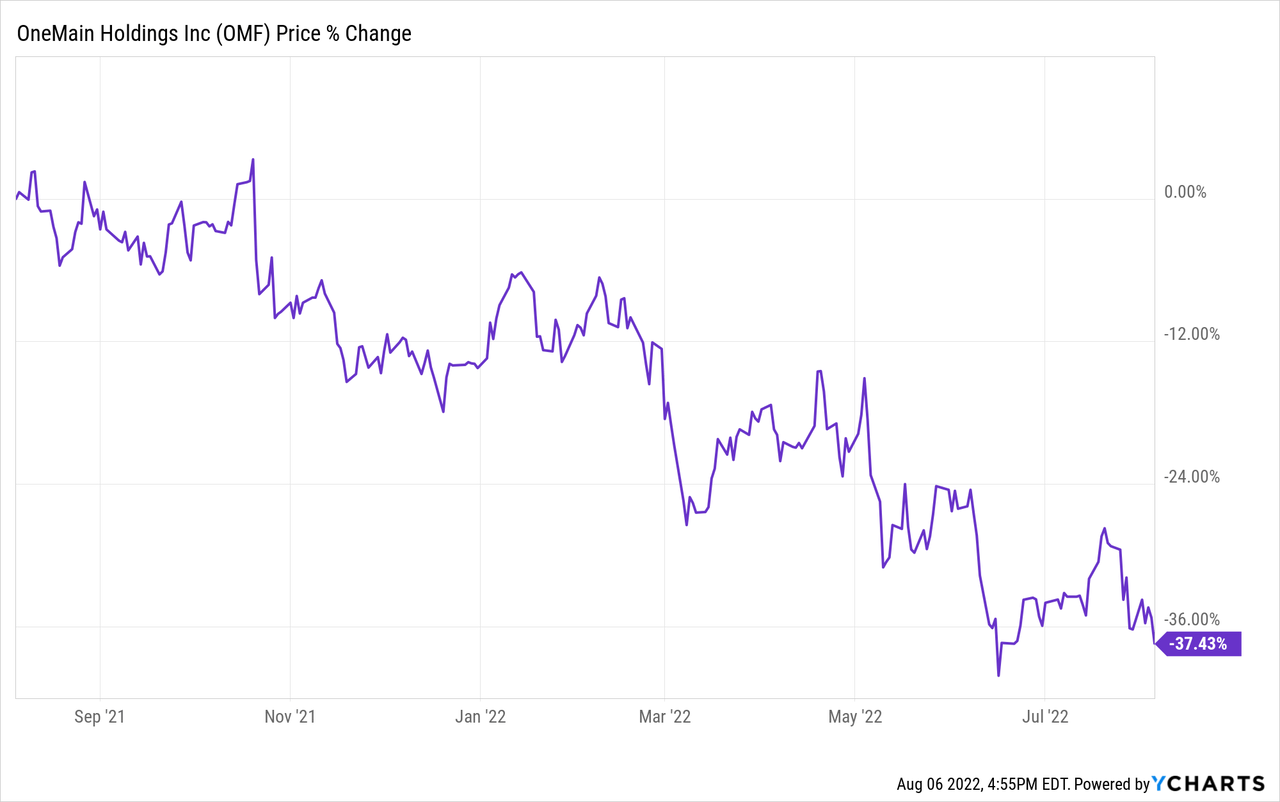

This is my first time ever running across this name, but it is definitely one to consider looking at. Over the last year, the stock has been down almost 37.5%.

Ycharts

Of course, that also catches my attention but isn’t too surprising given the expectation for a consumer slowdown. It hasn’t happened yet, but the stock is reacting as if it has.

