Published on the Value Lab October 11, 2022

da-kuk

The SPDR S&P China ETF (NYSEARCA:GXC) gives you exposure to some of the largest Chinese companies that trade publicly. We believe there are substantial risks in Chinese investment. Of course there is the delisting question, which has not been resolved yet, and there’s also local economic strife in China caused by authoritarian COVID-19 policies. On the horizon there are risks of more economic disintegration and mercantilism that will likely attack key touchpoints such as capital market access and access to manufacturing capacity, catalysed and exacerbated by the isolation of Russia. Risks both known and unknown make this ETF a pass likely indefinitely for the conservative investor.

Brief on GXC

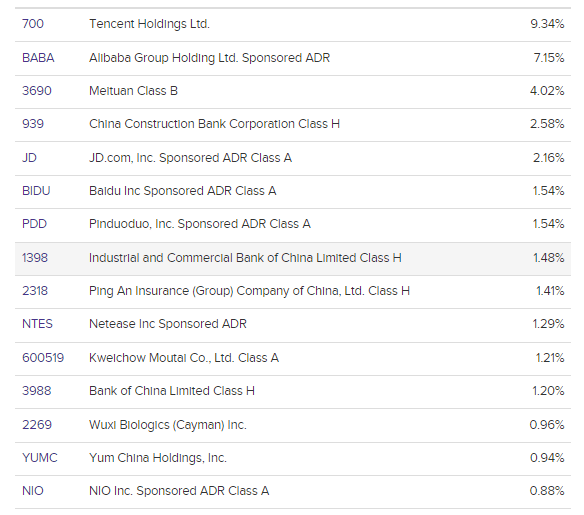

GXC contains the following stocks that dominate its allocations.

Top Holdings (etfdb.com)

Lots of consumption-based businesses, and also heavy industry and cyclical industries like construction are present here. The key levers of growth for these businesses are going to be (as almost always) consumer confidence and expendable income.

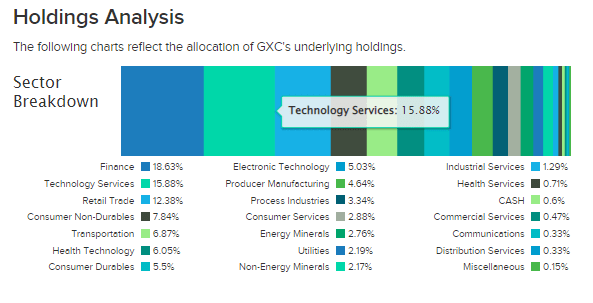

Sectoral Breakdown (etfdb.com)

Full Remarks

With the sectoral breakdown very substantially on the Chinese consumer, because remember that with such a large population and a relatively difficult to penetrate economy, Chinese companies can afford and were always incentivised to focus on their own market, the prospects for consumption of the average Chinese citizen is important. Those prospects are simply bad right now. The massive shrinking of the housing market and the reckoning on major industry like steel and construction with ghost towers certainly not in construction anymore, as well as the zero-COVID policy commitment from Xi Jinping which is hobbling the economy at every attempt to get back into the race out of middle-income status, has caused a pretty big hit to the labor prospects for Chinese residents. Labour market prospects are really dismal, as when Trump won the election on a pretty anti-China platform, targeting trade, and even worse than the 2020 collapse from worldwide COVID-19 lockdowns.

It gets worse of course, because it’s not just zero-COVID. The isolation of Russia has put offshoring as a risk factor for many businesses. They will choose to raise costs to be able to save on warehousing and the working capital effects of anticipating supply chain issues by onshoring capacity. This will obviously hurt China quite a bit. Moreover, the US is now leveling its economic cannons at trade with China as a consequence of decades of stolen trade secrets and patents. Specifically, US businesses are going to become very limited in their ability to sell semiconductors to Chinese companies. China really has some wallet share here, so this is quite bad for the semiconductor industry. The response to this salvo as Beijing assesses other strategic trade could further hurt the Chinese economy as a trade-off for national security.

In a similar vein, delisting remains a risk. While there has been some sign of cooperation between Beijing and the US, where steps have been taken to give auditors more access to Chinese books and operations, concomitant with a wave of Chinese companies switching to US auditors, US regulators do not believe that this will be enough to give real insight into the activities of Chinese companies. As such, the US may still move to delist Chinese companies as a matter of protecting US investors from the risk of being defrauded by Chinese companies who cannot be properly controlled. The only upshot of this is the activity of IPOs on Chinese exchanges, and we must acknowledge that Tencent, which is almost 10% of the GXC, already trades in Hong Kong and not on US exchanges, so the incremental risk there is limited. Nonetheless, other companies will suffer from a NASDAQ or NYSE delisting as a large chunk of potential investors may not be able to access the securities or invest in them within the confines of their mandates. Overall, signs point towards trouble for both the Chinese consumer, but also capital market access as a whole as we make a return to mercantilism. The 12x PE that averages across the portfolio, while low given the growth of some of these businesses, does not compensate us sufficiently for what we feel are the comprehensive risks. Moreover, the expense ratio is a little higher than average at 0.59%.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment