yujie chen

Near term recovery for Marriott (NASDAQ:MAR) is ongoing but a recession may delay full recovery. Long term strategies to fuel growth include expanding property portfolio, international growth, and broadening rewards program could help capture revenue and room market share but execution risks may damage Marriott’s positioning and brand equity.

Recovery underway

Global hotel chain Marriott is recovering after a pandemic-induced slump in lodging with the company seeing a consistent YoY improvement in revPAR, revenues and profits this year.

|

Worldwide revPAR YoY growth (%) |

Revenues (USD millions) |

Revenue growth YoY (%) |

Net income (USD millions) |

Net income growth YoY (%) |

|

|

96.5% |

4,199 |

81% |

377 |

3,527 |

|

|

70.6% |

5,338 |

70% |

678 |

61% |

|

|

36.3% |

5,313 |

35% |

630 |

186% |

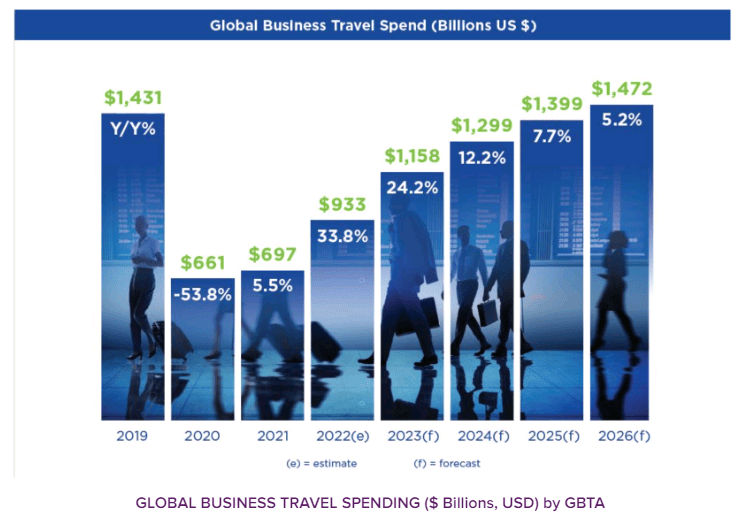

For the nine months to September 2022, revenues are still below-pre pandemic levels however (USD 14.85 billion in revenues until September 2022 versus USD 15.6 billion for the same period in 2019), and further recovery is anticipated in the coming months. Drivers to support recovery include a continued recovery in international travel (from countries such as China for instance where quarantine restrictions and flight bans were eased just a few days ago, and Japan and Thailand where international travel restrictions were lifted last month) as well as a recovery in business and group travel (global travel recovery has so far been driven by leisure travel, but the gap is narrowing and corporate travel is expected to reach 65% of pre-pandemic levels this year, reaching full recovery only by 2026).

Kambr

Expanding hotel brand portfolio, international expansion to help drive revenue and market share growth long term

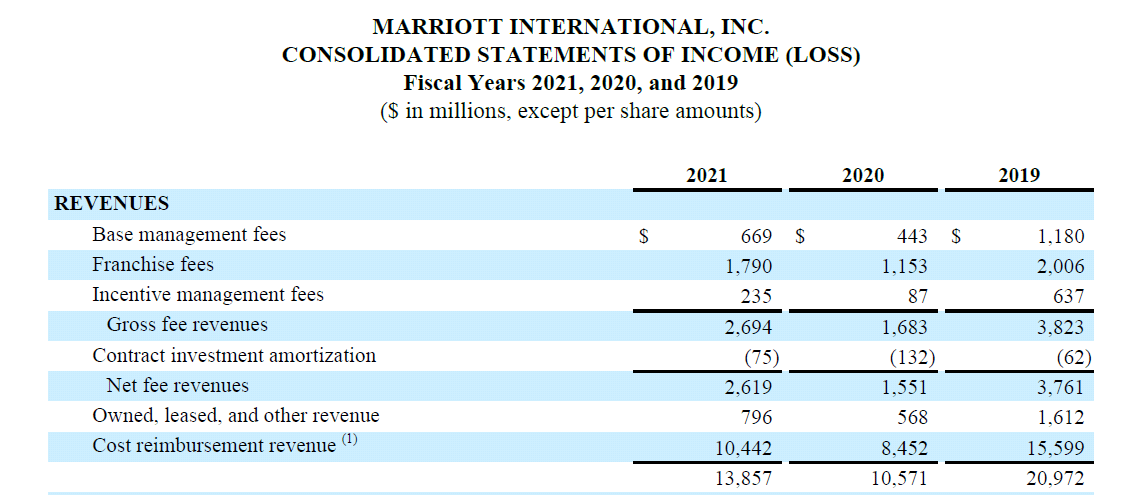

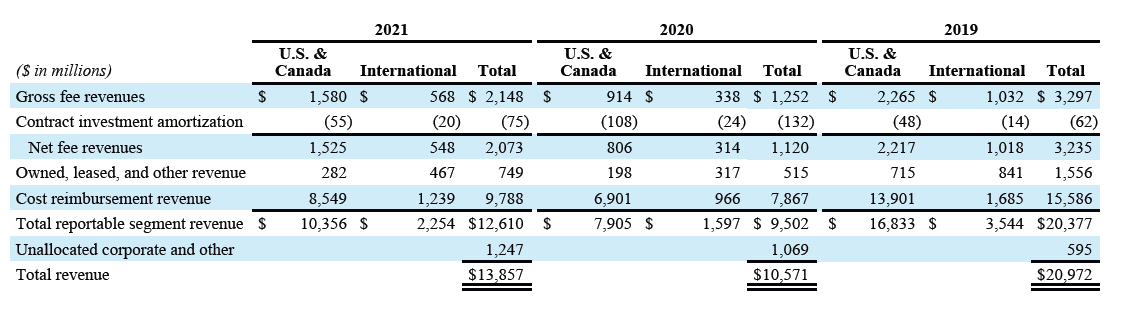

The vast majority of Marriott’s hotel properties are franchised and the majority of Marriott’s revenues are derived from base fees (fees earned as a percentage of hotel revenues) and franchise fees. Expanding their portfolio of hotel properties directly contributes to top line growth through base fees and franchise fees.

