Michael Vi

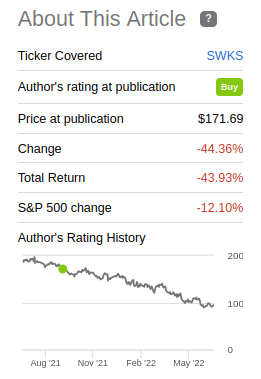

We have been very wrong with respect to Skyworks (NASDAQ:SWKS), despite the company performing relatively well fundamentally, it has been severely punished together with other growth stocks, despite it having a much more reasonable valuation to start with. Since our last article, shares are down ~44%, while the market has gone down only ~12%.

Seeking Alpha

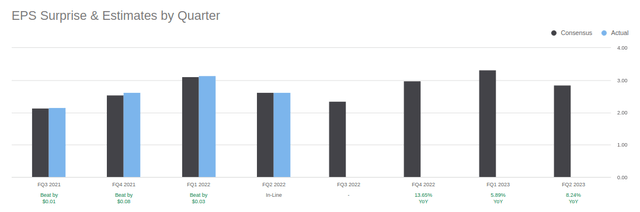

Of the last four quarters, Skyworks beat earnings estimates for three of them, and reported inline earnings for the last one. This was despite some headwinds it experienced from the recent lockdowns in China. Guidance for the next quarter was not great, but expectations are that earnings should recover in the next 2-3 quarters. Despite some minor issues, we believe the company is doing well operationally, and therefore believe that shares have become a bargain. We are changing our rating to ‘Strong Buy’ now.

Skyworks is one of only a few firms that has the necessary scale and know-how to supply millions of RF devices per year to mobile companies. While this should make it harder for entrants to gain this level of know-how and scale, the industry is attractive enough to attract competition, so the industry should be monitored for possible increased competitive pressures. One issue that Skyworks and its peers have is that they serve a very concentrated customer base, where this giant mobile phone manufacturers can and do put pricing pressure on Skyworks and its competitors such as Qualcomm (QCOM) and Qorvo (QRVO).

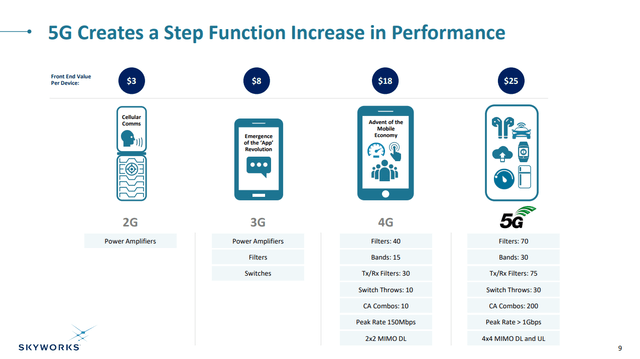

We still consider Skyworks our favorite 5G investment idea, now more so given the much more attractive valuation. Skyworks makes most of its revenue from chips that go into mobile devices, such as switches, filters, amplifiers, radios, etc. Given the technical complexities that arise from 5G, the amount of Skyworks’ content necessary in a phone is significantly more compared to 3G and 4G. Since 5G is only in the initial phases of roll-out, we believe this will continue to be a powerful tailwind for the company.

Financials

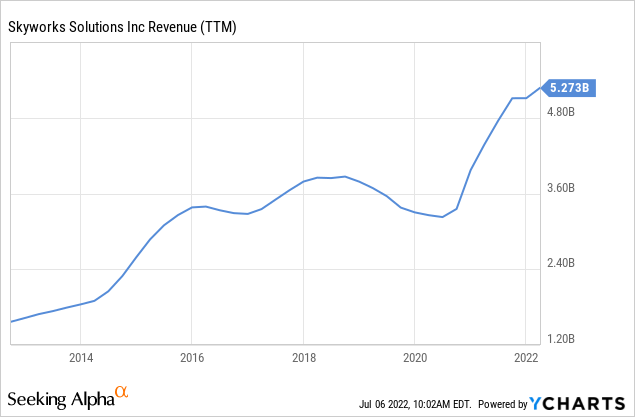

In contrast to the declining share price, revenue has been significantly increasing, and has now reached a trailing twelve months record of $5.2 billion.

