GoodLifeStudio/iStock Unreleased via Getty Images

In my opinion, there has never been a better time to invest in high-quality tech stocks for the long term. Given the massive declines that we’ve seen in the sector since November, due both to a general valuation cooldown plus rising macro concerns (Russia/Ukraine tensions and rising interest rates), many previous high-flyers are now trading at quite attractive values.

Upwork (NASDAQ:UPWK) is one company that I’ve been eyeing over the past few months. Upwork, needless to say, was one of the biggest beneficiaries of the pandemic and skyrocketed greatly in 2020 owing to a lot of one-time deals to help enterprises set up remote/freelance workforces. While those one-time tailwinds have subsided, the underlying theme that more and more work will shift to remote/gig-based work still sustains.

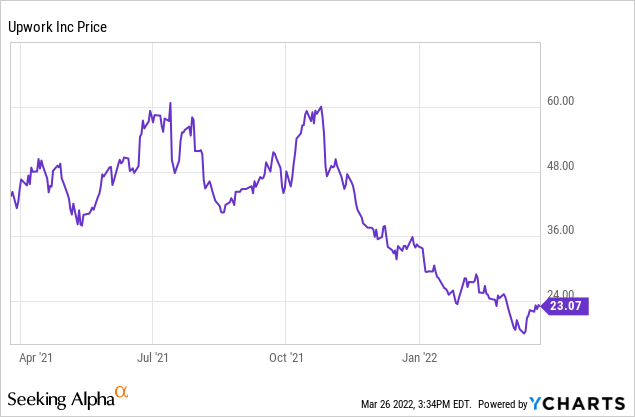

Year to date, shares of Upwork have lost 30% of their value. Relative to highs above $60 that Upwork notched prior to the November correction, the stock has lost 60% of its value. It’s a good time, in my view, for investors to take a hard reassessment at the bullish thesis for this stock.

My take here: take advantage of this relentless crash to buy Upwork. I remain bullish for the long term, though it may take 6 months to a year for Upwork to regain investors’ confidence.

The guidance shakeup

Now, admittedly, Upwork’s recent decline in March did come with some fundamental concerns.

In early March, Upwork announced that it was suspending all of its operations in Russia, emulating the playbook that many companies have adopted since Russia’s aggressions toward Ukraine began.

Previously, Upwork had guided to $620-$630 million in revenue, representing 24-25% y/y growth for the year, as well as positive adjusted EBITDA (down from $19 million in FY21, due to a planned ramp in marketing spend).

Upwork outlook (Upwork Q4 shareholder letter)

Citing the uncertainties around the length and severity of the Russia exit, the company suspended its guidance for the year. To put some rough context around the potential impact of the geopolitical tension here, Upwork wrote in its press release announcing the guidance suspension as follows:

“Approximately 10% of Upwork’s total revenue in 2021 was derived from work where either the talent or the client was located in the region, with Ukraine representing approximately 6% and Russia and Belarus representing approximately 4% combined. Nearly all such revenue was derived from work performed by talent inside the region for clients located in other parts of the world. Since the beginning of the invasion in late February 2022, Upwork has experienced a meaningful decrease in activity from talent in the region, most notably in Ukraine. Given the complex nature of Upwork’s business and two-sided nature of its work marketplace, and with talent on the work marketplace located in over 180 countries, Upwork is monitoring the impact on client spend from clients that have historically engaged talent in the impacted region and the extent to which those clients engage talent in other regions.”

Wall Street analysts are now expecting the company to generate $613.0 million in revenue for the year, reflecting 22% y/y growth and a ~2% hit to the prior guidance range.

To me, while this situation certainly poses a risk for a company that has a fair amount of concentration in a troubled region, I think the risks are more than baked into Upwork’s current share price.

At current share prices near $23, Upwork trades at a market cap of $2.98 billion. After we net off the $684.8 million of cash and $561.3 million of debt on Upwork’s most recent balance sheet, the company’s resulting enterprise value is $2.86 billion. This represents a 4.7x EV/FY22 revenue multiple versus Wall Street’s updated revenue consensus – which, to me, severely undervalues a company with mid-20s baseline growth in a large market with secular tailwinds.

