lindsay_imagery

The momentum anomaly was first commercialized by Mark Carhart in the 1990s and has served many traders well over the past few decades. Over the years, derivations of momentum investing have surfaced, but Blackrock’s (NYSE:BLK) iShares Edge MSCI USA Momentum Factor ETF (BATS:MTUM) is an old-school price momentum ETF that seeks alpha by leveraging various cross-sectional and time series momentum techniques.

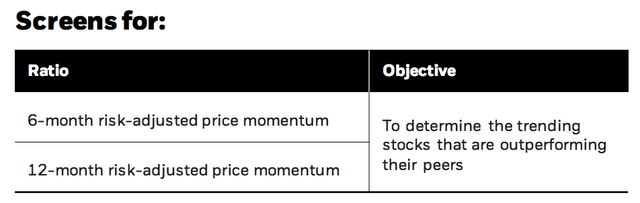

Methodology (BlackRock)

Despite our overwhelming respect for BlackRock, we think this ETF makes little sense as it doesn’t emphasize influencing factors that could counteract its statistical methodology.

Today’s analysis isn’t about price speculation. Instead, it serves the purpose of enhancing market transparency by dissecting a thematic approach that many might misunderstand.

The Momentum Factor Explained

Cross-Sectional Momentum

Momentum anomalies occur in two formats. The first is cross-sectional momentum, which seeks to invest in the stocks that outperformed the market during the past 12 months. The method behind the madness is that investors remain invested in stocks longer than they ideally should; therefore, you can make a profit by rotating in and out of momentum stocks.

Empirical evidence suggests that cross-sectional momentum does work. However, it is not easy to apply and manage.

Time Series Momentum

Time series momentum strategies consist of investing in stocks that gained in value in the preceding 12 months and staying invested until the momentum trend eventually wanes. It’s similar to cross-sectional momentum; however, the difference is that you’re not looking at market quantiles where the top quantile of stock performers will be bought, and the bottom quantile will be avoided (or sold). Instead, time-series momentum is utilized in isolation.

Again, empirical evidence suggests the strategy works; however, it’s challenging to apply and manage.

Why MTUM’s Momentum Is Polarized

I’m just going to come out and say it; this momentum ETF probably won’t produce superior results because it doesn’t place enough emphasis on sector allocation.

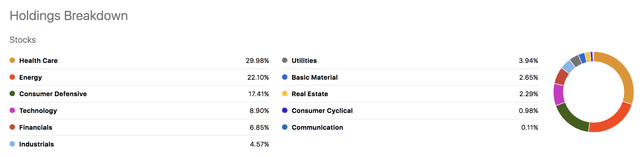

MTUM Sector Allocation (Seeking Alpha)

The ETF holds significant exposure to the energy sector, which is a dangerous ploy. Energy stocks are extremely cyclical, and their record-breaking profits during the past year shouldn’t be overhyped; there will come a day when mean reversion settles in.

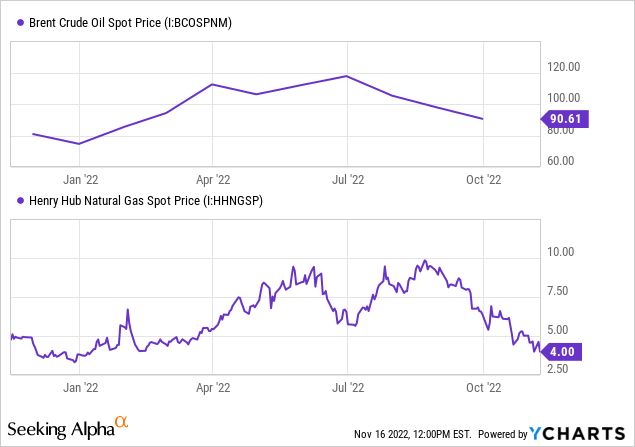

Energy supply shortages will eventually get filled, and oil and gas prices will likely retreat. Based on the charts below, it’s evident that oil and gas prices are already starting to recede after they spiked during the pandemic and exacerbated as the Russia-Ukraine war unfolded. Furthermore, global recession risk is extremely high, and historically speaking, resource prices fall off a cliff whenever the economy starts to contract.

Essentially, I want to convey that energy stocks won’t boom forever and will eventually retreat. In addition, energy stocks are volatile and can decline sharply, often inflicting significant losses.

