ArtistGNDphotography/E+ via Getty Images

Investment Thesis

Enphase Energy (NASDAQ:ENPH) opens its earnings call with its NPS score of 70. This is a company that is evidently seriously focused on pleasing its customers. Any company that has its customers at the forefront of its value proposition is likely to be a long-term winner.

Furthermore, Enphase is showing through its guidance that it’s not going to be slowing down any time soon, as it guides for a very impressive Q4 2022.

In a time when many companies are now seeing their multiples compress, Enphase is being priced at north of 50x next year’s EPS.

That’s not a crippling valuation. But it’s far from the bargain basement, as I’m confident you’ll agree.

Q3 2022, What’s Happening?

Let’s get some context.

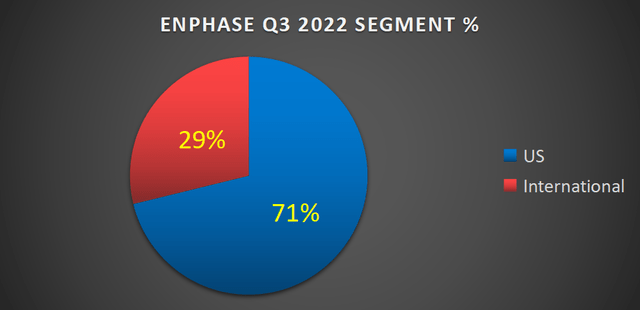

As you can see above, approximately 30% of Enphase’s revenues come from its International segment. Enphase’s International revenues were up 118% y/y, while US revenues were up 69% y/y.

Put another way, the crown jewel of Enphase is its International business. More specifically, it’s the European business where its growth opportunity has come from, as households seek alternative home energy solutions, given the widely reported energy crisis.

Accordingly, one negative consideration that now surfaces, is that throughout 2022, while Europe has suffered from an energy crisis, this saw unrivaled demand for alternative energy sources, which has been a huge win for Enphase Energy.

But looking ahead to 2023, given that Europe is likely to be facing an economic downturn, that means that a fair amount of discretionary household spend will be constricted. Hence, this means that there will be less available money for the installation of solar panel solutions.

Revenue Growth Rates Remain Very Strong

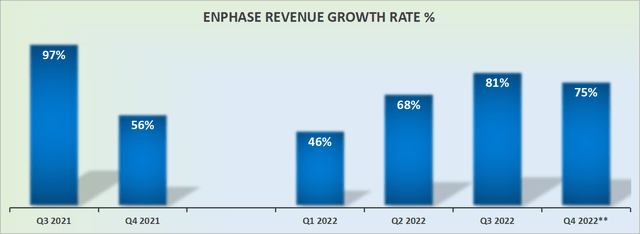

On yet the other hand, as we can see above, the growth rates that Enphase has been putting out for some time are nothing to sneer at.

Even before European energy costs went through the roof, Enphase was already seeing strong revenue growth rates.

With that in mind, we’ll turn our focus to Enphase’s profit margins.

Enphase’s Profitability Profile is Impressive

In the section that follows, consider Enphase’s GAAP operating margins

- Q2 2021: 19%

- Q3 2021: 11%

- Q4 2021: 14%

- Q1 2022: 14%

- Q2 2022: 18%

- Q3 2022: 22%

What you can observe is that since Q3 2021, Enphase’s operating margins have been stable and expanding. Of course, there’s a limit to how much Enphase’s profitability will expand.

But at least we can gain confidence that the business model has already cracked a way to be meaningfully profitable, despite growing at a breakneck pace.

In a time when the market is bifurcating between businesses that are profitable and have a path to reward shareholders and businesses that are seeking growth, for growth’s sake, Enphase is clearly on the right path.

Particularly in this period, when the economic backdrop is likely to slow down, and customer sentiment is going to be negatively impacted, it’s important to see that Enphase has already figured out how to be profitable.

That will provide Enphase with lots of flexibility over the coming year. Furthermore, Enphase’s balance sheet has a net cash position of approximately $100 million. Once again reinforcing that Enphase has plenty of room to maneuver as it seeks future growth opportunities.

ENPH Stock Valuation — The Stock is Expensive, But

Very few investors appraising Enphase believe that the stock is cheap. That’s not the right way to think about it. What investors are thinking about, is that beyond its valuation, there’s a possibility that Enphase continues to rapidly grow at a very strong clip for a prolonged number of years.

If 2022 taught me anything is that what I believed was a reliably strong growing company can at times have a lot more cyclicality than I would have previously assumed. Everything can be going swimmingly well, for a prolonged period of time. But when the tide turns, it does so unexpectedly. And often dramatically.

On the other hand, on a non-GAAP basis, Enphase is priced at approximately 57x forward earnings. I don’t believe that is exaggerated or stretched multiple for a company that presently appears to be growing at higher than 70% CAGR.

The Bottom Line

The one-line summary is this, Enphase is not cheap at +50x forward EPS. For now, Enphase is growing at a very fast rate, as Europe continues to be the crown jewel in this investment thesis.

But I question whether Europe will still be the growth engine in 2023 if Europe goes into a recession.

On yet the other hand, lest we forget, Enphase is already highly profitable, despite growing at a very fast rate. Given that Enphase has already carved out its path to profitability if Enphase’s revenue growth rates were to temporarily slowdown in Europe, I’m inclined to believe this wouldn’t fully break the overall bullish thesis.

Be the first to comment