Focusing on the long-term bullish drivers for Upwork

Current situation aside, here’s a refresher for investors who are newer to Upwork as to why the company is so attractive for the longer term:

- Workers have the upper hand and remote work is winning out. There’s a global shortage of everything right now, including and especially talent. In the drive to keep up with massive consumer demand and heightened business activity, more and more employers are rethinking their traditional workforce and replacing permanent, in-office positions with a number of non-standard arrangements, including remote work, contract positions, gig-based work, and the like. This is Upwork’s bread and butter and the space it’s excelled in since its founding. Upwork estimates its long-term market opportunity at $1.3 trillion in gross services volume (GSV).

- Backdrop for freelancers has never been more optimal. Upwork notes that 10 million Americans are currently considering leaving their jobs while half of “Generation Z” is also choosing to start off their careers as independent freelancers.

- Enterprise push. Before the pandemic, Upwork was largely a “retail” site. Gig seekers would use the site to find small, one-time jobs. But more and more, Upwork is evolving into an enterprise platform. Companies as large as Microsoft (NASDAQ:MSFT) have used the platform to drive their contract hires.

- Sales expansion. Following alongside this newfound enterprise orientation, Upwork aggressively expanded its sales team in the third and fourth quarters of FY21, while also boosting its marketing budget to increase unaided brand awareness, which should start bringing us tangible revenue benefits in FY22. Again, Upwork is a late bloomer here, but it’s fully capitalizing on heightened demand for its services to chase growth in a very intentional way.

- Beginning to eke out profitability. Upwork is now profitable on an adjusted EBITDA basis, which will give investors more comfort in a jittery stock market.

Q4 download

We note that through Q4, Upwork’s results have been excellent – and I think we’ll find that when Upwork reports Q1 results, a lot of the near-term concerns around Russia will likely have been overplayed.

Take a look at the Q4 earnings summary below:

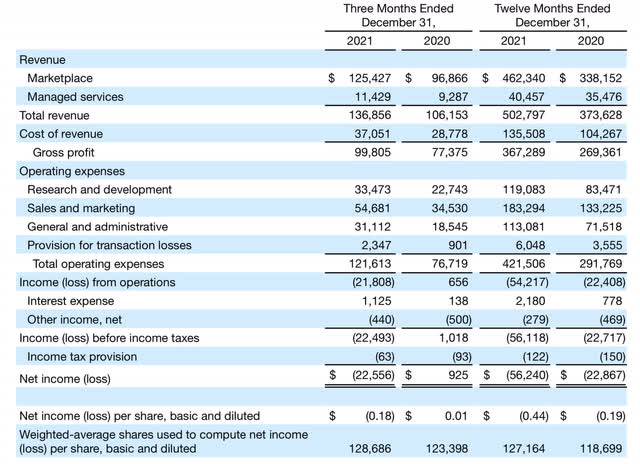

Upwork Q4 results (Upwork Q4 shareholder letter)

Upwork’s revenue grew 29% y/y to $136.9 million in the quarter, beating Wall Street’s expectations of $131.8 million (+24% y/y) by a substantial five-point margin.

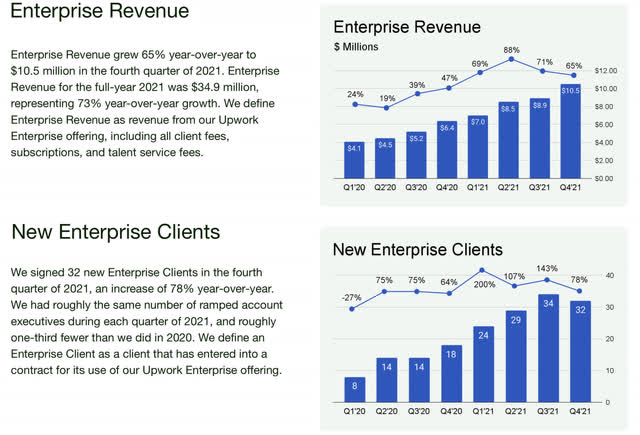

The biggest driver of growth, though it’s still a relatively small portion of overall revenue, is Upwork’s enterprise business – into which the company has invested significantly in terms of marketing and sales talent. In Q4, enterprise revenue hit a record of $10.5 million (representing only 8% of total revenue, with plenty more contribution to go). The company has also steadily added roughly 30 net-new enterprise clients every single quarter of the past year, as shown in the chart below:

