sefa ozel

Thesis

The Krane Shares Trust – Quadratic Interest Rate Volatility and Inflation Hedge ETF (NYSEARCA:IVOL) is an exchange traded fund that tries to capture the rates market volatility. As per its literature:

- IVOL is designed to provide a hedge against inflation and fixed income volatility

- IVOL may act as a market hedge since volatility has historically increased during large equity sell-offs

- IVOL may help hedge the risk of falling real estate prices brought on by rising long term interest rates

We initially covered the ETF here, and we expressed a view that the fund had a very bombastic name with little to show in term of performance, and that the fund composition was inadequate for its stated purpose.

We decided to re-visit this instrument on the back of continued heightened bond market volatility and a historic inversion in the yield curve:

Bloomberg Headline (Bloomberg)

The fund continued to disappoint in 2022, not only failing to provide a positive performance in a year with massive volatility and inflationary pressures, but it is substantially underperforming the plain vanilla aggregate bond market as measured by the iShares Core U.S. Aggregate Bond ETF (AGG) while other rates volatility hedging instruments are outperforming.

A retail investor who would have predicted in the beginning of the year the tsunami to come in rates and vol, would have been ill suited in choosing IVOL just by going by its bombastic name. The main factors behind IVOL’s underperformance are its long rates set-up and erroneous positioning in the 2s/10s spread in the yield curve. Rates have gone up this year and the yield curve has inverted, both factors going against this ETF.

Factors Driving Its Negative Performance

There are two main factors driving this fund’s negative performance in 2022:

Factor No. 1 – Rising Interest Rate Environment

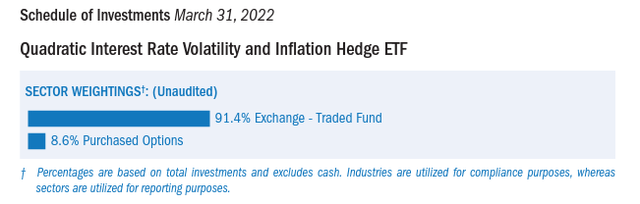

Despite its bombastic name, the fund loses money when interest rates rise. And usually interest rates rise when there are inflationary pressures. The fund’s build is over 91% allocated to the Schwab U.S. TIPS ETF (SCHP):

As rates have risen violently in 2022, SCHP has lost over -15%:

We can see that SCHP exhibited as similar performance at the end of 2018 when rates were rising prior to the Fed pivot.

Factor No. 2 – Erroneous positioning in the 2s/10s CMS Options

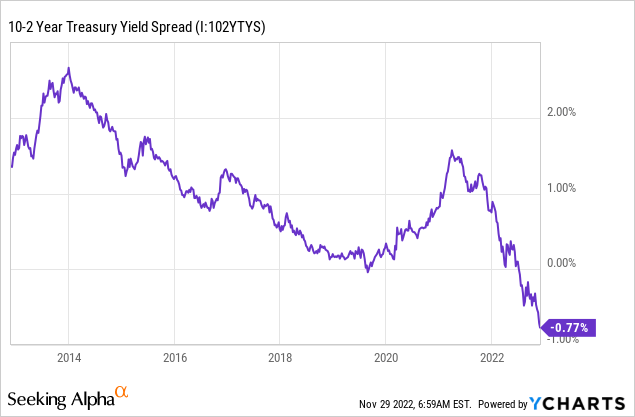

The ETF basically took a punt that the spread between 10-year Treasuries and 2-year Treasuries would widen. Instead we have a historically wide inverted yield curve that is predicting the recession to come in 2023.

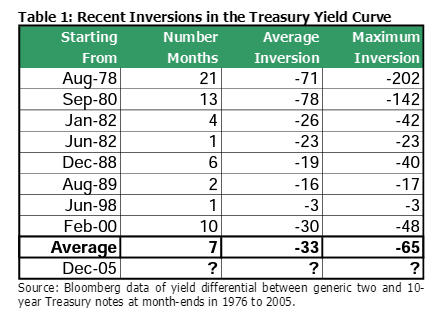

As the line in the graph above goes down, the fund loses money. As you can see from the chart, the ETF has lost a significant amount this year. To put things in context, let us have a look at other historical instances where the 2/10s curve was inverted:

2s10s Inversion (Capital Advisors)

We can see that 2022 ranks as the third widest in recent history in terms of 2s10s curve inversion.

Performance

The fund is down substantially in 2022, despite an unprecedented run-up in inflation and volatility:

Price Return YTD (Seeking Alpha)

When compared to the iShares Core U.S. Aggregate Bond ETF and the Schwab U.S. TIPS ETF, IVOL underperforms. We can see how IVOL is down -16% on a price basis, versus -13% for AGG and -15% for SCHP.

When compared to a true inflation hedge ETF, IVOL is left in the dust:

Simplify Interest Rate Hedge ETF (PFIX) is an ETF that correctly uses swaptions to provide for an investor return in a rising and volatile interest rate environment. Its build is very different, but it performed when it should, namely in an inflationary and rising interest rate environment. IVOL did not.

Conclusion

A retail investor has very few alternatives when it comes to bond market volatility. While there are many instruments and listed options that allow retail investors to access equity markets volatility, the opposite is true for rates and bond market volatility. This year has been a record one when it comes to bond volatility, as measured by the MOVE Index. Not only has volatility been high, but inflation has been on a tear and rates are substantially higher. Going by its bombastic name IVOL should have provided for a hedge against these factors. It hasn’t. In fact it lost investors more than -16% this year when other ETFs such as the Simplify Interest Rate Hedge ETF is up more than 60% in 2022. A retail investor needs to understand that IVOL is in effect a composition of being long and a bet on the spread between 10-year and 2-year treasuries (which has backfired). As horrendous as 2022 has been there is some light at the end of the tunnel. Rates are about to peak, and the curve will not stay inverted for the entire year ahead of us. We predict better times in the second half of 2023 for IVOL, but the lesson to be learned here for a retail investor is that this ETF is not an appropriate inflation and rates volatility hedge.

Be the first to comment