NicoElNino/iStock via Getty Images

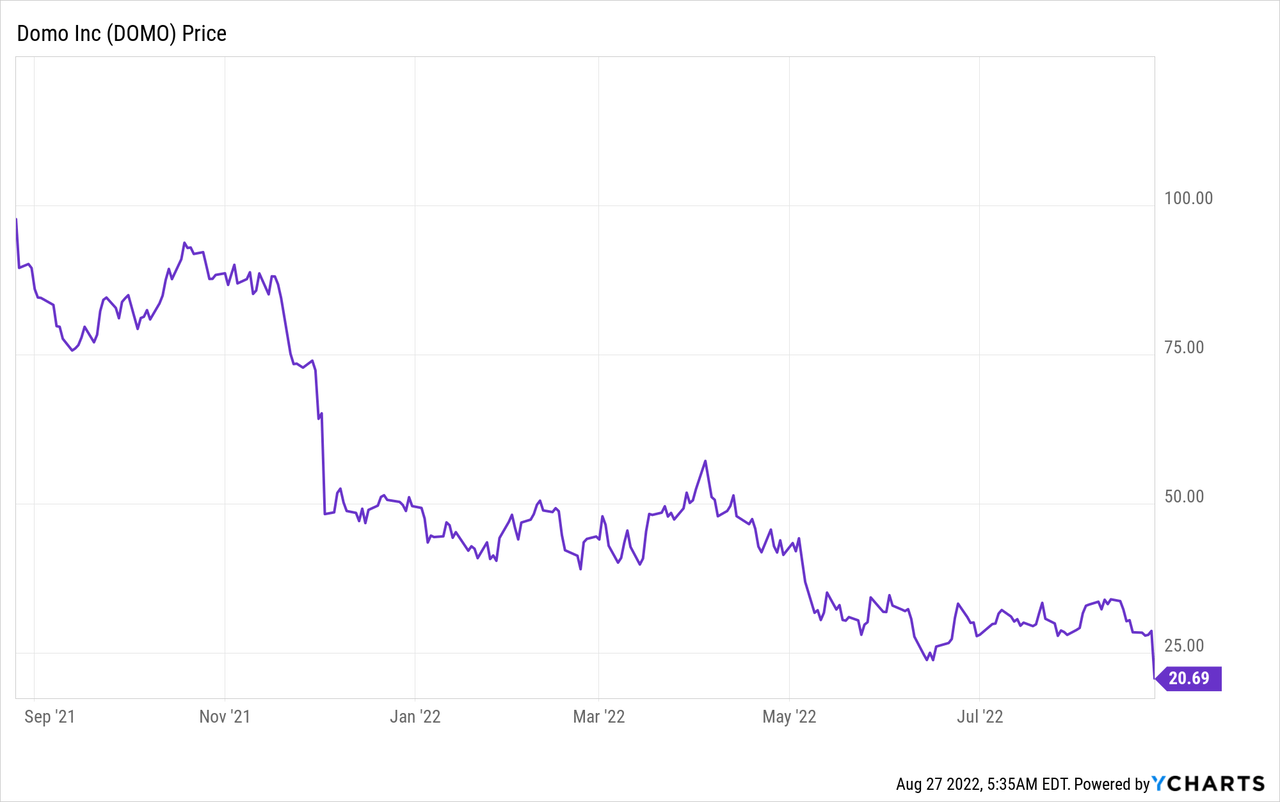

Domo (NASDAQ:DOMO) is a leading data visualisation platform. The stock price has recently been butchered by over 27% in a single day after its guidance was cut, but are things all bad? Well not exactly the company still beat earnings estimates and let’s not forget its elite customer base which includes brands such as Cisco, Zillow, eBay, DHL, Unilever, NBA, L’Oréal and more. The company also has a grand market opportunity. The Big Data Market is forecasted to increase in value by 47% between 2022 and 2027, reaching over $100 billion by the end of the period. In this post, I’m going to review the company’s strategy, break down its recent earnings report and reveal its valuation, let’s dive in.

Business Strategy

Domo, Inc., provider of data visualization software. Many organizations have “siloed” data across multiple databases and spreadsheets. For example, this could be marketing data, sales data, product data, supply chain data and more. Domo’s software platform helps to bring this all together with a customer data application and “single pane of glass” for viewing and data driven decision-making. The beautiful feature with Domo is it makes the building of customer Data Apps accessible via “low code” tools. Workflows can also be integrated, which opens up automation opportunities across a business.