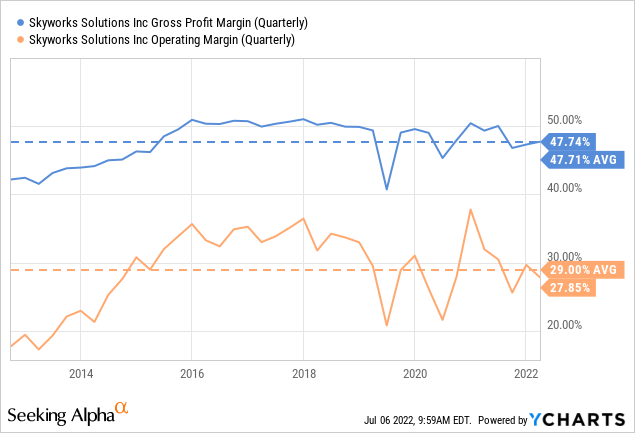

What has been a little bit disappointing perhaps is that this record revenue has come with slightly weakened margins. While margins are only slightly lower, this is probably a reflection of increased competitive pressures, and pricing demands from customers.

Growth

We are still very optimistic about Skyworks’ growth prospects given a number of tailwinds the company is benefiting from. As already mentioned, the amount of content per mobile phone increases significantly with 5G, from ~$18 per phone for 4G to $25 for 5G.

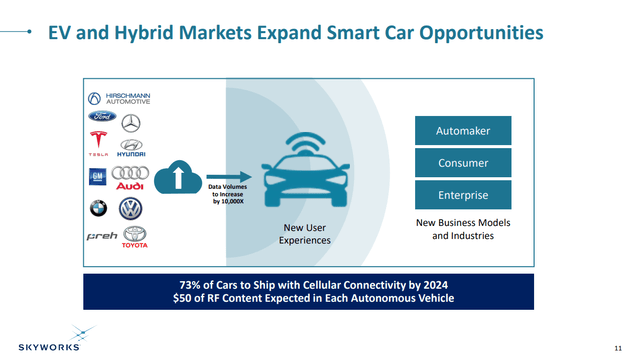

Skyworks Investor Presentation

Then there is the growth in other attractive markets where the company operates, including IoT and Automotive. The company believes that by 2024 ~73% of cars will ship with cellular connectivity.

Skyworks Investor Presentation

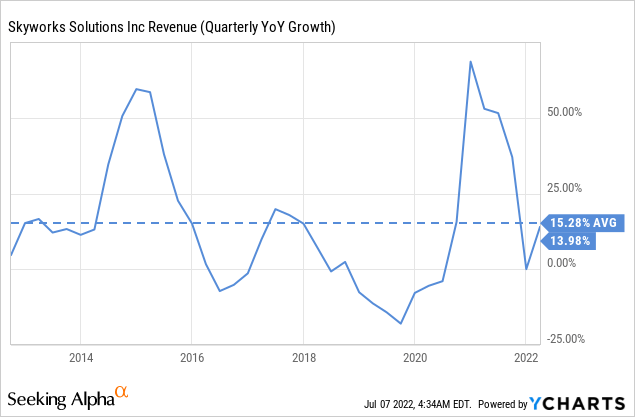

For the last decade Skyworks has been growing at ~15% per year, even if that growth has been uneven, and given the number of tailwinds the company has, we would be surprised if it did not match that growth rate for the next 5-10 years.

