imaginima

Clearwater is the most profitable oil play in North America. This heavy oil reservoir is the subject of significant development by companies like Headwater (OTCPK:CDDRF), Baytex (OTCPK:BTEGF) (BTE) and Rubellite (OTCPK:RUBLF) (RBY.TO) all of which are attracted by the relatively low cost per well and high netbacks they are realizing in this prolific oil play.

Deltastream was one of the largest operators in the Clearwater play and Tamarack Valley (OTCPK:TNEYF) surprised the market by announcing its agreement to buy Deltastream for a total of CAD$1.4 billion comprising $300 million in Tamarack shares and the balance in cash. The Clearwater play has attracted a lot of attention and is now the subject of a number of analytical reports.

Daily Oil Bulletin screen clip (Daily Oil Bulletin)

Investors don’t seem to know how to value the expanded Tamarack Valley or how to handicap the added risk of the large increase in debt. Energy investors have preferred to invest in companies that are paying off debt, raising dividends and buying back stock. This major move by Tamarack Valley was definitely a contrarian one.

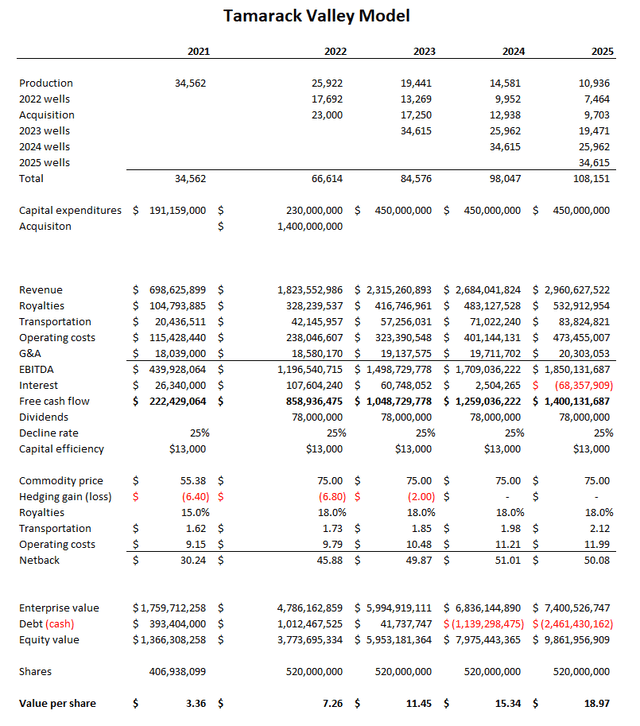

Fortunately, despite the high volatility in oil prices (which will be the key determinant of success or failure) it is relatively easy to model the economic performance of Tamarack Valley within reasonable bounds of accuracy. I have. This is that model.

Tamarack Valley Model (Blair analysis, Company data)

Based on a Canadian dollar price of $75 per barrel of Western Canada Select (“WCS”) which is the grade of oil found in Clearwater, Tamarack Valley seems likely to turn in cash flows well over CAD$1 billion for each of the next three years which will see debt disappear by 2024 and free cash flow surge. While speculative owing to the ever-present risk of a deep recession tanking oil prices, Tamarack Valley’s balance sheet improves by about CAD$100 million a month and the risk posed by the increased debt will disappear quite quickly.

The company pays a small dividend (2.75% yield at today’s CAD$4.35 stock price) and trades at a discount to my estimate of fair value based on 4x EBITDA adjusted for debt. If I am anywhere close in this analysis, Tamarack Valley stock should reward investors with both capital gains and rising dividends over the next few years. Of course, if the highly expected recession emerges early next year and drives oil prices down to the CAD$40 range, Tamarack Valley will limp along until prices recover and the stock might fall substantially. I like the risk-reward ratio and bought 10,000 shares.

Be the first to comment