Torsten Asmus

Stocks were directionless yesterday with the S&P 500 and Nasdaq Composite closing lower for the sixth day in a row. Tension is building in advance of this week’s corporate earnings reports and what today’s Consumer Price Index will say about inflation. We also had the release of minutes from the Fed’s late-September meeting, which provided both bulls and bears with ammunition in their debate about an eventual pivot in monetary policy. On one hand, officials asserted that risks to the inflation outlook are increasing, requiring rates be higher and for longer with no mention of cuts. On the other hand, some officials noted that policy was now restrictive and that it would be important to start considering adverse impacts on the economy with further rate increases. The reality is that these officials have no idea what they will do, because they have no idea what the impact will be from what they have already done. We are just starting to see that now.

Finviz

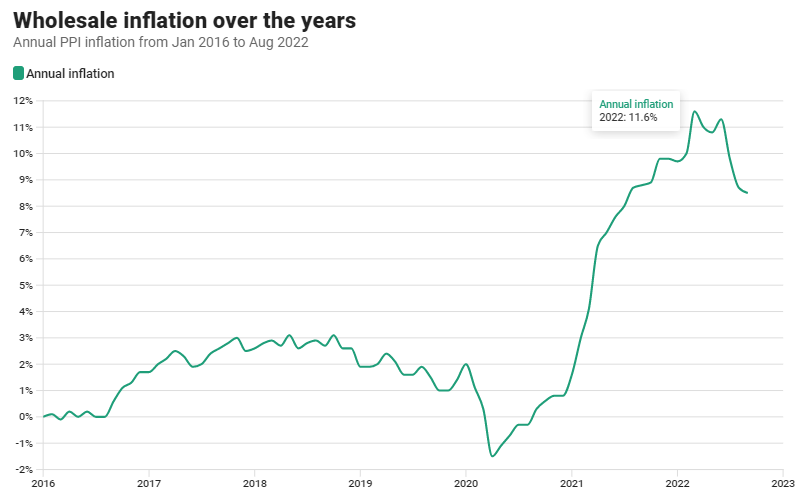

The consensus was disappointed with yesterday’s Producer Price Index report, because it continues to show elevated price increases, but it also shows progress in declining from the peak rate of 11.6% earlier this year. The headline number rose 0.4% last month, but the annualized rate fell again from 8.7% to 8.5%. The core rate, which excludes food and energy, rose 0.3% last month, while the annualized rate fell from 7.3% to 7.2%. Bears can bemoan the absolute rate, but it is its direction and rate of change that are more important. The peak is behind us and it is falling.

FOX Business

Furthermore, the suppressed demand that comes with slower rates of global growth, resulting from tighter financial conditions, will weigh more heavily on producer prices in the months ahead. The punditry on Wall Street acts like this should happen overnight, and Fed officials do the same. The sudden constraints to supply combined with stimulus-fueled demand are what led to the surge in prices in 2021. The unwinding of both will take just as long or longer, but it is happening.

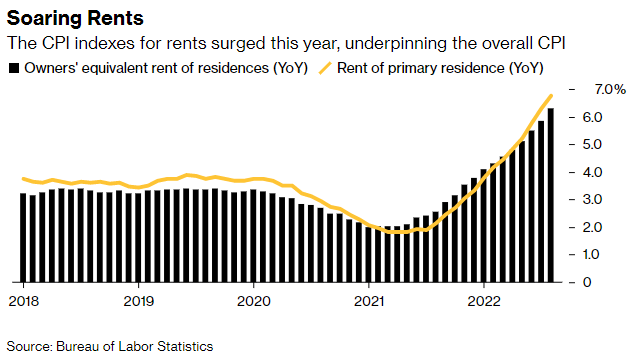

We are seeing the same storyline with consumer prices, which should show more progress from the peak earlier this year, but also a rate of increase that remains elevated. If the core rises on a monthly basis, it is most likely due to shelter costs, but that should not concern investors. The surge in mortgage rates has halted further price increases in the housing market, which is what drove the owners’ equivalent rent component of the inflation gauge over the past year. Rents follow home prices with a 6-12 month lag, so we know the rate of increase will fall rapidly in the coming year.

Bloomberg

The idea that the Fed still has a lot of work to do in tightening monetary policy, because of these still elevated rates of price increase, reflects a misunderstanding of how policy works. We can excuse Fed officials for their rhetoric, because they are trying to manage expectations, as they discuss future policy moves. The inflation numbers reported today and yesterday are telling us about the past 12 months, while the short-term rate increases over the past six months are just starting to work their way through the economy now and will determine the inflation numbers over the coming 12 months. Therefore, investors should be investing based on where they see inflation and rates a year from now rather than where they are today or were yesterday.

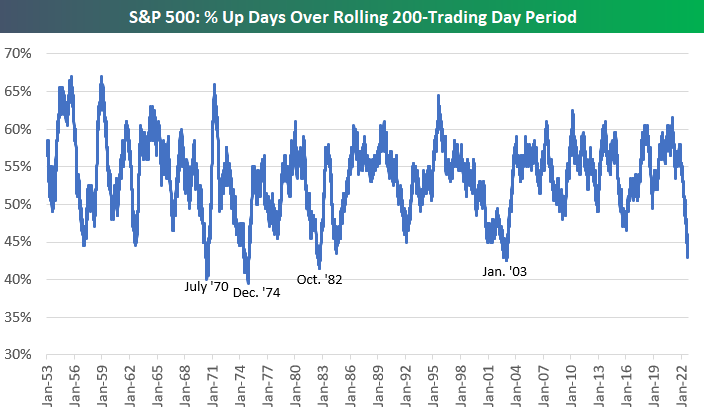

Regardless, some of the more prominent bears on Wall Street are calling for another 20% decline in the S&P 500, but many indicators suggest the selling has exhausted itself. Bespoke pointed out yesterday that only 43% of the past 200 trading days have been in the green, which may not sound too bad, but it ranks as one the lowest percentages in decades. In fact, there have only been four other periods in the last 70 years that saw lower percentages.

Bespoke

This tells me that we are not on the 50-yard line of this bear market decline, but standing in the endzone and positioning to change direction for a march back up the field. No one knows what the catalyst will be that changes sentiment and market direction. I am not suggesting the bulls will score a touchdown, but working their way back to midfield in 2023 is highly likely. This is not the time to sideline portfolios.

Be the first to comment