alicat/E+ via Getty Images

Rising Interest Rates

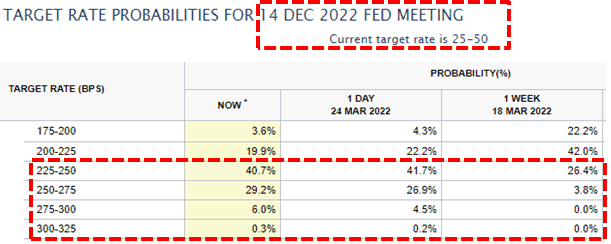

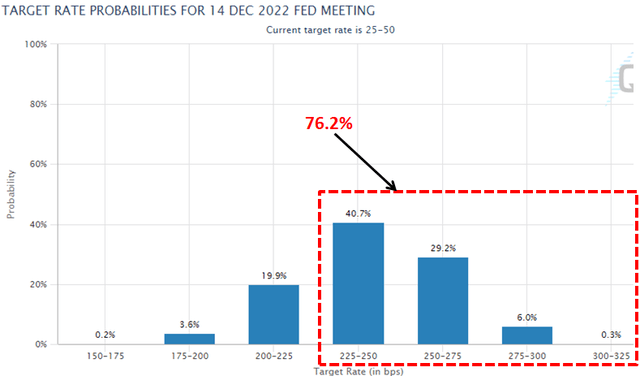

The Fed is finally starting to hike interest rates with a 76.2% chance (up from 30.2% last week) of the fed funds upper target rate increasing to 2.50% or higher over the next 9 months. This is important because the last time the Fed increased rates starting in late 2015, it took three full years before reaching 2.50% as shown below.

FOMC

FOMC

FRED

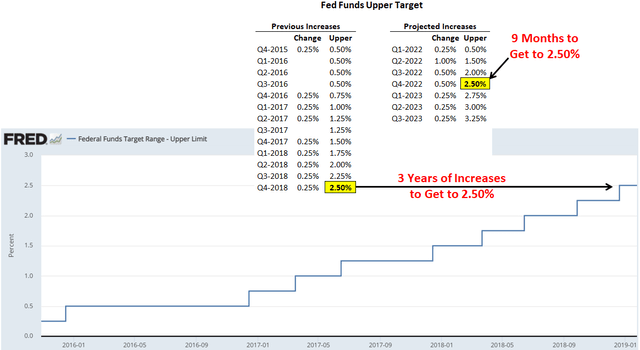

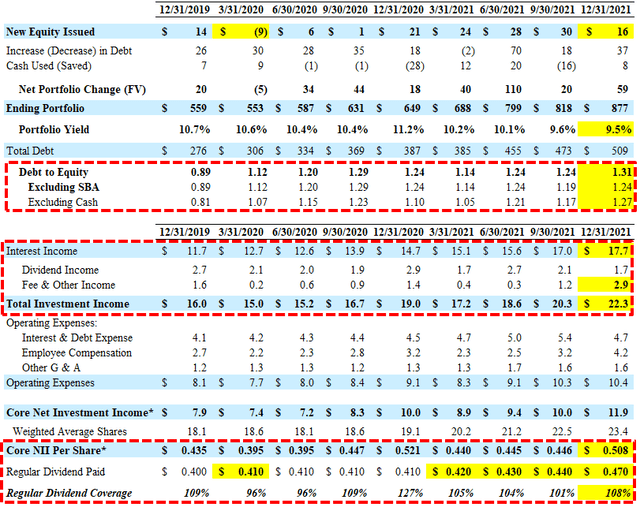

During 2013 and 2014 many BDCs experienced declining portfolio yields driven by competition for “true” first-lien and higher-quality assets. This was followed by a period of rate hikes shown above which resulted in higher portfolio yields for most BDCs including Capital Southwest (NASDAQ:CSWC) as shown below. Please note that the current Fed Funds upper target rate is 0.50% implying an increase of at least 200 basis points of 2.00% over the next nine months. Most BDCs benefit after the first 1.00% of rate increases.

