Vertigo3d/E+ via Getty Images

Investment Thesis

The Trade Desk (NASDAQ:TTD) has not seen its share price react in the past few months, despite having to navigate a lot of cross currents.

Not only has there been Snap (SNAP) downgrading its own guidance, which is arguably a sign of things to come, but more broadly, we are all now aware of the slowing economic environment and higher inflation.

Even though The Trade Desk has a lot of secular tailwinds, I’m not sure it will navigate this period unscathed. What’s more, as I discuss in the analysis that follows, consensus estimates have not come down in the past several months.

Consequently, given all this context, I am now neutral on this stock.

Why I Changed My Mind, Yet Again

I know that a lot of people will call me inconsistent. And if the fact that I’ve changed my mind, yet again, on The Trade Desk doesn’t sit well with you, then I apologize.

However, so much has happened since my last bullish article on The Trade Desk, even though the share price has barely moved.

Author’s coverage

From my perspective, it feels like there’s been a huge shift in the ad tech space, but somehow The Trade Desk has been unaffected.

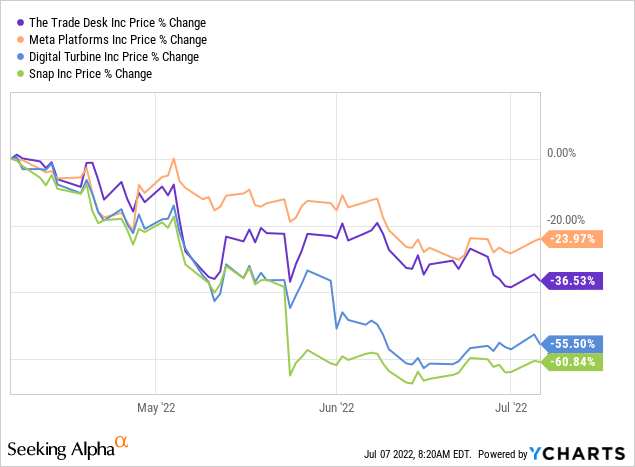

Meta (META) is down 24% in 3 months. However, keep in mind that Meta is one of the biggest companies in the world. While I have a lot of respect for The Trade Desk, it isn’t quite in the same league as Meta.

Two closer comparisons to The Trade Desk could include Digital Turbine (APPS) and Snap. And both of these companies have massively re-rated in the past several months.

And we know that the news that Netflix (NFLX) is now planning to have ads on its lower-tier packages has gone some way to support the stock. However, I’m not convinced that Netflix’s decision to have ads running through its platform is enough to bolster The Trade Desk.

Or better put, Netflix isn’t going to meaningfully move the needle on The Trade Desk’s investment case.

Why the News of Netflix is Over Discounted

In the first instance, Netflix simply doesn’t have enough free cash flow to go around to meaningfully deploy capital to The Trade Desk in a manner that would change the needle at The Trade Desk.

Also, perhaps most importantly, Netflix doesn’t want to give The Trade Desk too much power at the negotiation table. What Netflix has reported on is its eagerness to partner with a supply-side platform, such as Magnite (MGNI).

As a reminder, The Trade Desk is a demand-side platform that brands use to get their advertising out on a digital asset.

In return, The Trade Desk allows brands to use its self-serving platform to measure the impact of those ads and the ability to iterate those ads. This provides ads with very high ROI and The Trade Desk charges handsomely for this service.

That’s different from what Netflix seeks to do. Netflix wants to partner up with supply-side providers, which gives Netflix control over what surfaces ads get played on.

It’s very quite different. It’s not that The Trade Desk and Netflix are rivals. But they are both going to be competing for the same market. Namely, giving brands control over ads. But Netflix itself wants to be able to monetize those ads.

Does that mean that there is no chance that Netflix partners up with The Trade Desk? Admittedly, there’s always a possibility, but it’s not probable.

Netflix openly states that it will look to build and iterate the product. There’s very little upside to Netflix giving up the revenue stream that comes from being an advertising platform.

Particularly at a time when Netflix is notably struggling to impress investors with its attractive unit economics.

TTD Stock Valuation – 32x EBITDA?

By my estimates, The Trade Desk could reach $650 million of EBITDA. For this, I assumed that H1 2021 will report $250 million of EBITDA.

Here’s the math. Q1 2022 reported $121 million. And Q2 is pointing to $121 million also. That means $242 million for H1 2022, rounded up to $250 million given that management is likely to be lowballing estimates.

Furthermore, I recognize that digital ad tech stocks are back half-weighted.

Now, here’s my question, could the Trade Desk grow its EBITDA by 30% y/y in H2 2022 compared with the same period a year ago?

Here’s my thought process. For H2 2021, The Trade Desk reported $315 million ($123 million +192 million). If The Trade Desk grew in the second half by 30%, that would mean its EBITDA reaches $410 million in the second half.

This puts The Trade Desk at about $650 million for 2022. And the stock is now priced at 32x this year’s EBITDA.

Is that fairly priced?

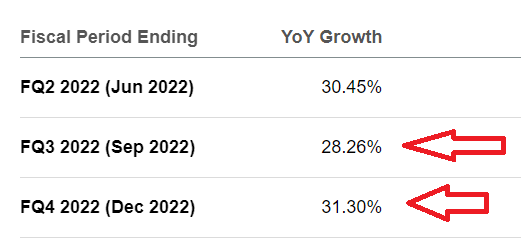

TTD revenue estimates

As you can see above, for now, analysts following The Trade Desk continue to believe that it could indeed continue growing at a 30% CAGR throughout 2022.

Not only do these estimates appear high, but they don’t appear to have been downwards revised at all for everything that’s happening in the background.

The Bottom Line

This analysis has a lot of question marks. That’s because I have a lot of uncertainty. I was very much bullish on The Trade Desk back in May.

But we have seen so many aspects surface in the past several months that we simply had no visibility into at the time.

Perhaps, the biggest consideration that I’m weighing up is that there are countless stocks that have been hit to a pulp in the past twelve months. And given that stocks don’t trade in a vacuum why would the investors coming to the stock today, with fresh capital and open mind, given all the alternatives available, be willing to pay 32x this year’s EBITDA for The Trade Desk?

After all, let’s be honest, for The Trade Desk to grow its EBITDA by 30% y/y in the second half of the 2022, a lot of stars need to align.

In conclusion, I’m neutral on the stock.

Be the first to comment