Vertigo3d

Investment Thesis: Strong growth in revenues and earnings, as well as growth across Distribution Revenue could result in further upside for the stock.

In a previous article last month, I made the argument that Nexstar Media Group (NASDAQ:NXST) is likely to see significant growth in Political Advertising revenue in the upcoming quarter as the U.S. midterm elections approach. However, I also made the argument that given the seasonal nature of this business (i.e. Political Advertising revenue tends to spike when an election takes place) – investors will also want to see growth in Core Advertising as evidence that Nexstar Media Group can sustain growth once the U.S. midterms are over.

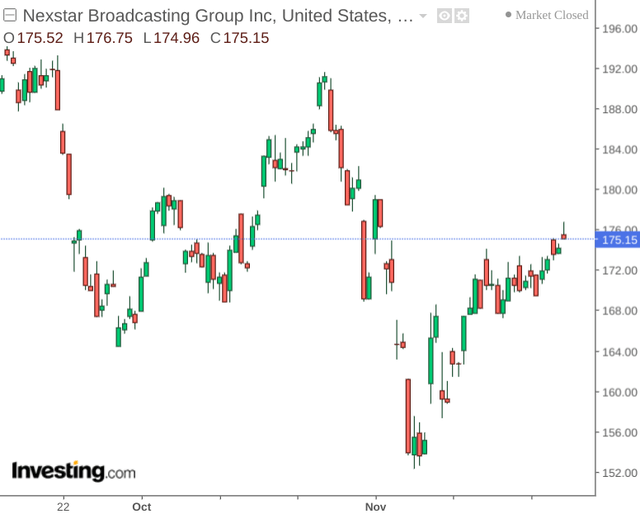

The stock is up by just under 4% since my last article:

The purpose of this article is to assess whether we could see further upside in the stock in light of recent earnings results.

Performance

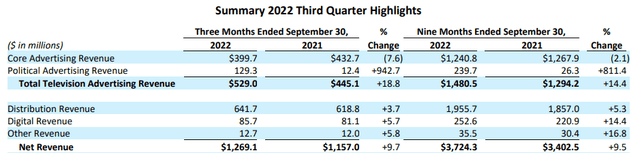

When looking at the Q3 2022 earnings release, we can see that Political Advertising revenue was up sharply on the same quarter last year – in line with expectations.

Nexstar Media Group: Q3 2022 Earnings Release

However, we also see that Core Advertising revenue was down on both a three and nine-month ended basis.

In spite of this, diluted earnings per share was up strongly over the past year – from $3.90 in Q3 2021 to $7.30 in Q3 2022.

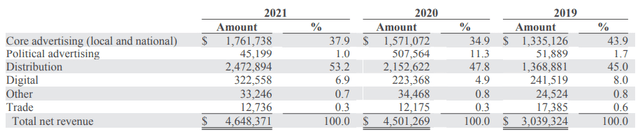

Additionally, while I had previously pointed out that the drop in Core Advertising revenue could be a significant concern – it is important to bear in mind that Distribution Revenue has accounted for the largest portion of the company’s revenue:

Nexstar Media Group: Annual Report 2021

In this regard, the fact that we have seen Distribution Revenue grow by 5.3% on a nine-month basis as compared to the same period in 2021 is encouraging and allows the company to diversify against a fall in Core Advertising revenue. Additionally, the company states that it expects 2023 to mark another strong year for Distribution Revenue owing to agreement renewals that represent more than half of the company’s subscribers.

Moreover, the company has cited political inventory displacement as well as a weaker national advertising market behind the decline in Core Advertising. However, this was partially offset by growth in local advertising, which accounts for 70% of the company’s core advertising revenue. With the company claiming that this segment of the market tends to be more stable than national advertising – this segment could be better placed to withstand macroeconomic-related pressures such as inflation or a possible recession – and we could see this segment bring Core Advertising growth back into positive territory.

From a balance sheet standpoint, we can also see that the company’s long-term debt to total assets ratio has decreased slightly from 0.6 in December 2019 to 0.56 in December 2021:

| Dec 2019 | Dec 2021 | |

| Long-term debt | 8,383,278 | 7,367,956 |

| Total assets | 13,989,737 | 13,264,462 |

| Long-term debt to total assets ratio | 0.60 | 0.56 |

Source: Figures sourced from Nexstar Media Group 2019 and 2021 Annual Reports. Figures provided in thousands of USD, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

While we have seen a slight decrease in the two-year period which is encouraging – I take the view that a more meaningful reduction in this ratio would be encouraging to investors – as it would signal that the company’s revenue growth is sufficient to fund operations without being overly reliant on long-term debt.

Looking Forward

Going forward, Nexstar Media Group has seen strong overall growth across revenue and earnings, in spite of a decline in Core Advertising revenue.

While investors would like to see this segment return to positive revenue growth – the fact that Distribution Revenue has continued to accelerate is quite encouraging – and could provide a buffer against a decline in Core and Political advertising over the next year.

As mentioned, inflation and a potential recession could prove to be a risk for Nexstar Media Group, as this could lead to lower demand for national advertising. However, if the local advertising market remains stable – then it is plausible that the company could continue to see growth in spite of macroeconomic pressures.

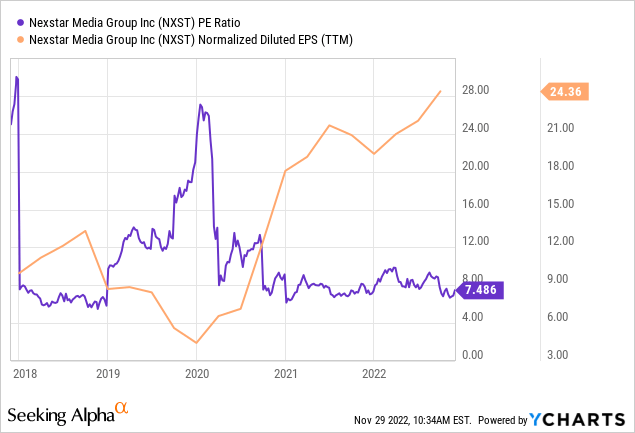

When looking at the company’s P/E ratio over the past five years – we can see that the ratio is trading near levels seen pre-2020 but earnings per share is at a five-year high.

ycharts.com

From this standpoint, the case could be made that the stock is trading at an increasingly attractive price relative to earnings – despite the fact that price itself has more than doubled since 2018.

The stock reached a high of $205 over the summer before consolidating to $175 at the time of writing. I take the view that should the next quarter continue to show earnings growth – then a rebound to the $205 level if not higher is quite plausible.

Conclusion

To conclude, Nexstar Media Group has continued to see respectable growth in overall revenues and earnings. Given that Distribution Revenue growth continues to remain strong – I anticipate that the stock could have further upside from here in spite of macroeconomic pressures.

Be the first to comment