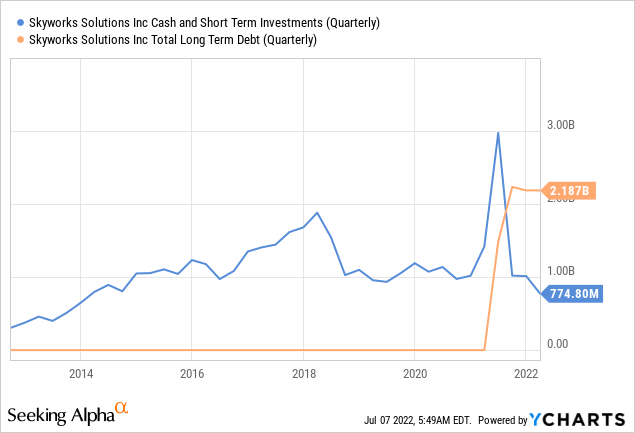

Balance Sheet

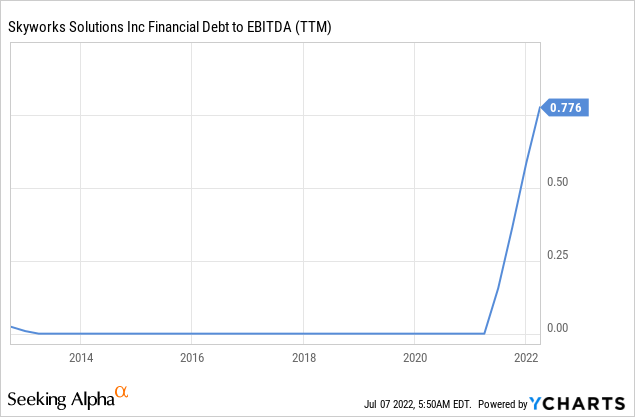

Skyworks used to have a very clean balance sheet with no debt, but after it purchased the Infrastructure & Automotive Business from Silicon Labs for $2.75 billion in cash it had to issue some long-term debt. The company currently has ~$774 million in cash and short-term investments, and about $2.1 billion in total long-term debt.

Still, the company is far from over-leveraged, with a debt/EBITDA ratio of less than one. While not as rock solid as before, this is still a very strong balance sheet.

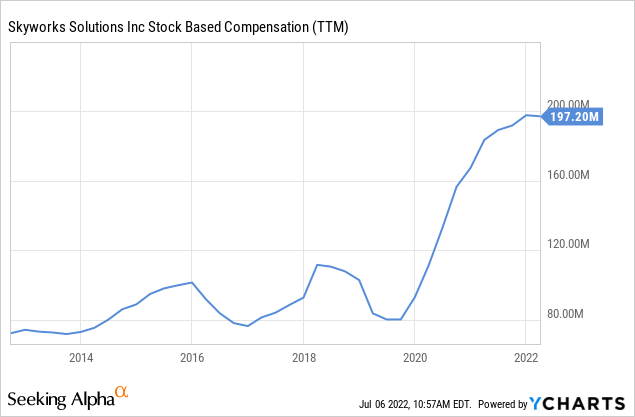

Stock-Based Compensation

One area where Skyworks has disappointed us is in the sharp increase in stock-based compensation, which has more than doubled in about two years. While we are all in favor of using some reasonable amount of stock-based compensation to align the interests of employees and shareholders, we dislike when it becomes excessive, especially when companies try to ignore the expense by high-lighting Non-GAAP earnings.

SWKS Valuation

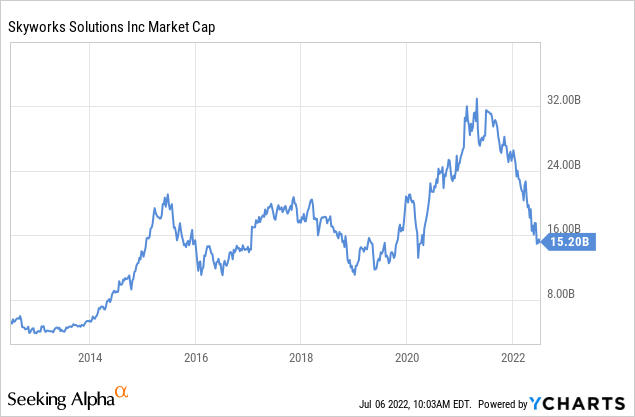

Still, despite the increasing competitive pressures and the high-levels of stock-based compensation, we believe Skyworks has become too cheap. Its market cap currently is ~$15billion, which is about 3x its annual revenue, and this is a company with very high profit margins and growth.

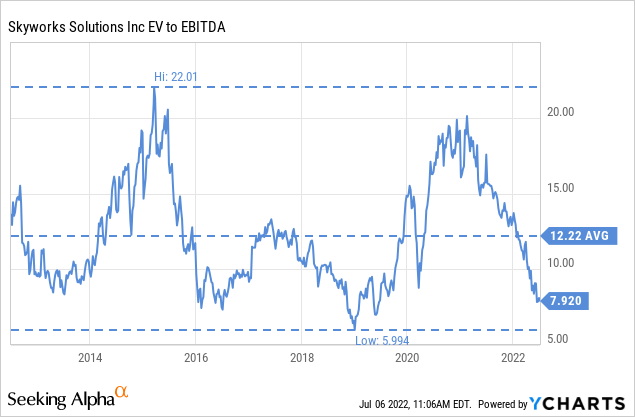

The EV/EBITDA is currently significantly below its ten-year average at ~7.9x, compared to a ten-year average of ~12.22x.

