patty_c

Thesis

The Home Depot, Inc. (NYSE:HD) is scheduled to release its Q2 earnings report on August 16 amid the current housing market slowdown, which has battered HD since its highs in December 2021.

Our analysis suggests that HD has likely staged its long-term bottom in June, in line with its peers in the consumer discretionary ETF (XLY). Therefore, investors looking to add exposure at the current levels should see limited downside, as the market sentiment has recovered remarkably.

Home Depot’s high-quality operating model provides a tremendous level of revenue visibility. However, it’s still susceptible to changes in housing prices. Therefore, negative price pressures in the housing market could potentially affect the recovery momentum of HD, leading to underperformance.

Investors should also note that Home Depot expects its growth to slow in H2’22 compared to H1’22. But, we posit the market has already expected the changes in growth cadence, corroborating our thesis that it should limit the downside in HD from here.

Accordingly, we reiterate our Buy rating on HD.

Need To Watch For Slower Growth From Home Depot

Investors’ expectations of HD stock have weakened tremendously since its highs in December 2021. We believe the market has astutely adjusted for the slowdown in the housing market. Home Depot also reminded investors of the criticality of home price appreciation, as CFO Richard McPhail accentuated:

Over our history, we’ve seen that home price appreciation is the primary driver of home improvement demand. When your home appreciates in value, you view it as a smart investment and you spend more on it. So let’s look at what’s happened at home prices. We’ve seen appreciation of over 30% over the last two years. In fact, home equity values over the last two years have increased by 40% or over $7 billion just in the last two years. So the homeowner has never had a balance sheet that looks like this. They’ve seen the price appreciation, and they have the means to spend. (Home Depot FQ1’22 earnings call)

Therefore, it’s reasonable for investors to interpret that cooling housing may not augur well for home improvement demand moving forward, as home sellers have also started to cut prices. Fund manager PIMCO was even more downbeat, suggesting a significant slowdown could be on the cards. It articulated:

We do think housing is going to slow and slow significantly. We think on a national basis, housing is likely to decline in real terms or inflation-adjusted terms over the course of the next few years. – Bloomberg

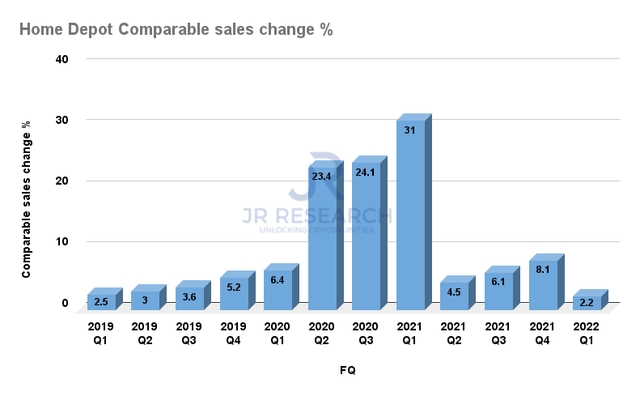

Home Depot comps sales change % (Company filings)

Home Depot posted a markedly slower 2.2% growth in its comparable sales in Q1. However, as a reminder, the company guided that it expects “Q2 to be the highest comp quarter of the year.” Notably, the company also estimates growth to slow down in H2’22 while maintaining a full-year revenue growth target of 3%.

Therefore, we believe the market has justifiably battered HD, as it couldn’t keep up with its outperformance in 2020/21. Coupled with worsening macro headwinds that could further crimp consumer spending, the market needed to de-risk HD to reset expectations.

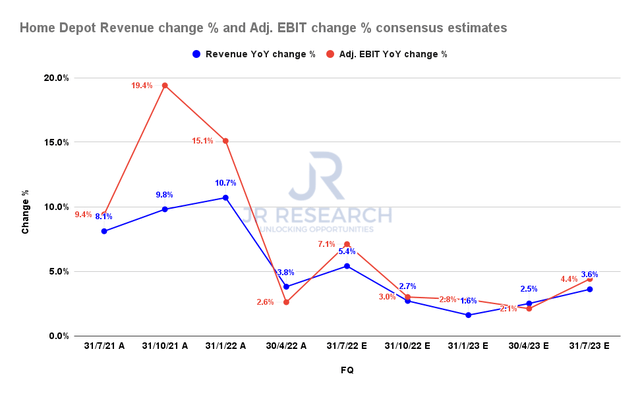

Home Depot revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that Home Depot’s revenue and adjusted EBIT growth could bottom out in Q1’23 before recovering. However, given the current dynamics in the housing market, investors are urged to pay attention to management’s commentary on any potential revision to guidance.

HD Price Action Suggests It Formed Its Long-Term Bottom

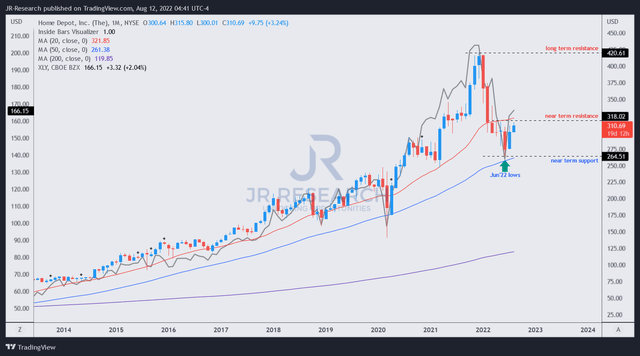

HD price chart (monthly) (TradingView)

We noted that HD formed a long-term bottom in June, close to its long-term 50-month moving average support (blue line). Furthermore, HD has a robust long-term uptrend that has been consistently supported above the 50-month moving average over the past ten years.

Coupled with the long-term bottom we saw in XLY (gray line overlay), we believe it’s also constructive to help undergird HD’s June lows. Given the market bottom in June, we are confident that HD should see limited downside from here.

Is HD Stock A Buy, Sell, Or Hold?

HD last traded at an FY23 free cash flow (FCF) yield of 5.66%, well above its 5Y mean of 4.81%. Therefore, we are confident that the market has already de-risked HD to some extent, as it accounted for the heightened risk in the housing market. Nevertheless, coupled with slowing growth through Q1’23, the battering from December 2021 is justified.

Notwithstanding, investors need to pay close attention to management’s guidance in its upcoming Q2 commentary and discern any potential impact given the current housing market conditions. These could potentially impact HD’s recovery momentum.

Accordingly, we reiterate our Buy rating on HD.

Be the first to comment