Kamil Krzaczynski

Molson Coors Beverage Company (NYSE:TAP) manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, Middle East, Africa, and Asia Pacific. The firm is part of the consumer staples sector and the brewers industry.

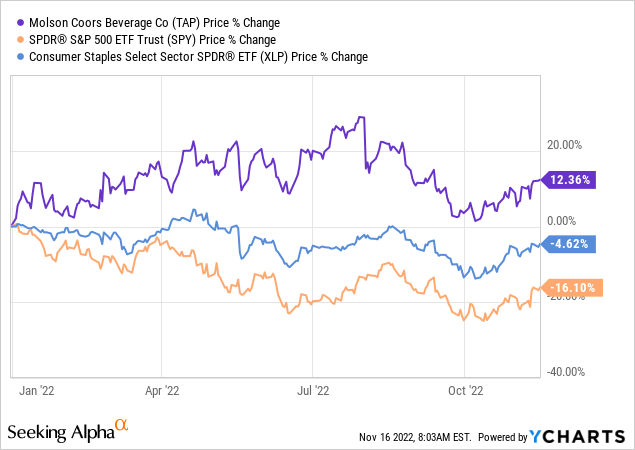

Year-to-date the company’s stock price has increased by more than 12%, substantially outperforming both the S&P500 (SPY) and the consumer staples sector (XLP).

In today’s article we are going to be focusing on the firm’s latest earnings results to gauge whether this outperformance can last and whether it is a right time to invest in the stock now.

Earnings highlights

In the third quarter of 2022, TAP has managed to achieve a net sales growth of 4% year-over-year. The growth was primarily driven by the positive net pricing and the favourable sales mix. On the other hand, both financial volumes and brand volumes have decreased by 0.2% and 2% respectively. Net sales per hectoliter on a brand volume basis in constant currency has grown by 9.2%, driven by the positive net pricing and favorable sales mix.

We believe that the sales growth is a strong indication that the demand for TAP’s products remains high despite the poor consumer sentiment in the United States. The negative changes in both financial and brand volumes are primarily driven by political and geopolitical events, which we believe are temporary in nature, including the Québec labor strike and the Russia-Ukraine conflict.

On the other hand, cost of goods sold have skyrocketed in Q3:

Cost of goods sold (COGS) per hectoliter: increased 20.0% on a reported basis primarily due to a $192.6 million increase as a result of changes in our unrealized mark-to-market commodity positions, cost inflation mainly on materials, transportation and energy costs, and mix impacts from portfolio premiumization, partially offset by the favorable impact of foreign currency movements and lower depreciation expense. Underlying COGS per hectoliter: increased 12.0% in constant currency, primarily due to cost inflation mainly on materials, transportation and energy costs and mix impacts from portfolio premiumization, partially offset by lower depreciation expense.

While this increase has a substantial negative impact on the firm’s financials and causes a material contraction in the margins, we believe that the recently published inflation figures in the United States are giving room for some optimism going forward. Commodity and material prices have also came off of their peaks seen in Q2 this year. Further, the conflict between Russia and Ukraine also appears to be deescalating, with the potential for peace talks on the horizon. For these reasons, we see these headwinds as temporary, which are expected to diminish by the first half of 2023.

The firm has also reiterated its full year guidance for 2022, which signals management’s confidence that the demand will continue to remain high for the company’s products despite the tough macroeconomic environment.

- Net sales: mid single-digit increase versus 2021 on a constant currency basis.

- Underlying income (loss) before income taxes: high single-digit increase compared to 2021 on a constant currency basis. Due to increased inflationary cost pressures and weakening demand in Central and Eastern Europe, we expect underlying income (loss) before income taxes to be at the lower end of the range.

- Deleverage: We expect to achieve a net debt to underlying EBITDA ratio below 3.0x by the end of 2022.

- Underlying free cash flow: $1.0 billion, plus or minus 10%.

- Consolidated net interest expense: approximately $265 million, plus or minus 5%.

While the quarterly results have been mixed, we believe that TAP is a solid stock to hold. Let us look at some of the reasons why.

