xijian/E+ via Getty Images

Real Estate Weekly Outlook

U.S. equity markets advanced for the second-straight week despite a surge in Treasury yields and energy prices after the Federal Reserve reiterated the central bank’s aggressive stance to combat inflation. Fed officials communicated a distinctly hawkish tone in speeches throughout the week, underscored by Fed Chair Powell hinting at the possibility of “double-hike” 50-basis-point steps to “ensure a return to price stability.” The transmission mechanism of raising borrowing costs is having quite the inverse effect on housing costs – the single largest component of the CPI inflation basket – as mortgage rates recorded the largest 12-week jump in nearly 30 years.

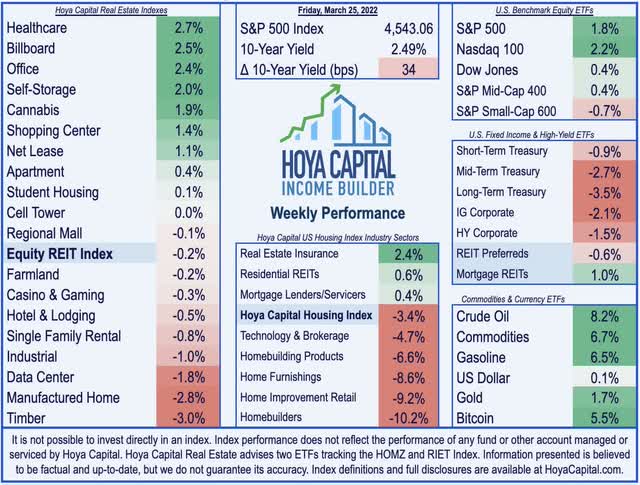

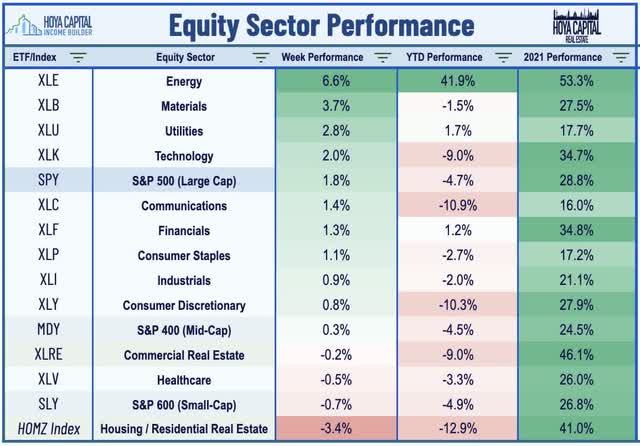

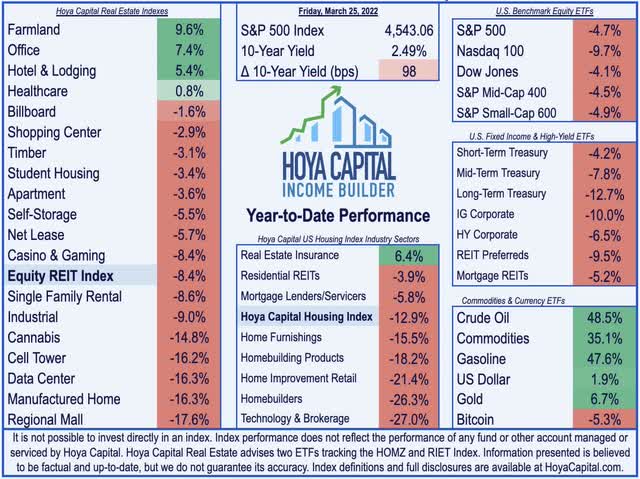

Adding to their best weekly gains since November 2020 in the prior week, the S&P 500 advanced another 1.8% on the week while the tech-heavy Nasdaq 100 gained 2% – adding to its 13% rebound since dipping into “bear market” territory two weeks ago. The gains were quite “top-heavy” on the week, however, as the Mid-Cap 400 gained just 0.4% while the Small-Cap 600 slipped 0.7%. Pressured by the surging 10-year Treasury yield – which climbed to its highest level since late 2019 – real estate equities were among the laggards as the Equity REIT Index slipped 0.2% with 10-of-19 property sectors in positive-territory while Mortgage REITs gained 1.0%.

Energy and commodities prices rebounded sharply following two weeks of declines as the Russia/Ukraine conflict dragged into a second month with few clear signs of diplomatic progress. WTI Crude Oil (CL1:COM) surged 8% to climb back above $112/barrel while the broader Commodities (DJP) Index posted another historic week of gains. Nine of the eleven GICS equity sectors finished higher on the week led by the Energy (XLE) and Materials (XLB) sectors, but homebuilders slumped deeper into “bear market” territory following mixed earnings results from KB Home (KBH) and softer-than-expected New and Pending Home Sales data in February resulting from the combination of record-low supply levels and the jump in mortgage rates.

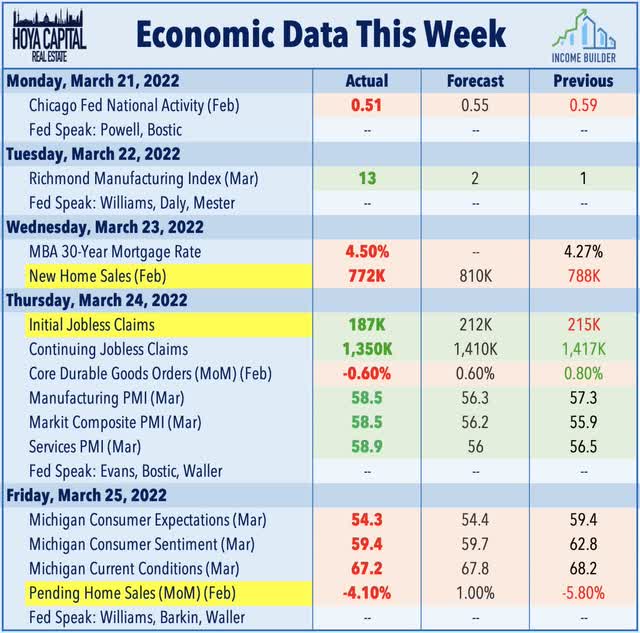

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

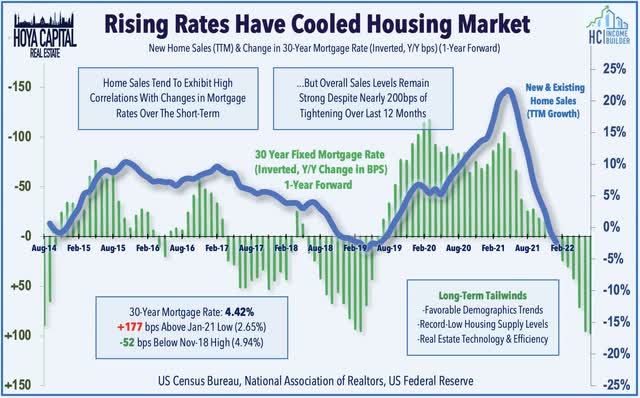

The U.S. housing industry – which served as a critical source of stability throughout the pandemic – has exhibited clear signs of moderation over the last several months as a historically swift rise in mortgage rates has ushered in some long-awaited “normalization” to the previously red-hot housing market. New and Pending Home Sales this week were each softer than expected as the average rate on a new 30-year fixed-rate mortgage is now within 50 basis points of its post-financial Crisis highs from late 2018 – and nearly two full percentage points higher than three months ago.

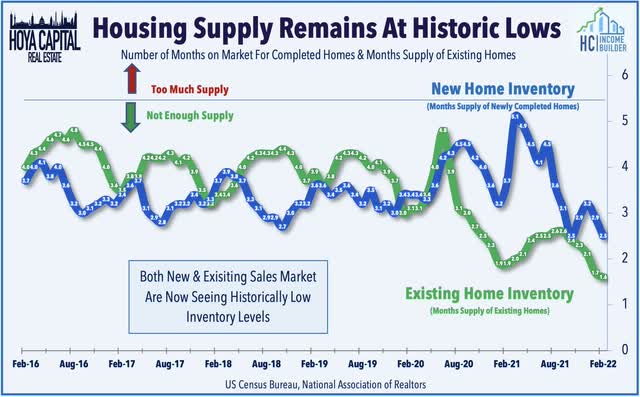

Just as we saw back in 2018 when rising mortgage rates resulted in a notable near-term slowdown in buying activity, the longer-term outlook for the housing industry remains highly promising. Demographic-driven growth in household formations, combined with the lingering housing shortage resulting from a decade of underbuilding, remain long-term tailwinds for the housing industry and a return to sustainable “trend-level” growth is a welcome sign to prolong the secular growth trends into the latter half of the decade. Notably, New Home Sales data this week showed that the supply of newly-completed homes declined to the lowest level since the records began in 1975 at just 2.5 months while Existing Home inventory also remained near historic lows last week.