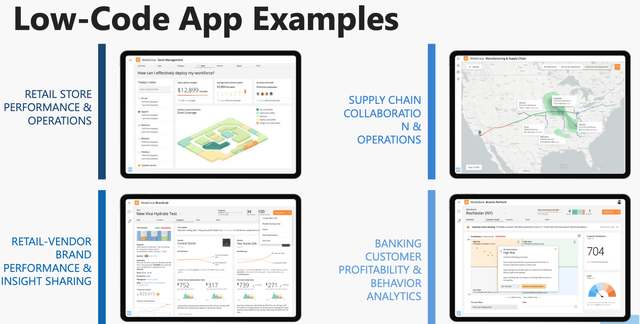

Low code app examples (Investor Presentation)

Domo has been named a “Leader” in multiple reviews on Business intelligence and self-service analytics. Domo is recognised for its strong ability to be adopted across “multiple clouds” which is a common use case for many enterprises. The company is also one of the most secure platforms on the market and has achieved HITRUST Certification by passing a rigorous security testing procedure. This makes the platform popular with banking customers, as you can see on the data app example above (bottom right image).

Strategy Moving Forward

Moving forward, the business strategy includes hiring 25% more sales reps, introducing repeatable vertical sales plays and aligning the go-to-market strategy with business outcomes. In addition, the business plans to increase the cross-sell opportunities across various accounts.

Second Quarter Breakdown

Domo generated solid financial results for the second quarter of FY23. Revenue was $75.5 million, up a rapid 20% year over year, but $869k below analyst estimates. This was driven by 23% growth in subscription revenue to $67.4 million, which makes up 89% of total revenue.

As the company operates via a SaaS model, there are a few metrics which it makes sense to highlight.

Billings which is the amount invoiced to customers was $72.3 million, up a rapid 21% year over year. While Remaining Performance Obligations [RPO] was $349.1 million, up a rapid 22% year over year. RPO is the amount of revenue contracted but has not been invoiced for or paid yet, as usually split of a multi-year term. For example, if a customer signs up for a 5-year contract and receive an invoice annually, after the SaaS company delivers on its “Performance Obligations” which refers to providing the service for that period. RPO provides a reliable indicator into future revenue and in this case short term RPO (expected to turn to revenue in the next 12 months) was $225.4 million, up 23% year over year.

