abadonian/iStock via Getty Images

Elevator Pitch

I have a Hold or Neutral investment rating assigned to Mobilicom Limited (NASDAQ:MOB) [MOB:AU]. Investors should know about the key bull and bear arguments for this new IPO. On one hand, MOB potentially has a very long growth runway ahead, considering that its current revenue is a small fraction of the company’s estimated Total Addressable Market, or TAM. On the other hand, Mobilicom is unprofitable and its initial IPO valuation implying a high single-digit price-to-sales multiple isn’t appealing.

When Is Mobilicom IPO?

Mobilicom, which has been listed on the Australian Securities Exchange since May 2017, first announced on April 22, 2022, that the company is “progressing a NASDAQ dual listing.” In this announcement, MOB noted that its US listing or IPO is expected to happen in the third quarter of 2022.

In its most recent June 9, 2022 update with regard to its NASDAQ IPO, Mobilicom revealed that it “intends to conduct an investor roadshow over the coming weeks.”

Typically, a public listing can occur as fast as half a month following the conclusion of the IPO investor roadshow. As such, the timing of MOB’s IPO roadshow is aligned with the company’s earlier guidance of a third-quarter public listing. Previously, there were expectations of Mobilicom’s shares being listed on Nasdaq in late-June 2022, but that has not materialized.

In a nutshell, the official date of Mobilicom’s IPO has yet to be finalized. Based on a review of MOB’s announcements, it is likely that Mobilicom’s shares will be listed on the NASDAQ in Q3 2022, or as early as July 2022.

Is Mobilicom Profitable?

A company’s profitability track record is one of the key things that investors review prior to making decisions about potential investments.

In the case of Mobilicom, the company disclosed in its F-1 filing that it has been unprofitable “since our inception on February 2, 2017.” MOB also cautioned in the company’s F-1 that it might possibly remain loss-making going forward, as a result of “expending substantial resources for research, development, sales and marketing” to drive future growth.

Notwithstanding its history of losses, MOB could still be attractive as a potential investment candidate in the eyes of certain investors, as I will discuss in the subsequent section.

Who May Be Interested In Buying Mobilicom Stock?

In considering a potential IPO, it is important to ask “who may be interested in buying the company’s shares?” In other words, one is asking about the investment merits that will attract investors to purchase the company’s shares.

Specifically, Mobilicom does have specific characteristics that makes it appealing from an investor’s point of view.

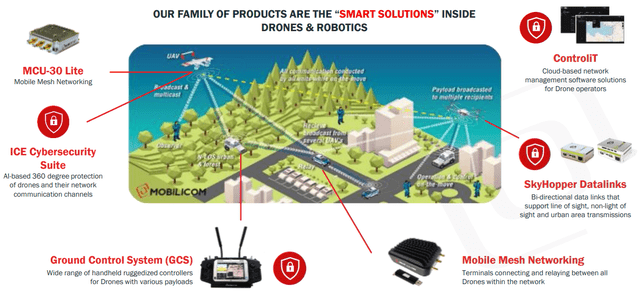

In its F-1 filing, MOB describes itself as “a provider of hardware products and software and cybersecurity solutions” which “are embedded into small drones or small unmanned aerial vehicles (SUAVs) and “into robotic systems.”

Mobilicom’s Products And Solutions

MOB’s June 2022 Corporate Presentation

MOB cited forecasts from “the Global Drone Market Report 2021” in its F-1, which highlighted that the SUAV drone market is predicted to expand by +57% in the next few years from $26.3 billion in 2021 to $41.3 billion in 2026. Mobilicom’s current trailing twelve months revenue of $2.6 million (as per S&P Capital IQ) is less than 0.1% of the company’s estimated 2026 TAM (Total Addressable Market) of $8.5 billion (roughly 20.7% of SUAV drone market which MOB currently serves).

A key metric that points to robust growth for Mobilicom in the future is the number of design wins, which it defines in the F-1 filing as “the large-scale and exclusive adoption of our component products by our OEM (Original Equipment Manufacturing) customers on an-ongoing basis.” MOB has achieved 36 design wins between the second quarter of 2020 and the first quarter of 2022, as highlighted in its June 2022 corporate presentation slides. These design wins included the usage of its Ground Control System and SkyHopper Datalinks solutions by Elbit Systems (ESLT) and Teledyne Technologies Incorporated (TDY), respectively.

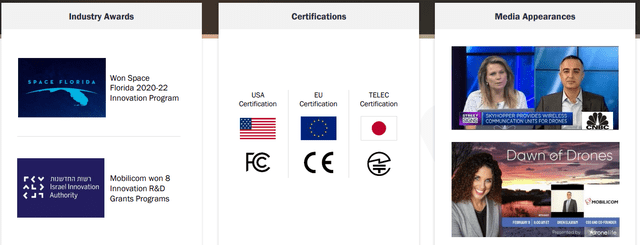

MOB has a strong footing in the defense industry, as evidenced by various “industry awards”, “certifications”, and “media appearances” highlighted below.

Mobilicom’s Presence In The Defense Industry

MOB’s June 2022 Corporate Presentation

Separately, Mobilicom also emphasized in its F-1 filing that its clients include “leaders in the supply of small drones for ISR (Intelligence, Surveillance and Reconnaissance) and loitering missions. For example, Elbit Systems, which I mentioned earlier, calls itself a supplier of “products for defense, homeland security” on its corporate website.

In a nutshell, investors, who are of the view that demand for drones will grow due to geopolitical tensions and conflicts, will be interested in purchasing the shares of Mobilicom as a bet on this specific investment theme.

Is Mobilicom’s Initial Valuation Fair?

According to a June 8, 2022 Seeking Alpha News article, Mobilicom “plans to offer 2.2M American Depositary Shares” at a price of “$4.65” as part of the planned NASDAQ IPO. This translates into an initial valuation of approximately $20 million for MOB, based on Renaissance Capital’s analysis.

In other words, Mobilicom’s initial valuation implies a hefty trailing twelve months’ price-to-sales multiple of 7.7 times for the stock. As I noted above, MOB delivered sales of around $2.6 million in the trailing 12-month period.

A high single-digit price-to-sales valuation multiple seems rather expensive for a relatively small (in terms of both historical revenue and expected market capitalization), loss-making company in the current market environment, where investors prefer stocks with consistent profitability and decent trading liquidity.

Is MOB Stock A Buy, Sell, Or Hold?

In my view, MOB stock is a Hold. Mobilicom does not deserve a Sell rating, as the company operates in the growing SUAV drone market and the revenue of defense plays like MOB could potentially be more resilient in a recession. However, I can’t justify a Buy rating for MOB either, as the stock’s initial valuation appears to be rich, and the company is still in the red now.

Be the first to comment