JHVEPhoto

Mondelez International (NASDAQ:NASDAQ:MDLZ) is a global leader in selling food snacks such as cookies, crackers, and powdered drinks. Oreo and Tang powdered juice are two of their most popular products. Recently, the company has been in expansion mode, increasing its international presence. However, it incurred integration costs on top of the inflationary pressures, affecting its bottom line performance.

Despite this, the management provided a more robust adjusted EPS growth outlook for FY ’22, which is over 10%. For monitoring purposes, the management’s former adjusted EPS growth outlook was around a mid-single-digit increase. MDLZ is relatively more expensive than its peers and trades near a logical resistance zone, making this stock unattractive as of this writing.

Company Overview

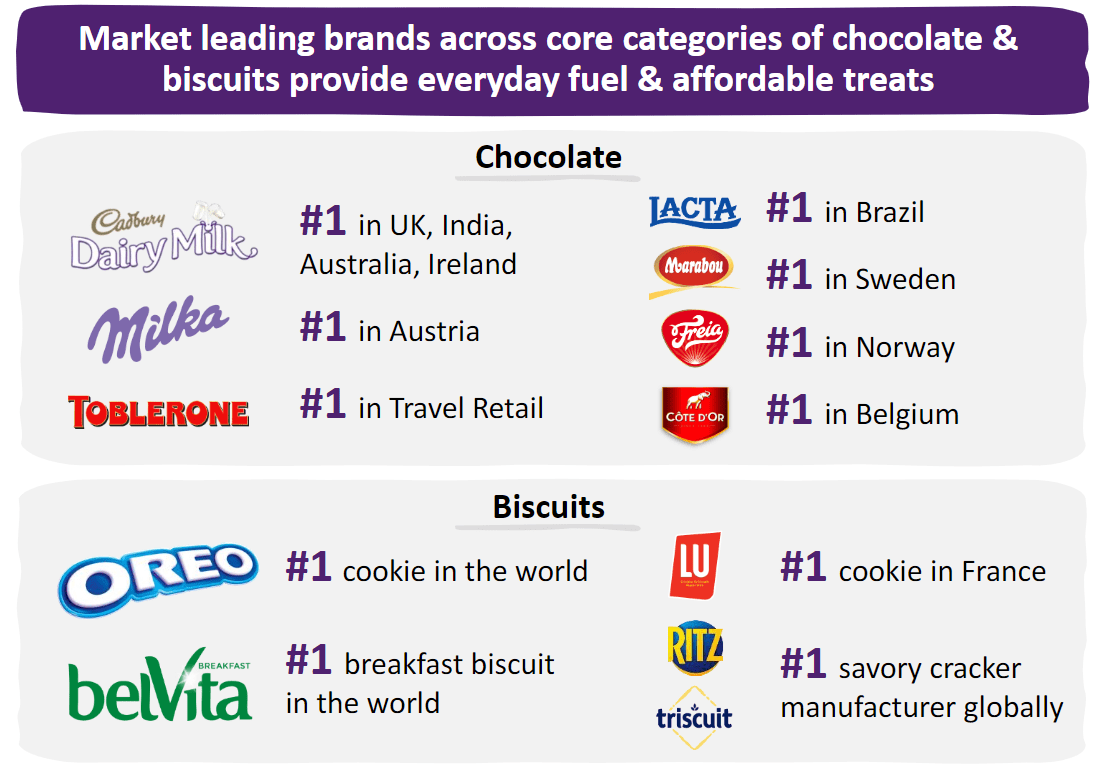

MDLZ still sold most of its products outside its North American region this quarter, amounting to 68% of its total revenue of $7,763 million, up 8.09% from its $7,182 million recorded in Q3 ’21. It ended the quarter with organic solid net revenue growth of 12.1%, up from its 5.5% recorded in Q3 ’21. The management also provided a better organic growth outlook of 10% for FY ’22, up from the 5.2% recorded in FY ’21. As seen in the image below, it is unsurprising that most of its products remain market leaders.

MDLZ: Market Leader in Biscuits and Chocolate (Source: MDLZ Investor Presentation)

The above two product categories, Chocolate and Biscuits, contribute 80.1% of MDLZ’s total revenue, up from 79.6% recorded in Q3 ’21. This is an improving figure, as the company has started to focus more on these categories.

