smirart/iStock via Getty Images

Armanino Foods of Distinction (OTCPK:AMNF) has survived the pandemic and the company’s financial stability is as strong as ever. It is growing, regularly breaking records in sales and earnings. The price is reasonable by different metrics, and offers a 3% dividend as well.

Armanino lays claim to being the “original pesto” and introducing the sauce to the United States more than 50 years ago. At least six varieties of pesto can be found on the company’s foodservice site. The company also offers a variety of other sauces including alfredo, bolognese, chimichurri, garlic, and harissa. In addition to sauces, the company produces cannelloni, ravioli, manicotti, and other pastas. Packaged meatballs are found on the company’s home site, as are grated cheeses.

2020 was a difficult year for Armanino. Both sales and earnings dropped, and the company cut its dividend. The stock price swirled down the drain, but then the company began to recover. By late 2021, Armanino was announcing that it was breaking records. The recovery can be seen in the headlines of the press releases over the past two years:

- October 19, 2020: The company reports net sales and earnings for the third quarter, reversing second quarter loss.

- February 22, 2021: Earnings continue to grow.

- April 23, 2021: Earnings grow above pandemic levels.

- October 25, 2021: Armanino reports highest quarterly sales ever, and record-breaking year-to-date net sales for the third quarter.

- March 10, 2022: The company reports highest quarterly and annual net sales ever.

- July 18, 2022: The company reports highest ever quarterly and first half sales and profits.

- October 14, 2022: The company reports highest ever sales for third quarter, and the highest ever sales and profits for the nine months ended September 30, 2022.

Armanino Results by the Numbers

The headlines are great, but is Armanino really doing that well? The company is a microcap that trades over the counter, the result of voluntarily delisting itself in 2005. As such, filings are not available for the company, and the numbers are hard to find after 2019. It was almost as if the company was not willing to be open about its difficulties during the pandemic.

The company does in fact post its financials after 2019 at OTC Markets, which is reassuring. But the data extends only back to 2018, and only to the quarter ending June 30th. Data for the most recent quarter ending in September can be found only in its third quarter press release. With the data scattered in three different locations, it is not easy to see long-term trends.

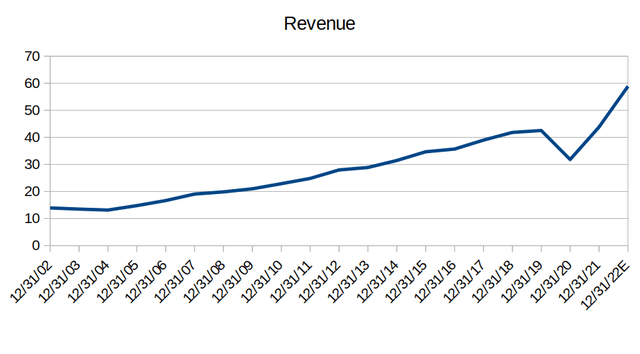

I compiled the data together from the different sources to resolve the problem. For 2022, I took results from the nine months ending in September and annualized it to get an estimate of earnings for the year. I was pleased with what I found. Revenues have not only recovered from 2020, the growth has accelerated.

Source: Author chart with data compiled from TIKR.com, OTCMarkets.com, and Armanino Foods’ third quarter press release.

The CAGR for revenue from 2002 to 2017 is 6.8%. The estimated CAGR for 2002 to 2022 is 7.5%.

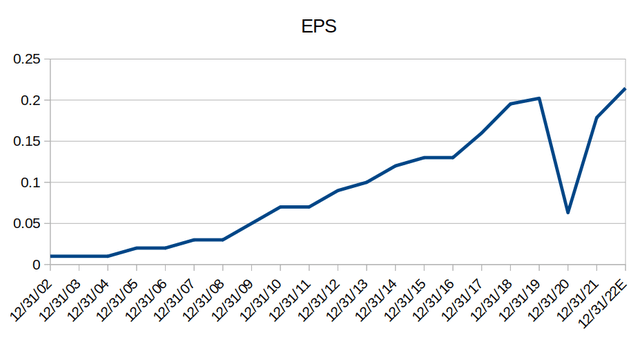

The picture is similar for earnings.

Source: Author chart with data compiled from TIKR.com, OTCMarkets.com, and Armanino Foods’ third quarter press release.

The CAGR for earnings from 2002 to 2017 is 19.4%, and the estimated CAGR for 2002 to 2022 is 16.4%.

These numbers indicate that management has done an outstanding job with steering the company out of the pandemic. This includes the new CEO, Tim Anderson, and the relatively new board members Jim Gillis and Albert Banisch.

Takeover Potential

I wrote in my last article may that I did not consider Armanino to be a takeover target. I am revising that opinion for several reasons.

First, an investor with a significant percentage of shares in the company commented on my article, saying that another company acquiring Armanino would be a happy outcome.

