Vertigo3d

Dividend Kings

The Dividend Kings are an elite group of companies that have all paid and increased dividends for at least 50 consecutive years. There are multiple lists of dividend kings on the internet, some that include more than 44 companies. I have chosen to use the list provided by Suredividend.com that was updated on July 5, 2022 and remains unchanged from the prior month.

The 44 companies on the dividend king list span 9 unique sectors, offer an average dividend yield of 2.62% and have an average 5-year dividend growth history of 6.78%. Even though all 44 of these companies share the status of an elite dividend stock, not all will offer great returns going forward. So how can an investor identify the dividend kings that have a higher chance of offering better returns?

In my prior article, I shared a method for selecting the dividend kings that present the best opportunity for better than average future returns. The method leverages a long-term pattern of correlation between share price appreciation and long-term earnings growth. The pattern is more evident when applied to a group of stocks and measured over a longer time period. While this method may not work for all stocks, it can help identify a group of stocks that collectively can outperform a universe of stocks.

First, let me explain in more detail how and why this strategy may work and then I’ll share the real results.

EPS Growth Combined With Valuation

Forecasted EPS growth rates are a useful indicator of future returns, but this factor can be strengthened when combined with the current valuation of a given stock. My preferred method of valuation for dividend stocks is the dividend yield theory. The premise is simple, if the current dividend yield exceeds the trailing dividend yield, a stock is considered to be potentially undervalued and vice versa.

I have decided to test this theory on the dividend king universe of stocks going forward. Each month, I will select roughly the top quarter of dividend kings that present the best-forecasted EPS growth rate combined with current valuation. I will be using analyst forecasted 5-year EPS growth rates from FinViz.com. Current valuation will be computed using current and trailing dividend yields obtained from Seeking Alpha. I will assume that a given stock can return to fair valuation within a 5-year period that aligns with the forecasted EPS growth rate. Potentially undervalued stocks will be awarded a boost to their forecasted EPS growth rate equivalent to the annualized rate of return necessary to bring the share price back to fair value within the 5-year period. Overvalued stocks will be penalized using the same principle in reverse.

The best way to apply and measure the success of this strategy is through a buy-and-hold portfolio. I have been tracking how such a portfolio is working out and I will share those results later on in the article.

Past Performance

The table below shows the returns for the chosen dividend kings using this methodology for the time period of July 2021 through May 2022.