1.) Not directly impacted by low consumer confidence

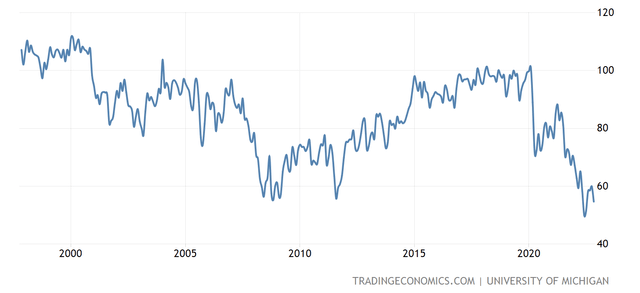

Consumer confidence is a leading economic indicator, which is often used to gauge the potential changes in the spending behaviour of the people in the near future. Low consumer confidence can be a sign that people may start saving money and spend less on durable, discretionary, non-essential items.

Currently, consumer confidence in the United States is at extremely low levels, despite the slightly bouncing up from the June lows.

U.S. Consumer confidence (Tradingeconomics.com)

Normally, the demand for staples are not directly impacted by such trends. To prove our hypothesis let us take a look how TAP’s stock price has performed during times of low consumer confidence in the last 25 years.

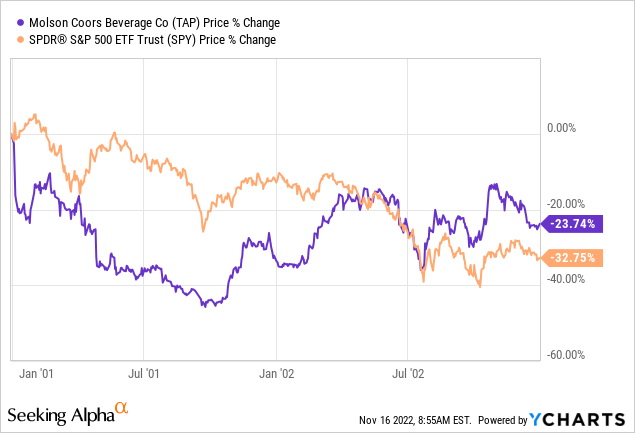

2001-2003

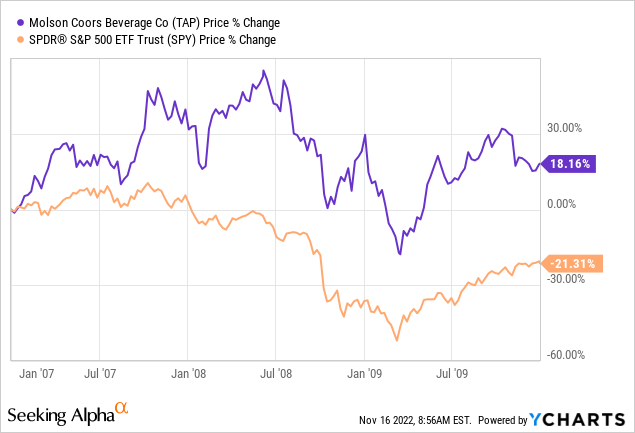

2007-2010

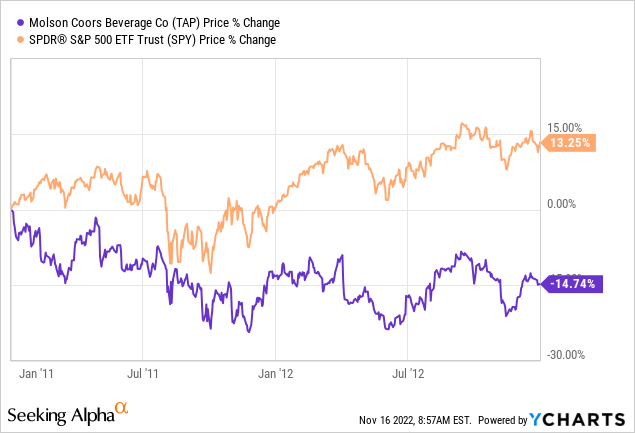

2011-2013

2 out of 3 periods TAP’s stock has managed to outperform the broader market. If the firm is able to reduce their costs of goods sold in the near future, we believe that TAP may continue to outperform the broader market in the current volatile market environment.

