Chung Sung-Jun/Getty Images News

Thesis

Microsoft Corporation (NASDAQ:MSFT) finished its fiscal year with mixed results. On the one hand, the software giant reported a multitude of headwinds such as unfavorable foreign-exchange effects, COVID-induced lockdowns in China, softened global PC shipment, et al.

On the other hand, growth prospects remain bright. Its core commercial business and cloud services are expected to maintain strong momentum even amid a tough macroeconomic backdrop. Azure has garnered big wins (as to be detailed next). In addition to robust organic growth, bolt-on acquisitions provided further catalysts. The acquisition of Nuance (closed in early March) and the pending acquisition of game publisher Activision Blizzard are two recent examples. Both are expected to further augment Microsoft’s core strength and accelerate growth (in the Intelligent cloud segment and gaming segment, respectively).

All told, I am expecting 8% to 10% growth in the next few years. Such healthy growth, when combined with its aggressive share repurchases, is projected to propel its market cap to $3T in about 5 years.

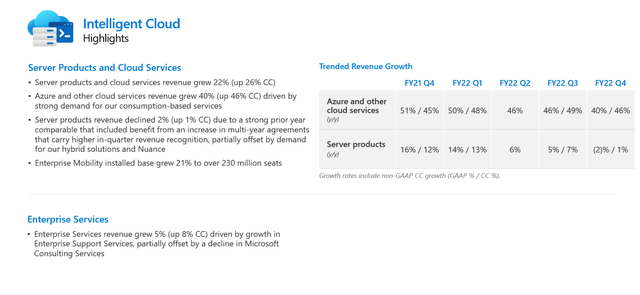

Azure

Azure is a highlight in its recent earnings call with a record number of high dollar value contracts. MSFT noted big wins with high-profile customers such as GM, American Airlines, Tesla, Kraft Heinz, Fujitsu, and Unilever. As CEO Satya Nadella commented during the recent earnings call (abridged and emphases added by me):

Organizations in every industry continue to choose our cloud to align their IT investments with demand. We are seeing larger and longer-term commitments and won a record number of $100 million-plus and $1 billion-plus deals this quarter. We have more data center regions than any other provider, and we will launch 10 regions over the next year… With Azure Arc, we are meeting customers where they are enabling companies like GM, Greggs, UBS and Uniper to run applications across on-prem edge and multi-cloud environments. We are seeing more customers move their mission-critical workloads to Azure.

Looking forward, the pie of cloud computing is expanding at a healthy pace. Currently, more than 1.5 million businesses are purchasing cloud products. And the total market size is estimated to exceed $130 billion by 2022. And MSFT Azure is in a good position to capitalize on such secular growth. For example, its recent acquisition of Nuance provides a strategic edge to transform the healthcare segment. The AI capabilities provided by Nuance will facilitate the development and adaptation of outcomes-focused AI solutions.

Share repurchases

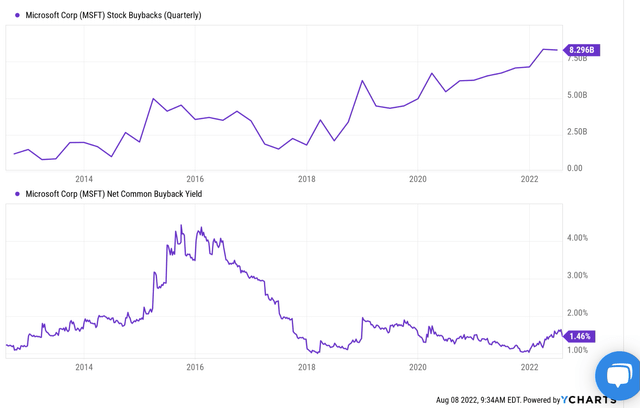

MSFT has been aggressively buying its own shares in recent years, as you can see from the following chart. In the recent quarter alone, it returned $12.4 billion to shareholders. The total cash returned to shareholders exceeded $46 billion for FY 2022. Out of this amount, the majority, $32.1 billion, was spent on share repurchases. As you can see from the top panel of the following chart, it has already been spending about $2B to $2.5B per quarter on share repurchases in the earlier part of the decade. And the amount has steadily grown to the $8.3B it spent last quarter.