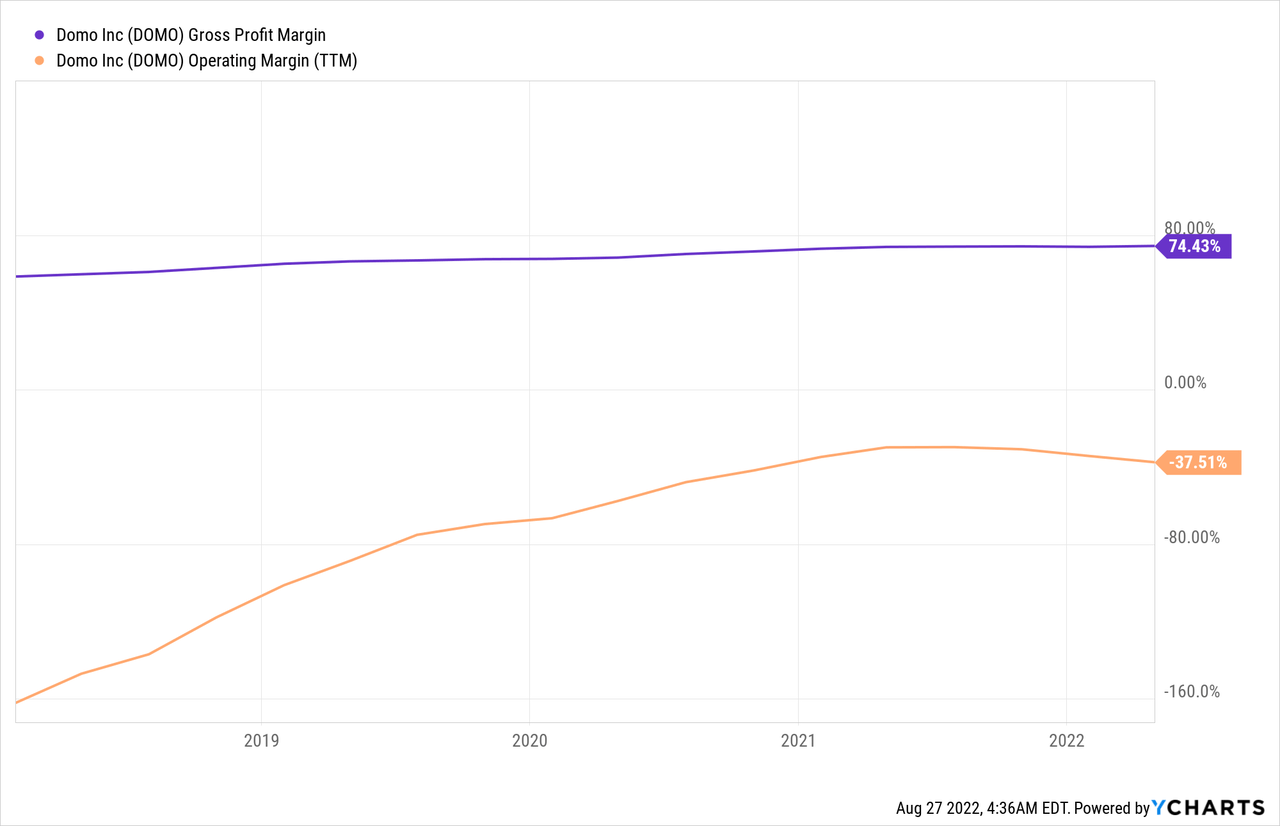

As a software company, Domo has a super high gross margin of 84% which was up 2% year over year.

The company generated a solid Earnings Per Share [EPS] of $0.26 (non-GAAP) which beat analyst expectations by $0.21.

Domo saw its operating expenses increase by 27% year over year from ~$65 million to $83 million. This was driven primarily by a discretionary $10 million in Sales and Marketing expenses as the company invests for growth. The key factor I will be looking for moving forward will be some operating leverage in the Sales and Marketing expenses. For example, I will be looking for sales to grow at a much faster rate than costs, which would ensure sustainable growth long term.

