Sundry Photography

MongoDB, Inc. (NASDAQ:MDB) is a leading NoSQL software provider for the fast-growing $16.9 billion Database-as-a-Service industry. MDB’s YTD performance is -69%. Trading at less than $151, MDB trades far below its 52-week high of $570.58. I opine that MongoDB is not yet a bottom-fishing buy opportunity. It has more downside potential. Do not average down or go long on MDB. Wait for other people to kick it down further.

MDB is still a falling knife that you should not try to catch. The Relative Strength Index indicator is bearish for MDB. Its RSI score is now 40.31. This is way below the neutral score of 50. The Exponential Moving Average indicator remains bearish for MongoDB’s stock. MDB’s last closing price was $150.77. This is lower than the 5-day EMA of 153.80. The 5-day EMA is lower than the 13-day EMA of 159.99. These most recent EMA numbers are lower than the 20-day EMA of 164.63.

The estimated annual EPS for the fiscal year ending in January 2023 is -$0.31. MongoDB’s consistent annual net losses are not going to attract bulls who could boost MDB’s price.

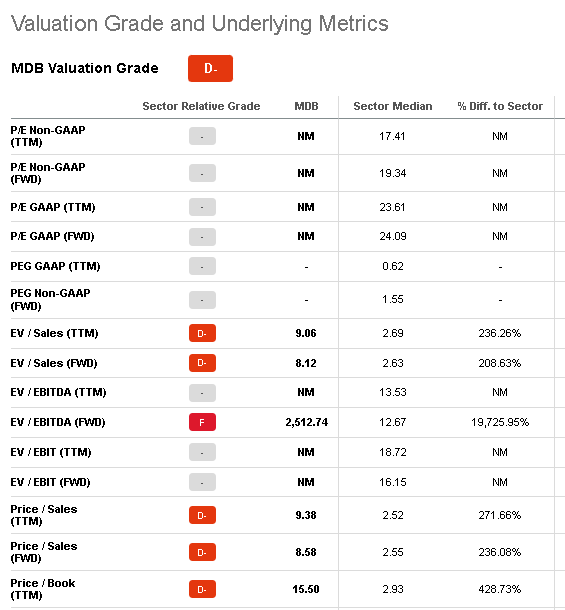

Unprofitable And Overvalued

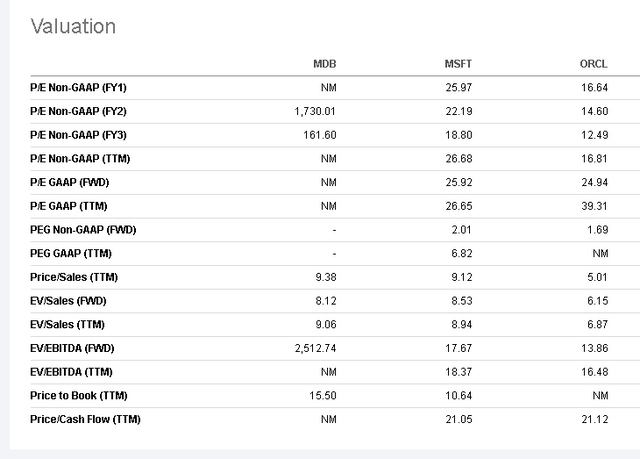

Sad but true, the massive YTD decline has not erased MongoDB’s relative overvaluation. The chart below is partly why Seeking Alpha Quant has a Sell rating for MDB. Relative to the Information Technology sector, MDB’s 9.38x Price/Sales ratio is 271.66% higher than the sector average of 2.52x.

Seeking Alpha Premium

The persisting relative overvaluation of MongoDB is even more problematic when you couple it with the fact that MongoDB has never been profitable. MDB released the first version of its MongoDB NoSQL software product 13 years ago. My expectation was that an enterprise-grade database software company would have been profitable many years ago. It is not prudent to give an unprofitable software company a forward Price/Sales valuation of 8.58x.

MDB is not a growth-at-a-reasonable-price stock when it trades at 9.38x TTM P/S ratio. Yes, it is very impressive that MongoDB touts a 5-year average revenue CAGR of 53.92%. The forward revenue CAGR is now only 37.77%. These high double-digit revenue growth rates did not make MongoDB a profitable venture. I opine it is a bit quixotic to grow annual sales by more than 50% every year and remain a loss-making company.

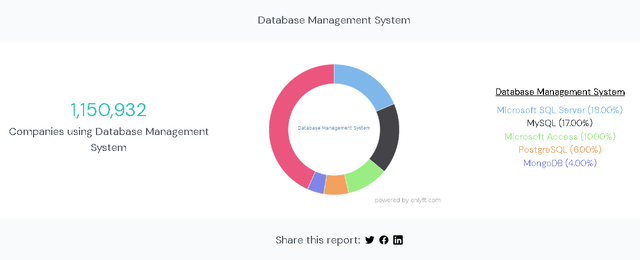

High Revenue Growth Rate, Still Low Market Share

The past 54% average annual sales growth rate has not translated into a substantial market share gain. After 13 years, Enlyft says MongoDB’s market share is a measly 4%. Microsoft’s (MSFT) Access and SQL Server (18.15%) still enjoy a significant lead over MongoDB. The old Microsoft SQL Server 2008 has a market share of 4.6%. Enlyft’s sample size is more than 1.15 million companies. As per its own company website, more than 35,000 customers are using MongoDB.