BDC Buzz

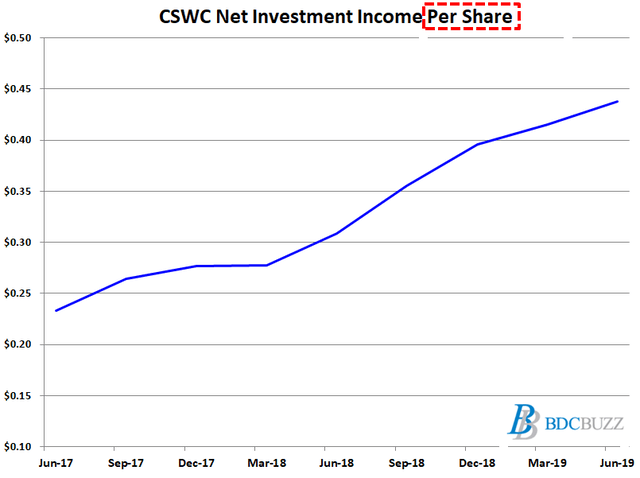

For CSWC, the previous rates increases had a direct impact on earnings partially responsible for growing net investment income from $0.23 per share in Q2 2017 to $0.44 per share in Q2 2019:

BDC Buzz

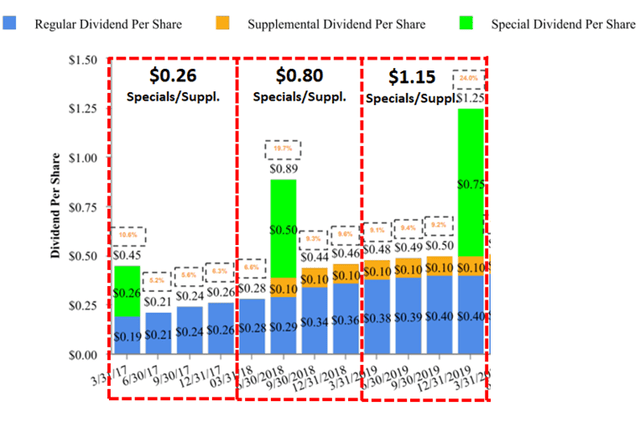

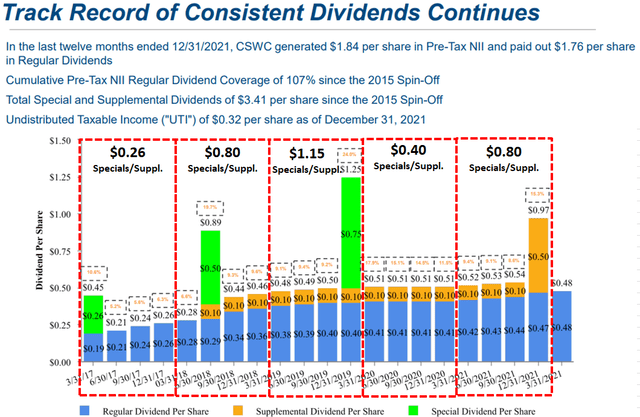

Clearly, the increased portfolio yield and earnings were the primary drivers for increasing the regular quarterly dividend from $0.19 per share to $0.40 per share:

CSWC

Previous Changes in BDC Prices

As mentioned last week in “Positioning For Higher Rates With This 11.2% Yielding Investment“, BDC prices climbed in early 2016 as the Fed started to raise rates including CSWC as shown below. During that period BDCs easily outperformed the S&P 500 and REITs after taking into account dividends paid and I am expecting the same for 2022 and 2023. Please adjust your portfolios.

Fidelity

Quick Introduction to Business Development Companies (“BDCs”)

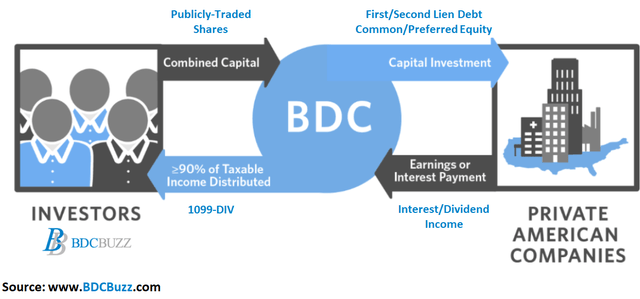

Business development companies (“BDCs”) invest shareholder capital in privately owned, small- and medium-sized U.S. companies. BDCs aim to generate income and capital gains when the companies they invest in are sold, much like venture capital or private equity funds. Anyone can invest in BDCs as they are public companies, traded on major stock exchanges.