Innovative Industrial Properties (IIPR) 7.41% Yield

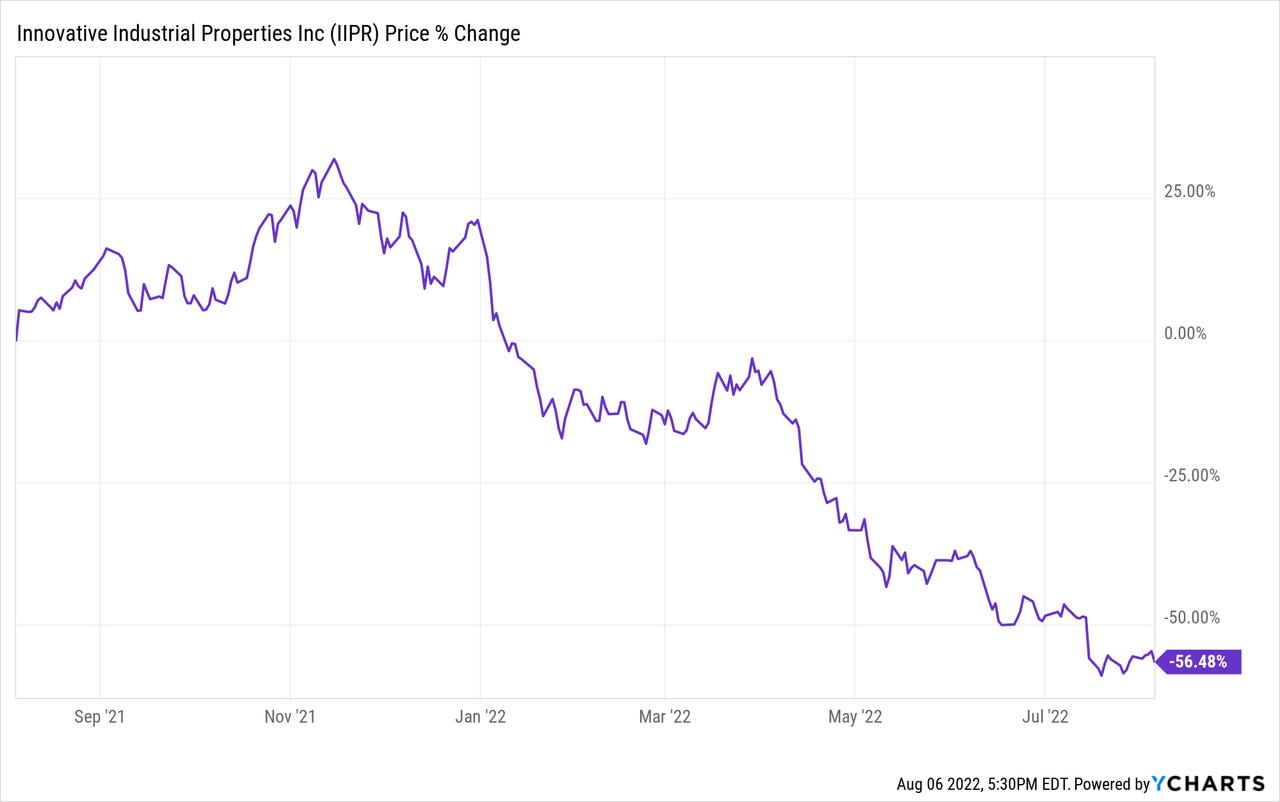

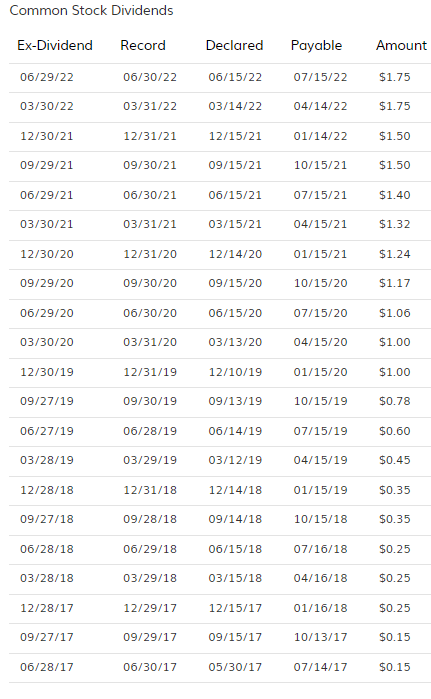

This is the portfolio name that has shown up. Unfortunately, it is due to its rapid decline in price that has pushed the yield up to 7.41%. This is based on the latest $1.75 that should be expected to continue.

