francescoch/iStock via Getty Images

Long-suffering MoneyLion (NYSE:ML) investors were treated to even more misery towards the end of September when common shares fell below the $1 price threshold required by the NYSE to remain listed. This marked a new milestone in the protracted collapse of the New York-based fintech company whose year-to-date chart now resembles that of a company hurtling towards the gates of bankruptcy.

But MoneyLion last reported revenues that grew by triple digits year-over-year with cash and equivalents that now represents nearly 58% of its market cap. To highlight just how steep the decline has been, MoneyLion went public last year at a pro forma valuation of $2.9 billion which now stands at around $267 million. This is a more than 90% decline in equity value. The company’s rallying cry to its customers “Here We Roar” now seemingly muffled by an unrelenting more than year-long risk-off trade. Bears would absolutely be right that MoneyLion is a minnow going up against traditional banks and dozens of private venture capital-funded neobanks some of whom went public last year too on the back of the now largely dead SPAC boom.

But at what point does the company become too oversold? Bulls thought that was at $4, then $2, and now shares briefly went below a point where their listing compliance would be threatened.

Financial services from mobile banking, cash advances, and automated investing delivered through digital native companies form a secular growth market as consumers continue to shift away from the brick-and-mortar orthodoxy. MoneyLion has positioned itself well to ride this wave with its suite of financial products and with its Even Financial subsidiary.

The Bulls Have It As Earnings Maintain Upward Ramp

MoneyLion last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $87.3 million, a 128.5% increase from the year-ago period and a beat of at least $3.96 million on consensus estimates. This came on the back of a 124% year-over-year growth in total customers to 4.9 million. Total products also grew to reach 10.4 million, a 75% increase over the year-ago quarter as loan originations, secured personal loans and cash advances, expanded sequentially by 8% to $439 million.

The company also has a dual consumer and enterprise revenue model with Even Financial. This saw its enterprise mix increase to 41% of total revenue from 31% in the first quarter. A gross margin of 36.5% meant gross profit came in at $31.9 million, up from $19.5 million in the year-ago quarter. The company’s operating costs are declining and management has reiterated guidance of breaking even on an adjusted EBITDA basis exiting 2022. Cash burn from operations during the quarter came in at a loss of $900,000 as MoneyLion prepares to also be operating cash flow positive.

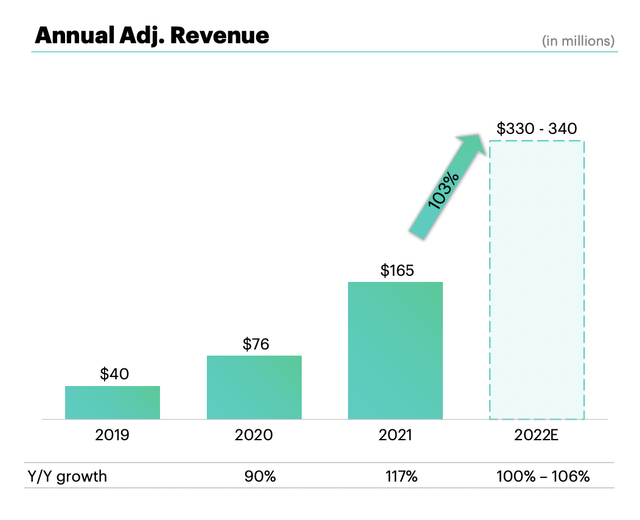

The unit economics are also attractive with a $9 CAC dwarfed by a $76 ARPU. Most of the company’s customers now have a 6 month payback period. This came against a quarter where MoneyLion realized record customer adds with lower marketing spending. For its full-year 2022, MoneyLion raised its revenue guidance to be between $330 million to $340 million. This will see a growth of at least 103% over fiscal 2021.

Against the low end of this guidance, MoneyLion currently has a 0.785x price to forward fiscal 2022 revenue multiple. Hence, the market is not just discounting historical growth, it’s also entirely discounting future growth which stands to be triple digits at its low end. This is as adjusted EBITDA profitability is set to be achieved in the next few quarters.

Common Shares Are Stranded Assets Until They Are Not

I own MoneyLion shares but it’s hard to recommend the stock as a buy now due to just how pertinent the market pullback has been. Such a monumental collapse is a far cry from the heyday of the SPAC boom when pre-revenue companies in fringe industries would trade at multi-billion dollar market caps. The pendulum has swung too far the other way and the risk-off trade is looking overdone. This will continue to be the biggest risk faced by MoneyLion shareholders and a reason why it’s hard to recommend shares as a buy. There is no floor and management will just have to deliver quarter after quarter until the market changes its tune.

MoneyLion has a bright future ahead. Indeed, the company was formed just five years after the 2008 global financial crisis created opportunities for new banks. MoneyLion fundamentally is now a tool for millions of Americans to manage their income and expenses as the economy goes through a period of intense weakness and general uncertainty.

I expect continued weakness even after third quarter earnings are released next month. For now, the market is dancing to the tune of a hawkish Fed and the financials that should matter in such a young and fast-growing company is being overlooked. The future of contemporary American banking is digital and MoneyLion will one day no longer be a stranded asset.

Be the first to comment