Thomas Barwick

Macroeconomic Backdrop

Food inflation has crippled economies in 2022. Shifts in environmental conditions paired with a war in Ukraine, have pushed prices higher despite a recent cooling of commodity markets. Climate phenomena have hampered food production either through severe flooding or widespread droughts.

La Nina, a climatic phenomenon characterized by lower air pressures over the Western Pacific, has often been associated with drier than normal conditions observed along the West coast of tropical South America, and the Gulf Coast of the United States.

The Ukraine-Russia conflict, a catalyst for the spike in the cost of fossil fuels and energy intensive fertiliser production, accentuated these environmental shifts, curbing farmers’ ability to meet demand through increased yields. Much of the world’s food output is underpinned by crop technology boosting yields but closely linked to energy prices. Any spike in energy prices has invariably seeped indirectly into food staples.

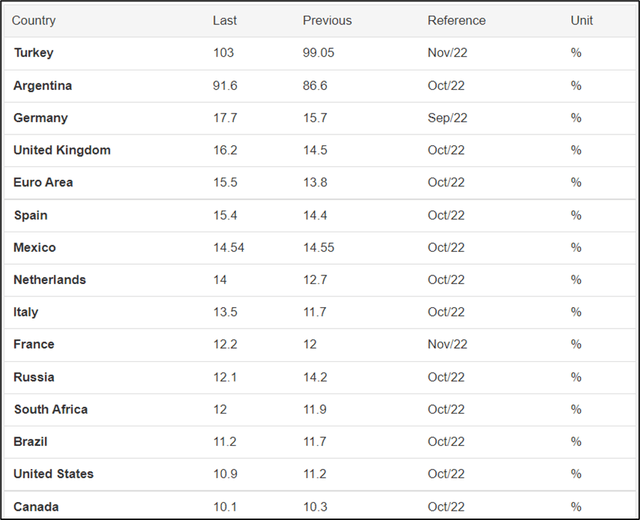

Trading Economics

Food inflation in select G20 countries shows double digit postings in most countries with the poorest often suffering severe inflation.

Crippling inflation has spread across the world. Yet the latest food price index update compiled by the UN Food & Agricultural Organization (FAO) posted its eighth monthly decline since its March peak. Thus far, that has not translated into lower inflation for households around the world.

Demographics play a factor too. Population imbalances – with receding wealthier nations being replaced by emerging high growth but poorer countries – have caused disparities and social unrest. The Arab Spring, while being a public uprising against certain North African administrations, had its underpinning factors in food price escalation.

It makes for a compelling investment theme – populations are likely to continue unevenly growing, while inflation shows no real signs of abating. That is why my outlook on commodity-based investment tools such as Invesco DB Agriculture ETF (NYSEARCA:DBA) is resoundingly positive.

Product Recap

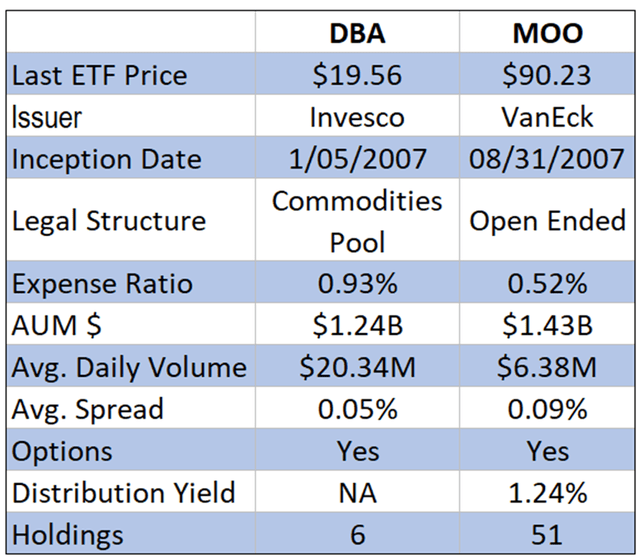

Invesco’s DB Agriculture ETF is an all-out play on agricultural upside. Unlike VanEck Vectors Agribusiness ETF (MOO) which provides a more diverse set of underlying securities extensively across the ag value chain, Invesco’s package is more futures focused, tracking indices of 10 agricultural commodity futures contracts.

It provides an interesting option for money managers seeking some exposure to future contract risk without perhaps the margin profile or know-how to explicitly go long or short on a given contract.

