Spod/iStock Unreleased via Getty Images

Investment Thesis

Covid-19 has been harsh on the capital-intensive aerospace and defense sector, with orders for commercial planes dropping by 55% in 2020. The same was the case for U.K.’s aerospace giant Rolls-Royce Holdings plc (OTCPK:RYCEY), which plunged to a record pre-tax loss of $6.31 billion in the first half of 2020 as Covid hit.

After three tough years of dealing with the pandemic, Rolls-Royce aimed to restructure and realign its business strategy, which focused on cost-cutting initiatives, disposal of certain assets, and entering new markets to generate multiple sources of revenue. It’s time to carefully observe Rolls-Royce in the upcoming few months as the results from reformation have started to materialize. With the recent announcement of new projects and a new chief executive, an upward price trend is expected.

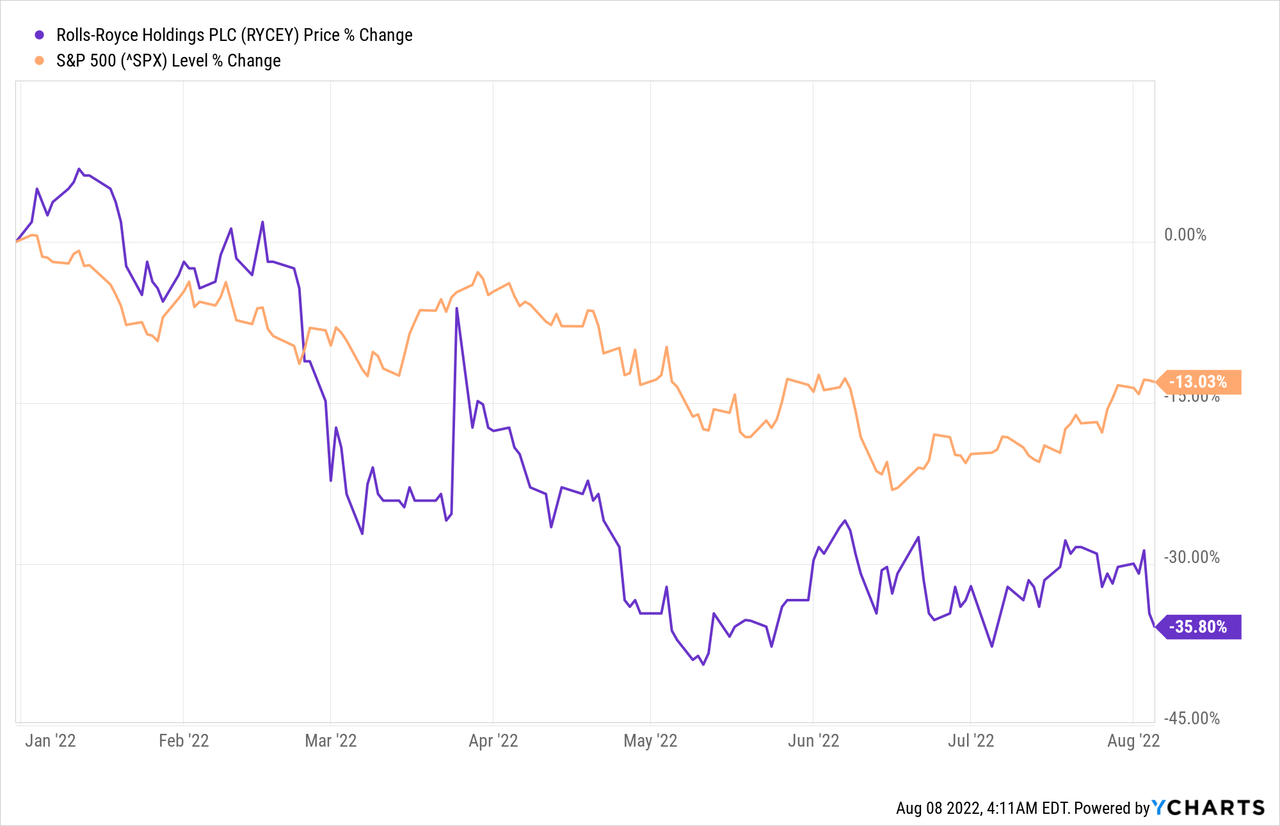

Rolls-Royce is still in a recovery phase. The company has lagged the S&P 500 by 20%, while its 3-year revenue declined by a CAGR of about 10%. Still, the cash coming in from the $845 million Department of Defense contract and the sale of its ITP Aero business to a private equity firm in a deal worth around $2 billion might turn the tables for Rolls-Royce in strengthening its financial statements.

Company Overview

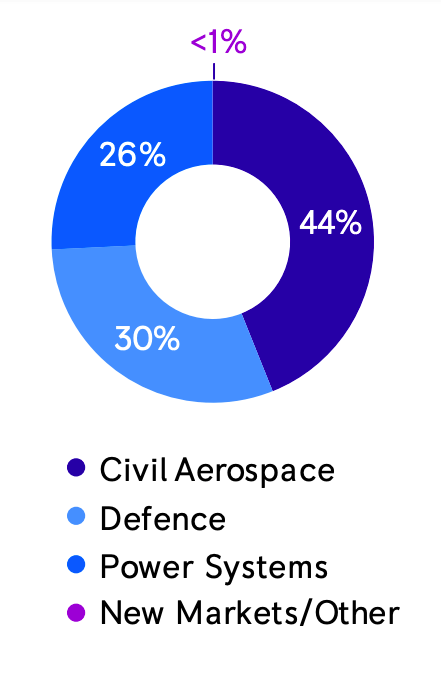

Rolls-Royce’s core business segments include civil aerospace, power systems, and defense markets. The Civil Aerospace sector contributed 44% of the total revenue in MRQ, with defense and power systems responsible for 30% and 26%, respectively. While the civil aerospace segment saw an increase of 3% in revenue, defense and power systems declined by 1% YoY.

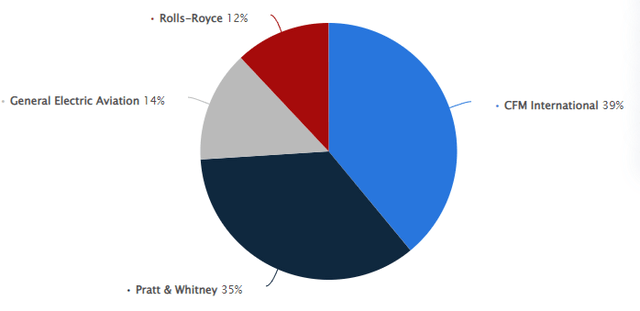

Rolls-Royce is one of the largest aircraft engine manufacturers besides Pratt & Whitney, GE Aviation, and Safran. Together, these companies account for over 99% of the commercial aircraft engine market.

The company has been focusing on zero emission initiatives lately by indulging itself in energy-related projects such as constructing small modular reactors and building hydrogen-powered aircraft projects.

Rolls-Royce Investors’ Presentation

With over 50,000 engines in 500 airlines and business relations with over 2,400 corporations and over 100 armed forces, the company is well reputed amongst many investors and nations across the globe.

The company has been struggling for the past three years. From unprecedented market conditions in COVID-19 to issues arising in its flagship engine Trent 1000, a need to realign itself to the company’s core fundamentals seemed compulsory.

The company initiated its largest restructuring and dedicated itself to improving its financial position by reducing unnecessary costs, disposing of certain assets, and focusing on the energy sector and sustainability projects. These measures have recently started showing their results as the company reduced its operating costs by 35% YoY and its investments by 46% YoY.

An Oil Industry Veteran as a CEO

The company announced in June ’22 that a former British Petroleum executive, Tufan Erginbilgic, would take over Rolls-Royce as its new CEO in these crucial times. Erginbilgic, a 23-year experienced technocrat, is known for generating record revenues and safety performance at BP (BP) Downstream. Rolls-Royce will compensate the new CEO with a base salary of GBP 1.25 million, of which 30% will be shared-based compensation deferred for two years. The board expects that this strategy will incentivize the new CEO to “further strengthen the link between executive remuneration and the interests of shareholders.”

Erginbilgic seems to be well reputed among corporations, and his experience in the energy sector will be valuable in helping Rolls-Royce to generate revenues. Decarbonization efforts and energy-focused programs such as Small Modular Reactors (‘SMRS’), Hydrogen-powered aircraft, and other long-term Rolls-Royce projects will be the new boss’s key focus. The appointment appears more focused on the company’s long-term goals.

Meanwhile, the current CEO, Warren East, is set to retire at the end of December 2022.

Creating a Market for Electric Planes

A successful engine is crucial for the company to remain a key player in the industry. The airline markets have been impressed by the CFM56 engine by CFM International, an engine manufacturing joint venture of GE and Safran. In contrast, Rolls-Royce’s market share lagged behind these companies, significantly affected after the company had various issues with its flagship engine, Trent 1000.

Now that the company has been set free from ITP Aero, which was sold as part of the strategy to strengthen its loss-inflicted financial position, Rolls-Royce has been dedicating itself to zero-emission transition.

