ajr_images/iStock via Getty Images

Investment Thesis

MicroStrategy’s (NASDAQ:MSTR) Michael Saylor has long been the proponent of Bitcoin’s massive potential, given the immense amount held on its balance sheet. However, as of FQ2’22, the company reported $1.98B of carrying value for 129.69K of Bitcoins, representing an immense decline of -50.2% and -$1.98B in losses from the original cost basis of $3.97B. Wild, since MSTR only generated $510.76M of revenues and $295.35M of adj. net incomes in FY2021, the best it had in the past five years.

Unfortunately, Saylor’s retirement from the CEO seat may not help MSTR’s short-term recovery, since the company continues to be highly invested in the cryptocurrency, with the former “continuing to provide oversight of MSTR’s bitcoin (BTC-USD) acquisition strategy as head of the board’s Investments Committee.” Combined with its lackluster core business, it is likely that the MSTR stock will continue its sideways price action moving forward, if not moderately declining.

The Crypto Winter May Not Be Ending Anytime Soon

The upcoming August report on the US Inflation rate will be critical to the Fed’s eventual increase of 50 or 75 basis points during the September 2022 meeting. Assuming that the rate has peaked in June at 9.1% and continues to moderate from 8.5% in July to the 7% range by August, we may see a more favorable market condition for Bitcoin and MSTR recovery in the intermediate term. San Francisco Fed President Mary Daly said:

If we just see inflation roaring ahead undauntedly, the labor market showing no signs of slowing, then we’ll be in a different position where a 75-basis-point increase might be more appropriate. But I go in with the 50 in mind as I look at the data coming in.

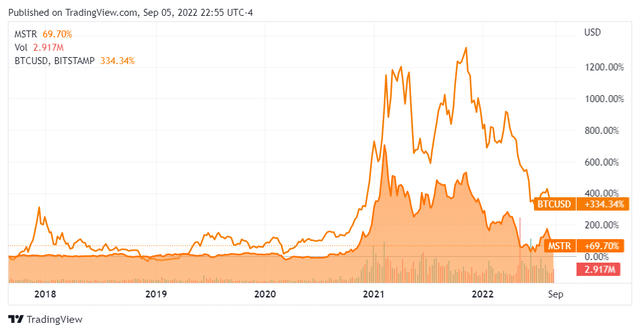

MSTR & BTC 5Y Price

Seeking Alpha

However, we may be seeing more pain ahead, given Powell’s hawkish commentary on 26 August 2022. Early signs in the stock market are also pointing to more pessimism, with the S&P 500 Index falling by -9.2% and the Dow Jones Industrial Average by -8.8% in the past three weeks. Naturally, Bitcoin has also tumbled by -20.9% – simultaneously leading to MSTR’s plunge of -42.1%. As a result, we may potentially surmise another aggressive hike of 75 basis points in the upcoming 20 September meeting, since inflation has remained elevated for the past few months compared to an average of 1.9% in 2019.

Assuming a sustained harsh stance through 2023, the bear market could continue to underperform in the intermediate term. Many big tech companies are already tightening their belts, with hiring freezes and cost cuts through 2023 globally. Notably, more than 41K tech workers in the US have been laid off as of September 2022, pointing to the over-hiring during the pandemic hyper-growth. Additionally, the $2T loss of crypto value, the panic withdrawals, and the bankruptcies announced in the past few months do not point to a favorable environment for the recovery of cryptocurrency and MSTR.

The argument of Bitcoin acting as an inflation hedge is also relatively odd, since the cryptocurrency has obviously plunged since hitting all-time highs in November 2021 and has further underperformed in the last nine months during a bear market. We shall see since this speculative economic downturn would put Bitcoin’s recessionary-proof theory to the test. It is also important to highlight that MSTR had not performed well in the previous recession, with a -28.4% YoY fall in profitability in FY2008 and a -67.3% stock plunge between December 2007 and March 2009

The bulls may assert that Bitcoin would likely recover to its normalized levels, once the macroeconomics improve and the bull market returns. This is attributed to the massive support it historically garnered from global fans, such as Elon Musk of Tesla (TSLA) and Jack Dorsey of Block (SQ), beyond the obvious Michael Saylor. However, we would like to highlight that Elon Musk had also liquidated 75% of his holdings worth $936M, at a time of maximum pain when BTC averages below $20K.

Thereby, pointing to further uncertainties ahead for the cryptocurrency and, consequently, MSTR, due to its underperforming core business.

MSTR’s Core Performance Remains Underwhelming

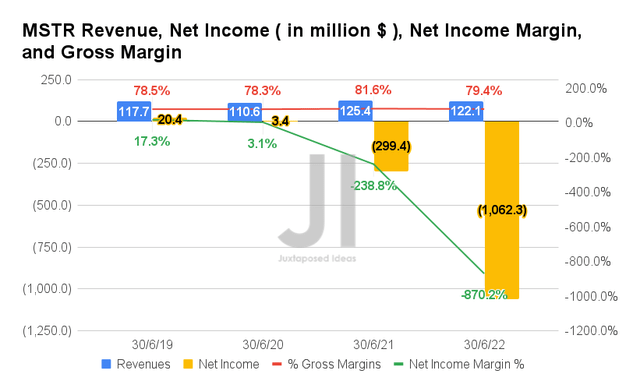

S&P Capital IQ

In FQ2’22, MSTR reported revenues of $122.1M and gross margins of 79.4%, representing a decline of -2.3% and -2.2 percentage points YoY, respectively. The company also reported net incomes of -$1.06B, adj. net incomes of -$144.46M, and adj. net income margins of -18.3%, representing a decline of -354.8%, -215.1%, and 18.2 percentage points YoY, respectively. The adjustments are after discounting the recent decline in its digital assets values, i.e.: Bitcoins.

MSTR’s Declining Core Business and Elevated Costs

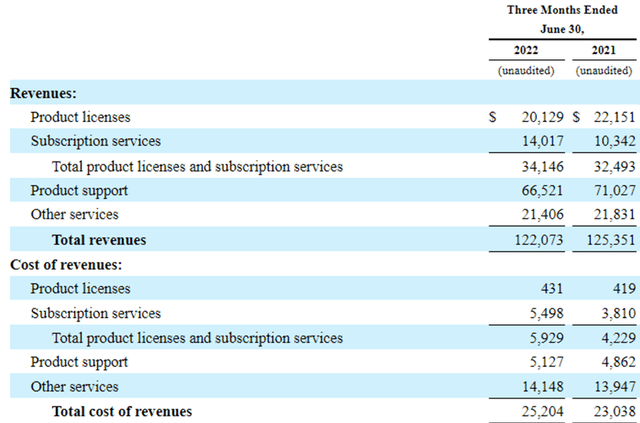

Seeking Alpha

In FQ2’22, MSTR reported a continued decline in its revenues, mostly attributed to product licenses and product support segments, representing a decrease of -9.1% and -6.3% YoY, respectively. It is unfortunate that subscription services, which grew 35.4% YoY, were not able to compensate for the shortfall in the two underperforming segments. On the other hand, the cost of revenues went up by 9.4% YoY, providing further headwinds to MSTR’s profitability, especially worsened by the elevated inflation for the next few quarters.

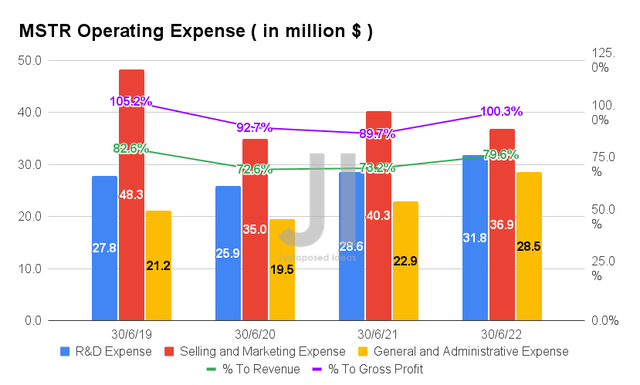

S&P Capital IQ

In addition, MSTR continues to report elevated operating expenses of $97.2M in FQ2’22, representing an increase of 5.8% YoY. This results in a notable growth in the ratio of expenses to sales, to 79.6% of its revenues and 100.3% of its gross profits in the latest quarter, compared to 73.2%/ 89.7% in FQ2’21 and 72.6%/ 92.7% in FQ2’20, respectively. Thereby, further explaining MSTR’s adj. net incomes of -$144.46M in FQ2’22, compared to $125.42M in FQ2’21 and $3.38M in FQ2’20, after adjusting for its digital asset impairment losses.

S&P Capital IQ

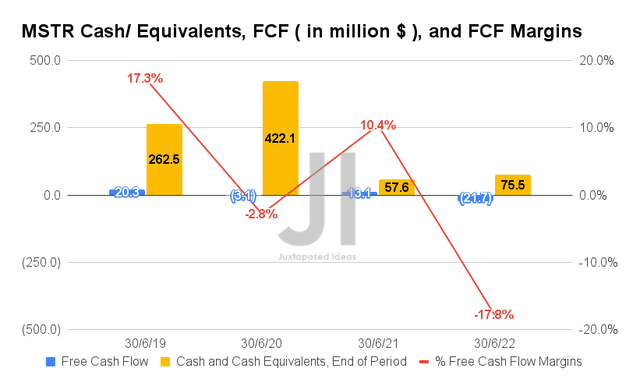

Therefore, it is not surprising that MSTR reported a negative Free Cash Flow (FCF) generation of -$21.7M and an FCF margin of -17.8% in FQ2’22, representing a massive decline from $43.04M/36.1% in FQ1’22 and $13.08M/10.4% in FQ2’21. Its cash and equivalents remain underwhelming as well, with $75.5M left on its balance sheet in the latest quarter.

S&P Capital IQ

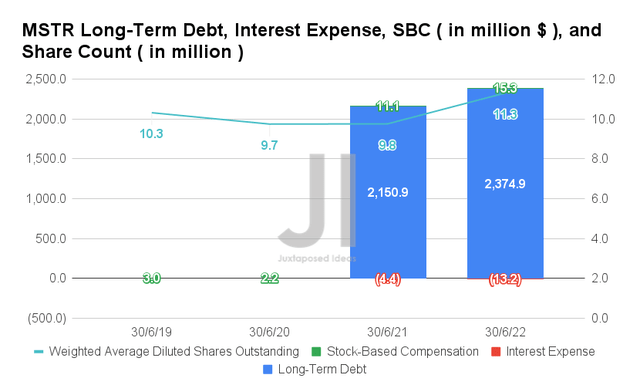

In the meantime, MSTR continues to report elevated long-term debts of $2.37B and interest expenses of $13.2M in FQ2’22, representing a notable increase of 10.2% and 300% YoY, respectively. Furthermore, the company reported increased Stock-Based Compensation (“SBC”) expenses of $15.3M, further diluting long-term investors due to the increase of shares outstanding to 11.3M in the latest quarter. It indicates a drastic increase of 37.8% and 15.3% YoY, respectively.

Since MSTR is projected to be unprofitable for the next few quarters, we may likely see it further relying on SBC and debt leveraging ahead.

S&P Capital IQ

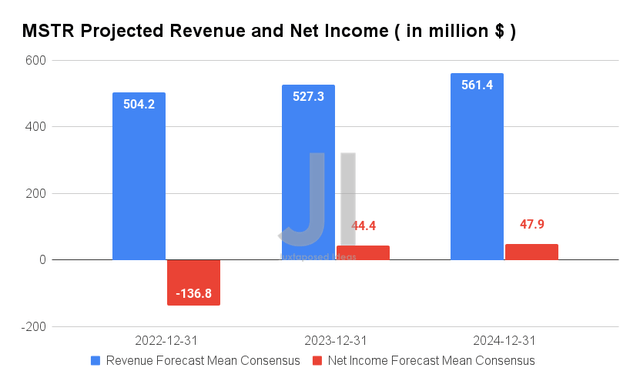

Over the next three years, MSTR is expected to record revenue growth at a CAGR of 3.20%, while finally reporting net income profitability from FY2023 onwards, after three years of pandemic losses. Consensus estimates are also relatively optimistic about its forward execution, given the improvement of its net income margins from 7.1% in FY2019 to 8.5% in FY2024. It is essential to note that these numbers have remained relatively stable since our previous analysis in July 2022, despite the worsening macroeconomics.

For FY2022, MSTR is expected to report revenues of $504.2M and adj. net incomes of -$136.8M, indicating an inline top-line growth though a further decline of -22.1% in bottom-line growth from consensus estimates. These indicate additional headwinds to its core business, beyond the vast write-offs from digital asset impairments. Combined with a bleak two-year crypto winter similarly experienced between January 2018 to December 2020, we may see further sideways action for MSTR through 2024, given its massive Bitcoin exposure.

In the meantime, we encourage you to read our previous article on MSTR, which may help you better understand its position and market opportunities.

So, Is MSTR Stock A Buy, Sell, or Hold?

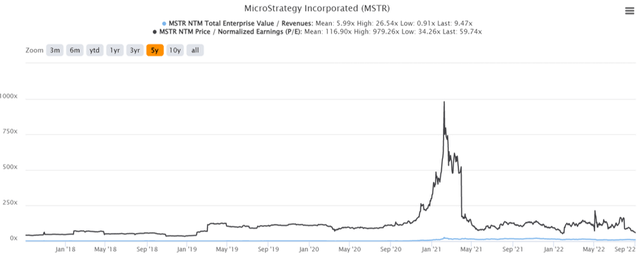

MSTR 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

MSTR is currently trading at an EV/NTM Revenue of 9.47x and NTM P/E of 59.74x, higher than its 5Y EV/Revenue mean of 5.99x though lower than its 5Y P/E mean of 116.90x. The stock is also trading at $218.06, down 75.5% from its 52 weeks high of $891.38, though at a premium of 62.6% from its 52 weeks low of $134.09.

Consensus estimates remain bullish about MSTR’s prospects, given their price target of $661 and a 203.13% upside from current prices. However, it is painfully evident that the stock had retraced by -22.08% since our last article. More pain may be in store depending on the Fed’s upcoming move.

As a result, we continue to rate MSTR as a highly speculative stock only suitable for investors with a higher tolerance of risk, long-term trajectory, and, most importantly, tremendous Bitcoin conviction. Even then, investors would be well advised to size their portfolios appropriately, given the massive volatility.

Be the first to comment