BDC Buzz

Similar to Real Estate Investment Trusts (“REITs”), Business Development Companies are regulated investment companies (“RICs”) required to pay at least 90% of their annual taxable income to shareholders, avoiding corporate income taxes before distributing to shareholders. This structure prioritizes income to shareholders (over capital appreciation), driving higher annual dividend yields that mostly range from around 6% to 11%.

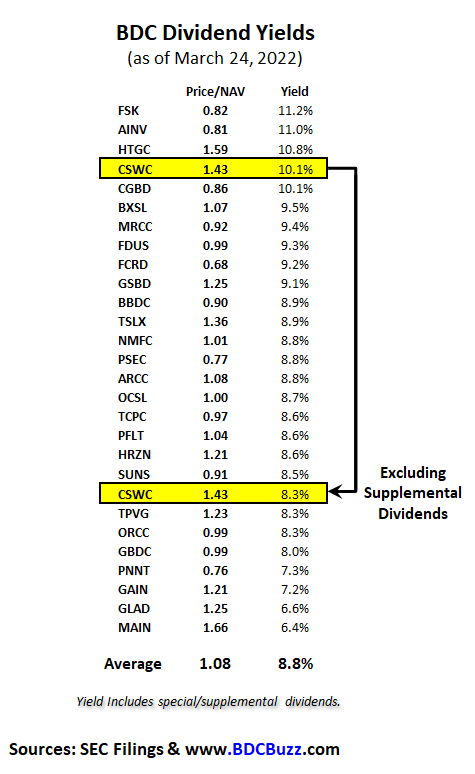

This article discusses Capital Southwest which is currently one of the highest yielding BDCs at 10.1% (taking into account upcoming special and/or supplemental dividends) likely due to being underpriced.

I firmly believe that higher-yield investments will become even more attractive in an inflationary and rising interest rate environment (as shown below), especially as investors are seeking additional income from invested capital.

CSWC Quick Dividend Update

Author’s Note: The following information was provided to subscribers of Sustainable Dividends along with three quarters of financial projections using base, best, and worst-case assumptions to test the sustainability of the current dividends for CSWC.

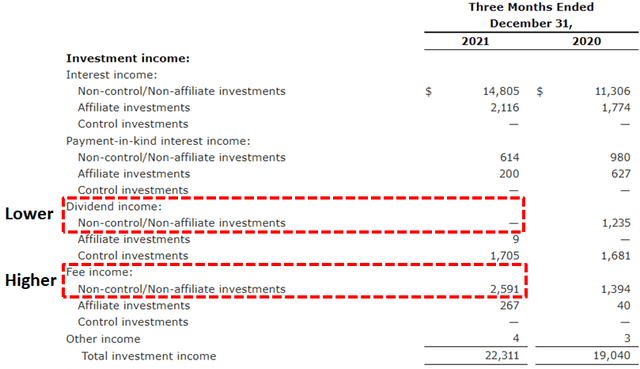

For calendar Q4 2021, CSWC hit its ‘best case’ projections due to higher-than-expected prepayment fees partially offset by lower-than-expected dividend income. Total income hit a new high of $22.3 million and the amount of payment-in-kind (“PIK”) income continues to decline from 10.9% to 4.6% of total interest income over the last few quarters.

CSWC

BDC Buzz

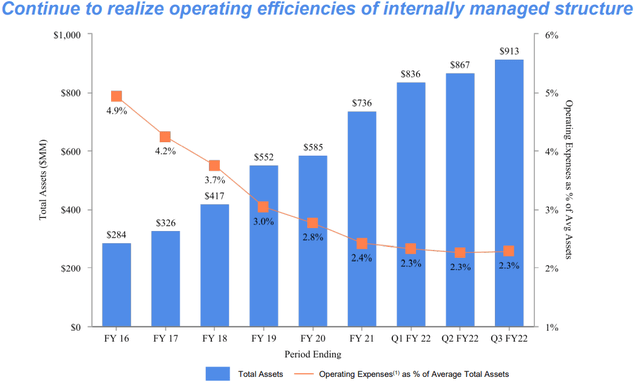

CSWC’s total quarterly recurring income has increased by over 50% over the last two years partially responsible for continued dividend increases as the company leverages its internally managed cost structure.