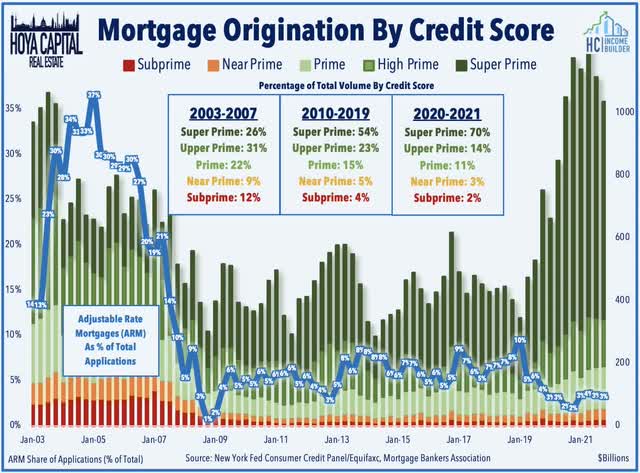

Signs of a cool-down have renewed the perennial “Bubble” calls from pundits, but fundamentals suggest that national housing markets are instead far more likely to see a somewhat “boring” return to normalcy ahead. Importantly, subprime loans and adjustable-rate mortgages – the dynamite that led to a cascading financial market collapse in 2008 – have been essentially non-existent throughout this cycle. Adjustable-rate mortgages – which would be most “at-risk” from the surge in rates – accounted for nearly a third of all new mortgages at the peak in 2005, but have accounted for less than 5% of mortgages originated since 2009. Mortgage payments as a percent of incomes are nearly 50% below the average from 2000 to 2007.

Equity REIT & Homebuilder Week In Review

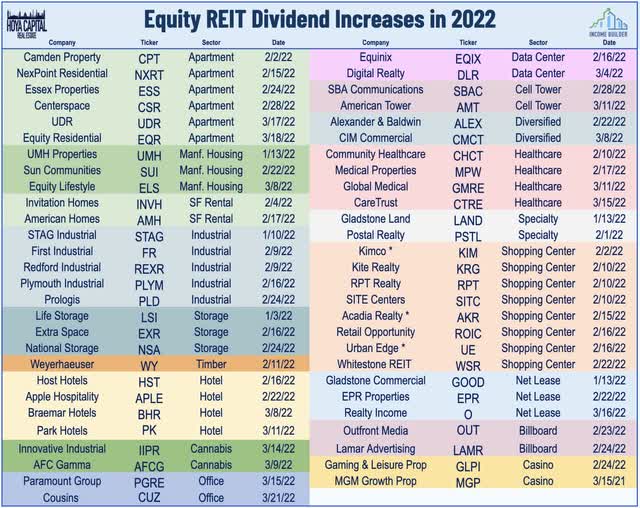

Office: Cousins Properties (CUZ) – which we own in the Income Builder REIT Portfolio – advanced 1% on the week after it became the 61st REIT to raise its dividend this year, hiking its quarterly dividend by 3.2% to $0.32/share. As we discussed in our recent office REIT report, It’s Always Sunny In the Sunbelt, Cousins – which focuses on Sunbelt markets – is the only office REIT to hike its dividend in each of the past three years. Elsewhere in the office sector this week, Paramount Group (PGRE) advanced 4% on the week after turning down Monarch Alternative Capital’s proposal to acquire the REIT for $12.00/share, saying the offer “significantly” undervalued the company. Closing the week trading at $11.04, PGRE is higher by more than 20% since reports of the offer emerged in late February.

