Feverpitched/iStock via Getty Images

The Real Brokerage (NASDAQ:REAX), Inc. operates as a technology-powered real estate brokerage company. The Real Brokerage Inc. (TSE: REAX) is quickly becoming a juggernaut in the real estate brokerage business. As of August 2, 2022, the Company had assembled a roster of 6,000 agents and is licensed to do business in 44 U.S. States, two Canadian Territories, and the District of Columbia.

- We initiate with a Buy-Long-Term rating

- 12-Month Price Target: $2.10.

|

52-Week Range |

$1.00-$4.35 |

Total Debt |

— |

|

Shares Outstanding |

178.3 million |

Debt/Equity |

— |

|

Insider/Institutional |

9.34%/42.00% |

ROE (LTM) |

NM |

|

Public Float |

86.64 million |

Book Value/Share |

$0.10 |

|

Market Capitalization |

$285.35 million |

Daily Volume (90-day) |

56,859 |

|

FYE Dec |

FY 2021A |

FY 2022E |

FY 2023E |

||

|

EPS ($) |

ACTUAL |

CURRENT |

PREVIOUS |

CURRENT |

PREVIOUS |

|

Q1 Mar |

$(0.04)A |

$(0.02)A |

$(0.01)A |

||

|

Q2 Jun |

$(0.03)A |

$(0.02)A |

$(0.01)E |

||

|

Q3 Sep |

$(0.01)A |

$(0.04)E |

$(0.01)E |

||

|

Q4 Dec |

$(0.02)A |

$(0.04)E |

$(0.01)E |

||

|

Year* |

$(0.07)A |

$(0.13)E |

$(0.05)E |

||

|

P/E Ratio |

NM |

NM |

NM |

||

|

Change |

NM |

NM |

NM |

||

* Numbers may not add up due to rounding and changes in diluted shares outstanding.

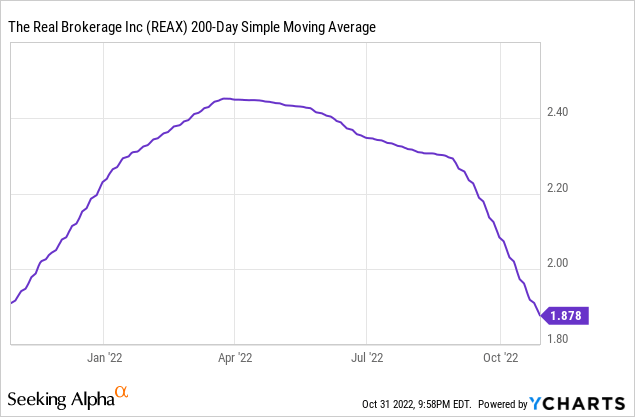

Investment Thesis

REAX has developed a very strong, internet-based real estate business that offers agents highly compelling economics versus traditional brick and mortar real estate brokerage businesses. The Company’s technology platform has recently been upgraded and has the ability to support as many as 100,000 agents, giving REAX substantial runway to continue to grow its roster of agents without spending significant capital. Recently boasting a roster in excess of 6,000 licensed agents, up from just 3,850 at the end of FY:21, REAX has experienced tremendous revenue growth in FY:22. The only factor causing caution for the potential upside to the Company’s revenues and in turn, the equity price, is the challenging macroeconomic backdrop facing the real estate industry. Rapidly rising interest rates are already causing declining transaction volumes and lower prices in the market, and with a hawkish Federal Reserve implying more rate hikes in the near future, we believe that even with continued growth in its roster of active agents, REAX could face challenging headwinds to continuing its rapid revenue growth in the near-term.

Traditional real estate brokerage firms want agents to come into an office, have layers of management that need to be compensated, and do not offer brokers particularly compelling economics. This antiquated business model that has been incredibly averse to change has opened the door to innovative technology-based companies such as REAX, who can offer agents significantly better economics and a more innovative technology platform for their business.

REAX offers agents four compelling opportunities to enhance their income versus traditional real estate brokerages.

- Keep more commission. REAX offers agents commission payouts as high as 85% to 100% on transactions, whereas traditional brokerages historically paid agents as low as 50% of commissions. While the competitors have more recently raised their payouts as many agents are transitioning to companies like REAX, most are still well below the 85% threshold.

- 100% mobile brokerage services. REAX is a 100% mobile real estate services company, so agents have all of the resources that they need right on their mobile devices (phones, tablets, and laptops) to close transactions and nothing has to be deducted from their commission payouts to pay for unused office space and needless overhead.