Marriott Annual Report

North America accounts for the bulk of Marriott’s revenues but more than 50% of the 485,000 rooms in Marriott’s development pipeline are outside North America. Marriott is aggressively expanding into fast-growing markets such as China, India, and Africa.

Marriott Annual Report

Already the biggest hotel chain in the industry by number of rooms with an extensive brand portfolio covering ultra-luxury to budget friendly, with a wide geographic reach, Marriott is already a strong competitor. An expanding hotel brand portfolio not only makes their rewards program considerably more attractive to users (which could help Marriott capture a greater share of member travel spend, attract new members, and enhance member loyalty), but it also could make generate cross-selling opportunities and scale economies, potentially making Marriott more attractive to hotel owners, thereby enabling Marriott to capture revenue and room market share.

Marriott Bonvoy: from loyalty program to lifestyle platform

Marriott has one of the largest hospitality loyalty programs in the industry with 160 million members in its Marriott Bonvoy program at the end of 2021 (Hilton has about 128 million (HLT) and Wyndham has over 95 million (WH)); this is nearly half the entire population of the United States, and if Marriott’s loyalty members were an independent country, it would be the world’s ninth largest in terms of population count, and likely to be one of the wealthiest too given Marriott’s positioning as an upscale and luxury hotel chain.

Marriott is moving to cement its grip on Marriott Bonvoy members by turning its loyalty program into a platform for lifestyle products and services including travel insurance, credit cards, and VIP access to concerts, culinary events, and premier sporting events such as the Superbowl, Formula 1 and more. Marriott has also been inking a slew of partnerships to enable members to earn points when shopping with partners such as Uber which can be redeemed at Marriott’s nearly 8,000 hotels around the world as well as cruises such as Marriott’s swanky new Ritz-Carlton Yacht Collection launched last month. The effort strengthens Marriott Bonvoy’s value proposition, which could not only attract new members into what is already one of biggest hotel rewards programs, and increase stickiness but also incentivize spending and thereby drive revenues.

Upscale extended-stay offerings to fend off Airbnb

Leisure travelers and travelers on long business trips are increasingly seeking new experiences and stays; Marriott discovered a few years ago that more than a quarter of its members were booking outside their hospitality ecosystem when it came to renting vacation homes (Airbnb was likely one of the beneficiaries). Airbnb’s success demonstrated an underserved market, an insight further strengthened when a 2018 pilot under Marriott’s Tribute Portfolio Homes found that 90% of homes booked during the pilot came from Marriott Bonvoy members.

To plug this gap, Marriott ventured into the extended stays space in 2019, with the launch of its home rentals offering Homes & Villas by Marriott. The hotel chain took a step further with its new upscale long-term accommodation offering Apartments by Marriott Bonvoy, in what appears to be a strategy to retain Marriott Bonvoy members within Marriott’s hotel ecosystem, and possibly lure upscale travelers away from Airbnb and VRBO. The timing seems opportune with Airbnb receiving considerable negative publicity lately, from customers reporting hidden cameras to hygiene lapses.

Risks

Covid cases are rising again in some countries including the U.S., Australia, and even in China, despite its zero-covid policy. Rising cases worldwide and potential new lockdowns to prevent imported covid cases could be particularly problematic for international travel, hindering the travel and hospitality industry’s recovery. Meanwhile, the risk of a global recession is very high (there is a 98% chance of a global recession according to research firm Ned Davis) could deal another blow to the industry’s recovery in the near term.

Execution risks could mar Marriott’s brand equity name and hinder Marriott’s market share growth; there are rumblings that Marriott’s ever-growing portfolio of brands, lodging and experience offerings is driving down hotel service and quality. This may alienate their discerning, affluent customers who may turn to upscale hotel rivals such as Hilton for instance, who has so far opted to remain focused on their hotels.

Summary

Marriott is recovering from a pandemic-induced demand slump and further recovery is anticipated. A possible recession may delay recovery however.

Longer term, the company is aiming to capture room and revenue share through a number of strategies including an expanding hotel property portfolio, international expansion, expansion into extended-stays, and broadening its rewards program. Rumblings are surfacing about a deterioration in hotel quality however, and Marriott’s growth plans may backfire if dissatisfied members shift to rival upscale players such as Hilton, Hyatt, and Four Seasons.

With a P/E of 24.9, Marriott is not exactly cheap and investors may opt for a better entry point.

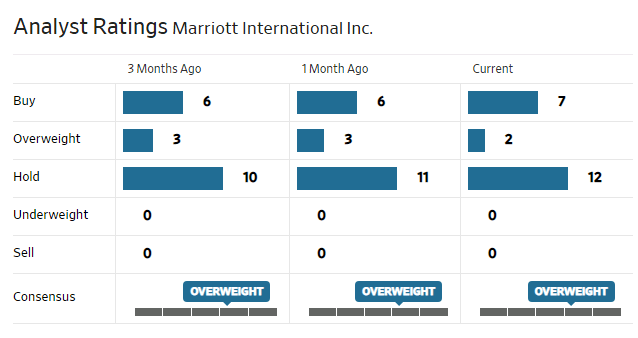

Analysts are mostly neutral on the stock.

WSJ

Be the first to comment