|

Ticker |

Jul 21 |

Aug 21 |

Sep 21 |

Oct 21 |

Nov 21 |

Dec 21 |

Jan 22 |

Feb 22 |

Mar 22 |

Apr 22 |

May 22 |

Jun 22 |

|

ABM |

4.83% |

6.52% |

-9.11% |

-1.82% |

2.25% |

-9.22% |

2.52% |

7.53% |

2.70% |

-0.78% |

-10.20% |

|

|

ABT |

-5.37% |

-1.87% |

||||||||||

|

BDX |

6.42% |

1.06% |

||||||||||

|

CWT |

12.86% |

1.75% |

3.98% |

3.50% |

||||||||

|

FUL |

1.86% |

4.57% |

-4.45% |

9.50% |

3.76% |

10.72% |

-11.40% |

-3.36% |

1.22% |

6.57% |

||

|

HRL |

-1.81% |

-9.97% |

3.81% |

-2.17% |

17.90% |

|||||||

|

LOW |

-0.25% |

5.81% |

-0.51% |

15.68% |

4.61% |

5.68% |

-7.87% |

-6.86% |

-1.82% |

-10.56% |

||

|

MMM |

-9.57% |

0.15% |

-3.13% |

|||||||||

|

MO |

-3.33% |

|||||||||||

|

MSA |

6.04% |

-5.04% |

||||||||||

|

NDSN |

-0.19% |

6.74% |

0.63% |

-8.90% |

-2.39% |

0.26% |

-5.02% |

-7.09% |

||||

|

NWN |

-0.91% |

-4.37% |

13.13% |

|||||||||

|

PH |

1.60% |

-4.60% |

1.01% |

-9.60% |

||||||||

|

PPG |

-9.42% |

-14.23% |

-1.78% |

-2.35% |

-0.71% |

-9.61% |

||||||

|

SJW |

8.89% |

|||||||||||

|

SWK |

-1.92% |

-8.92% |

2.52% |

-2.33% |

-7.41% |

-6.84% |

-13.64% |

-14.05% |

-1.22% |

-11.07% |

||

|

SYY |

-3.98% |

7.35% |

-0.85% |

-2.04% |

-8.92% |

12.15% |

0.08% |

11.45% |

-5.72% |

4.69% |

-1.52% |

1.21% |

|

TGT |

-12.76% |

|||||||||||

|

TNC |

-3.24% |

-4.80% |

||||||||||

|

TR |

1.42% |

-7.97% |

-3.85% |

4.31% |

-0.63% |

15.47% |

-6.29% |

-0.59% |

6.97% |

0.20% |

-5.60% |

7.19% |

|

Return |

3.40% |

2.21% |

-4.73% |

4.19% |

-1.31% |

7.18% |

-5.17% |

-3.28% |

-2.91% |

-2.66% |

1.36% |

-6.91% |

|

Benchmark |

1.71% |

0.83% |

-5.33% |

4.05% |

-1.68% |

8.79% |

-3.88% |

-2.25% |

0.97% |

-2.41% |

-0.10% |

-5.39% |

|

Alpha |

1.70% |

1.37% |

0.60% |

0.13% |

0.36% |

-1.61% |

-1.29% |

-1.04% |

-3.88% |

-0.25% |

1.46% |

-1.52% |

4 out of the 11 chosen dividend kings for June finished last month with a return better than the average dividend king universe return. The returns from these 4 better performing kings were not strong enough for the June list to beat the average dividend king universe return. Ultimately the June selections finished the month with a loss of 6.91% compared to a loss of 5.39% for the dividend king index. The main culprits of underperformance were: ABM Industries (ABM) that lost 10.2%, Lowe’s (LOW) that lost 10.56% and Stanley Black & Decker (SWK) that lost 11.07%. Parker-Hannifin (PH) and PPG Industries (PPG) posted losses in excess of 9%, also contributing to the underperformance. All of the alpha gained in May (+1.46%) was lost in June as the strategy is struggling a bit in the bear market of 2022. But since this is a long-term strategy a short period of weaker results is perfectly normal. The strategy actively seeks out-of-favor companies that may offer weak initial returns. A better measure for this strategy is with a buy-and-hold approach that is discussed later in this article.

11 Best Dividend Kings For July

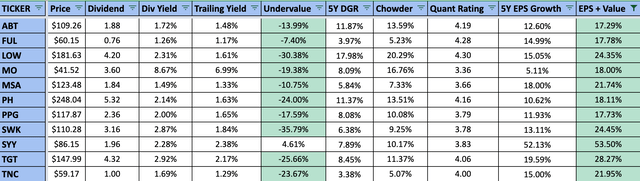

Since this method relies on two factors that are constantly changing, it is likely that we will experience a high turnover rate with this strategy. I have updated the analysts’ expected future earnings growth rates for all the dividend kings and applied the necessary valuation adjustments. Here are the 11 dividend kings with the best expected future growth rates for July.

There are three changes in the chosen stocks between June and July. ABM Industries, California Water Service (CWT) and Nordson (NDSN) make way for Abbott Labs (ABT), H.B. Fuller (FUL) and Altria (MO). All new stocks for July are making a return to the watchlist and as a result will not expand the number of holdings in the buy-and-hold portfolio. Abbott Labs posted a loss of 7.5% in June and appears to be about 13% undervalued right now. H.B. Fuller posted an awful loss of 15.29% in June and is now about 7% undervalued based on dividend yield theory. Altria had an even worse month, the stock lost 21.28% in June and now appears to be about 19% undervalued. The expected rate of growth for this month’s 11 dividend kings is 23.92% as compared to 22.77% last month.

Please note that this stock selection strategy focuses solely on quantitative data. Further due diligence is necessary to ensure there are no major negative catalysts for each dividend king.

Buy And Hold Strategy

In addition to tracking the returns for the 8 best dividend kings each month, I also track how a buy-and-hold portfolio has performed for this stock selection method.