- Build equity in REAX. All of the Company’s agents have the opportunity to earn equity in the Company through the REAX equity incentive program. A high percentage of the Company’s agents have elected to participate in the equity incentive program and the dilution impact is limited to 2% to 3% of overall outstanding shares in any given year.

- Earn more with revenue sharing. REAX offers agents a very compelling referral bonus opportunity. Agents are able to participate in a revenue share program that has five tiers for their referrals, up to an annual cap. Thus, if an agent refers a high producer, there could being meaningful upside to their compensation through the production of their referrals, in addition to the higher payout they are already earning on their own production.

The Vertical Integration Opportunity

Initially, REAX wanted to build the most compelling opportunity for agents in the residential real estate business to build a meaningful revenue base. In doing so, the Company has had to make some gross margin sacrifices. However, the truly compelling long-term value opportunity as REAX continues to evolve is around the vertical integration opportunities that the Company is now working to seize to continue to enhance the broker’s experience and to more fully penetrate the consumer side of transactions.

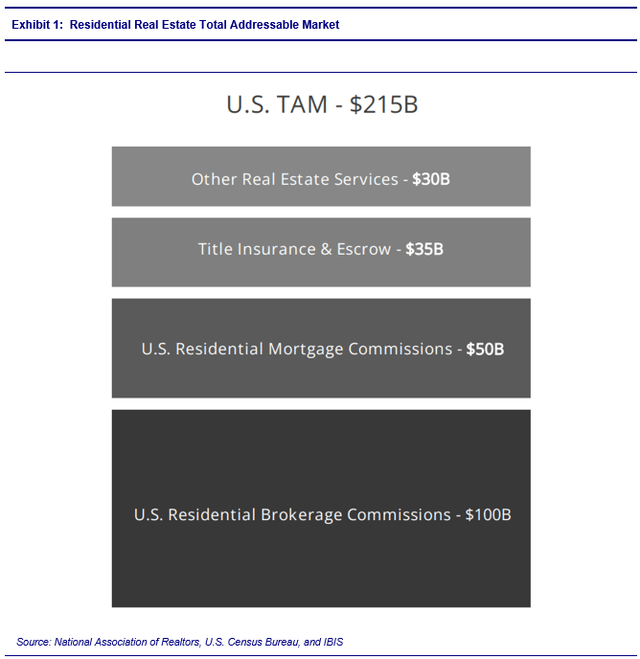

Overall, the residential real estate business in the United States represents a total addressable market (TAM) of $215 billion in annual revenue. The largest piece of the pie is in brokerage commissions, which are estimated to represent approximately $100 billion annually, or 46.5%, of TAM revenue. However, beyond that, mortgage commissions, title insurance and escrow, and other real estate services represent the remaining $115 billion of annual revenues, making up 55% of the TAM and offering a compelling vertical integration opportunity for REAX. Exhibit 1 below shows a quantified illustration of the TAM.

National Association of Realtors, U.S. Census Bureau, and IBIS

The Real Title

In January, 2022, REAX announced the acquisition of Expetitle, Inc., a company that has developed technology that simplifies the paper-intensive and time-intensive title and eEscrow process, reducing errors and saving time. Expetitle, which was rebranded as The Real Title in April, 2022, is a multi-state title company that was operating in Florida, Georgia, and Texas at the time of the acquisition, delivering fully digital closings through a secured collaborative platform. This acquisition gives REAX a toehold in the $35 billion a year title business.

The Future Real Lending

On September 26, 2022, REAX announced the acquisition of LemonBrew Lending Corporation. LemonBrew is a tech-enabled home loan platform, licensed to provide a full suite of mortgage services across 20 states in the U.S., including Florida, Texas, and California. The transaction is expected to close in Q4:22 and play a meaningful role in the Company’s vertical integration strategy. This acquisition will give REAX a solid foothold in the $50 billion a year mortgage business, enabling the Company to further vertically integrate and provide home buyers and sellers with a one stop shop for more of the steps in the residential real estate transaction process.

