Pietro S. D’Aprano/Getty Images Entertainment

Better than other sectors, fashion companies managed to recover from the pandemic crisis. And despite the recent geopolitical turmoil, in the first nine months, the 78 multinational fashion companies with revenues exceeding one billion recorded a 15% increase in turnover. At the aggregate level, this was led by the European market rebound, which grew by 24%, and by the American one (+19%), while Asia (+3%) was penalized by China’s zero COVID-19 policy. We recently analyzed Moncler (OTCPK:MONRF) with an interesting publication called Winter is Coming, confirming our buy rating target supported by MACRO and MICRO upsides.

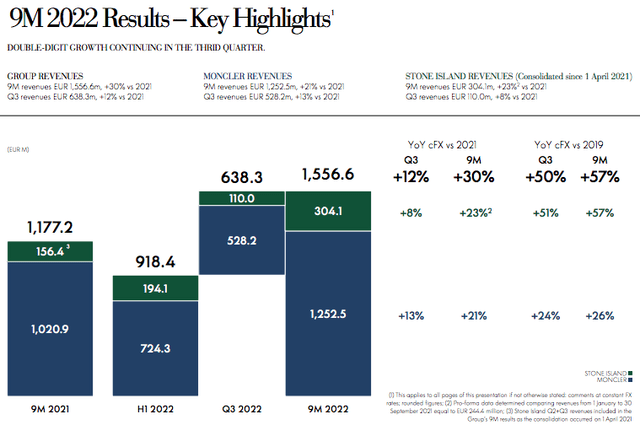

Q3 results

Last week, the company released its quarterly numbers and positively outperformed the market. In the first nine months of 2022, Moncler achieved consolidated top-line sales of €1.5 billion with a plus +32% at current exchange rates and a plus 30% at constant exchange rates compared to the same period of 2021. These positive performances include the Moncler brand as well as the Stone Island division which recorded revenues of €304.1 million.

During the Q&A call, Luciano Santel, Chief Corporate and Supply Officer of the group, declared that the consensus numbers for 2022 are “achievable“, even if “everything will depend on the geopolitical scenario and also on the trend of COVID-19“. Cross-checking Wall Street consensus estimates, on average, they forecast 2022 revenues of approximately €2.5 billion with an operating profit of €760 million (and a margin of around 30%). The Moncler manager also indicated that sales in China in the first two weeks of October went very well, although they were affected by the new lockdowns for COVID-19 new outbreaks. The company has also announced that it will probably make new adjustments to its listing price if costs continue to rise and also emphasized that clients seem very inelastic to incremental price increases (with volume demand which has not been impacted).

Mare Evidence Lab’s key takeaways:

- We are raising our revenue line projection by 1% for 2022 (this is also in line with consensus expectations). In our Q4 numbers, Moncler sales are forecasted to be up by 44% compared to 2019 values

- Looking ahead, we confirm our 2023-24 estimates with an expected turnover in 2023 of €2.8 billion and a net profit of €584 million

- The P/E in 2023 and in 2024 stands at 22.5x and 19.6x against an historical average of around 25x

- The Chinese recovery is comforting, even if there is uncertainty about the winter season trend in the area

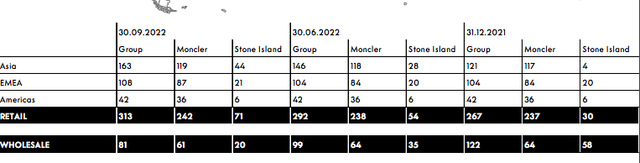

- There is a positive upside on a more sustained revenue trend of in-store sales compared to wholesale ones (and given Moncler store segment exposure, this is supportive for the company) (Fig below)

- In October/November, despite good third-quarter sales and a reassuring outlook for the coming months, Moncler’s stock price was relatively weak compared to the sectors

- On the ESG side and for the fourth consecutive year, Moncler scored at the highest level in the S&P Global Corporate Sustainability Assessment within the sector

Conclusion and Valuation

Moncler remains one of our industry favorite stocks, thanks to its quality business, strong brand momentum, Stone Island development prospects, and attractive valuation. Therefore, we continue to value the company with a target price of €75.

Be the first to comment