Ethan Miller/Getty Images News

From patent lawsuits to a high profile fight with the founder, Velodyne Lidar (NASDAQ:VLDR) has seen nothing but drama since going public. The stock couldn’t even stay green after announcing a new multi-year agreement with Boston Dynamics. My investment thesis remains Bullish on the stock with this focus on non-automotive Lidar contracts.

Not A Complete Disaster

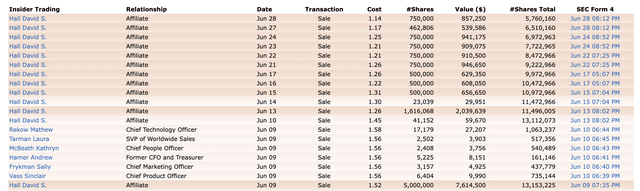

Just this week, founding CEO David Hall sold another 1.5 million shares for $1.85 million. Mr. Hall has regularly sold shares this year after disagreements with other executives led to his departure. The founder selling shares so aggressively has now pushed the stock down all the way to $1.

Source: FINVIZ

Even though the company hired Dr. Ted Tewksbury as the new CEO, Mr. Hall still doesn’t appear happy with Velodyne Lidar. The new CEO is making good progress and building up the business functions outside of a firm solely focused on engineering.

For Q1’22, the company reported bookings of $11.5 million. The reported revenue figure was only $6.2 million due to an adjustment related to the Amazon (AMZN) warrant agreement. Velodyne Lidar plans to use this bookings number as the sales figure going forward.

The company sold 2,350 sensor units compared to 2,684 units last Q1, but the amount was highly impacted by supply chain constraints. Velodyne Lidar ended up hiking ASPs by 48% to account for the higher costs of supplies and the lower inventory.

Either way, the picture of the quarterly report was far better than market views. The company now has a substantial amount of the product manufacturing in Thailand and only lacks FPGAs in order to boost sales focused on the industrial and robotic spaces.

The reported numbers appear a far more disaster than the reality, as the $6.2 million reported figure painted a dire picture for a company leading the Lidar industry in sales after all of the SPAC deals closed. Velodyne Lidar guided to Q2’22 bookings of $12.0 to $14.0 million for a sequential increase of $0.5 to $2.5 million. The company is now using the bookings metric to better reflect the actual sales during the period due to the Amazon warrant accounting impact.

For perspective, industry valuation leader Luminar Technologies (LAZR) only reported Q1’22 revenue of $6.9 million. Velodyne Lidar has a sales book of about double the company with a $2.5 billion market cap.

Big Picture

The weak quarterly revenues and drama with the founding CEO left investors with the view of a company falling apart. At the end of Q1, Velodyne Lidar still has more revenue than most of the Lidar sensor companies that went public combined.

The company just announced a multi-year deal with Boston Dynamics and generated about a third of revenues from automotive deals with the likes of Motional. Velodyne Lidar doesn’t get the same attention as other companies due to the lack of focus on automotive sectors with large announced deals on future orders.

The new CEO stripped out the previous presentation highlighting a strong order book and backlog leading to more negative investor sentiment that these deals disappeared. In reality, Velodyne Lidar continues to build on this previous customer and project base.

The most recent numbers had the company with an order backlog of up to $800 million through 2025 based on 35+ signed and awarded multi-year deals. Velodyne Lidar was forecast to reach $400+ million in revenues by that year based on a project pipeline of 220 deals and $4.2 billion of potential orders.

A lot in the industry have pushed out revenue estimates as Covid and now recession fears have delayed projects. As the new CEO discussed, the original projections provided competitors with too much detail on major contracts while the numbers didn’t accurately reflect actual contracted orders.

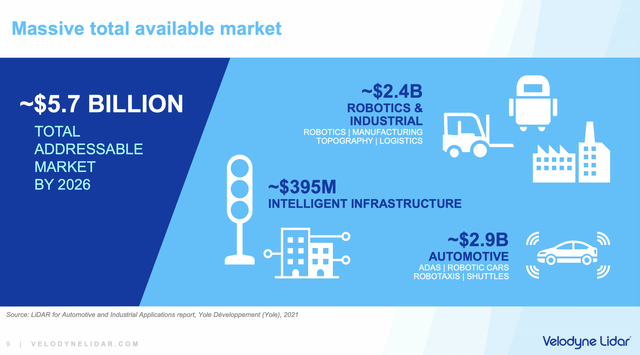

Velodyne Lidar is looking for another way to accurately reflect the contract backlog. Investors shouldn’t over extrapolate the removal of the figures from the presentations as any indication the order book won’t surge as industrial and robotics projects for the likes of Boston Dynamics and Knightscope (KSCP) expand in the near term while automotive deals aren’t likely to reach production until 2025 and beyond. The company still forecasts a market size of ~$5.7 billion by 2026 for a business with only $11.5 million in Q1’22 bookings.

Source: Velodyne Lidar Q1’22 presentation

The Lidar sensor company has a cash balance of $256 million after burning $38 million in the last quarter. The company focusing on more near-term revenue opportunities in industrial, robotics and intelligent infrastructure provides a better path to profitability and reduced cash burn before the cash balances run out.

Takeaway

The key investor takeaway is that the drama surrounding the founding CEO has distracted the market from a promising technology business. Velodyne Lidar continues to make progress in the Lidar space, yet the stock has seen the market cap collapse to just $200 million. Once Mr. Hall quits irrationally dumping stock, Velodyne Lidar should snap back to much higher levels.

Be the first to comment