2.) Dividends

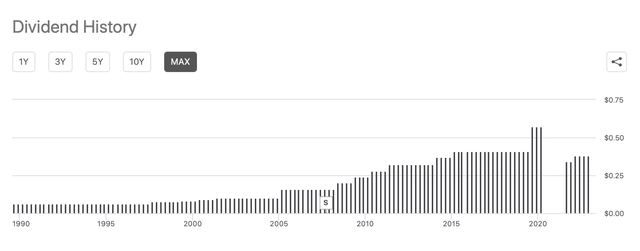

TAP has a solid track record of paying dividends to its shareholders. Before the pandemic, the firm has been paying dividends consecutively for more than 30 years and in most the years they have even managed to increase the quarterly payments. With the start of the pandemic, however this trend came to an end and the firm had to pause the payments.

Dividend history (Seeking Alpha)

In the second half of 2021, payments have been resumed, however they have not yet reached pre-pandemic levels.

In our opinion, pausing the dividend during the pandemic was a sensible. We appreciate the management’s decision, as keeping the dividend payments would have likely put significant financial burden on the firm and would have likely resulted in much less financial flexibility to navigate through the challenging environment.

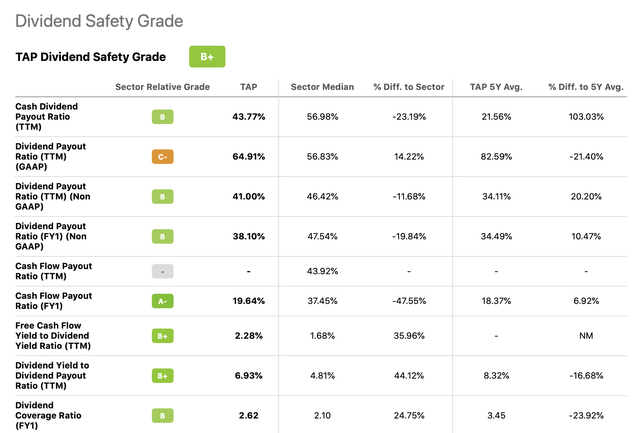

Right now, we believe the current dividend is safe and sustainable. Most of the company’s dividend safety metrics compare favourably to the consumer staples sector medians, even if they are in some cases higher than its own 5Y averages.

Dividend safety (Seeking Alpha)

While we like these dividends, the question is, how much should we be paying for them?

Valuation

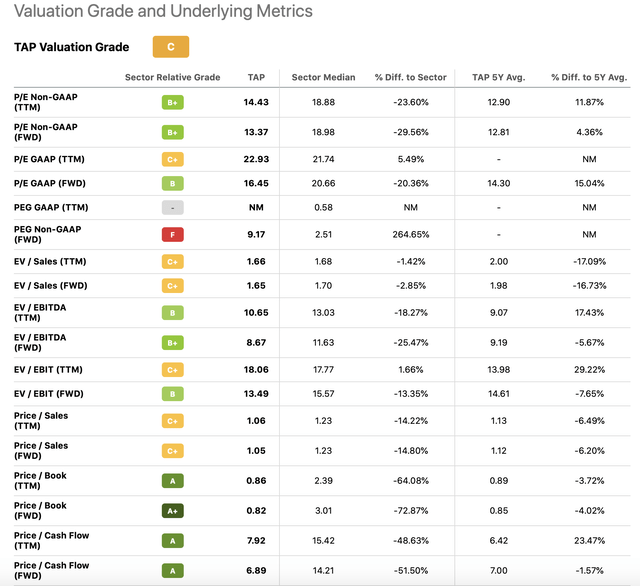

According to most of the traditional price multiples, TAP is trading at a discount compared its respective sector median.

Valuation metrics (Seeking Alpha)

On the other hand, it is trading somewhat above its own 5Y averages according to quite a few metrics. Right now, we do not believe that this premium compared to the 5Y averages is justified. we would like to see the stock price come down by 10% to 15%, before we would consider starting a new position or adding to an existing one.

Key takeaways

TAP has reported mixed results in the third quarter of 2022. While sales have grown by 4%, the costs of goods sold have skyrocketed by as much as 20%.

Despite these results, the stock has managed to keep outperforming the broader market. We believe that this outperformance may last, if the firm manages to control their COGS.

At this point, we rate the stock as a “hold”, due to the valuation and the near term uncertainty.

Be the first to comment