The bottom panel of the chart shows its net common buyback yield. For readers new to the concept, the buyback yield is the amount spent on repurchases divided by the market cap of a company (just like dividend yield is the total amount of dividends paid divided by the market cap). As you can see, its quarterly buyback yield has been consistently above 1%. Currently, its buyback yield stands at 1.46%, far exceeding its dividend yield of 0.88%. And, therefore, the share repurchases are, and are also expected to continue to be, the main driver for shareholder returns.

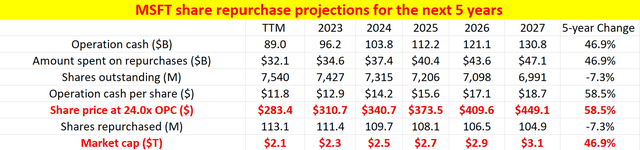

Path to $3T

The following chart shows a simple projection to illustrate the potency of such share repurchase programs when combined with its healthy pace of growth. The chart is made under the following assumptions:

1. Firstly, it assumes that MSFT spends a fixed percentage of its operating cash flow on share repurchases. The percentage is taken to be 36%, consistent with the average in recent years. It spent 36.7% of its operating cash in FY 2022 on share repurchases, and 36.0% in FY 2021.

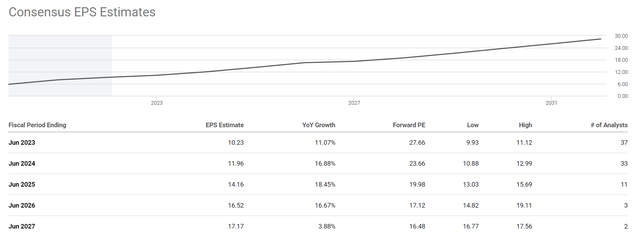

2. Secondly, it assumes that MSFT’s profits grow at an 8% CAGR according. The consensus estimates project about 10% CAGR in the next 5 years. I will use 8% to be on the conservative side.

3. And finally, it assumes that MSFT’s valuation is maintained at 24x of its operating cash, which is its current valuation. To me, a multiple of 24x operating cash is a bit on the expensive side, and I will address this in the risk section. But I suppose part of the risk is canceled off in this projection because by assuming a higher multiple, the potency of share repurchases is also reduced.

Based on these assumptions, you can see that MSFT will be able to reduce its total share count by another 7.3% in the next five years (thus providing an average of 1.46% of buyback yield per year). And also, its market cap is projected to reach $3.1T in 2027. And the growth and share repurchases are projected to propel its share price to about $449 per share by 2027.

Valuation risks

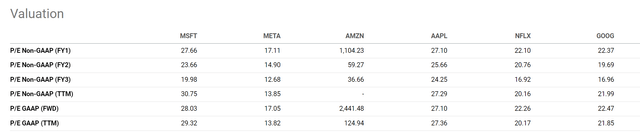

Despite the recent corrections, Microsoft’s valuation is still expensive both in relative and absolute terms. Its long-term valuation has been on average about 20x cash flow, as you can see from the first chart below. And its current 24x multiple is about 10% above its long-term average. When compared to its peers like the FAANG pack, it’s also trading at a premium (or even a substantial premium) as you can see from the second chart with the exception of Amazon (AMZN). Common valuation metrics such as P/E cannot be meaningfully applied to AMZN, as detailed in my earlier articles.

Final thoughts and other risks

Despite all the short-term issues, it’s just a matter of time in my view before MSFT’s market cap reaches $3T. Based on the key drivers (Azure, bolt-on acquisitions, and share repurchases), this article projects the time is in about 5 years. Should its valuation contract to the historical mean of 20x cash flow, it will delay its time to reach $3T by a year or two. As such, investors with 5-year or longer timeframe should feel safe to engage.

While investors with shorter timeframe should be cautious with the near-term headwinds. Besides the valuation risks, there are a few other risks worth mentioning. The competition in the cloud space is intensifying, and Azure’s current market share is behind AWS. As of Q1 of 2022, AWS claimed the top market share in the cloud computing space. With a 33% market share, AWS is leading Microsoft Azure (2nd place with 21% market share) by a whopping 12%. And Google Cloud’s 8% market share came in third. Another near-term uncertainty involves its acquisition of Activision Blizzard. The transaction is still pending and under regulatory review/approval.

Be the first to comment