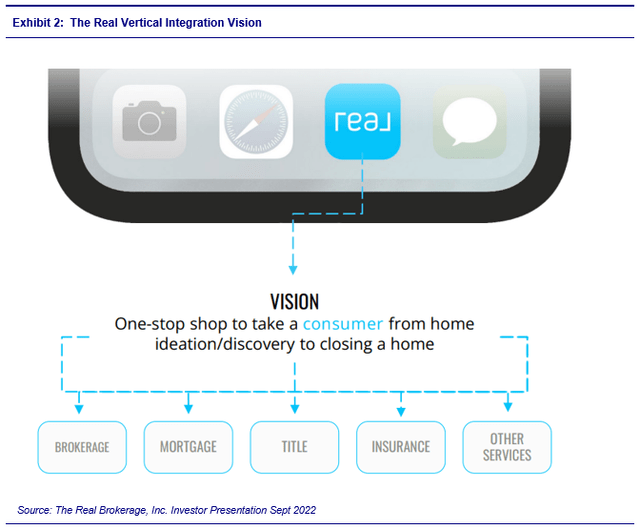

The Real Vertical Integration Vision

The Company’s long-term vision is to offer home buyers a one-stop shop solution to manage the entire home buying process. If REAX can become more fully vertically integrated, home buyers will have a more predictable, more transparent, and more organized process. The Company’s vertical integration Vision is displayed in Exhibit 2.

The Real Brokerage Company Presentation

As discussed, REAX has already made acquisitions in the title and mortgage spaces, so additional needs for a more fully integrated services offering include insurance and other services, such as survey services, home inspection, and the like. As such, we would expect REAX to continue to seek acquisition opportunities in spaces such as Insurance to continue the progression of their vertical integration strategy. Alternatively, it is conceivable that the Company could also pursue greenfield buildouts to complement the vertical integration strategy, but with a strong balance sheet, acquisitions are likely to be the quickest and easiest way to continue the buildout.

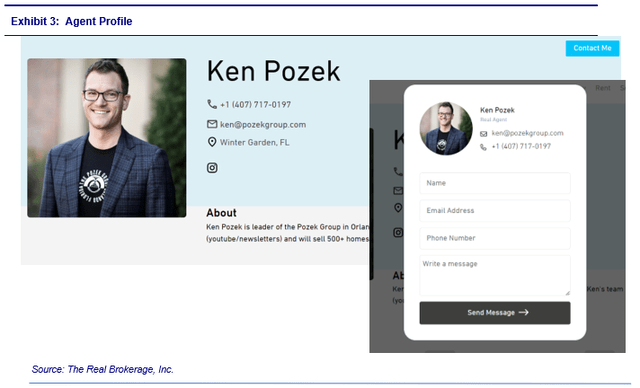

Current Technology

As mentioned previously, REAX recently upgraded its technology platform so that with its current technology, the Company can support as many as 100,000 agents. When an agent joins REAX, they are added to the Company website, making it easy for potential customers to look them up and find their contact information. Exhibit 3 below shows a contact page for an agent on the REAX website.

The Real Brokerage Company Presentation

As the images illustrate, the Company makes it easy for potential customers to find and contact agents and for the customers to provide their contact information to the agent, so that he or she can quickly connect with the prospective client.

Competition

In a business that generates an estimated $100 billion in annual revenue, it is no surprise that REAX faces substantial competition from both traditional real estate brokerages, as well as innovative technology-based competitors. Many of the Company’s competitors have long operating histories and entrenched operations. According to the National Association of Realtors, as of July 2022, there were 1.6 million licensed agents in the U.S. and approximately 90% of them are still with legacy brokerages such as Keller Williams, ReMax, and Century 21, which have had dominant market share since the mid-1900s. REAX also faces competition from other real estate operations that are similar, such as eXp World Holdings (EXPI), which started in 2008 and boasted a roster in excess of 82,000 agents at the end of June, 2022.

REAX competes for agents primarily on the basis of the more desirable potential compensation package that it can offer its agents, as well as on the basis of its proprietary technology, which is more innovative than that possessed by traditional brokerage companies. The other significant differentiators that REAX has relative to traditional real estate brokerage firms is the vertically integrated title company, the recently acquired mortgage business, and the vision to become more fully vertically integrated. Successfully attaining more robust vertical integration will make residential real estate transactions more seamless for brokers and consumers alike, which will be a meaningful competitive advantage for REAX.

Recent News & Acquisitions

- On September 26, 2022, the Company acquired LemonBrew Lending, a tech-enabled home loan platform, licensed to provide a full range of mortgage service in 20 states in the U.S. REAX is paying an aggregate purchase price of $1.25 million, broken down as $800,000 in cash and $450,000 in common stock based on a five-day volume weighted average price of the Company’s shares. The transaction is expected to close in Q4:22.

- On August 22, 2022, REAX announced that it had surpassed the 6,000 agent milestone.

- On January 21, 2022, the Company announced the acquisition of Expetitle, a title and eEscrow company, for aggregate cash consideration of $8.23 million. Expetitle has subsequently been rebranded The Real Title.

