Rouzes/iStock via Getty Images

Waste Management, Inc. (NYSE:WM) via its subsidiaries operates throughout the US and Canada and provides, you guessed it, waste management services. It has a large wingspan with residential, commercial, industrial and municipal communities being part of its service demographic. Its services range from collection to disposal, including recycling, and it owns a vast network of landfill sites and transfer stations to facilitate efficient and economical operations. WM is also a leading developer, operator and owner of landfill gas-to-energy facilities, which is also used to power its own fleet.

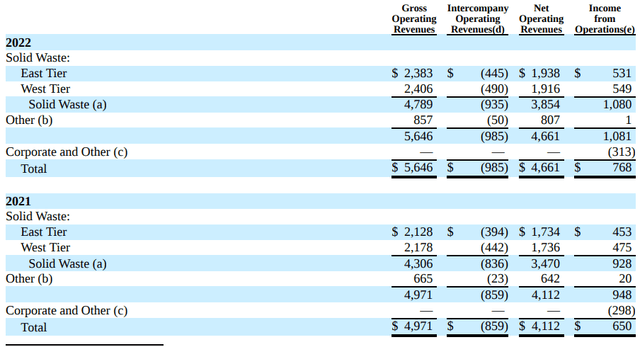

WM has primarily two business segments, Solid Waste and Other. The gas to energy operations are included in the latter, while the waste disposal activities of collection, landfill, transfer and recycling make up the former. The Other segment also includes adjunct lines of business that do not fall under the Solid Waste segment.

Q1-2022 10-Q

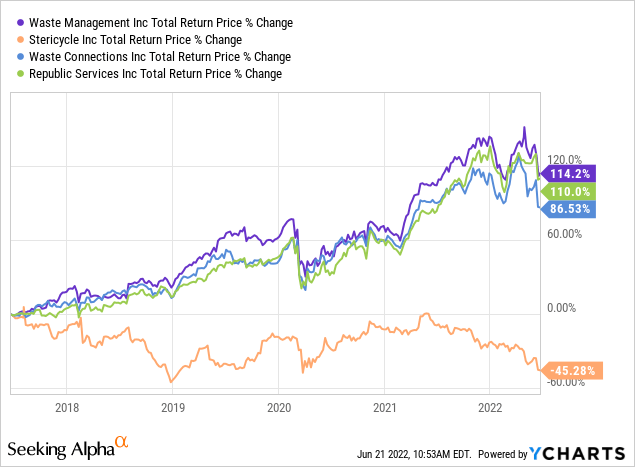

WM leads the pack in terms of price appreciation and dividend yield over the last few years.

Let’s dive into our favorite part, the numbers next, and reach a conclusion whether trash is cash as indicated by the charts.

Valuation

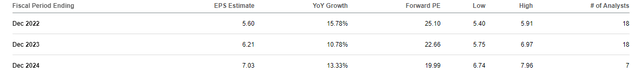

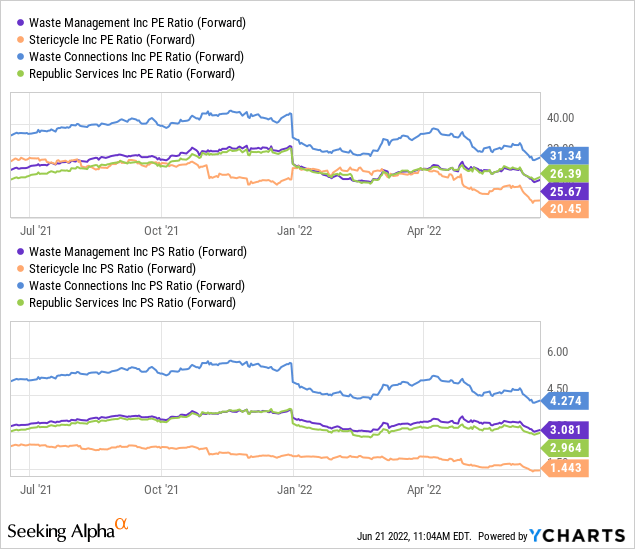

WM trades at about 23X 2023 earnings.

Seeking Alpha-WM

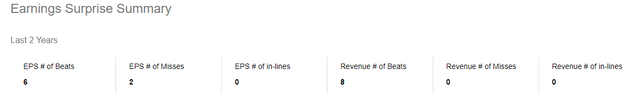

Historically, WM has a very high hit rate of beating or exceeding earnings estimates.

Seeking Alpha-WM

So we can reasonably count on these numbers in most economic climates. The multiple is about in the middle of the waste disposal group, and the same can be said about its prices to sales ratio. Waste Connections, Inc. (WCN) appears the most expensive on both metrics, while Stericycle, Inc. (SRCL) appears the cheapest.

