Khanchit Khirisutchalual

Elevator Pitch

I have a Buy investment rating for Envestnet, Inc.’s (NYSE:ENV) stock.

I highlighted the possibility of Envestnet becoming an acquisition target in the future with my prior April 18, 2022 update for ENV. My attention turns to Envestnet’s new Wealth Data platform and its upcoming third quarter earnings in my latest write-up.

Given that expectations are low despite the company’s excellent track record of earnings beats, I am of the view that there is a reasonably good chance of Envestnet announcing better-than-expected Q3 earnings next week. Separately, I expect ENV’s new Wealth Data platform to become a new revenue stream for the company, and allow the company to provide greater value to its clients. Taking into account the above-mentioned factors, I stick with a Buy rating for Envestnet.

Wealth Data Platform

Envestnet recently issued a media release on October 20, 2022 announcing that the company has introduced “the Wealth Data platform, a cloud-based data intelligence solution for wealth advisory firms” to the market.

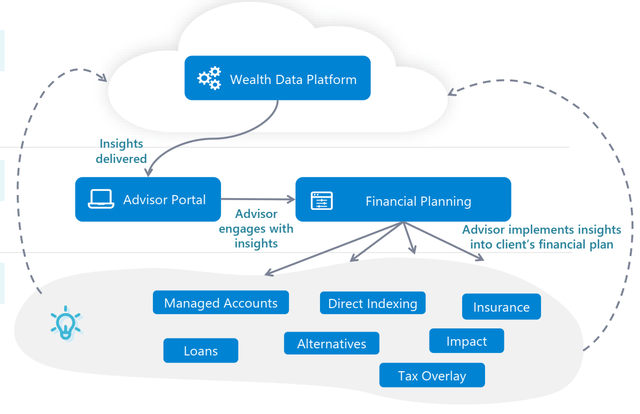

In the late-October press release, ENV emphasized that its Wealth Data platform will enable “home offices and financial advisors to connect and enrich all the data sources” in a single platform and “deliver better insights.” The chart presented below offers a graphical representation how Envestnet’s Wealth Data platform provides value to the company’s clients.

Envestnet’s Wealth Data Platform

ENV’s Q2 2022 Results Presentation Slides

There are a number of metrics and indicators which suggest that Envestnet’s new wealth data platform is very likely to be a success for the company.

At the company’s Q2 2022 investor briefing in early-August, ENV specifically mentioned that “inside the WDP (Wealth Data Platform), is the Envestnet Insights Engine.” In other words, ENV sees the Envestnet Insights Engine as a key component of its Wealth Data platform’s offerings. In another press release published on October 24, 2022, ENV defines the Envestnet Insights Engine as a “machine-learning based tool that supports the growth of client activities.” It is encouraging that the number of advisors who chose to adopt the Envestnet Insights Engine grew by +37% QoQ in Q2 2022, as per management’s comments at the most recent quarterly earnings call.

There are other signs implying that Envestnet’s Wealth Data platform is gaining greater acceptance. ENV revealed on October 27, 2022 that FNZ has entered into an agreement to “integrate and distribute Envestnet’s Wealth Data platform internationally.” It is worthy to note that FNZ is a wealth and asset management platform boasting approximately “$1.5 trillion in client assets” under administration as highlighted in its media releases.

Envestnet guided at its second quarter earnings briefing that it expects the Wealth Data platform to contribute yearly sales amounting to $35 million by 2025. This is equivalent to about 2% of its sell-side consensus revenue in that year as per S&P Capital IQ. In other words, the Wealth Data platform could possibly add approximately +200 basis points of revenue growth to Envestnet’s fiscal 2025 top line.

More significantly, there are synergies between the new Wealth Data platform and Envestnet’s existing businesses. Specifically, Envestnet noted at its most recent quarterly results briefing that its Wealth Data platform “drives increasing subscription and asset management revenue”, considering that “our clients are leaning more and more on us.” As Envestnet’s products and services (such as the Wealth Data platform) become more integrated with its clients’ workflows, customer stickiness will continue to grow and boost the revenues of the company as a whole.

In summary, I am positive on Envestnet’s new Wealth Data platform and its favorable impact on the company’s business outlook.

Q3 2022 Earnings Preview

Envestnet is scheduled to report the company’s Q3 2022 earnings next week on November 8, 2022 after trading hours.

I think that ENV has a decent chance of delivering above-expectations earnings next Tuesday, as the market’s expectations with regards to Envestnet’s upcoming third quarter financial performance are low.

Based on the Wall Street’s consensus financial forecasts sourced from S&P Capital IQ, analysts take the view that Envestnet’s top line will decrease by -5% QoQ from $318.9 million in the second quarter of 2022 to $302.6 million for Q3 2022. The sell-side also expects ENV’s normalized earnings per share or EPS to drop by -14% QoQ from $0.49 to $0.42 over the same period.

In the last three months, seven of the nine Wall Street analysts who have Envestnet within their coverage universe lowered their normalized Q3 2022 EPS estimates for the company. The third quarter consensus bottom line forecast for Envestnet was reduced significantly by -25% in the past three months.

Notably, Envestnet has an impressive track record of earnings beats, having delivered above-expectations EPS for the past 16 quarters. This implies that ENV’s management has historically been rather conservative in their forward-looking guidance. The current market consensus Q3 2022 normalized EPS of $0.42 for ENV is within the company’s third quarter bottom line guidance in the $0.40-$0.42 range.

Closing Thoughts

I continue to have a Buy rating assigned to Envestnet. In the near term, a Q3 2022 EPS beat could bring about a positive re-rating of ENV’s stock price and valuations. In the medium to long term, introducing more new products like the Wealth Data platform which creates more value for ENV’s customers is a step in the right direction.

Be the first to comment