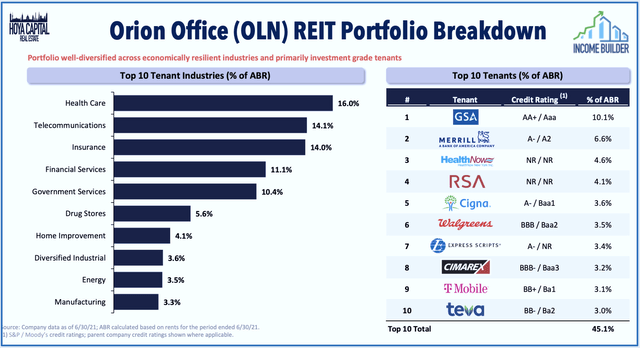

Sticking in the office sector, Orion Office (ONL) – the newest office REIT that was spun out from Realty Income (O) as part of its merger with VEREIT – plunged 12% on the week after reporting its first inaugural earnings results. Investors got their first look at the REIT’s distribution strategy and were not pleased, as ONL expects to pay a $0.10/quarterly dividend – representing a yield of just 2.6% – which the firm says was “sized to permit future growth while preserving meaningful cash flow for reinvestment into the current portfolio.” The initial earnings outlook for 2022 was decent, however, with Core FFO expected to be $1.70 at the midpoint of its guidance range, implying a Price-to-FFO multiple of 9x – one of the cheapest office REITs based on this valuation metric.

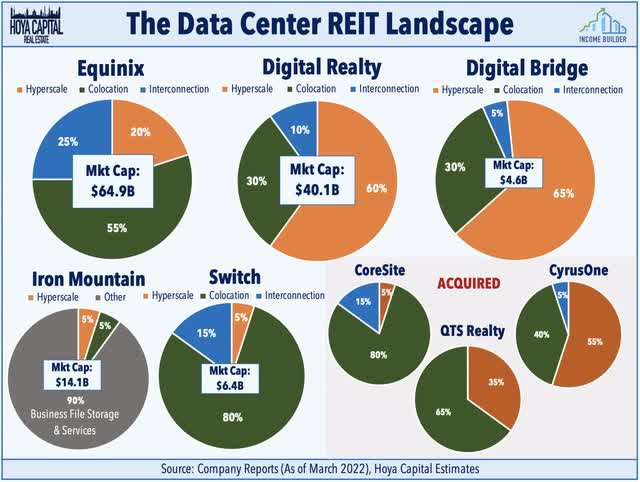

Data Center: Switch (SWCH) – a data center operator that plans to convert to a REIT by 2023 – advanced 3% on the week following a report that it is exploring a potential sale of the company. Digital Realty (DLR) and Equinix (EQIX) are expected to be possible buyers, both of which are “overdue” for a major M&A move based on their historical cadence and both are sitting on a mountain of dry powder. Their smaller peer, DigitalBridge (DBRG), remains very active on the M&A front, announcing a deal this week to acquire the mobile telecommunications tower business of Telenet Group in an all-cash transaction valued at $820 million. The transaction – which is expected to close in Q2 2022 – will provide DigitalBridge with ownership of 3,322 communications sites in Belgium.

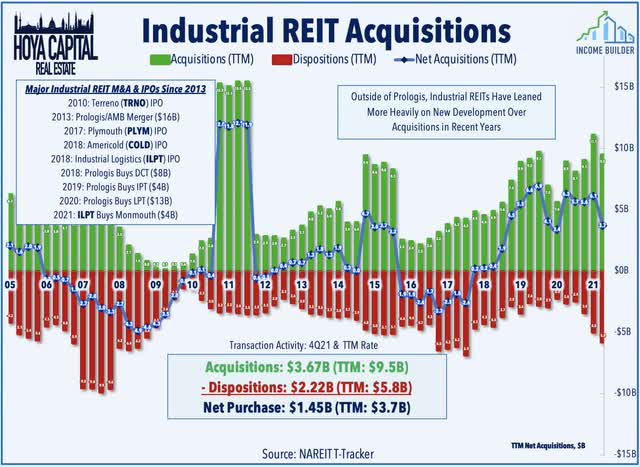

Industrial: Prologis (PLD) – the largest industrial REIT with a market cap of roughly $120B – ended the week lower by 2% after it reportedly bid more than $23B for Blackstone’s Mileway logistics warehouse company in Europe, a portfolio of about 2,000 European warehouses that Blackstone has accumulated over the past six years. The deal, if completed, would be the largest industrial real estate deal in history and the largest ever for a REIT, eclipsing PLD’s $13B acquisition of Liberty Property Trust in 2020 and its $8B acquisition of DCT Industrial in 2018. In Supply Chains At Breaking Point, industrial REITs continue to benefit from the added tailwind of external growth. After years of relying on ground-up development to fuel external growth, industrial REITs have been more active on the acquisition since 2018, acquiring nearly $4B in net assets in 2021.