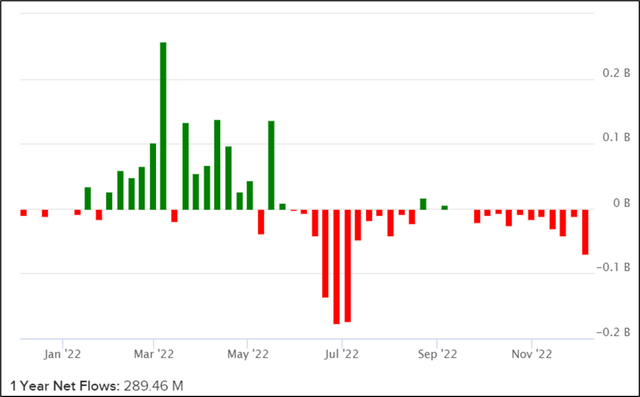

ETFDB.com

The start of the Ukraine War saw a spike in commodities prices and large fund inflows for DBD

The fund remains relatively liquid, despite having smallish assets under management. Fund inflows were notably strong at the outset of the war in Ukraine. Since then, fund outflows have tended to be more prominent with year-to-date net flows totalling $289M. Not bad for a fund that has only $1.2B in total assets under management.

As mentioned previously, this fund is configured as a commodities pool – implying the issuance of a K-1 tax form to fund holders. This may generate complexities during individual tax declarations.

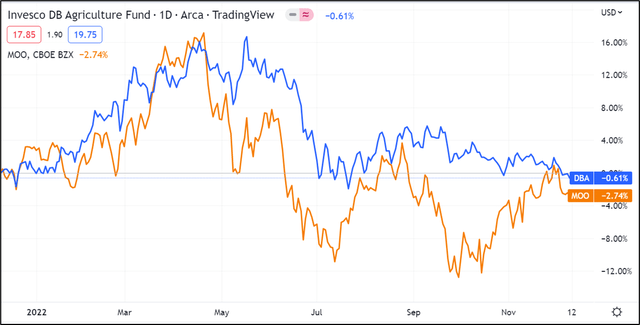

TradingView

Year-to-date price action DBA (-0.61%) v MOO (-2.74%)

Year to date price action has been a story of two tales – with commodity prices boosted by uncertainty generated by the War in Ukraine. Since then, prices have started to roll over as both the European and US economies show signs of slowing.

Over a longer period, it is worth highlighting the benefits of a more diverse basket of assets contained in VanEck’s (MOO). This ETF holds a diverse range of sectors covering agriculture such as materials, consumer stables and even industrials. Over a 5-year holding period, (MOO) delivered returns of +57.66% v (DBA) +9.55%.

Invesco’s DB Agriculture ETF tracks the DBIQ Diversified Agriculture Index Excess Return in addition to any income derived from holdings in US treasury securities, money market funds or T-bill ETFs. Unlike a pureplay ETF composed of equities, investors considering taking a position in Invesco’s DB Agriculture ETF need to be privy of the frequency of future contract rolling and various risk exposures across these derivatives. This will be material for holders of the security.

Structure

Due to the relatively unique structure of Invesco’s BD Agriculture ETF, investors not specifically interested in future contract risk exposure may be tempted to look elsewhere.

In any case, Invesco’s DB Agriculture ETF does boast a range of interesting characteristics. It touts best-in-class liquidity driven by its substantial assets under management. Spreads too are reflecting of both churn rates for trades and a heightened degree of liquidity.

Invesco’s flagship agricultural ETF is time-tested having been marketed for ~15 years. The standout feature to the ETF is its exposure to futures contracts (unlike, for example, MOO which holds underlying ag-linked equities).

Accordingly, the product has a futures contract risk profile – Simply said, futures contracts unlike perpetuities, have a maturity. This is materials because rolling futures contracts forward, and implied costs to do so, makes up a prominent part of the ETF. The importance of contango and backwardation are critical in fully assessing product risk.

Spreadsheet developed by author

Comparative analysis (DBA) v (MOO)

Key Takeaways

Geo-political volatility has driven commodity price upside at the start of 2022, only to progressively slow at the realization that global economies were cooling.

Despite this, food prices are likely to remain tight in 2023 and investment themes around the subject, such as agricultural commodities, appear to be an interesting place to hide.

For investors looking for derivative-like risk exposure in an ETF wrapper, DBA is worth consideration. For the others, VanEck’s (MOO) could provide a compelling alternative.

Be the first to comment