“We maintained LTM operating leverage at 2.3% as of the end of the quarter. We are targeting operating leverage to approach 2% or better in the coming quarters.”

CSWC

As predicted in “Excellent Dividend Growth Stock Currently Yielding 9.1%: Capital Southwest“, CSWC increased its quarterly regular dividend from $0.47 to $0.48 per share for calendar Q1 2022. It should be noted that the increase to the regular dividend was partially driven by reduced borrowing rates that “allows us to pass the cost of capital savings directly to our shareholders”.

We are also pleased to announce that our Board has declared an increase in our regular dividend per share to $0.48 for the quarter ended March 31, 2022, an increase of 2.1% from the $0.47 per share paid in the December quarter. This increase in our recurring regular dividend reflects the increased earnings power of our portfolio, resulting from the growth and performance of our credit portfolio and the continued reductions in our cost of capital and improvements in our operating leverage.”

I am expecting additional regular quarterly dividend increases mostly due to reduced borrowing rates, increased returns from its I-45 Senior Loan Fund, and continued portfolio growth. Management mentioned that calendar Q1 and Q2 2022 will likely be less active than Q4 2021 with new investments partially offset by prepayments.

“The I-45 senior loan fund continues its solid performance. As of the end of the quarter, 95% of the I-45 portfolio was invested in first lien senior secured debt. Weighted average EBITDA and leverage across the companies in the I-45 portfolio was $72.8 million and 5x, respectively. The portfolio continues to have diversity among industries and an average hold size of 2.4% of the portfolio. Leverage at the I-45 fund level is currently 1.52x debt to equity. There was a big flurry of activity in the December quarter. So I would tell you that activity in the March and June quarter, we would expect to be down from where it was in the December quarter.

However, management is still expecting net portfolio growth of $30 million to $50 million which is taken into account with the updated projections along with lower ‘Employee Compensation’ both of which were discussed on the recent earnings call:

“I think we assume we’re going to originate somewhere in the $60 million to $75 million per quarter of new investments and our repayment activity is somewhere in the $20 million to $30 million each quarter. So net, we look to see somewhere in the $30 million to $50 million of net growth per quarter as a general run rate.”

Q. “A question for you on the comp line. Just any help you can give us, obviously, it went up. I assume that’s a function of a performance accrual getting baked in here for the December quarter, but any kind of thoughts around that would be helpful?”

A. “For this quarter, our bonus accrual for the quarter was about $1.4 million above our normal run rate. So essentially, there’s about $600,000 of onetime income or net income or $0.03. So I think when we look at our performance to date for the year and where we’re tracking for the full fiscal year 2022, we did accrue a bonus above the target commensurate with the performance so far of our staff.”

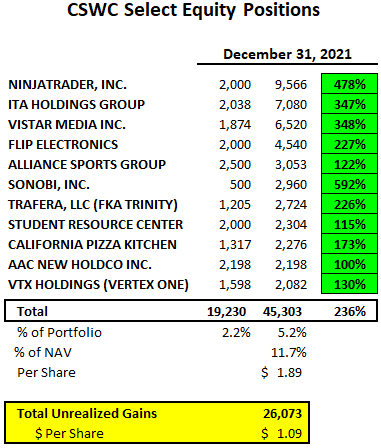

Most dividend coverage measures for BDCs use net investment income (“NII”) which is basically a measure of earnings. However, some BDCs achieve incremental returns with equity investments that are sold for realized gains often used to pay supplemental/special dividends.

We believe that this combination is powerful for BDC as it provides strong security for the vast majority of our invested capital, while also providing NAV upside from equity investments in many of these growing businesses. Building out a well-performing and granular portfolio of equity co-investments is important to driving growth in NAV per share while aiding in the mitigation of any credit losses over time. As of the end of the quarter, our equity co-investment portfolio consisted of 39 investments with a total fair value of $74.5 million, which included $17.7 million in embedded unrealized appreciation or approximately $0.74 per share. Our equity portfolio, which represented approximately 9% of our total portfolio at fair value as of the end of the quarter, continues to provide our shareholders attractive upside from growing lower middle market businesses.”