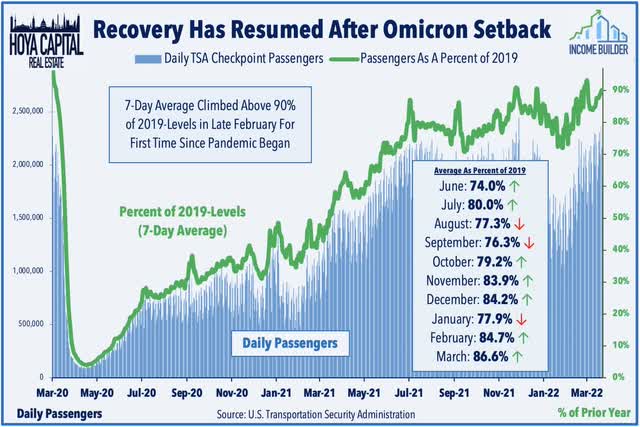

Hotels: Pebblebrook (PEB) – which owns a portfolio of upscale hotels on the East and West Coast – slumped 2% on the week after providing a business update in which it noted that its first-quarter RevPAR (Revenue Per Available Room) is expected to be 30% below comparable 2019-levels. In our report this week, Spring Break Is Back, we discussed how Sunbelt and leisure-focused markets continue to substantially outperform Coastal business-focused markets. Recent travel data has been encouraging, contrasting with the gloomy attitude in confidence surveys as TSA Checkpoint throughput data rebounded to 90% of pre-pandemic levels this past week while average hotel occupancy is back at its 20-year average despite the depressed performance in northern markets.

Cannabis: Among the leaders this week were a trio of small-cap cannabis REITs – AFC Gamma (AFCG), Chicago Atlantic (REFI), and NewLake Capital (OTCQX:NLCP), which we covered in our report this week: Cannabis REITs: Own The Pharmland. Cannabis REITs have stumbled in early 2022, pressured by the broader growth-to-value rotation and uncertainty over progress on federal legalization, but owning the “Pharmland” – the physical real estate – has been one of the few themes in the space that has worked as cannabis ETFs have delivered dismal investment performance since 2019. Thriving in the murky and often contradictory regulatory framework of legalized marijuana, valuations now appear quite attractive as sector leader Innovative Industrial (IIPR) REITs has established a genuine competitive moat, a track record of operational execution, and consistent dividend growth.

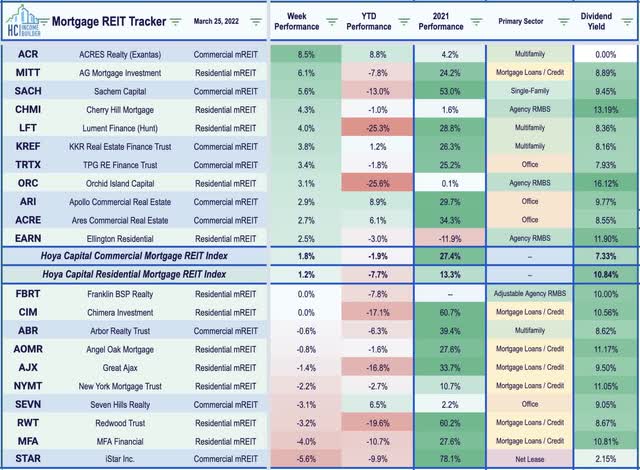

Mortgage REIT Week in Review

Mortgage REITs delivered their second-best week of the year as commercial mREITs rallied 1.8% while residential mREITs advanced 1.2%.On the upside this week, AG Mortgage (MITT) rallied more than 6% on the week after holding its quarterly dividend steady at $0.21/share while New Residential (NRZ) also finished higher by 1% after holding its dividend steady at $0.25/share. Small-cap Western Asset Mortgage (WMC) was also among the leaders on the week despite cutting its dividend by 33% to 0.04/share – the third mortgage REIT to reduce its dividend this year compared to seven dividend increases. The average residential mREIT pays a dividend yield of 10.85% while the average commercial mREIT pays a dividend yield of 7.33%.

On the downside this week, MFA Financial (MFA) – which currently trades at $4.07/share – declined 4% on the week after announcing that its Board of Directors approved a reverse stock split of the Company’s common stock at a ratio of 1-for-4, which will take effect following the close of business on April 4th. Elsewhere, New York Mortgage Trust (NYMT) was also among the laggards today after announcing an equity investment in AlphaFlow, a technology platform for institutional investment in real estate debt. iStar (STAR) also slumped despite announcing the closing of the previously-announced portfolio sale of its net lease assets to Carlyle’s Global Credit for $3.1B – which the company expects will generate net cash proceeds to iStar of approximately $1.2 billion – and intends to use the proceeds to “continue scaling the ground lease ecosystem.”