Ycharts

Shares have dropped over 56% in the last year. However, a lot of the losses began at the beginning of January. This is an industrial REIT that focuses on warehouses for Marijuana growers. This was always a riskier REIT, but these risks are starting to show themselves.

With more speculative tenants and the overall decline in valuations among the more speculative names, this has really hit IIPR. Dane Bowler’s recent article highlighted the publicly traded names and their stock performances more in-depth recently. The tenant’s stock prices were down 62%+, which really highlights the current environment that we are operating in.

At least for now, they’ve been able to raise their dividend quite aggressively.

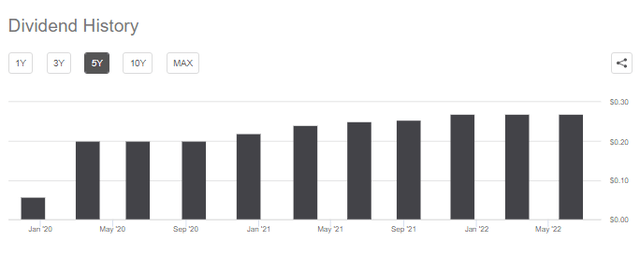

IIPR Dividend History (IIPR Investor Website)

Going forward, given the risks, the growth should probably slow. That being said, they had still announced an FFO of $1.97 and AFFO of $2.14 with their latest earnings. That would suggest the current dividend is still being earned.

Alpine Income Property Trust (PINE) 5.87% Yield

While the yield of PINE isn’t as high as OMF and IIPR that we touched on above, this is still a relatively high yield. That being said, it has resulted from the stock declining 7.16% over the past year – not the ~37.5%.

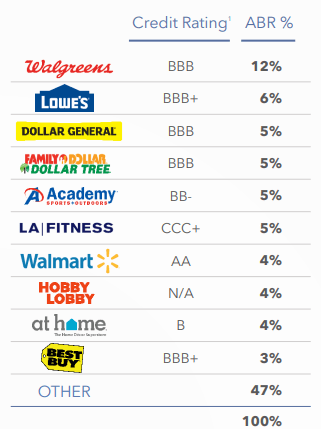

This is a small retail REIT. To give some context, the market cap of PINE is around $250 million, and STOR is at a market cap of $7.87 billion. Realty Income (O) has a market cap of $45.01 billion. PINE owns 143 properties in 35 states.

It only has a short history, but PINE has been fairly aggressive in growing its dividend. Particularly noteworthy is that they began growing it more regularly through 2021, with quarterly raises.

PINE Dividend History (Seeking Alpha)

Analysts expect FFO to be $1.68 this fiscal year, putting the payout ratio at only 64.3% based on the latest $0.27 quarterly dividend. With many recognizable investment-grade names, this REIT seems set to be a strong contender in the future.

PINE Top Tenants (PINE Investor Presentation)

I believe that PINE is definitely a name I’d want to look at even deeper.

TC Energy Corporation (TRP) 5.68% Yield

Interestingly, we have TRP showing up as an energy name. This is after Hess Midstream (HESM) showed up last month, our first energy name to appear. Overall, I’m fairly cautious about adding energy names besides the larger integrated names or top MLP names such as Enterprise Products Partners (EPD). You can only get burnt so often until you become skeptical of a sector.

That being said, TRP is mostly focused on natural gas. Natural gas doesn’t fall under the same criticisms as oil because it is a more environmentally friendly fossil fuel. Therefore, all else being equal, we should expect natural gas to stay in higher demand for longer.