CSWC

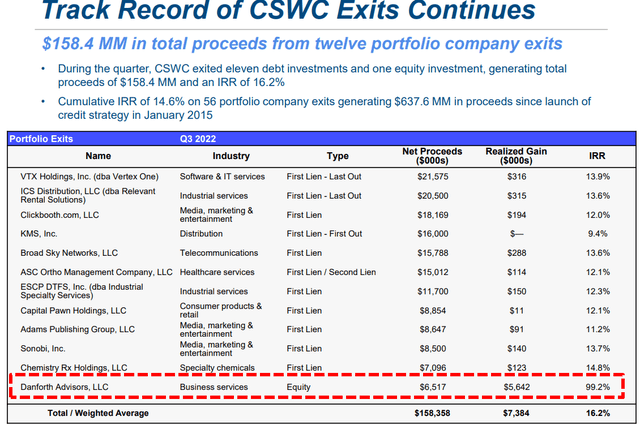

During Q4 2021 CSWC had additional net realized gains of $2.7 million or $0.12 per share mostly driven by the sale of its equity investment in Danforth Advisors:

Notably, the equity exit was a very successful outcome as it generated a realized gain of $5.6 million and an IRR of 99.2%. As we have previously stated, our intention over time is to distribute these realized gains periodically through special dividends to our shareholders.”

The following table shows some of CSWC’s many equity investments as of December 31, 2021, currently accounting for over 5% of the total portfolio fair value with over $26 million of unrealized gains. If these investments were sold at their previous fair values it would generate around $1.09 per share of realized gains to support additional supplemental dividends.

BDC Buzz

BDC Net Interest Margins and Interest Rate Sensitivity

Net interest margins are the difference between interest income from portfolio investments and interest expense on borrowings/debt. Most BDCs used the recent pandemic to strengthen their balance sheets including lowering the overall amount of the leverage converted to mostly longer-term unsecured borrowings at extremely low fixed rates. Also, most BDCs continue to position their portfolios away from cyclical sectors and into growth, technology, defensive sectors that will continue to do well over the coming quarters.

These changes have resulted in much stronger balance sheets ready for anything from an economic recession to an overheated economy driving inflation and higher interest rates.

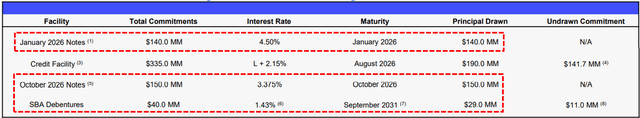

On November 4, 2021, CSWC issued an additional $50 million of 3.375% unsecured notes due October 1, 2026. Previously the company redeemed its $125 million of 5.375% notes due 2024 and recently reduced the borrowing rate on its credit facility from L+250 to L+215. This will have a meaningful impact on its overall borrowing rate and has been taken into account with the updated projections. In April 2021, CSWC announced that it received a license from the U.S. Small Business Administration (the “SBA”) to operate a Small Business Investment Company (“SBIC”) subsidiary. An SBIC license provides CSWC an incremental source of long-term capital by permitting it to issue up to $175 million of SBA-guaranteed debentures.

As shown below, CSWC has a strong balance sheet (from a liability standpoint) with 63% of borrowings at fixed rates.