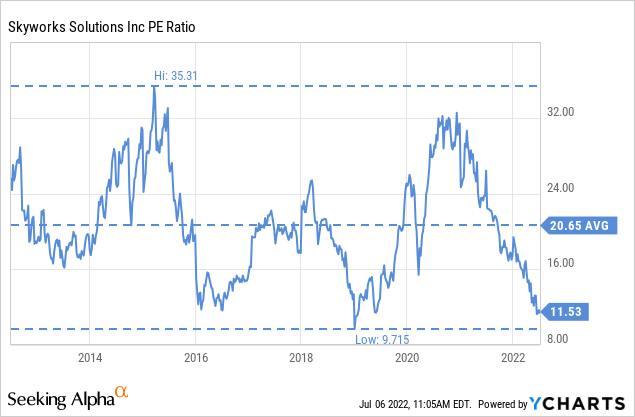

Similarly, the price earnings ratio is almost half of the ten-year average, at ~11.5x compared to a ten-year average of 20.65x. We believe a 20x p/e multiple is reasonable for a company with Skyworks’ growth and financials, and therefore believe the company to be almost 50% undervalued. Returning to a 20x multiple with current earnings would mean a share price of ~$170, which we believe is closer to the real intrinsic value of the shares.

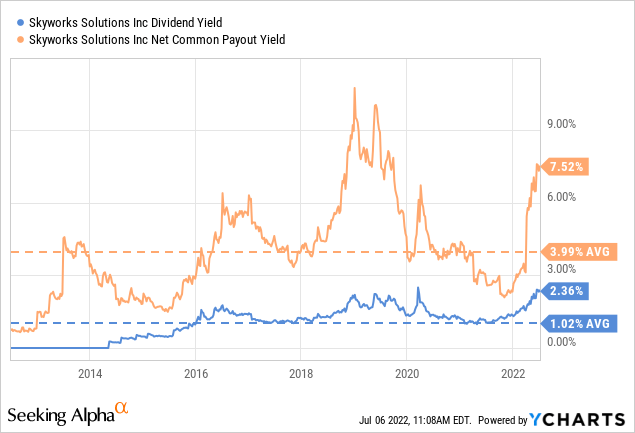

At least the company appears to recognize shares are significantly undervalued, and has been ramping up buybacks, as can be seen with the increased net common payout yield. Both the dividend yield and the net common payout yield are considerably higher than their ten-year averages.

Risks

There are several important risks to consider before investing in Skyworks, including the high customer concentration with Apple (~59% of fiscal year 2021 revenue). This puts Apple in a strong position to demand price concessions. Still, we believe both companies need each other, and are likely to continue working together going forward. Another risk is technology risk, if a Skyworks competitors figured out how to manufacture better devices for a reduced price, it could take market share away from Skyworks.

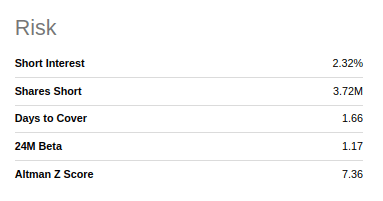

On a positive note, Skyworks is increasingly diversifying to other markets beyond mobile phones, including automotive and IoT. Another positive is that the balance sheet remains quite strong, and the company has a solid 7.36 Altman Z-score. The short interest in the shares also remains quite small.

Seeking Alpha

Conclusion

We believe shares of Skyworks have been unfairly punished along with other growth stocks that were trading at very high valuations. This has left Skyworks with a very attractive valuation, and we are changing our rating from ‘Buy’ to ‘Strong Buy’, since we do not see any major fundamental reason for the decline. Shares are trading at about half of what we consider the intrinsic value to be, therefore having the potential to double quite quickly if they return to close to its ten-year price/earnings multiple average.

Be the first to comment