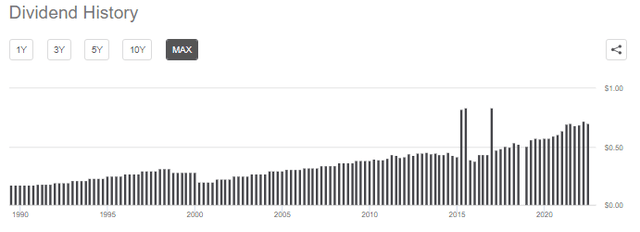

The dividend history for TRP probably seems a bit more unusual. However, that’s because it is a Canadian company. So it gets adjusted for USD, and as the currencies fluctuate in value relative to one another, you get an inconsistent dividend.

TRP Dividend History (Seeking Alpha)

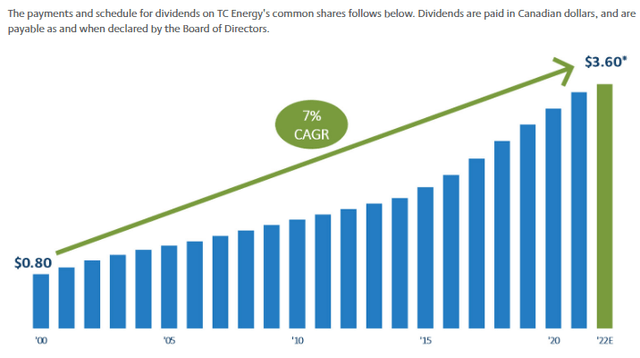

When looking at their own material, you can see that there has been a gradual increase since 2000.

TRP Dividend History (TRP Investor Presentation)

For those interested in energy, you can’t argue with their track record. They’ve been able to operate successfully if the 22 years of dividend raises are any gauge.

LyondellBasell Industries (LYB) 5.56% Yield

This is the watchlist name and the name that has shown up previously, but we haven’t taken a look at LYB since April. Since then, the stock has paid a monster special dividend and raised its regular dividend too.

LYB Dividend History (Seeking Alpha)

The latest $1.19 quarterly dividend was a raise of 5.31% over the $1.13 the stock was paying. Based on the EPS expectations of $16.88, we are looking at a payout ratio of only 28.2%. The earnings can vary from year to year because it is a cyclical name as a chemicals and plastics company. Demand will very much depend on the state of the economy.

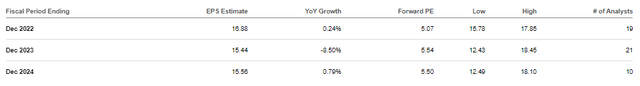

Going forward, earnings aren’t expected to slip too much, but they are expected to decline nonetheless.

LYB Earning Estimates (Seeking Alpha)

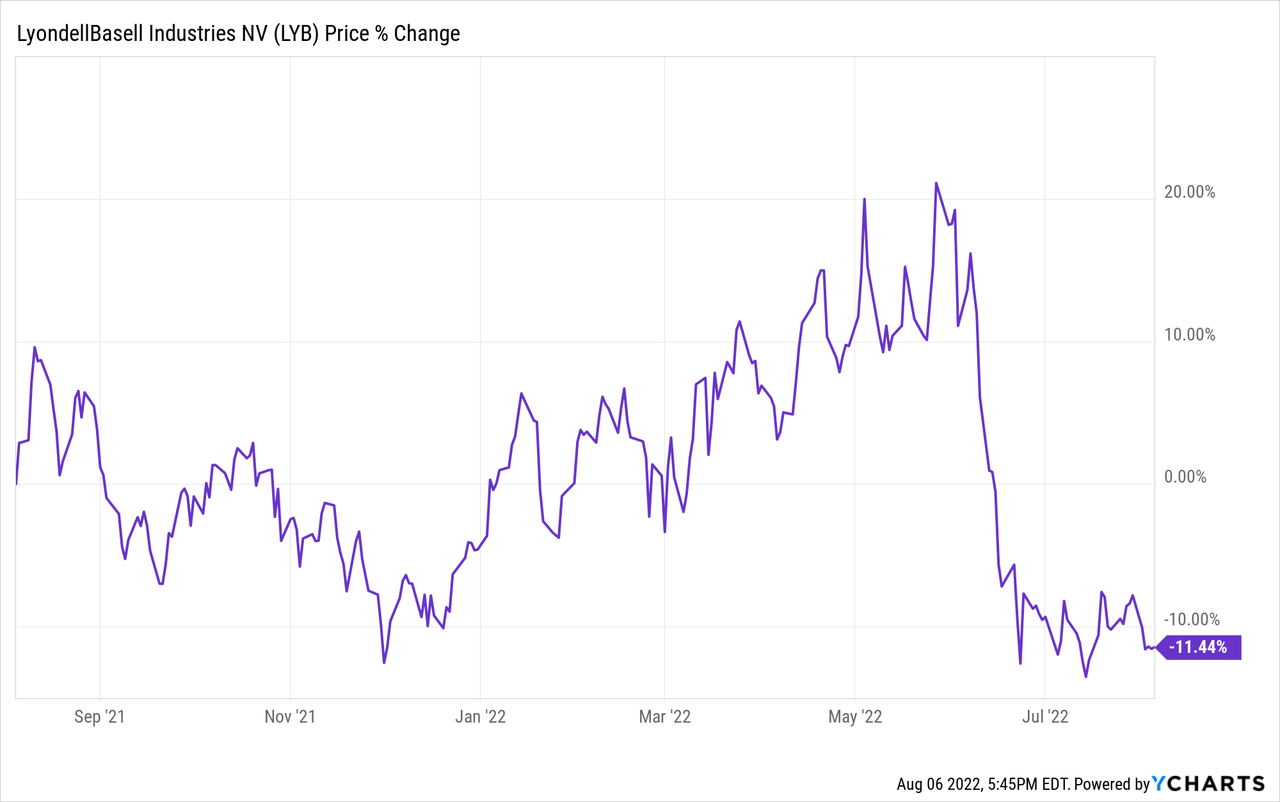

One reason this stock has popped up again is because of the decline in the share price. That has raised the yield (but the raised dividend also bumped up its yield too, which is positive.) The declines were more recent. Investors seemed to wait for that special dividend and then bale on the company’s shares. Part of the decline from the 52-week average of $112.53 was simply the $5.20 special too.

Ycharts

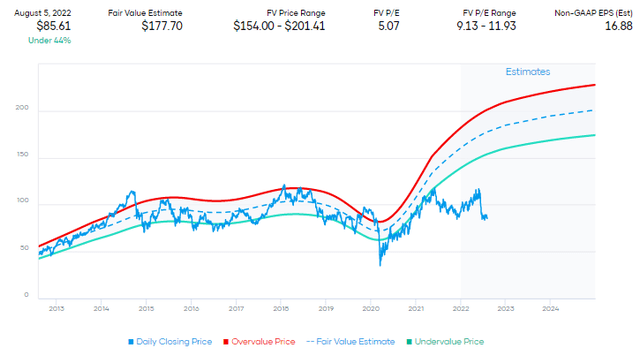

Based on the P/E valuation, it is looking fairly undervalued now.

LYB Valuation (Portfolio Insight)

That’s why it has been a particularly interesting watchlist name. However, these latest declines also reflect the heightened risks the economy could face with a Fed hiking aggressively.

One cause for concern for me is how they will fair in a major recession. LYB’s dividend history only goes back to 2011. The company we know today was formed only in 2007, with the merger of Basell and Lyondell. We might not have to see how that plays out with the expectations for a mild recession. LYB should be seen as holding up well, with little concern if we get a mild recession.

Be the first to comment