Below is a table of the ETF’s top energy holdings and their fundamental valuation metrics for you to garner more insight.

| Stock | Price-Book | Price-Earnings | % of Portfolio |

| Chevron (NYSE: CVX) | 2.29 | 10.87 | 4.96% |

| ExxonMobil (NYSE:XOM) | 2.53 | 8.98 | 5.74% |

Source: Seeking Alpha

The ETF’s healthcare and consumer defensive exposure can be seen as a positive in today’s topsy-turvy economy as they’re counter-cyclical industries. However, I don’t understand how you’re going to drive momentum if you have large exposure to sectors such as real estate, financials, and technology; they’d likely move in the opposite direction of energy plays throughout the economic cycle. Thus, you’d likely see much offsetting in the portfolio throughout the economic cycle, preventing the ETF from eclipsing the broader market.

The table below presents a few of the ETF’s counter-cyclical holdings with their key valuation metrics. It’s for you, as the reader, to assess the situation; they look a tad overvalued.

| Stock | Price-Book | Price-Earnings | % of Portfolio |

| United Health (NYSE:UNH) | 6.30 | 23.58 | 4.91% |

| Johnson & Johnson (NYSE:JNJ) | 6.05 | 17.34 | 4.22% |

| Costco (NASDAQ:COST) | 11.29 | 39.67 | 2.94% |

Valuation, Dividends & Cost

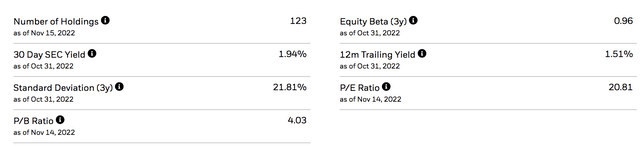

At first glance, the ETF seems overvalued as its price-to-book ratio is trading at a surplus than that of the SPDR S&P 500 ETF Trust (NYSEARCA:SPY). Furthermore, the ETF’s PE ratio exceeds the SPY’s by 1.19x.

Ultimately, it shouldn’t be surprising that the momentum ETF’s valuation metrics are higher than the general market ETF’s as it’s allocation in momentum stocks that will have higher price multiples by default. However, I’d still feel uncomfortable investing in an overvalued ETF with low-growth constituents (implied by the ETF’s low Beta coefficient).

BlackRock iShares

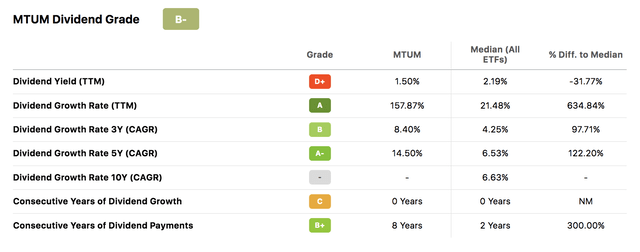

Although the ETF presents a robust and consistent dividend, it doesn’t pay a dividend that would get pulses racing. In our opinion, a dividend yield of 1.50% is something you could earn from your risk-free account and doesn’t provide much of a value-add.

Seeking Alpha

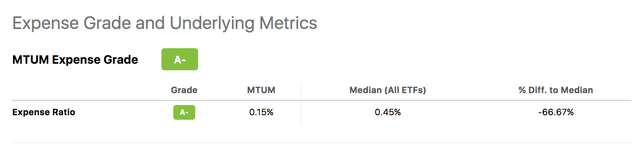

If you’re interested in investing in this ETF, then you won’t be let down by its cost attributes. The ETF has lower expenses than most, providing investors with a way to access momentum strategies without having to incur substantial portfolio rebalancing costs.

Seeking Alpha

Concluding Thoughts

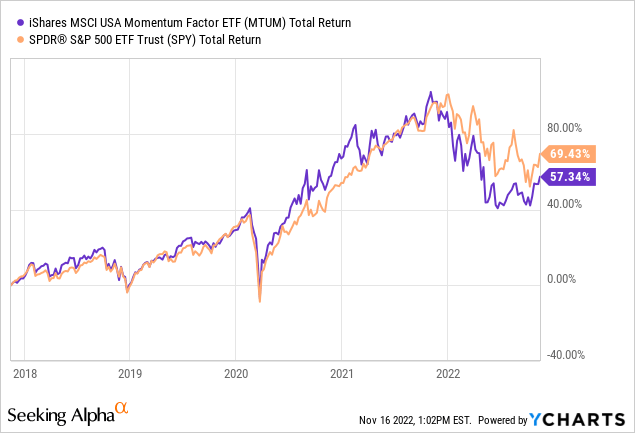

Based on our analysis, this Momentum ETF could be counteracted by polarized sector allocation, which could be one of the core reasons why it has underperformed the broader market in the most recent 5-year economic cycle. The ETF follows an empirical strategy that is designed to outperform the market but has failed to do so in recent times; thus, intertwining recent returns with its elevated valuation metrics, we conclude that the ETF isn’t ideally placed to capitalize on momentum anomalies.

Be the first to comment