Upwork enterprise clients (Upwork Q4 shareholder letter)

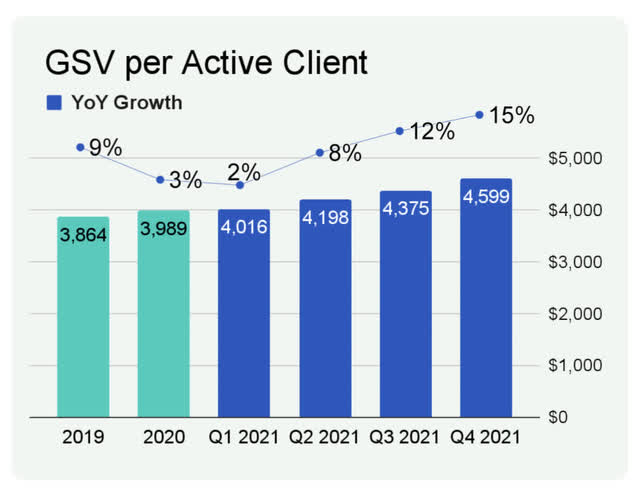

Driven largely by the shift toward larger enterprise clients and recurring buyers, Upwork has also continued to grow its GSV (gross services value) spend per client. In Q4, GSV per active client saw accelerated 15% y/y growth to $4,599:

Upwork GSV per client trends (Upwork Q4 shareholder letter)

Note as well that while take rates in Q4 (the amount that Upwork generates on a marketplace transaction on its platform) were slightly down to 14.0% (a 60bps reduction from 14.6% in the year-ago Q4), the company expects the greater contribution from enterprise clients the eventually drive an increase in take rates.

Upwork still intends to invest heavily in growth. Relative to its headcount in Q3 when it announced this expansion, Upwork plans to double the number of account executives it has by the end of 2022. The company is also doubling down on marketing spend in 2022, targeting $80 million of brand spend (versus $47 million in FY21).

This shift in focus toward growth has taken a dent on margins, of course. Sales and marketing expenses as a percentage of revenue rose to 39%, seven points higher than 32% in the year-ago quarter. This has dropped Upwork’s pro forma operating margins to -3.9%, a sharp fall from positive 7.1% in the year-ago Q4.

That being said, however, given Upwork’s superb enterprise momentum plus the fact that it’s the “right time” to take center stage in the remote-work/freelance space while the theme is hot, the company’s decision to invest for growth in 2022 is a smart and well-timed one.

Management is still guiding to $1 billion in revenue by FY24, a target it has not withdrawn since the Russia announcement. Per CEO Hayden Brown’s prepared remarks on the Q4 earnings call, detailing the company’s growth priorities:

In terms of time frame, 2021 was the first year, executing our three-part strategy to innovate, evangelize and scale our work marketplace. We have always known this strategy will take multiple years to fully deliver and we are pleased with our progress to date. Due to this progress and are confident in our execution, we are accelerating our target of achieving $1 billion in revenue by one year to 2024, up from our previous time line of 2025, with a compound annual growth rate of approximately 25% over the next three years.

We are also excited to announce, that we are setting an enterprise revenue target of $300 million by 2025, almost 10 times what we delivered in 2021, which represents a compound annual growth rate over the next four years of more than 70%. Our innovation ambitions are bigger than ever. Amidst the backdrop of the work awakening at time in which people are reevaluating what they want in work and life and realigning their priorities accordingly. We have embraced an expanded vision for Upwork as the world’s work marketplace.”

Key takeaways

To me, it’s the right time to take advantage of Upwork’s sharp declines in price to build a position for the long term. The share of remote/freelance workers will only continue growing, as enterprises recognize that they need to adapt to workers’ demands for flexibility in order to remain fully staffed. Buy the dip here.

Be the first to comment