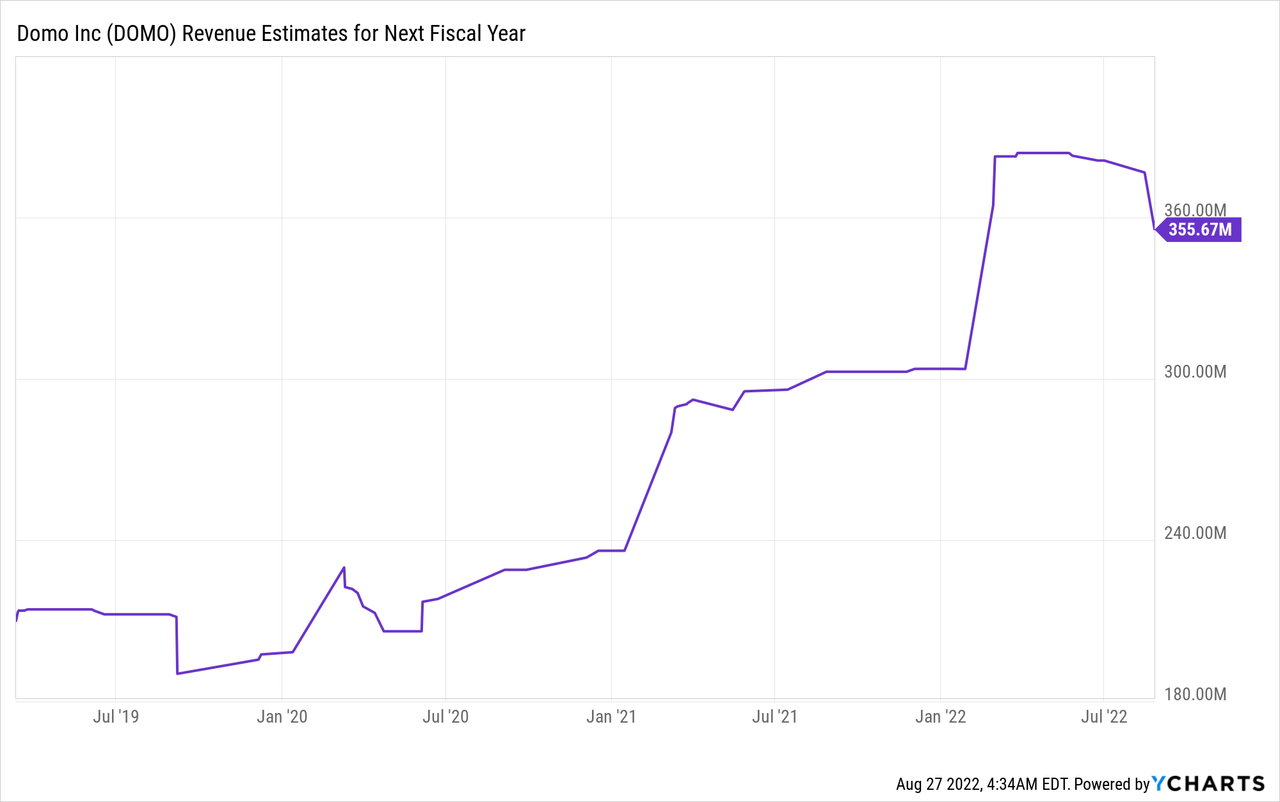

Moving forward, management is guiding for Revenue of $305 million to $310 million which would represent an increase of up 20% for full year Fiscal 2023, which is aligned with prior growth rates. Net loss per share [Non-GAAP] is also expected to continue to narrow to between $0.23 and $0.27 for Q3, FY23. However, guidance was lower than what analysts were hoping for.

Domo has a solid balance sheet with cash, cash equivalents of $79.9 million and long-term debt of $106 million.

Advanced Valuation

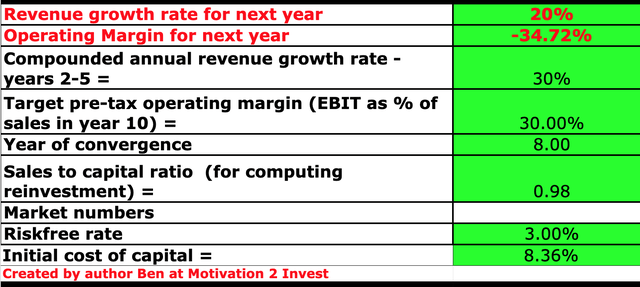

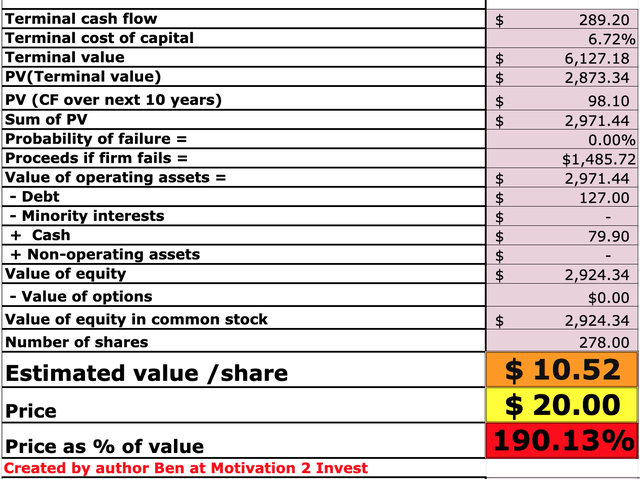

In order to value Domo, I have plugged the latest financial data into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 20% revenue growth next year and optimistically forecasted this to accelerate to a 30% growth rate for the next 2 to 5 years due to the growing big data market.

Domo stock valuation (created by author Ben at Motivation 2 Invest)

I have forecasted the company to benefit from high operating leverage long term, driven by low fixed costs and improving marketing efficiency. With a 30% operating margin forecasted in the next 8 years, which again is optimistic.

Domo Stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $10/share, the stock is currently trading at $20/share and thus is at least 90% overvalued at the time of writing. Therefore, even though the stock price has crashed by over 27% in a day, it could still fall further.

As a positive data point, the Domo is trading at a Price to Sales ratio = 3.43 which is ~35% cheaper than its 5-year average.

Risks

High Valuation

As mentioned above, the main risk for this company is its high intrinsic valuation.

Recession

Many analysts are forecasting a recession, which could cause a temporary slowdown in new software spending. This may negatively impact growth rates for Domo to less than 20%, which would make the stock even more overvalued.

Final Thoughts

Domo has a tremendous market opportunity to help businesses visualise their big data in a custom app-based way. The company is growing at a solid 20% clip and has surpassed earnings estimates. However, intrinsically the stock is overvalued, and thus one may wish to “Hold”. However, its elite customer base is a strong positive and thus a position on one’s watch list with a buy point lower than my intrinsic value number below $10 could also be an option, as the stock price could continue to fall an opportunity may open up.

Be the first to comment