CSWC

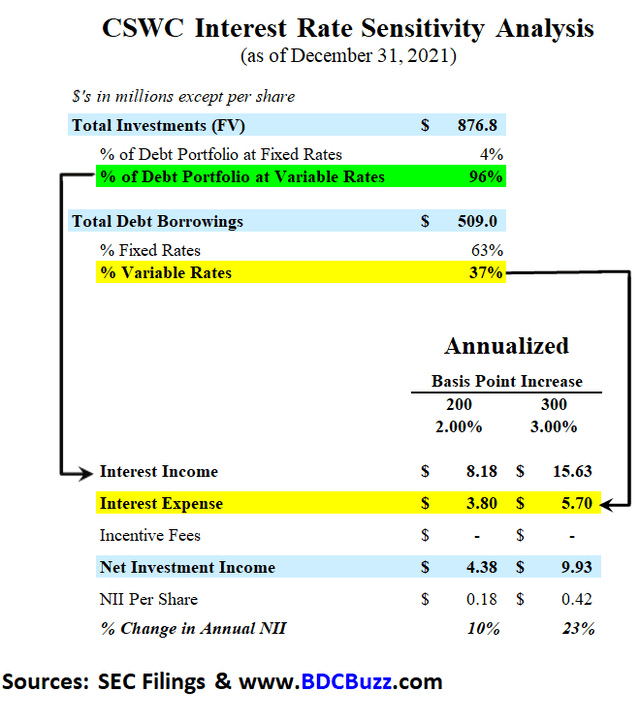

Also, 96% of its debt portfolio is floating rate loans that will benefit from rising rates after taking into account floors.

As shown below, there is the potential for increased earnings as rates rise and was discussed on the recent call:

We do anticipate increasing the dividend. I would say as LIBOR/SOFR increases with the Fed announcing 3 to 4 hikes, or rate hikes is in the next year, that also will be some level of compression still NII and the dividend should grow. I think once we get beyond 75 basis points of hikes, then you’ll see significant expansion. So maybe from here, maybe as much as 2 dividend increases potentially for the year. Though we’re not saying that setting that in stone, but that would be the hope.”

BDC Buzz

Article Summary & Recommendations

I am expecting at least $0.40 per share of supplemental dividends in 2022 mostly due to additional realized gains from exiting equity investments as well as over-earning the dividend combined with still having undistributed taxable income (“UTI”) that will likely need to be paid out at some point.

Our investment portfolio continues to perform well, generating $700,000 in net realized and unrealized gains this quarter, bringing the net realized and unrealized gains over the past 4 quarters to $12.2 million. Going forward, we intend to periodically distribute special dividends to our shareholders as we monetize the unrealized appreciation in the portfolio.”

Even after taking into account the $0.80 per share of supplemental dividends paid in 2021, CSWC still has around $0.32 per share of UTI for additional supplemental dividends in 2022. Also, this does not include the $5.6 million or $0.23 per share of realized gains from the sale of its equity position in Danforth Advisors as discussed earlier:

As of December 31, 2021, our estimated UTI balance was $0.32 per share. The end of the year UTI balance excludes the $5.6 million gain on the sale of one of our equity investments this quarter as this company was held at our taxable subsidiary. Post quarter end, we distributed taxable income from our taxable subsidiary to CSWC and these proceeds are now available for distribution to our shareholders.”

CSWC

As mentioned earlier, the company is currently paying a regular quarterly dividend of $0.48 per share or $1.92 annually plus $0.40 per share of supplementals for a total of $2.32 per share in 2022. This would imply a dividend yield of 10.1% assuming no additional dividend increases potentially driven by higher rates on portfolio investments as discussed earlier.

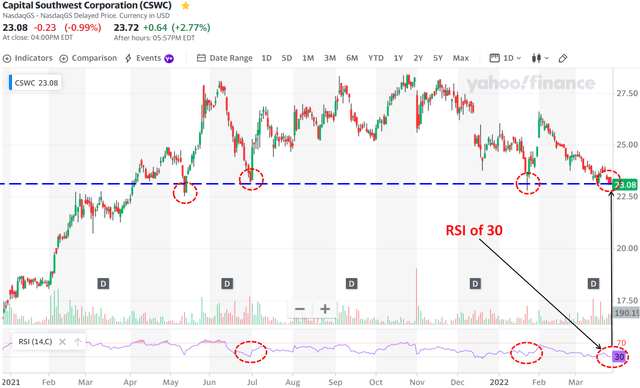

CSWC has recently dipped to its frequently visited “near term low” of around $23.00 driving its Relative Strength Index or RSI to 30 which is typically where I like to make purchases. As mentioned in previous articles, RSI is an indicator that I use only after I already know which BDC I would like to purchase but waiting for a good entry point. I consider target prices to be much more important when adding to current positions.

- 40 or below = “Buy”

- 41 to 69 = “Hold”

- 70 or higher = “Overbought”

Fidelity

As shown below, CSWC has one of the highest dividend yields in the sector which is typically reserved for risky BDCs such as FSK and AINV. However, there’s a good chance that investors are not taking into account the supplemental dividends which are likely going to continue in 2023 and 2024.

BDC Buzz

Be the first to comment