|

EPS + Value |

Benchmark |

Alpha |

|

|

Jul 21 |

3.40% |

1.71% |

1.70% |

|

Aug 21 |

1.99% |

0.83% |

1.16% |

|

Sep 21 |

-5.05% |

-5.33% |

0.28% |

|

Oct 21 |

4.54% |

4.05% |

0.48% |

|

Nov 21 |

-0.07% |

-1.68% |

1.60% |

|

Dec 21 |

7.75% |

8.79% |

-1.03% |

|

Jan 22 |

-4.89% |

-3.88% |

-1.02% |

|

Feb 22 |

-0.26% |

-2.25% |

1.99% |

|

Mar 22 |

-2.14% |

0.97% |

-3.11% |

|

Apr 22 |

-2.20% |

-2.41% |

0.21% |

|

May 22 |

0.79% |

-0.10% |

0.89% |

|

Jun 22 |

-7.12% |

-5.39% |

-1.73% |

|

Total |

-4.20% |

-5.43% |

1.24% |

|

2021 |

12.72% |

8.06% |

4.66% |

|

2022 |

-15.01% |

-12.49% |

-2.52% |

The buy-and-hold portfolio for this strategy finished June with a loss of 7.12%. It underperformed both the watchlist and the average dividend king universe return. As a result, the alpha generated by this strategy decreased from 3.19% to 1.24% since July 2021. This portfolio performed very well in 2021 but is slightly underperforming this year. June actually marked the first full year for the watchlist and generating alpha of 1.24% in the first year is quite alright in my book.

The underperformance last month was partially attributable to large losses incurred by H.B Fuller, 3M Company (MMM) and Altria that made up about 17% of the buy-and-hold portfolio at the end of May. The 4 largest positions in the portfolio at the start of June were: Sysco (SYY) 13.72%, H.B. Fuller 12.06%, ABM Industries 11.87% and Lowe’s 9.44%. Collectively they made up about 47% of the market value of the portfolio and the average return in June for these 4 kings was a loss of 8.71%.

Here is the current allocation of the buy-and-hold portfolio as of June 30, 2022. I’ve also included the May 31, 2022, allocation to show you how it has shifted as a result of contributions and market activity.

|

TICKER |

May |

June |

|

ABM |

11.87% |

11.25% |

|

ABT |

2.19% |

2.00% |

|

BDX |

2.49% |

2.37% |

|

CWT |

3.33% |

4.26% |

|

FUL |

12.06% |

10.07% |

|

HRL |

6.58% |

6.31% |

|

LOW |

9.44% |

9.06% |

|

MMM |

3.39% |

2.90% |

|

MO |

1.47% |

1.14% |

|

MSA |

1.22% |

1.93% |

|

NDSN |

7.41% |

7.55% |

|

NWN |

4.30% |

4.15% |

|

PH |

3.22% |

3.62% |

|

PPG |

5.15% |

5.34% |

|

SJW |

1.15% |

1.14% |

|

SWK |

7.46% |

7.27% |

|

SYY |

13.72% |

14.53% |

|

TGT |

0.00% |

0.72% |

|

TNC |

1.12% |

1.83% |

|

TR |

2.42% |

2.55% |

A buy-and-hold approach is a much easier and more tax-friendly investing approach to adopt. Unless a portfolio is held in a tax-free or tax-deferred account, the impact of taxes as a result of moving in and out of positions each month would significantly impact total returns.

Performance For All Dividend Kings In 2022

All 44 dividend kings are down 12.11% year-to-date through month-end June. 22 dividend kings are outpacing the dividend king universe of stocks this year and are driving the return. The remaining 22 dividend kings are all trailing the dividend king universe return.

Best 5 Dividend Kings in 2022:

- AbbVie (ABBV) +15.32%

- Northwest Natural Holding Co. (NWN) +11.05%

- Universal Corporation (UVV) +10.64%

- Sysco +9.73%

- Coca-Cola (KO) +7.85%

Worst 5 Dividend Kings in 2022:

- Stanley Black & Decker -43.76%

- Target (TGT) -38.47%

- PPG Industries -33.12%

- Dover Corp. (DOV) -32.73%

- Lowe’s -31.93%

Best 5 Dividend Kings in May:

- Tootsie Roll (TR) +7.19%

- Lancaster Company (LANC) +6.35%

- AbbVie +3.93%

- California Water Service +3.50%

- American Water Services (AWR) +2.85%

California Water Service, the 4th best dividend king in June, was included in the top 11 dividend king list for June. Additionally, Tootsie Roll, the best dividend king in June, is part of the buy-and-hold portfolio that benefitted from the long-term inclusion of this stock.

Summary

I believe that targeting the 11 best dividend kings with the highest forecasted growth rate based on EPS growth forecasts and reversion to fair value will offer excess returns over the dividend king universe of stocks. It may take time to fully see the results; an ideal evaluation period will be 5 years. For some investors, that is a long period of time and I encourage all of you to do further due diligence on any of the companies I mentioned prior to investing. So far, this simple strategy is working out well, but 12 months of data is a relatively short period of time. I look forward to seeing what this method has to offer in the future.

Be the first to comment