- Throughout the course of FY:22, REAX has announced ten major real estate brokerage teams as having joined the Company, exemplifying growth and ability to attract top producing agents.

Management

Tamir Poleg, Chairman, CEO, and Director. The Company is led by Tamir Poleg, Chairman and CEO who founded the Company in 2014. Prior to founding REAX, Poleg founded and spent seven years as CEO of Optimum RE Investments LLC, a Texas-based investment company focused on multi-family real estate and technology, which was sold in 2013. Earlier in his career, he held a number of leadership roles in organizations that spanned the real estate and technology sectors across multiple continents. He holds a BA in economics from The College of Management Academic Studies and is a member of the Forbes Real Estate Council.

Michelle Ressler, CFO. Michelle Ressler was appointed CFO of REAX in July 2020. Before joining the Company, Michelle spent six years as the Controller for Canaccord Genuity Inc. (TSX: CF), a leading full-service global financial services firm with operations in two key segments of the securities industry, wealth management and capital markets. In this role, Michelle was responsible for implementing robust global financial systems, improving operational performance, and creating corporate value. Michelle started her career in public accounting focusing on corporate tax management and audit for both privately held and public companies. She holds a BS in business administration and finance from York College of Pennsylvania and is a member of Chief, an exclusive network of executive women.

Raj Naik, COO. Raj Naik has been COO of REAX since November 2021. Prior to joining the Company, he was a Managing Director at Workrise, a leading job placement and career building resource for skilled laborers from December 2019 through November 2021. Before his time at Workrise, Naik was CEO of Key, a curated marketplace offering vetted vacation rentals and home services during 2019, after spending four years at Uber in a variety of positions, culminating in the role of General Manager, Uber Eats Mid-Atlantic. Raj co-founded his first company while studying at the University of North Carolina at Chapel Hill, which was later sold to Oracle. He holds a Bachelor’s degree from the University of North Carolina, Chapel Hill, as well as an MBA and an MA in Government from Johns Hopkins University.

Pritesh Damani, CTO. Pritesh Damani is the Chief Technology Officer at The Real Brokerage, where he has developed an industry-leading proprietary platform that streamlines communication and document management for real estate agents. In January 2021, Pritesh joined Real’s senior leadership team through the Company’s acquisition of RealtyCrunch, a modern web and mobile app for home buyers and real estate agents, where he served as Founder and Chief Executive Officer since 2019. Prior to founding RealtyCrunch, Damani held Engineering roles with a variety of companies including National CineMedia (NCMI), Atypon Systems, and Rovi over the course of 15 years. He holds a Bachelor’s in Computer Engineering from the University of Mumbai and a Masters in Computer Science from Pace University.

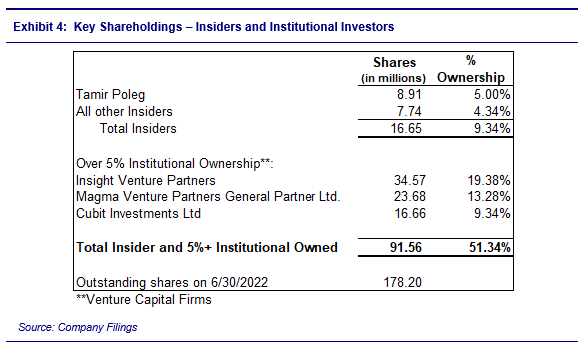

As of June 30, 2022, insiders owned approximately 9.34% of REAX outstanding common shares, and three institutions owned a combined 42% of the Company’s outstanding shares. The three institutional owners are all venture capital firms, which is not uncommon for a Company that, until recently, was not listed on a major stock exchange. We would expect that over time these institutions will look to divest some or all of their stakes in the Company, but will likely be opportunistic in doing so, as venture funds typically have significant discretion regarding managing their investments. As part of the Company’s compensation plan, real estate agents can receive restricted stock units (RSUs) as a portion of their compensation. Therefore, we expect insider ownership to continue to grow, as employees continue to take some of their compensation in the form of equity. Exhibit four below shows a list of insider shareholdings.

Company Filings

Financial Results and Forecast

REAX has displayed impressive revenue growth in H1:22, as its roster of real estate brokers continues to grow at a rapid pace. The Company has grown its agent headcount from 3,850 at December 31, 2021 to 5,600 at the end of Q2:22 and is now over 6,000 today. Revenues of $112.4 million in Q2:22 were up 82% sequentially versus Q1:22 and 386% year-over-year versus Q1:21. The Company is still modestly EBITDA negative. We calculate an EBITDA loss of $1.3 million in Q2:22, but over time, management expects that the Company will become EBITDA positive as it can layer in revenues from higher margin services, such as mortgage and title.