Upside Potential

The overall (SQL, NoSQL, on-site and Database-as-a-Service) global database business had a market size of $85.37 billion in 2020. It had a CAGR of 10.2%. MongoDB therefore has enough growth potential. Its TTM annual revenue is only $1.082 billion.

A lower 20% to 30% sales growth rate is preferable if it leads to better profitability. My fearless forecast is that MDB could climb higher than $180 if the company reports four succeeding consecutive quarters with a positive GAAP EPS. Management must prove that MongoDB’s NoSQL core business is not going to be a loss-making effort for another five years.

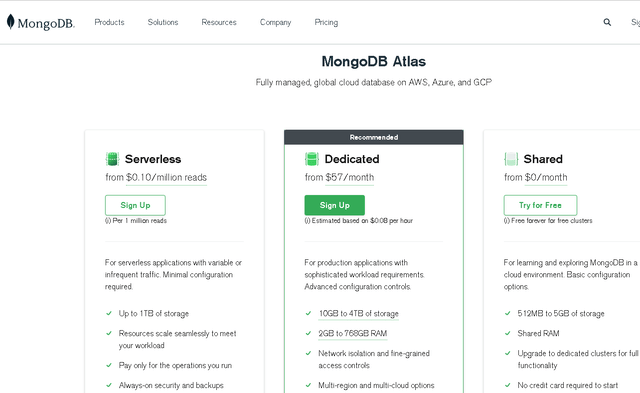

Raising itself above net losses is a straightforward way to regain the trust of investors. This could be achieved by increasing the pricing for MongoDB Atlas. I repeat, growing sales at 50% per annum is commendable. Unfortunately, focusing so much on increasing the topline is mismanagement if it doesn’t lead to profitability.

Perhaps a 10% to 15% increase in pricing might produce a net profit next year. MDB could shoot up higher if it starts reporting positive GAAP EPS for the next quarters. It is better to lose potential customers due to higher pricing rather than further aggravate the TTM net loss of $361 million.

The urgent need to be profitable is obvious. The total cash position of MongoDB is only $1.8 billion. The total debt load is $1.24 billion and its TTM net operating cash flow is -$16.58 million. That $1.8 billion cash will probably get depleted fast if MongoDB keeps losing $350 million or more per year.

The road to profitability as a NoSQL Database-as-a-Service operator is not going to be easy. MongoDB has serious rivals in this niche market. MongoDB has a giant NoSQL rival in Amazon’s (AMZN) DynamoDB.

My Verdict

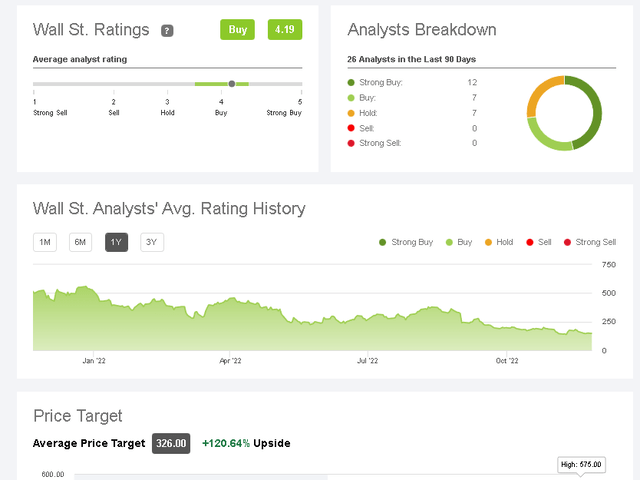

This is just my opinion. Exercise your own critical thinking. You can hold on to your positions on MongoDB. I cannot rate it as a buy right now. Seeking Alpha Quant has a sell rating for MDB, and technical indicators are bearish. You can ignore the warning in this article. You can heed Wall Street’s buy rating for MongoDB. Twelve of those highly paid analysts endorsed MDB as a strong buy. Wall Street analysts have an average price target of $326 for MDB.

The core purpose of Seeking Alpha authors and Seeking Alpha Quant is to allow investors to rely less on Wall Street analysts. MDB is a persistent money-long enterprise competing against a behemoth like Microsoft. A TTM P/S ratio of 9.58x disqualified MDB as a GARP stock. If you like the database software industry, avoid MDB and buy more MSFT. Microsoft is highly profitable and has a lower P/B, P/S, and EV/EBITDA ratios than MongoDB. Please refer to the chart below. Even Oracle (ORCL) is a better-value database industry investment than MDB.

The significant relative overvaluation of MongoDB, Inc. makes it vulnerable to activist/investigative short-sellers like Muddy Waters Research. I hope this essay does not encourage any short-seller to start attacking MongoDB. I’m now an inactive WordPress + MySQL (MariaDB) + PHP web developer. I admit that MongoDB’s survival is an essential counter to Microsoft’s dominant position in database software solutions.

Be the first to comment