According to European Commission, the aviation industry is responsible for 3.8% of the E.U.’s total CO2 emissions and 13.9% of the emissions from transport. Long touted as a sustainable fuel, Hydrogen is now gaining serious traction as a possibility for aviation, and tests are already underway to prove its effectiveness. Rolls-Royce has championed manufacturing combustion engines, but now that the circumstances require manufacturing an engine compatible with sustainable aviation fuel, will the company be able to contrive sustainable innovations?

Rolls-Royce announced two strategic partnerships at the Farnborough Air show on July 22. One with Korean automaker Hyundai to create a hydrogen fuel cell propulsion system for airplanes and the other with easyJet, a Swiss low-cost airline, to develop hydrogen-powered internal combustion engine (ICE) technology. The company has invested $62.7 million in R&D in MRQ, 5% lower as a percentage of sales compared to last year. This amount in R&D is focused on low carbon solutions such as hybrid-electric aircraft and hydrogen-powered solutions.

One of the major problems hydrogen-powered jets can be that storing Hydrogen, naturally a gas, would take up a lot of space in a passenger aircraft. It will need to be stored in liquid form. That liquid Hydrogen will then need to be vaporized into gas to be used as fuel – this will mean that certain parts of the engine could see temperature differences of some 1,500 degrees Fahrenheit. But industry experts believe that hydrogen-powered planes could enter the market by 2035, as major aircraft stakeholders, including CFM International, General Electric (GE), and Airbus, are involved in the extensive research and development phase of green hydrogen feasibility.

The shift towards decarbonization will be relatively more time-consuming for aircraft engine manufacturers, with lower saturation in the market and significantly high barriers to entry for new players. The R&D costs will be huge in upcoming years as the EU and the UK are geared toward achieving net zero emission targets by 2050.

Improving Financials

The company expects to make 4 further disposals, generating $2.4 billion. Even though the financial statements will gain temporary health with the proceeds, the company needs to focus on sustainable revenue and cash generation sources because asset disposals for raising cash are not what investors usually look for in a winning stock.

The company has been awarded an $854 million contract from the U.S. Department of Defense. This deal will also improve the cash flows in the upcoming months, improving Rolls-Royce’s liquidity. Cash and equivalents represent 16% or $3.3 billion of total current assets in the MRQ. Revenue compared to last year has decreased by 2.38% YoY, but a little stability can be observed as receivable, and inventories are decreasing. EBIT Margins have improved for RYCEY, with an amazing performance of 384% YoY. This improvement is attributed to the company’s cost-cutting strategies.

Long-term debt has increased by 37%, with a significant debt raised from BNP Paribas SA (OTCQX:BNPQF), Citigroup Inc. (C), and HSBC Holdings plc (HSBC) since the pandemic. This $6.28 billion debt is estimated to decline sharply in the current quarter. This debt pressure will be alleviated through the $2 billion proceeds generated from the sale of ITP Aero to the private equity firm Bain Capital. Rolls-Royce is committed to using the proceeds to reduce its debt, which will decrease its D/E ratio, and improve its liquidity and solvency metrics.

Valuation

The company’s cash flows are improving with time, with a price to cash flow multiple of 2.72x against the sector median of 13.39x. I expect other valuation metrics to improve with time as many structural changes are occurring with Rolls-Royce.

This could be a perfect time to build a position in RYCEY, as the growth metrics look strong, with EBITDA growth of 348.6% YoY, much higher than the sector median of 17.79%. The company’s low EV/EBITDA FWD multiple of 9.39x suggests a wiggle room for the metric, with peers averaging around 10.87x. If the company can reduce its debt in the future, which is expected to happen in the upcoming financial reports, the flow towards equity will significantly increase.

The P/E FWD multiple of 75.5x is huge against the sector median of 16.20x. As the company has seen a decline in sales in the last two years with faltering profitability, we can expect to see the P/E ratio stay at similar levels in the future.

Conclusion

RYCEY presents a buying opportunity. The reorganization effort and new announcements indicate that Rolls-Royce is serious about changing its market perception and improving shareholders’ returns.

Besides exploring new markets and industries, if the company also imposed further focus on its aviation engine sales, which it pioneered for a long time, we might see sustainable revenue numbers.

With the focus on energy transition, one can imagine why the need for a CEO from the energy sector was a good choice. Even though it is still an estimation, this new appointment will play a major role in developing Rolls-Royce in energy markets. These new developments will likely be reflected in the share price in the upcoming months, making me rate this as a “long-term Buy and hold” stock.

Be the first to comment