Management does not currently provide any financial guidance, so we are left to our best judgement when it comes to creating a financial forecast. For Q3:22, we are projecting revenue of $93.4 million, which would represent a 17% sequential decline versus Q2:22, but 141% year-over-year growth versus Q3:21. We expect the continued growth in the Company’s roster of agents to be adversely offset by the well-publicized decline in overall transaction volumes. For Q4:22, we expect revenues to decline 5% to $88.8 million, due to seasonal factors and continued transaction volume pressure from rising interest rates, offset by continued growth in the Company’s roster of agents.

Looking ahead to FY:23, we project continued revenue growth, albeit at a slower pace, as we expect macroeconomic headwinds to again offset the continued growth of the Company’s agent roster. For the full year, we are projecting revenue growth of 9% for total revenue of $389.5 million. We expect REAX to turn modestly EBITDA positive in FY:23, as the Company begins to layer in some higher margin revenues from its recently acquired title and mortgage businesses. Importantly, with $32.5 million in cash on the balance sheet and the Company not currently burning meaningful amounts of cash, we do not expect the Company to need to raise significant amounts of capital in the near to intermediate term. In fact, if the Company begins generating steady EBITDA in FY:23, we would expect REAX to begin to be able to generate sustainable free cash flow without requiring significant capital infusions.

Investment Risks

- REAX is expected to remain EBITDA negative through the end of FY:22, which will likely result in negative cash flow.

- REAX is 100% levered to the real estate market, which faces material headwinds in the form of rising interest rates and a hawkish Federal Reserve.

- REAX faces meaningful competition from larger market participants such as EXPI and more seasoned competitors such as RMAX.

Valuation

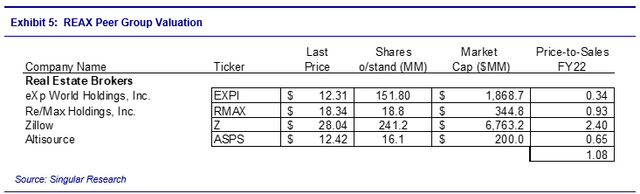

We value REAX using a peer group analysis valuation framework, as well as a discounted free cash flow model. On a positive note, there are several publicly-traded competitors that enable a reasonably healthy comparable company analysis. The downside is that most competitors do not seem to generate meaningfully positive, if any, positive EBITDA or earnings per share, leaving only price to FY:22 projected revenues as a beneficial valuation metric. The identified peer group is shown in Exhibit 5 below.

Singular Research

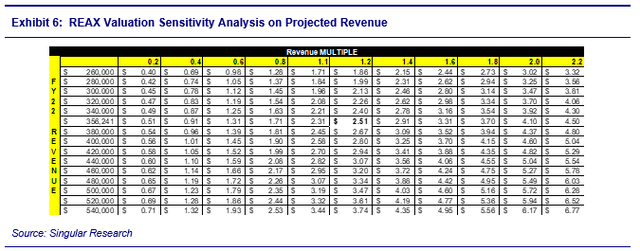

The publicly-traded company comparable group trades at an average multiple of 1.08 times projected FY:22 revenues. With REAX expected to exhibit strong revenue growth in FY:22, we believe that valuing the Company at a slightly higher multiple than the peer group multiple at 1.2x projected FY:22 revenues, is reasonable. REAX is growing its agent count at a significantly higher rate than the average of its peers. For example, traditional broker ReMax experienced 2.7% year-over-year growth in agents in Q2:22, whereas REAX grew its agent count by 119% in the same time frame. Even larger online rival EXPI only realized a 42% year-over-year increase in agents in Q2:22. Using the 1.2x multiple generates a price target for the equity of $2.51 per share, representing 64% upside from its current value. Exhibit 6 provides a detailed sensitivity analysis of this valuation methodology.

Singular Research

As an alternative valuation methodology, we used a discounted free cash flow model to value REAX off of projected future growth in revenues and EBIT. We project that REAX will turn modestly EBIT positive in FY:23 and FY:24, then project meaningful EBIT growth in FY:25 through FY:28, as we expect the Company to continue to aggressively grow its agent base and finish building out its vertical integration. For FY:28 and beyond, we use a terminal value growth rate of 3% and a weighted average cost of capital [WACC] of 15.45% and arrive at a projected value for the equity of $1.71.

Blending our two valuation models, we arrive at a 12-month average price target of $2.11, which we round down to $2.10.

Be the first to comment