Not long after that, I learned that junior gold miners with little or no debt are good candidates for acquisition. Armanino is similarly small enough to be acquired by a bigger company, and it is essentially debt free. The company did pick up some long-term debt for the first time in years, and that is curious, but the amount is only a fraction of its cash and equivalents.

Finally, my other favorite OTC stock, Computer Services (OTCQX:CSVI) has been recently acquired. Computer Services had a relatively long history, sporting 50 years of dividend increases. Its financials were so solid that it was one of the few stocks that I did not keep an eye on. Armanino is similar in size and financial stability to Computer Services. If Computer Services can be acquired, so can Armanino.

So how much is Armanino worth it a takeover bid? Giesbers Investment Strategy took on that question in their article covering the company. They wrote:

In case of a takeover, the possible premium is an interesting aspect to consider. Some sources say that about 20% above the current share price is usual in the food industry. But a takeover premium is very difficult to predict.

Giesbers nevertheless made the attempt, and came away with a premium of roughly 30%, based on estimates of 2022 growth. This “optimistic” estimate was at an annual growth rate of 10%. It is reasonable to say the company has exceeded that growth rate. So a conservative estimate for a possible premium is between 20%, the apparent norm for the food industry, and Giesbers’ estimate of 30%.

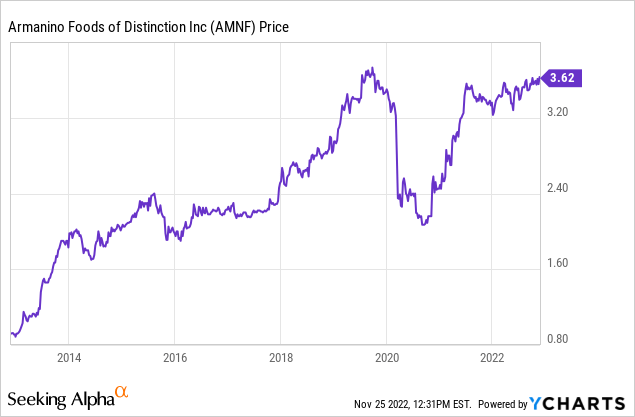

However, Giesbers wrote their article in September of 2021, when the stock price was at near multi-year lows. That was the ideal time to acquire the company. The stock price has since risen by more than 50%, and is now approaching the all-time high set in 2019. A 20-30% premium would exceed the current, all-time high price per share.

This is in contrast to Computer Services. I got a 50% premium for that company’s stock, and even then the price was still below all-time high records. It is possible that the current share price of Armanino will inhibit its acquisition.

But Is the Price Good for the Rest of Us?

Takeover speculation aside, is the company valued well for current investors?

Taking the long-term earnings CAGR of 16.4, as shown above, I calculate the current PEG Ratio to be at 1.05. This is a good number, but the Ratio can swing substantially if the growth rate is figured differently. So this number is not conclusive, but instead a data point to consider together with other factors.

I myself prefer an old tool from the value hunters’ toolbox called Net Current Asset Value Per Share, or NCAVPS, often referred to as “NCAV” for short. The formula is:

- Current Assets – (Total Liabilities + Preferred Stock) / Shares Outstanding

The inventor of the ratio, Benjamin Graham, wanted to have a stock price no more than 67% of the NCAV per share. A stock that meets that criteria is known as a net-net stock.

I have very rarely seen the Ratio of good, quality, growing companies paying a dividend fall below 2.0, and never below 1.0. When the Ratio does fall below 2.0, it usually means that there is some systemic problem lurking below the surface of the numbers. I have further seen over the years that a sweet spot for such quality stocks has a Ratio between 2 and 10. The NCAVPS for Armanino is currently at 6.2, a very nice number. I buy shares as often as not at that number.

At the end of 2018, Armanino shares had a P/E of 15.1. At the end of 2019, the P/E was 17.2. Using the trailing twelve months’ earnings, and the current stock price of $3.47, I figure the current P/E is 18.2. Given projected growth rates, this appears to be a reasonable price.

Investment Risks

Risk factors are essentially the same as they have always been. Armanino is not exactly the only manufacturer of pesto and pasta. The company has many competitors, some of them much larger.

A common complaint is the limited number of distributors. Armanino bulls have maintained for years that the company has had a relationship with these distributors, so this is not an issue.

The company makes up for its lack of size by good, sound management, but size is still an issue. The company remains overlooked because it is so small.

The company has traditionally taken the initiative to provide investors with information, but the location of that information is not easy to find anymore, and it is very easy to overlook. The company does not hold calls, nor do they give guidance. No analysts are known to cover the company.

Some have said that the company will struggle to grow beyond its current distribution area. This indeed could become a problem, but so far it has not been an issue.

Conclusion

Armanino has survived the pandemic and continues to grow. The company’s financial stability is as strong as ever. The stock is at a reasonable price and is a buy at $3.47, a dip, below $3.50. The quality of the company is enough for me to rank the stock a strong buy.

Be the first to comment