…Our chocolate category performed well with 75% of our revenue base holding or gaining share. Our biscuits category had a gain share in 40% of our revenue, close 40 points of headwinds from supply chain constraints in North America. We are already seeing some improvements in service and share, but we expect this improvement visible as the year progresses. Source: Q3 ‘22 Earnings Call Transcript

These two product categories are not typically regarded as “needs” or necessities for everyday survival and as a result, a slower demand volume in the future is not surprising, especially considering today’s potential recession.

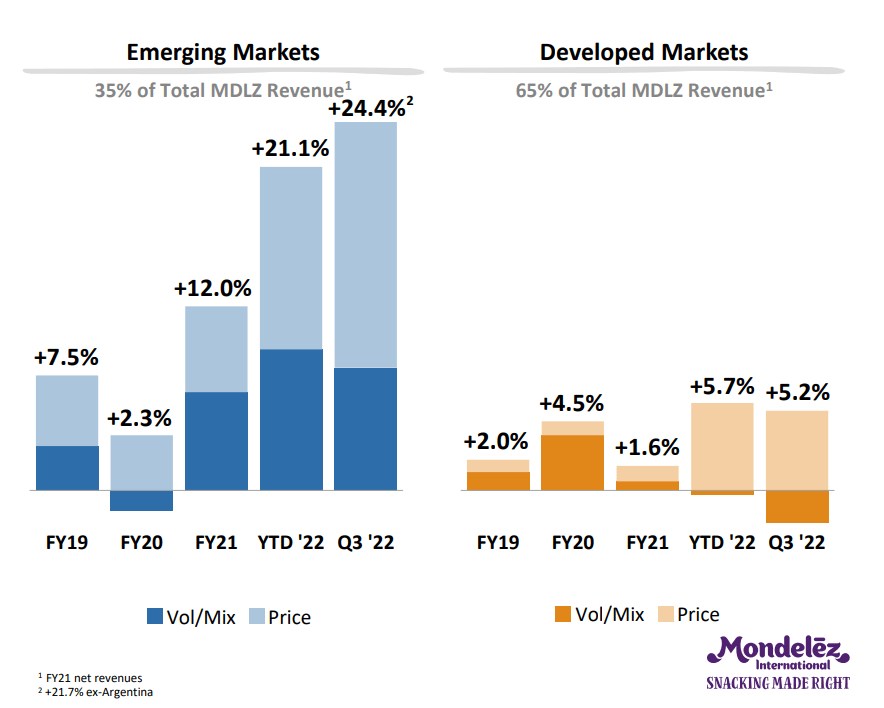

MDLZ: Volume/Mix and Price Trend (Source: Q3 ‘22 Earnings Call Presentation)

MDLZ’s developed market suffered a declining volume/mix of -3.4 points this quarter, down from its positive figures in FY ’21 of 1.3%, FY ’20 of 2.1%, and FY ’19 of 1.2%. However, this is offset by its stronger volume/mix performance this quarter of 8% derived from its emerging markets. Its year-to-date price mix of 5.7%, down from 6.0% in H1 ’22, as well as rising input costs, weighed on its slowing gross margin. The gross margin for the quarter is 33.66%, down from 39.32% in Q3 ’21 and 41.88% in Q3 ’20.

Pressured Margin Continues

MDLZ has made three meaningful acquisitions, expanding its presence in the global snacks market.

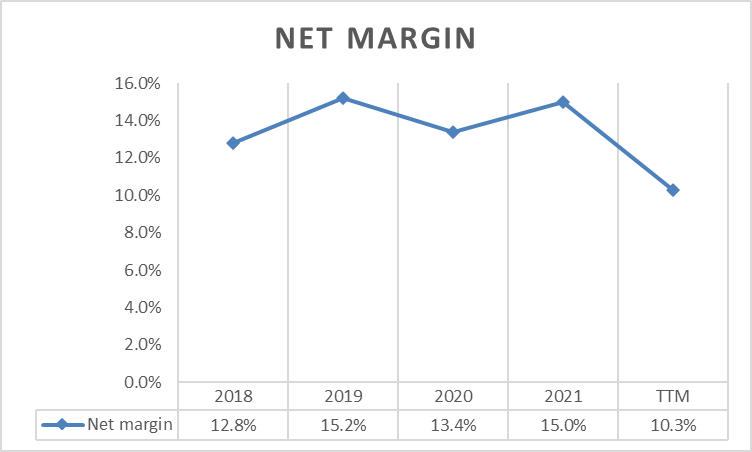

MDLZ: Deteriorating Net Margin (Source: Data from SeekingAlpha. Prepared by the Author)

Nevertheless, these acquisitions resulted in year-to-date acquisition-related expenditures of $332 million for Clif Bar, $106 million for Chipita, and $7 million for Ricolino. This snowballed to its deteriorating net margin. Considering its normalized trailing net margin of 9.8%, it remained lower than the 11% reported in FY ’21 and 10.1% recorded in FY ’20. Additionally, considering the management outlook about currency translation headwinds will reduce overall revenue growth by 6.4% in FY ’22.

Relative Valuation

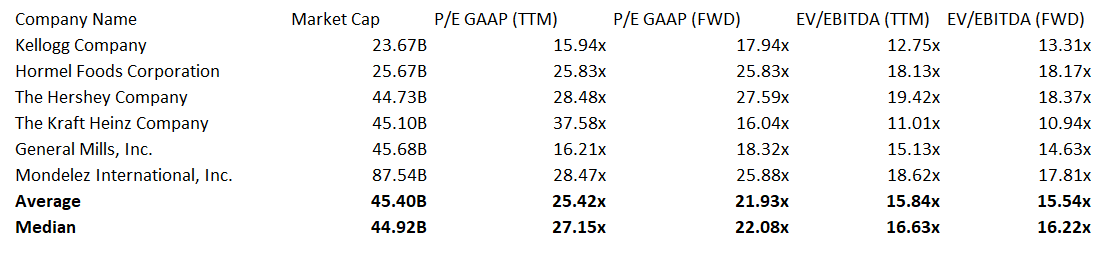

MDLZ: Relative Valuation (Source: Data from Seeking Alpha. Prepared by the Author)

Kellogg (NYSE:K), Hormel Foods (NYSE:HRL), Hershey (NYSE:HSY), Kraft Heinz (NASDAQ:KHC), General Mills (NYSE:GIS)

The market is pricing MDLZ at a premium if one compares its trailing P/E multiple of 28.47x to the average of its peer groups of 25.42x. A premium can be seen with its 18.62x trailing EV/EBITDA multiple, which is relatively higher than the 15.84x average of its peer group. Meanwhile, its forward P/E multiple of 25.88x is still adversely higher than its peers’ average of 21.93x, and its forward EV/EBITDA multiple of 17.81x will trade at a premium to its peers’ average of 15.54x.

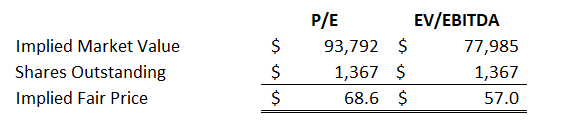

MDLZ: Relative Valuation (Source: Prepared by the Author)

Using an estimated EPS of $3.06 and an estimated $EBITDA of $6,041 million in FY ’22, at an implied P/E multiple of 22.08x and implied EV/EBITDA multiple of 16.22x, we can arrive at a blended fair price of $63, indicating no upside potential as of this writing. Hence, I do not see MDLZ as a good investment as of this writing.

Trading Near Resistance Zone

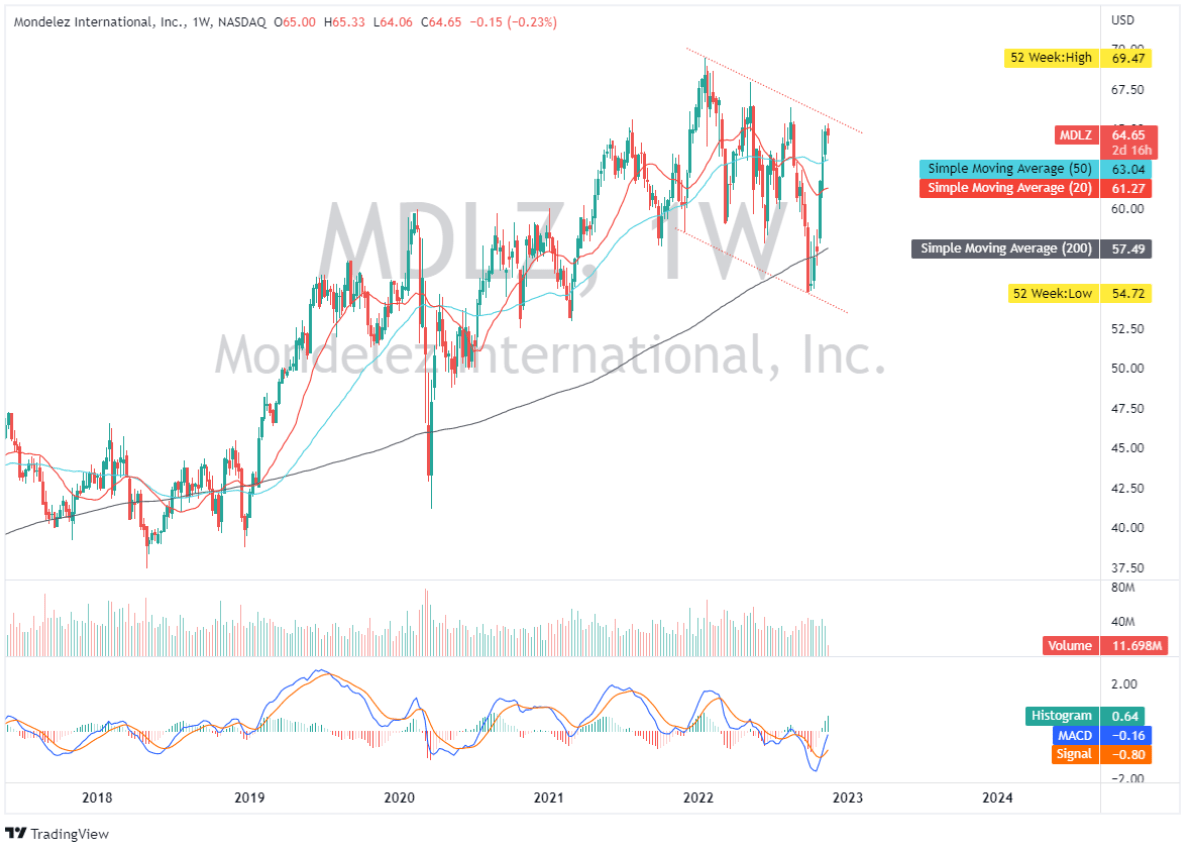

MDLZ: Weekly Chart (Source: TradingView.com)

As shown in the above chart, Mondelez is trading close to its upper trendline, a multi-month resistance level to keep an eye on. With a bearish crossover from its 20- and 50-day SMAs already in place, a break below its 50-day SMA will add negative pressure and may force MDLZ to retest its 200-day SMA for support, while the MACD indicator continues to show negative momentum below zero.

Acquisition Boosts and Efficiencies

- Early this year, MDLZ acquired Chipita Global, which advances its strategy to become the global leader in broader snacking. According to the management, they successfully integrated Chipita’s business, contributing an additional $158 million in total revenue and $25 million in operating income and remain confident that there will be operational synergies in their other two acquisitions this year.

- The other company acquired by MDLZ this year is Clif Bar & Company, a maker of nutritious energy bars. This quarter, it contributed an incremental revenue amounting to $157 million and an operating loss of $33 million.

- MDLZ’s most recent acquisition is Ricolino, Grupo Bimbo’s confectionery business, which has an annualized total revenue of $500 million and generates positive net income amounting to 443 million MXN, according to Grupo Bimbo’s Q3 report.

Overall, the management upgrade on its adjusted EPS growth on a constant FX basis of 10% in FY ’22 seems reasonable. In addition, management is confident that they will end FY ’22 with over $3 million in free cash flow to support the company’s growing dividend and continued utilization of its remaining $1.8 billion share repurchase program.

Final Key Takeaway

MDLZ’s two main product categories, Chocolate and Biscuits, can be classified as “Affordable Luxury” comfort food. Experts see a minimal impact on demand for chocolates if there is an upward shift in price. However, given the uncertainties from currency headwinds and higher input costs, which could further lead to an unfavorable mix, it could result in a margin contraction. Hence, this makes MDLZ’s short-term unattractive. Given today’s negative market and current overvaluation, I recommend waiting for a pullback rather than buying on breakouts.

Thank you for reading and good luck to us all!

Be the first to comment