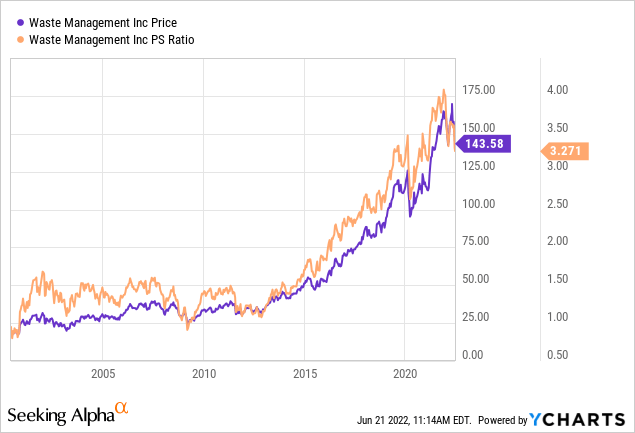

Looking out over the longer term though, we can see that the multiples have expanded, a lot, over this cycle.

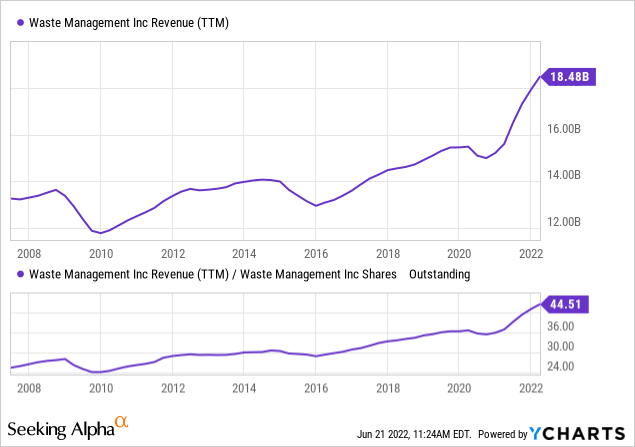

While investors were reluctant to pay anything over 1.5X sales back in the 2005-2015 phase, we have expanded that to over 3.0X sales. Some of this is well-deserved. WM has really shown great delivery and execution over the years. It has also been a great allocator of capital. At the same time, this is a very slow growing industry. WM’s revenues have merely increased 40% over the last 15 years. WM has been able to amplify this effect by share buybacks, and revenues per share have almost doubled.

Outlook

WM has great pricing power, and that has improved over the years as its size has become harder to compete with. It has swallowed up a few smaller players along the way, including the most recent acquisition of Advanced Disposal. The company plans to invest $825 million to strengthen its renewable natural gas component in the next few years. This is a big environmentally friendly move which is aimed at promoting sustainability. It includes fueling the entire natural gas fleet with renewable natural gas by 2026. WM also plans on adding 17 new facilities across the country and this is aimed at increasing renewable energy generated by about 700%!

On its core business, its size and scale, alongside access to the few remaining landfills in the country, make it a very strong candidate for high levels of return on capital. It has monopoly like moats built up around it and smaller players will not be able to penetrate this business, especially with rising environmental regulation. So we can see WM delivering revenue growth exceeding nominal GDP from here. It will also be a favorite for ESG funds as it is really playing well to that crowd.

Key challenges will come from inflation and energy costs. WM consumes a lot of manpower and while the company invests heavily in automation, it still has a lot of manual labor that it needs. Energy costs might become a tailwind down the line as WM focuses on generating renewable energy, but for now it remains front and center as an issue. Overall, the company is dealing with 9% inflation and that will be rough on margins.

Michael Hoffman

Okay. And then you shared with us last quarter your second half of the year, internal cost inflation kind of ran at 6% and 7%. What were we running in the first quarter?

Devina Rankin

It was closer to 9%.

Michael Hoffman

And is it coming down?

Devina Rankin

No. We think that this is effectively the peak, and we expect it to plateau and then as we discussed, we expect to see some moderation in the back half because we’ll lap the labor increases that we executed upon beginning in the third quarter of ’21.

Source: Q1-2022 Transcript

Verdict

WM is ideally suited for the push to higher ESG focus. There is nothing wrong that we can find with how it is conducting business or where it is dedicating its resources. We love the company, but the price and valuation are another matter. For a slow growing, low dividend paying, company, we just cannot pony up this multiple. It might work out, but the odds are high that we get at least a multiple contraction to 2.5X sales over time. We will keep it on our watch list, but for now, we rate it as neutral.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment