Michael Vi

Since we first recommended investors buy Okta (NASDAQ:OKTA) shares, they have declined over 75%. The shares have been in freefall due to multiple issues that have soured investor appetite for owning the shares. The cyber incident, challenges integrating Auth0 acquisition, lackluster performance, and macro have impacted estimates and the stock price. We believe shares have over-corrected, providing a good entry point for longer-term investors. While much work is needed to steer the ship in the right direction, Okta has the products, a sizeable under-penetrated market, and a large install base of customers. Identity is the core pillar around which security is being architected in enterprises of all sizes. Identity is the central tenet around which Zero Trust Architecture is built. The presidential order mandates Zero Trust Architecture (ZTA), and every company will eventually use ZTA to secure their businesses.

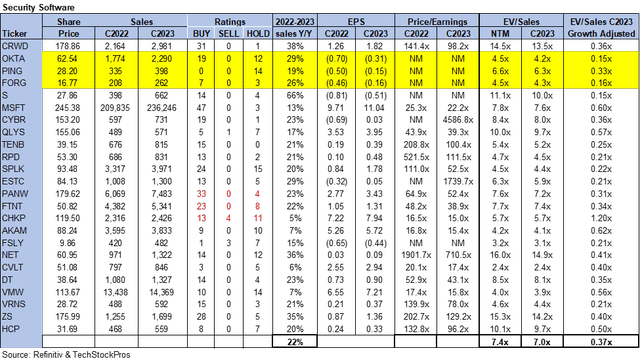

Okta is cheap on most metrics, and the estimates have been reset amidst a stable demand environment for security offerings. Okta currently trades around 4x EV/C2023 sales while growing around 30% Y/Y. We believe the risk/reward is favorable at these levels since the stock is near the bottom of the trading range. With the estimate reset, all the bad news is already priced into the stock. Therefore, we recommend investors to buy shares here as the risk/reward is favorable at current levels.

Guidance de-risked

Following F2Q23 results, the company provided Q3 guidance that was in line but implied guidance for Q4 was weaker than expected. Okta cited go-to-market challenges with Auth0 acquisition, sales attrition, and lengthening deal cycles for bringing down guidance for the full year. The company previously tried to integrate and sell CIAM (Customer Identity Access Management) and Workforce Identity solutions through a single integrated salesforce. The company now realizes the selling motions and buying centers within an organization are different for these products. The company now plans to have a dedicated salesforce for each product line, making it easy to sell the products.

Drivers of growth for Okta

- Enterprises are in the early stages of cloud adoption. According to Adam Selipsky, AWS CEO, enterprises spend only 5-15% of their IT budgets on Cloud.

- IT spending for security remains remarkably robust/resilient even during bad economic times, given security remains a board-level prerogative

- Identity is the pillar around which zero trust architectures are built. Zero trust architecture is mandated by presidential order

- Rapidly expanding customer base and maintaining high retention rates with low churn (around 5%) with dollar-based net retention rate remaining above 120%.

- Displacement of incumbents such as Oracle (ORCL), CA (AVGO), and IBM (IBM) in enterprises.

- International business is growing faster and becoming a more significant portion of the overall revenue.

Risks

The competitive landscape in the IAM (Identity and Access Management) space is intense. Microsoft (MSFT) continues to invest heavily in security, and IAM is one of the core focuses of the company. Microsoft boasted of investing $20 billion in building its security offerings over the next five years. Microsoft is working on expanding its SSO solutions by offering IGA (Identity Governance and Administration) and customer identity solutions as a single platform. Microsoft, PING, and ForgeRock (FORG) remain Okta’s immediate competitors. In addition, CyberArk (CYBR) also has a compelling platform in privilege access management and is chipping away at adjacent areas.

Following Okta’s Auth0 acquisition, Okta now has two different products with different routes to market. While Auth0 is sold via engaging the IT developers, the core workforce identity solution is sold through CISO engagement. Okta had problems integrating the Auth0 salesforce into Okta salesforce, leading to churn. Okta recently saw high attrition in the sales force, and the company is working to fix go-to-market issues. In the near term, the company has to work hard to steer the ship in the right direction.

Valuation

Okta is trading at around 4.2x EV/C2023 sales versus a high-growth peer group average of 7.0x. Okta is trading at a discount to the high-growth peer group, despite growing faster than the whole group. Okta is expected to grow at 29%, while the peer group is growing at 22%. The following chart illustrates the valuation of the security software peer group.

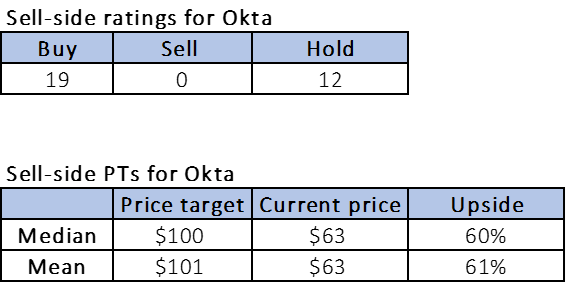

Word on the Street

Based on the Refinitiv Data, out of the thirty-one analysts covering the stock, nineteen are buy-rated, and the remaining are hold-rated. The ratings show the Wall Street consensus is bullish on the stock. OKTA is currently trading at around $63. The median price target is $100, and the mean price target is $101, for a potential upside of about 60-61%. The sentiment on Okta took a battering after it had acquired Auth0 for an inflated price of around $6 billion. However, we expect the sentiment to improve as the company executes its integration goals and beats and raises estimates for the remainder of the year.

The following chart indicates the sell-side ratings and price targets.

Refinitiv

What to do with the stock

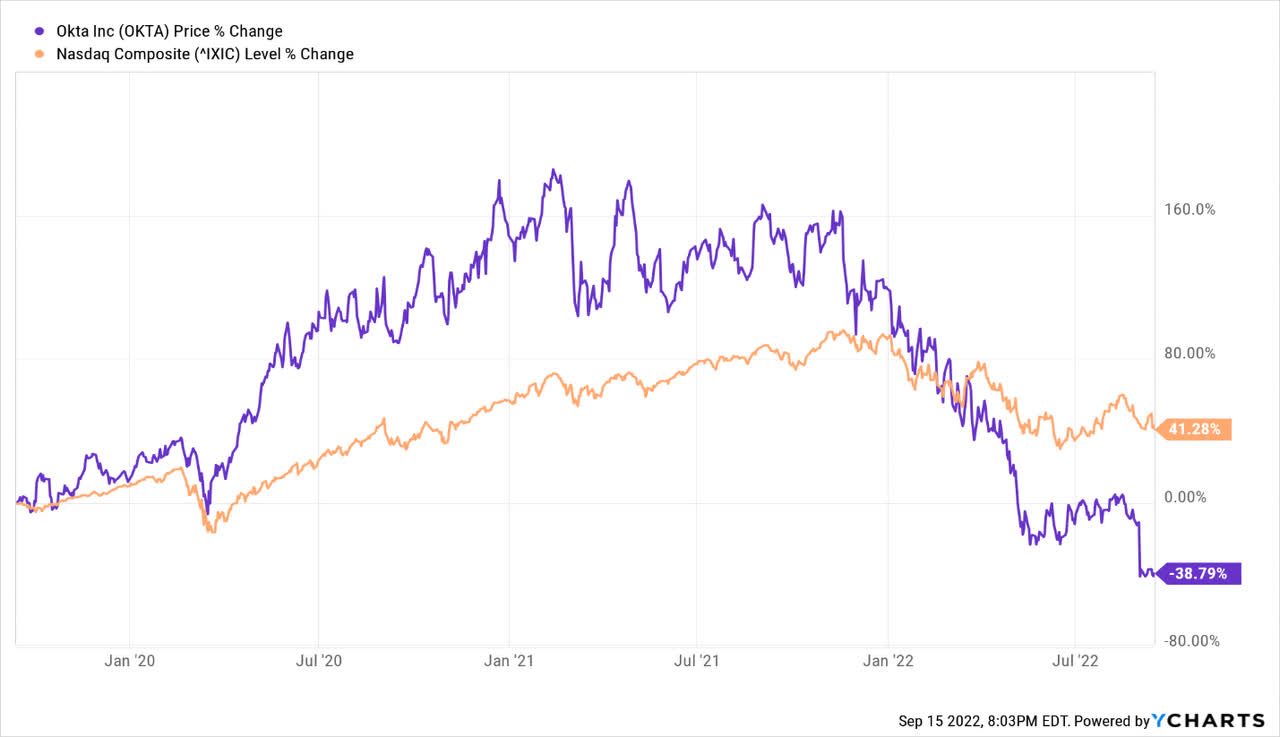

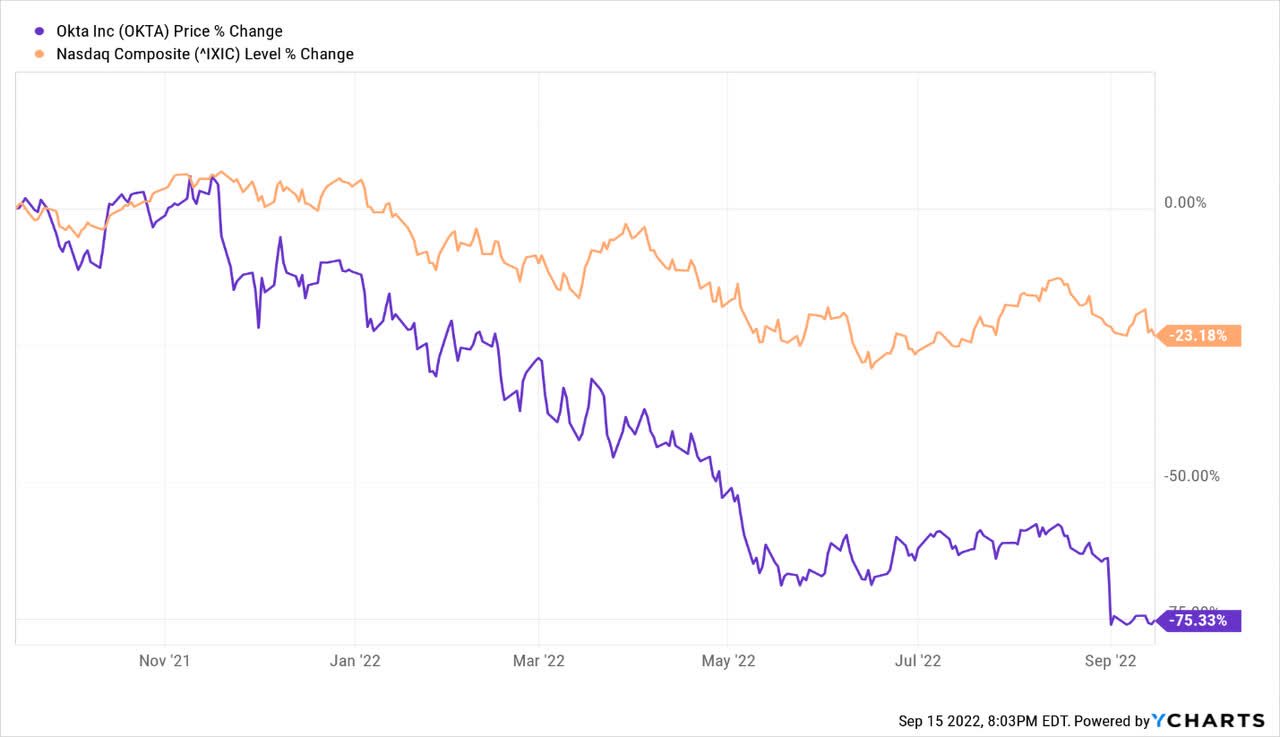

Over the last one and three years, Okta massively underperformed the Nasdaq index by a wide margin. Over the last three years, Okta declined by 39%, while the Nasdaq was up by about 41%. Over the last 12 months, Okta declined 75%, while the Nasdaq index only declined by 23%. We are optimistic that the stock will work from here with the estimates reset.

Ycharts Ycharts

We are bullish on Okta’s fundamentals and believe it is challenging for legacy players like IBM (IBM), Broadcom (AVGO), and Oracle (ORCL) to beat Okta. In IAM, the market is large, and Okta has a first mover advantage in its Cloud-native solution. After lowering estimates following last quarter’s results, Okta has lots of work to do. Okta is now focused on integrating the Auth0 acquisition. The company now has to execute two business lines with different sales cycles. The company needs to manage attrition within its salesforce while hiring talent simultaneously. The company has also cut costs to become profitable sooner than planned. Net-net, the work is daunting but doable. for the stock to work.

Okta is expected to launch refreshed IGA and new PAM products during Oktane conference in November. We expect Okta to beat estimates when it reports results again in November. We also expect the integrated CIAM product to accelerate growth for the company. We would buy shares in small increments since we expect Okta to remain volatile. Given our confidence in Okta’s story, we would stay long and use any weakness to buy additional shares.

Be the first to comment