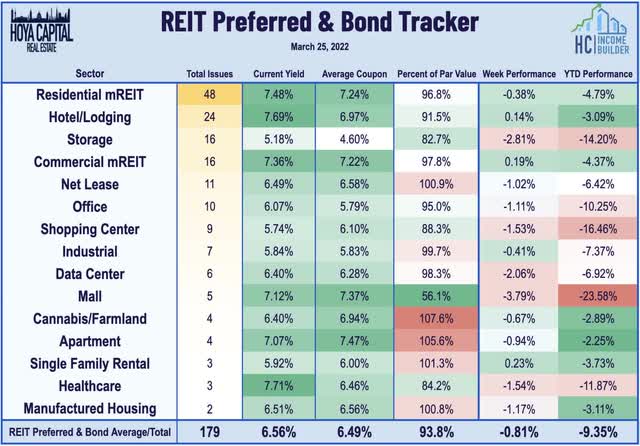

REIT Preferreds & Capital Raising

REIT Preferred stocks slipped 0.81% this week and are now off by 9.3% on the year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. The preferred series from EPR Properties (EPR) was among the better-performers this week after Fitch Ratings upgraded EPR’s credit ratings to “BBB-“ from “BB+” with a stable outlook. The preferred series from Hersha Hospitality (HT) – which we discussed in our Hotel REIT report this week as our “Preferred Picks” – were also upside leaders on the week.

2022 Performance Check-Up & 2021 Review

Through twelve weeks of 2022, Equity REITs are now lower by 8.4% this year on a price return basis while Mortgage REITs have slipped 5.2%. This compares with the 4.7% decline on the S&P 500 and the 4.5% decline on the S&P Mid-Cap 400. Dragged on the downside by the cell tower, mall, and data center sectors, 15-of-19 REIT sectors are now in negative territory for the year. At 2.49%, the 10-year Treasury yield has climbed 98 basis points since the start of the year and is now closer to its post-Great Financial Crisis peak of 3.25% reached in October 2018 than its August 2020 low of 0.52%.

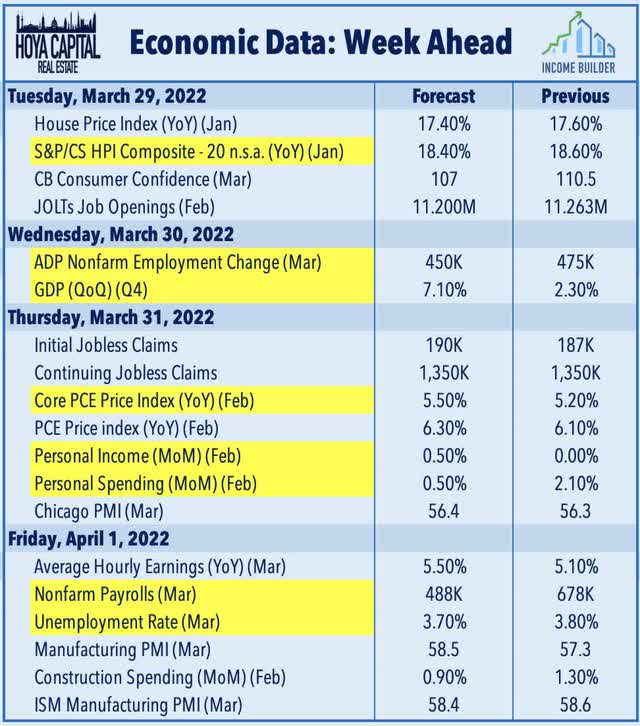

Economic Calendar In The Week Ahead

Employment data highlights another busy week of economic data in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 488k in March following two-straight months of stronger-than-expected job growth while the unemployment rate is expected to decline to 3.7% from 3.8% in February. We’ll also get the third and final revision to Q4 GDP data, which is expected to confirm that the U.S. economy was growing at a 7% rate at the end of 2021. We’ll also see home price data with the Case Shiller Home Price Index on Tuesday which is expected to show a deceleration in the pace of home price gains due to rising mortgage rates. Finally, we’ll also be watching Construction Spending on Friday and a flurry of Purchasing Managers’ Index (“PMI”) data throughout the week.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment